Improving returns on tight gas

Tight or unconventional gas represents a large remaining resource in North America. Tight gas assets are distributed throughout the country, but much of the industry’s focus is on development in the midcontinent states of Wyoming, Colorado, Oklahoma, and the Dakotas. Companies such as BP and ExxonMobil have announced multibillion-dollar programs to drill thousands of wells across thousands of acres over a five-year period.

Financial considerations

Tight gas assets are defined as gas reservoirs having very low permeability compared to conventional gas resources. With low permeability and high geologic heterogeneity, production of tight gas assets requires high well densities and costly stimulation treatments, usually hydraulic fracturing.

Due to these and other factors, such as environmental and resource availability, tight-gas development projects yield only marginal returns at a price of $7 per thousand btu and are very sensitive to gas price fluctuations. Financial returns, therefore, depend primarily on the volume of gas an average well delivers relative to the costs of drilling and stimulation. In this article, we present an approach for improving economic returns through integrated asset modeling.

The performance of tight gas reservoirs cannot be predicted using traditional reservoir evaluation and simulation methods. As a result, many operators resort simply to pattern drilling - also known as “carpet bombing” - an approach in which drilling is based on regular patterns on a map, rather than on considerations of actual deliverability.

While tight gas assets will always require a high density of wells, carpet bombing often results in a larger number of marginal or poor-performance wells. Also, to plan and drill thousands of wells, scheduling the delivery of materials to each rig site with due consideration of environmental impact creates a “factory-like” supply chain problem not found in conventional gas reservoir development and can lead to inefficiencies and bottlenecks if not properly managed.

In order to optimize returns on tight gas assets, the following objectives should be given highest priority:

- To address the supply-chain problem, strive for overall asset efficiency in drilling, stimulation and logistics, as well as for overall field surveillance and operations.

- To solve the marginal well problem, provide predictable delivery - given reservoir uncertainty - to maximize well rates and ultimate recovery.

An integrated asset model (IAM) can help E&P companies achieve these two objectives by integrating all aspects of tight gas development, including petrophysics, fracturing, production, drilling, scheduling, facilities, and economics. As a result, an IAM provides a complete set of investment scenarios defining better well efficiencies and the means to optimize supply-chain efficiencies.

Challenges of tight gas development

The production of natural gas from low permeability (tight) reservoirs has grown to represent a significant source of energy for the North American market. Unconventional gas reservoirs - including tight gas, shale gas, and coalbed methane - represent 30% of the US gas resource today and will grow to nearly 50% by 2030. (See Figure 1, “Annual Energy Outlook 2007 with Projections to 2030,” Report #: DOE/EIA-0383(2007.)

Over time, the companies developing these resources have evolved from small to mid-sized independents and, now, they are the largest international oil companies (IOCs). The economics, risk profiles, and development strategies for tight gas reservoirs, however, differ dramatically from more conventional oil or even higher permeability gas reserves. Familiar development models used with great success by larger operators and their workforce are in many ways inappropriate for tight gas assets.

From a development perspective, critical differences among tight gas reservoirs and conventional oil or gas reservoirs include the following:

- Tight gas wells require near-well stimulation before they will flow. Even then, production rates have fairly rapid declines. Due to the very low permeability and resulting inability to accurately calculate overall reservoir pressure, tight gas reservoirs cannot be modeled as full fields. Instead, they can be modeled with only a small number of individual wells (Holditch, 2006).

- Evaluation of tight gas assets requires a tight linkage among the well program and the facilities’ capacity and constraints. Given the rapid decline of tight gas wells, optimal performance requires a delivery network that can support both higher-pressure, new wells and the large majority of older wells with lower pressure.

- To provide acceptable returns, it is necessary, at least to date, to take a factory approach to tight gas development. With the added cost of stimulation for each well, relatively high uncertainty about individual well performance and the resulting need to drill many wells, tight gas fields generally operate on a much thinner margin than larger companies are accustomed. Thus, returns are highly sensitive to gas price fluctuations.

For conventional reservoirs, years of study and experience have provided the industry strong tools and methods for predicting new well and field performance, as well as a good understanding of risk. Equivalent tools and experience do not yet exist for unconventional gas reservoirs, in large part because very low permeabilities make it difficult to accurately model overall reservoir pressure with decline.

Instead of modeling the full field, tight gas reservoirs must be modeled as a set of individual wells. In addition, these wells produce natural gas only when stimulated by a large hydraulic fracture treatment or produced through horizontal or multilateral well bores. Hydraulic fracturing can account for as much as 50% of total well costs. Clearly, the design and performance of the hydraulic fracture treatment are critical. Integrating fracture modeling with low-permeability reservoir simulation is an important new step that operators are just now embracing.

Especially early in the development cycle, high levels of uncertainty about initial rate and longer-term performance in tight gas reservoirs are common. The combination of uncertainty, rapid production decline and relatively small drainage areas of tight gas wells has led to the current practice of high-density statistical development drilling. Where very limited geologic heterogeneity exists and wells are simple to drill, the regular, tight spacing of well bores may be the best way to develop a field.

Even with some poorly producing wells or dry holes, low well costs make it more cost effective to carpet bomb and focus on operational efficiency than to expend resources in technical evaluation. However, as shown in Figure 2, as well costs and geologic heterogeneity increase, the overall economic impact of these poor wells becomes much greater. Ultimately, uncertainty leads to lower field profit margins and high sensitivity to price fluctuations.

To improve the economic viability of complex unconventional gas development going forward, operators will have to focus more on optimal well placement rather than on pattern drilling.

Embracing a non-intuitive solution

With thousands of tight gas wells being planned and drilled over the next 5 years, there are a number of trade-offs and constraints that, if ignored or evaluated only superficially, will lead to quite suboptimal decisions.

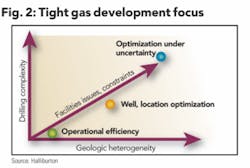

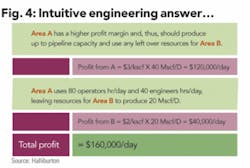

To illustrate, consider the seemingly simple decision whether to develop new Areas A or B (Figure 3) and with what investments in infrastructure and resources. Area A has limited pipeline capacity, while Area B’s production is not limited by the pipeline. Areas A and B have different unit costs. Both A and B require operations and engineering staff to maintain production, but these resources are limited by overall corporate needs.

Since Area A is expected to be 50% more profitable, the intuitive answer is to develop Area A up to the hard limit of the export line that is 40 MSTB/D, then develop Area B to use up the remaining resources that are 20 Mscf/D. The plan would yield an expected profit of $160,000 per day (Figure 4). That, however, does not happen to be the best answer.

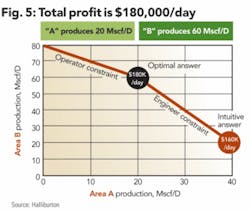

Evaluating the constraints through a linear optimization program generates a better solution - to develop Area A to produce 20 Mscf/D, and Area B to produce 60 Mscf/D, which yields $180,000 per day (Figure 5).

This simple example shows how project decisions that ignore the true trade-offs of multiple constraints can leave considerable money on the table and how systematic and mathematical optimizations that take account of all the components of the system can generate substantial value.

Of course, real projects have numerous and complex trade-offs, such as drilling, fracturing and completion logistics, pipeline infrastructure, gas delivery conformance, legal and contractual commitments, and more. And real projects can have large uncertainties in the reservoir, environmental impact, pricing and more. These do not lend themselves to the easy linear solution. Instead, they require a nonlinear and stochastic solution for all components of the value chain taken as a system.

Such a solution approach has been described (Cullick, 2004), and is being applied in many conventional field-planning studies. We believe this same approach will have a significant positive impact on how tight-gas field drilling and production programs are planned in the future.

Integrated tight-gas asset modeling

Profitable production of unconventional gas reservoirs depends on efficiently operating a large, complex asset characterized by almost continuous, high-volume drilling, massive hydraulic fracturing, and an ever-growing surface facilities network.

Large capital investments are targeting a resource in which production rates and ultimate per well recovery is highly uncertain. Over time, uncertainty can be reduced by integrating all available data from petrophysics to drilling, completion and production, and by using tools like artificial neural networks (ANNs) to identify key factors and practices that will optimize production (Grieser et al). With newer assets, however, this uncertainty can only be managed, not eliminated.

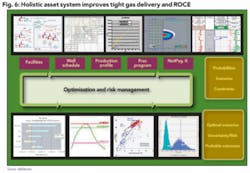

To identify the optimal tight-gas development scenario, operators must evaluate multiple drilling targets and schedules, hydraulic fracturing programs, facilities and network build-outs, and delivery system constraints. Many scenarios must be evaluated under conditions of uncertainty - with proper representation of potential initial production rates and profiles - linked to the appropriate well type, fracturing approach and completion. While each of the individual systems can be modeled independently, only very recently has it become possible to model an entire tight gas asset holistically (Figure 6).

This holistic approach uses an IAM to pull together all elements of the asset, to evaluate each scenario under uncertainty, and to help select the scenario that best meets project production and economic hurdles using mathematical optimization (Evans, 2005). By illuminating non-intuitive options in complex, tight gas systems, this approach offers distinct advantages over traditional domain-focused approaches, including:

- Better capture and valuation of all competing trade-offs, handling decisions in the context of the overall asset, not just the domains in question

- Capture of all probable outcomes

- Optimization of key development scenarios and identification of the most favorable options, such as:

- Well drilling and completion schedules relative to all variables and facilities

- Hydraulic fracture and completions

- Pad locations and sequence

- Quantification of the value of data collection relative to decisions

- Enabling and facilitation of cross-functional interactions.

Once initial development decisions have been made, this system can be updated periodically and optimizations rerun to enable course corrections and identify key trends. Regardless of the subsurface issues, given the high volume of drilling and workover operations, a tight gas asset must be run with a factory mentality. Operators must constantly monitor and re-evaluate all aspects of each program, striving to maximize operational efficiency.

With the increasingly significant contribution of unconventional gas to the overall supply of energy, it is critical that oil and gas companies continue to improve the methods and technologies that will enable efficient reservoir development. To that end, we believe it is critical to bring these technologies and methods together in more holistic models to identify specific development scenarios that will make these vital resources both economically viable and less sensitive to price fluctuations.

References

• Holditch, S. A.: “Tight Gas Sands.” Journal of Petroleum Technology (June 2006), Pages 86 to 93.

• “Annual Energy Outlook 2007 with Projections to 2030,” Report #: DOE/EIA-0383(2007).

• Society of Petroleum Engineers paper, SPE-100674. “Data Analysis of Barnett Shale Completions,” B. Grieser, B. Shelley and B.J. Johnson, Halliburton; E.O. Fielder, J.R. Heinze and J.R. “Rusty” Werline, Devon Energy Corp.

• Evans, S.: “A Modern Approach to E&P Assets Valuation, Development, and Decision Making.” Journal of Petroleum Technology (July 2005)

• Cullick, A. S., et al, Journal of Petroleum Technology, Nov. 2004, Society of Petroleum Engineers paper, SPE-88991.

About the authors

Scot Evans [[email protected]] is a senior manager for Halliburton’s Consulting and Project Management group Evans has spent more than 20 years in field development and production, split between Halliburton and Exxon. He has experience in many of the key petroleum provinces, including Alaska, California, Mexico, Argentina, India, Russia, and the Gulf of Mexico. At Halliburton, he has held management and senior technical roles in consulting, project management, and product development. Evans holds a bachelor’s degree in geology from Bucknell University and a master’s degree in geology from the University of Texas, Arlington.

Stan Cullick [[email protected]] is a technology fellow at Halliburton. For more than 25 years, he has developed and delivered a broad range of technologies and innovations to the upstream oil and gas industry that have improved field planning and production performance. Prior to working at Halliburton, Cullick was a consultant scientist for Mobil Technology. For the past several years, he has been active in developing uncertainty, risk analysis, and optimization software technology. Cullick has a PhD from Ohio State University and an MBA from the University of Texas at Dallas.