AN INTERVIEW WITH CORE LABORATORIES: Using the laws of physics to optimize production

Don Stowers, Editor, OGFJ

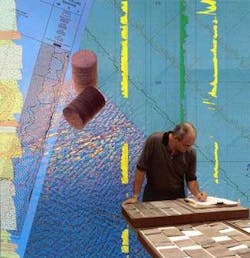

Photos and illustrations courtesy Core Laboratories

EDITOR’S NOTE: With 70 offices in more than 50 countries, Amsterdam-based Core Laboratories provides the technology and services to optimize petroleum reservoir performance. Following a management buyout in 1994, Core Lab went public in 1995 and began to expand. Today, it has a $2 billion market cap and about $575 million in annual revenues for 2006. David Demshur, chairman, president, and CEO, and Richard Bergmark, executive vice president and CFO, spoke with OGFJ recently.

OIL & GAS FINANCIAL JOURNAL: A few months ago, I attended a presentation by Core Laboratories at the IPAA’s OGIS West Conference in San Francisco. You said that you use the “laws of physics” to optimize daily production and to maximize ultimate production from the reservoir. Can you elaborate?

DAVID DEMSHUR: Every day that a well produces, the dynamics of the reservoir changes. Our mission is to use patented and proprietary technology and expertise to enable our clients to improve reservoir performance and increase oil and gas recovery from producing fields. Core Lab engineers precisely measure data from reservoir rock, fluid, and gas samples from analyses that our technicians perform in the company’s laboratories. From this, we can evaluate the effectiveness of well completions and develop solutions aimed at increasing the effectiveness of recovery methods. Improving production and lessening the decline rate of a reservoir just a few percentage points can make a tremendous difference over the lifetime of the reservoir.

OGFJ: What else does the company do?

DEMSHUR: Core Lab operates in three business segments - reservoir description, production enhancement, and reservoir management. The reservoir description segment encompasses the characterization of petroleum reservoir rocks, reservoir fluids, and gas samples. Through this segment, the company provides analytical and field services to characterize properties of crude oil and petroleum products. The production enhancement segment includes products and services related to reservoir well completions, perforations, stimulations, and production. Core Lab provides integrated services to evaluate the effectiveness of well completions and to develop solutions aimed at increasing the effectiveness of enhanced oil recovery projects. Finally, the reservoir management segment combines and integrates information from reservoir description and production enhancement services to increase production and improve recovery of oil and gas from our clients’ fields and producing regions.

OGFJ: Do you mostly study core samples to enhance the performance of a well or reservoir?

DEMSHUR: Even though our name is Core Laboratories, we do more reservoir fluid analysis than rock analysis. In addition to analyzing the porosity and permeability of reservoir rock, we analyze all three reservoir fluids which are crude-oil, natural gas, and water. Services related to these fluids include determining hydrocarbon composition and measuring the quality of the fluids and derived products. This includes determining the value of different crude oil and natural gases by analyzing the individual components of complex hydrocarbons. These data sets are used by oil companies to determine the maximum value of their to crude oil and natural gas production.

OGFJ: Can you tell our readers a little about the history of Core Laboratories?

RICHARD BERGMARK: Core Laboratories was founded in 1936 and traded on the American Stock Exchange from 1971 to 1984. The company was acquired by Western Atlas in 1984. After the acquisition, Core Lab began to shrink in size, in part because the parent company’s emphasis was on exploration rather than production. In 1994, Core’s revenue had fallen to approximately $40 million and the company was operating at a loss. In September of 1994, management bought the assets of Core for $38 million. Within the year, the company went public with a 1995 IPO and a $120 million market cap. Core Lab began to expand rapidly and now has a $2 billion market cap and $575 million in revenues for 2006. Current management realized that the application of our technology was better suited to production rather than exploration, and today more than 85% of our business is production oriented. The success of this change in strategy is apparent.

OGFJ: Who are your competitors?

DEMSHUR: Our chief competitors are also our biggest clients - the technology service centers of ExxonMobil, Chevron, BP, and Shell. We have a symbiotic relationship with these clients and other oil and gas producers, and many of them outsource work to us.

OGFJ: What about some of the larger oil service firms?

DEMSHUR: Other oilfield service companies conduct indirect measurements of reservoir rock and fluid properties through wireline logs or seismic responses. Core Lab is unique as our technologies revolve around direct measurement - that is, laboratory based analysis of reservoir rocks and fluids. So Core really doesn’t compete with other service companies.

OGFJ: Are your services customized for particular customers or formations?

BERGMARK: Very much so. Every geological formation is different. For example, we are putting together a study of how the Fayetteville shale is different from the Barnett shale. Even within a formation there are wide differences. Core Lab services and analyses are specific to whichever well and field we are studying.

OGFJ: What are some of the products and technologies Core Lab has developed to improve production and optimize reservoir performance and what has been the response to them by the industry?

DEMSHUR: Core Lab has introduced a confluence of new technologies recently. Demand for Core’s patented fracture stimulation diagnostic technology is at an all-time high. SpectraScanTM and SpectraStimTM services are utilized to determine the effectiveness and efficiencies of multi-zoned reservoir fracture stimulation programs. These technologies indicate zones that may not have been hydraulically fractured or have been under-stimulated and are yielding less than optimal hydrocarbon flow. Statistically, Core has determined that only one in three multi-zoned reservoir stimulation programs perform as planned. There is growing client recognition that fracture diagnostic technology is necessary to optimize production.

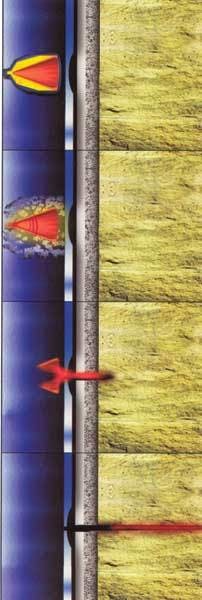

BERGMARK: Core introduced its HEROTM (High Efficiency Reservoir Optimization) perforating charges about 6 quarters ago, and the product remains in high demand domestically. It is also starting to penetrate the international markets. Last year, we began exporting HEROTM charges to the Asia-Pacific, North Africa, Middle East, and European markets. The HEROTM charge can minimize damage to the formation during perforation, which helps maximize hydrocarbon flow and ultimate recovery. We’re also working on a Super-HERO charge that we expect to have ready early in ’07. These charges are designed to work in gas shale reservoirs, and there will be different versions for different types of gas shales.

DEMSHUR: On the fluid side, Core continues to develop industry-leading miscible gas-flood technologies. In miscible gas floods, combinations of produced gases, including heavy hydrocarbon gases, carbon dioxide, and nitrogen can be re-injected into mature and ultra-mature reservoirs to boost hydrocarbon recovery from some of the world’s oldest fields. Miscible-flood pilot projects using Core Lab technology are ongoing in the North Sea and Middle East.

OGFJ: How much, percentage-wise, of Core Lab’s business is domestic and how much is international?

DEMSHUR: Roughly 70% of our revenues are from international reservoirs. This is up significantly since the management buyout in ’94, and we expect it will continue to increase. This is because our technology and services are a better fit for complex reservoir systems that you might see in the Middle East and elsewhere. Also, about 85% of our business is related to production, and 70% is related to crude oil.

OGFJ: What specific markets are you targeting?

DEMSHUR: Our plan is to grow our business in offshore West Africa, both shallow and deepwater. Also Core will grow its business in the Middle East and the Asia-Pacific regions. Core Lab operations are looking at the Indian subcontinent, which has growing potential. At this time we are servicing India out of our Kuala Lumpur and Jakarta offices, but we are looking at possibly establishing an office in India. Core Lab engineers also expect business to increase in the North Sea, which has seen significant production decline. Currently, Core is not actively growing our business in South America, in part due to political risks there, coupled with a low level of investment by the oil companies at this time.

OGFJ: It is widely believed that some of the large fields in the Middle East and the former Soviet Union have peaked and that production in some of the largest reservoirs is in decline. Producers in some countries have been pulling their wells too hard, resulting in damage to the reservoirs. Does Core Lab have any experience in these countries, and if so, what can be done to reverse this decline and improve efficiency?

DEMSHUR: We have been actively involved in many of the world’s largest producing fields. This year’s Annual Report for Core Laboratories will detail how our engineers are applying technology to these fields. We have initiated several new projects and are expanding our role in several giant and super-giant fields. Core lab is very active in Kuwait, Qatar, and the UAE. Saudi Arabia has asked us to expand our facilities there at the behest of Saudi Aramco. We have also been involved in major projects in Russia and most of the countries that were formerly part of the USSR.

OGFJ: Core Lab posted record earnings for the third quarter of 2006. Can you give us a breakdown on your financials and where you are headed in 2007?

BERGMARK: Core Laboratories reported record earnings per diluted share of $0.83 for the third quarter of 2006. This more than doubled last year’s third quarter total and was up 19% on a sequential quarterly basis from the second quarter of 2006. Net income for the quarter reached $22,384,000, while operating income reached $33,790,000.

Quarterly revenue reached an all-time high of $145,526,000, increasing 21% over the revenue totals posted for the third quarter of 2005. The year-over-year quarterly revenue growth rate was Core’s highest since the first quarter of 2001.

For the first 9 months of 2006, Core posted revenues of $422,878,000 - up 19% from year-earlier totals, while operating income for the first 3 quarters of 2006 increased 96% to $86,795,000.

For the full-year 2007, the company anticipates revenues in the $650 million to $670 million range - up about 15% over 2006 levels. Core expects 2007 earnings per diluted share to range from $3.95 to $4.16, an increase of about 30% to 37% from expected full-year 2006 earnings. Capital expenditures for 2007 are expected to be in the $18 million range, just slightly higher than expected depreciation and amortization for 2007.

OGFJ: To what extent does the cyclical nature of the oil and gas industry affect your business?

BERGMARK: We move with the cycles, but we usually grow at a rate higher than the increases in capex by our customers. Over the years, we have observed that our growth rate is 3% to 5% better than the capex increases. When our clients are more active, our revenues are up. At this time, we don’t see anything on the horizon that will have a sharply negative impact on our business.

OGFJ: What is the outlook for your business going forward?

DEMSHUR: In a few words, we’re very optimistic. Core Lab will become even more oriented towards international. NOCs and IOCs are gaining ground globally, and we can help them by improving the efficiency and performance of their complex reservoirs. As we said earlier, we are simply using the known laws of physics to enhance production and manage reservoirs. In my 27 years at Core Lab, we have always been business partners with our clients, so this is what Core Laboratories is proudest of.

Thanks very much for your time.