Today’s deal markets signify diversity in the US and around the globe

David Michael Cohen and Brian Lidsky, PLS Inc., Houston

PLS Inc. wishes to extend Oil & Gas Financial Journal and its dedicated team congratulations on 10 years of providing critical market intelligence on the oil and gas industry. This has been an exciting time in the US upstream sector where the opening of commercial resources from previously uneconomic shales has reversed the country's energy position from fears of peak oil and natural gas imports to bona fide talk of energy independence.

In the deal markets themselves, as recently as 2007, unconventional resources, including coalbed methane, accounted for just 8% of transactions.

Since the transformative $41 billion buy of XTO Energy by ExxonMobil in 2009, unconventional resources have been a major part of the deal landscape, and last year accounted for 54% of the US deal value. From 2007 to 2013, the leading unconventional play in the M&A markets has been the Marcellus ($37 billion), followed by the Eagle Ford ($28 billion), Bakken ($24 billion), Permian unconventional ($20 billion), and Barnett ($13 billion). On the conventional side, the ranking is led by the Gulf of Mexico ($43 billion), followed by the Permian ($19 billion), Rockies ($17 billion), Gulf Coast ($14 billion) and Midcontinent ($13 billion).

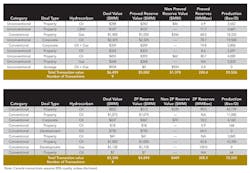

This month's Deal Monitor exemplifies the diversity of deals across the conventional and unconventional sectors, across the globe and across public and private companies. In the largest transaction, Calgary-based Baytex Energy Corp. announced a $2.3 billion deal with Australian-listed Aurora Oil & Gas to capture a prized Eagle Ford position. In the private sector, Aubrey McClendon has swiftly and confidently returned to the Utica via new firm American Energy Partners. On the conventional side, Occidental's $1.4 billion sale of its famous Kansas Hugoton field demonstrates the shifting nature of Big Oil's portfolios toward unconventional oil growth areas while some companies including the private and MLP sectors continue to buy long-lived gas.

With the Aurora deal, Baytex is diversifying its portfolio beyond Canadian heavy oil by adding Eagle Ford light oil. The buy should reduce the heavy oil portion of its 2014 production stream to 53% from a previously projected 75%. Aurora's primary asset is a 22,200-net-acre contiguous property (80,200 gross, 97% HBP) primarily operated by Marathon Oil at prolific Sugarkane field in Karnes, Live Oak and Atascosa Cos. with December net production of 19,500 boepd (44% oil, 37% NGLs and condensate). Sugarkane is well-delineated with infrastructure in place, which facilitates low-risk production growth.

Turning to shale gas, American Energy Partners signed three deals to acquire 130,000 net acres in the Utica from Hess, ExxonMobil and privately held Paloma Partners III, instantly doubling its acreage and becoming the largest leaseholder in the Ohio shale play. The biggest of the deals is with Hess, which is selling 74,000 acres for $924 million or $12,500/acre within the play's dry-gas window in Jefferson and Belmont Counties. The other two deals may have included liquids-rich acreage; industry sources placed their value higher at $17,000/acre for Paloma and $20,000/acre for Exxon.

Another high-profile deal is Occidental's sale of its legacy Hugoton gas assets primarily in Kansas, which cover a large 1.4 million net acres (including some fee lands) with average 2013 production of 110 MMcfed (30% oil). Upside includes both infill and deep drilling potential. In this transaction, PLS allocates $1.05 billion to the production and $346 million to the acreage. Concurrently, Oxy announced it will spin off its oily California business (154,000 boepd, 2.3 million net acres) into an independent public company.

Internationally, large US independents continue selling down their overseas assets to fund shale drilling back home, as illustrated most recently by Anadarko's $1.1 billion Chinese asset sale to Brightoil Petroleum and Apache's $852 million divestment in Argentina to state-owned YPF and local independent Pluspetrol.

Meanwhile Shell announced two billion-dollar divestments. First the major sold its stake in Australia's Wheatstone offshore LNG gas development project to existing JV partner Kuwait Foreign Petroleum Exploration Co. for $1.1 billion cash, and then it sold a 23% stake in its Brazilian deepwater BC-10 block to Qatar Petroleum International for $1.0 billion.