Part 1: Supply pressures and new infrastructure requirements - The North American gas economy

EDITOR’S NOTE: This 2-part series of articles examines the production, transportation, and marketing of natural gas in the economy of North America, how it is continuing to evolve, and important trends that will affect demand and prices. Part 1 takes a close look at supply pressures and new infrastructure requirements, including the roles played by Canada and Mexico in the energy equation.

The United States traditionally supplies its gas markets from domestic production, supplemented by significant import contributions from its neighbor Canada and growing contributions from liquefied natural gas (LNG) from around the world. Without the thirsty US market, it is clear that Canada’s gas production capacity would not have been so extensively developed. Canada has been integrated, as a willing supplier, into the US gas economy, and LNG seems to be drawing it further in.

By constructing LNG regasification plants along Mexico’s northeast and northwest coasts, linked into the US gas pipeline network, Mexico is also in the process of being drawn into the US gas economy. Indeed, Mexico is likely to not only benefit as a transit point for regasified LNG into the US, but is also likely to benefit from those facilities in terms of access to incremental gas to fill its domestic gas deficit.

Infrastructure developments in Canada and Mexico are set to become more significant in the future development of the North American gas economy and these will be addressed in the second part of this 2-part series. Will these developments further dilute the nationwide influence of the Gulf of Mexico and Henry Hub in supplying and controlling prices in the US natural gas market?

Evolution of the modern US gas market

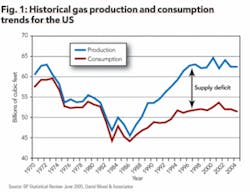

Annual market consumption of natural gas in the US has increased from ~5 trillion cubic feet (tcf) in 1949 to a peak of more than ~23 tcf in 1972 (about 63bcf /day). After falling back throughout most of the 1980s and 1990s, gas consumption resumed a steady upward climb to a level similar to the 1973 peak, i.e. ~23 tcf in 1998 and has hovered around the 62 to 65 bcf/day level since 1998 as shown in Fig. 1 (constrained by LNG import capacity at certain times).

Two factors account for most of the post-war expansion: the explosion of the housing market throughout the US, especially during the main years (1945-1960) of the so-called “baby boom,” and the expansion of medium and heavy industry beyond the coal-and-steel belts of the US northeast and Great Lakes to new urban growth centers of the West Coast, the “right-to-work” states in the South, and the tremendous expansion of population and industry in Texas and Florida.

By the mid-1990s, however, some 70% of new homes in the US were being heated with natural gas. Essentially this market had reached saturation point. Natural gas was increasingly substituted for fuel oil and coal for power generation with new build combined cycle gas turbines (CCGTs) attracting much investment. Home and space heating markets concentrated in the Northeast contributed a diminishing portion of overall gas sales revenue. Natural gas thereafter became produced increasingly as a feedstock commodity for the electricity-generating market.

Deregulation of natural gas pricing began in the US in 1978 and was operational by 1985. A situation was created whereby the natural gas producers, after having divested themselves of any significant financial involvement pipeline and-or other distribution networks and infrastructure, were released from a monopoly situation. Gas sales transactions increasingly became focused on the Henry Hub price based on delivery at the main hub at Henry, La., on the Gulf Coast, whence comes some 60% of domestically produced natural gas.

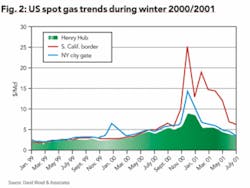

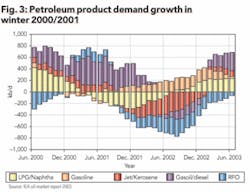

Deregulation of electricity markets opened opportunities in certain markets for market makers to manipulate the US gas markets in order to achieve illegal gains from increases in gas prices. The most-documented manipulation occurred during the winter of 2000-2001 when the combination of an extremely cold and extended winter heating season in the US Northeast, along with the partially Enron-induced brownouts and blackouts in California during a period of a tight gas supply in the summer months, created high gas prices across the US. In California, spot gas prices increased by more than a factor of 5 and took more than 6 months to return to former levels (Fig. 2). This led to significant fuel switching in dual-fuelled power plants and substantial increase in demand for heavy fuel oil (Fig. 3).

Fuelled by cheap energy (that is “cheap” in global terms due to its low taxation burden), the US economy grew 60% from1986 to 2000, an astounding 5% in 2000 alone. Gas consumption grew by some 43% over that period. But it was the demand for electricity, up 5.4% in 1998, an astounding rate for such a large economy that really impacted gas prices.

To meet growing electricity needs, utilities ordered 180,000 megawatts of gas-fired power plants to be installed by 2005. It was a logical thing to do: gas was the cheapest, cleanest way to convert fossil fuel to electricity. But if ordering a few CCGT gas turbines makes sound economic sense, ordering hundreds of such units dramatically increased gas demand for power generation - with the forecast for it to nearly triple from 1997 to 2017 from about 3.2 tcf to more than 9.1 tcf per annum. Domestic gas supply always looked unlikely to be able to meet such demand.

LNG regasification infrastructure

The importance of a distribution network cannot be overstated when it comes to natural gas infrastructure and enabling gas flows to customers. Owners of gas distribution and storage facilities are frequently able to extract the most value from gas supply chains, much more than producers, except when wellhead prices remain high for sustained periods.

So it is with LNG receiving and regasification infrastructure, and that is why there has been such intense interest and keenness to invest in new such facilities in North America by many of the major gas companies. These new facilities will be able to provide capacity to meet the increased demand for gas to feed power plants and to replace domestic gas production as it declines.

There has been intense US interest in building new LNG portside regasification and storage facilities in existing large US urban centers. Despite more than 40 such projects being considered for permitting in the past 3 years only 5 are actually in the construction phase (as of mid-2006), and all of these are located along the US Gulf of Mexico coast, in Texas and Louisiana.

Local referenda in the past few years have confirmed that public opinion is opposed to the statutory authorities granting planning approval for new LNG receiving facilities to be built in the ports north and east of the Boston-Portland corridor. Delay in achieving regulatory approval to build some new LNG receiving terminals, particularly along the northeast US coast has promoted some gas companies to look to Canada as an easier option to locate such facilities and to tie them into under-utilized existing pipelines, e.g. the Maritimes and Northeast Pipeline.

This holds profound implications for the development mainly by US companies of natural gas production in the Gully Zone of the Sable Island field along the Atlantic coast of the Canadian province of Nova Scotia. Although the gas find was developed entirely with US markets in mind, its estimated life is only about 20 years, and the main longer-term asset developed with it seems to be the Maritimes and Northeast Pipeline running from Goldboro, Guysborough County, Nova Scotia, where Sable Island gas is brought ashore.

This gas pipeline line runs across central and northern Nova Scotia through the neighboring province of New Brunswick, across the international border with the state of Maine, as far southwest as the Boston-area suburb of Everett, Mass., the nearest US gas pipeline distribution point and also the site of an existing LNG receiving terminal.

A survey of the Canadian energy industry in the winter of 2005 by the US Energy Information Administration (EIA) noted that “while not without controversy, the Canadian LNG terminals have not met with the same level of resistance from local residents and environmentalists that similar facilities in the US have faced” (US Department of Energy, 2005). In connection with the Maritimes and Northeast Pipeline, two proposals won approval in 2005 from Canada’s National Energy Board and have moved into construction:

1. A facility that would connect to this pipeline to be owned and operated by Irving Oil Ltd. This company is Canada’s largest privately held vertically integrated oil refiner and marketer and operator of the country’s largest refinery (250,000 bbl/day). It is based at Saint John, NB, where Irving already maintains its own ocean tanker loading and unloading facility known as “Canaport”. The estimated throughput is between 0.5 and 1 bcf/day (US Department of Energy, 2005).

2. A 1 bcf/day facility is under construction at Bear Point, NS, outside Point Tupper /Port Hawkesbury; Richmond County, NS -- near the pipeline’s Goldboro terminus -- owned and operated by Anadarko Petroleum, a US company with extensive previous involvement in the Alberta oil patch in the western Canada sedimentary basin. This project proceeded into the construction phase very rapidly in 2005 following permit approval. It did so without a contractual arrangement securing long-term LNG supply. In early 2006, Anadarko announced a slowdown in the construction of this facility until a long-term LNG supply contract was secured.

Both proposals raise the curtain on yet another aspect of the development of gas pipeline network distribution between Canada and the US, a link that has become critical for the overall US natural gas supply picture. In total, there are plans to build over 4 bcf/day of LNG receiving capacity by 2008 in eastern Canada alone, with additional LNG-terminal proposals on the Pacific and Atlantic coasts at various stages of review by National Energy Board.

Even before the latest Maritimes-based projects mentioned above, a $1.3 billion, 500-mmmcf/day LNG terminal at Gros Cacouna, Quebec, along the St. Lawrence River, to be built by Petro-Canada and TransCanada Pipelines, was approved, apparently in connection with the signing of a deal between Petro-Canada and Russia’s Gazprom to feed the Gros Cacouna terminal from Gazprom’s much heralded, but yet to be developed, Shtokman field (US DOE, 2005) or perhaps other sources of Russian gas being considered for export as LNG from Ust-Luga on the Gulf of Finland (Baltic Sea), near St. Petersburg, which has yet to progress beyond the feasibility study phase.

Implications

With US demand dominating the North American gas market and US domestic gas supply declining, Canada and Mexico are set to play an increasingly important role in transiting imported LNG into the US. Canada’s key role in this regard will be along the northeast Atlantic coast feeding gas to Northeast demand centers, whereas Mexico will be pivotal in providing California access to imported gas from Pacific LNG suppliers.

As pipelines and terminals come onstream over the next 5 years, natural gas entering the US from Mexico and Canada is set to play a more important role in some key regional US natural gas supply and in influencing regional gas prices (e.g. California and New York) than volumes flowing from and through the Gulf of Mexico via the Henry Hub in Louisiana.

Combine these trends with increasing concerns from natural gas consumers over the risks of climatic interruptions to supply (i.e. hurricane impacts) from the Gulf of Mexico, either to domestic offshore production facilities or LNG import terminals, and it is not unreasonable to expect that the Gulf of Mexico’s nationwide influence on the US gas industry may soon have to fend off some serious regional competition.

About The Authors

David Wood [[email protected]] is an international energy consultant specializing in the integration of technical, economic, risk, and strategic information to aid portfolio evaluation and management decisions. He holds a PhD from Imperial College, London. Research and training concerning a wide range of energy related topics, including project contracts, economics, gas / LNG / GTL, portfolio and risk analysis are key parts of his work. He is based in Lincoln, UK, but operates worldwide.

Saeid Mokhatab [[email protected]] is an advisor of natural gas engineering research projects in the Chemical and Petroleum Engineering Department of the University of Wyoming. He specializes in the design and operations of natural gas transmission pipelines and processing plants. He has participated in several international projects and has published more than 50 academic and industrial oriented papers, reports, and books. He has written on a broad range of issues associated with LNG, LNG economics and geopolitical issues.