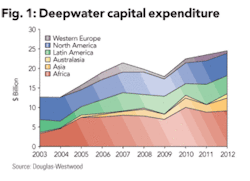

Deepwater expenditure to reach nearly $25 billion annually by 2012

A new study published by analysts Douglas-Westwood, The World Deepwater Market Report 2008-2012, forecasts that nearly $25 billion will be spent annually in deepwater capital expenditure by 2012.

Speaking at the Deep Offshore Technology International Conference 2007, Stavanger, John Westwood commented that “the deepwater oil and gas industry is set for continued growth through to 2012, with over 30% growth forecast for the 2008-2012 period when compared with the previous five years.”

Deepwater oil production currently accounts for almost 15% of total offshore production, but over the next few years its share relative to shallow water output will grow accounting for around 20% of offshore production by 2011.

Africa is expected to be the leading deepwater development area over the 2008-2012 period, accounting for nearly 40% of the global deepwater spend. Since the first deepwater ‘elephants’ Africa has emerged as perhaps the most significant deepwater region in the world, with some stunning successes, such as Girassol, Xikomba, and Kizomba.

The Latin America region is dominated by Brazil in terms of deepwater activity. National operator Petrobras has established itself as a pioneer in the use of innovative technology to achieve production from tremendous water depths. Overall, the region is expected to account for nearly 20% of world deepwater development spend over the 2008-2012 period.

The North America region is expected to account for over 25% of deepwater development Capex over the 2008-2012 period. With a few notable exceptions, deepwater fields in the US Gulf of Mexico tend to be smaller than those in other deepwater ‘hotspots’ such as Brazil or West Africa. The region’s extensive offshore infrastructure and the relative proximity of supply and service centers have a significant influence on E&P activity, turning otherwise marginal prospects into viable commercial propositions. These factors also mean that project lead times tend to be shorter than in other regions.

The ‘Golden Triangle’ of deepwater, namely the Africa, Gulf of Mexico, and Brazilian areas, will still account for 84% of global deepwater expenditure over the forecast period but the rapid emergence of Asia as a significant deepwater region should not be overlooked. Indonesia, Malaysia and India all have development prospects on screen for the 2008-2012 period and the region should account for 10% of deepwater Capex during this time.

The World Deepwater Market Report 2008-2012 forms part of a series of reports that are used by over 200 companies in 37 countries. These include leading corporations, investment banks, and agencies of governments. The report considers the prospects for this growing market and values future expenditure through to 2012. The report also reviews technologies and drivers and details prospects.

Esso Exploration Angola startsproduction of Marimba North project

Exxon Mobil Corp.’s subsidiary, Esso Exploration Angola Ltd., has started production from the Marimba North project, designed to develop 80 million barrels of oil in approximately 3,900 feet of water more than 90 miles off the coast of Angola.

The Marimba North project is a tie-back to the Kizomba A development and has come on stream ahead of schedule and within budget. Major components of the Marimba North project include subsea wells, a single drill center, 30 kilometers of flowlines and a unique riser system which ties the production flowline into the existing Kizomba A Tension Leg Platform. The Marimba North production and control facilities have been integrated with the existing Kizomba A development to effectively and cost efficiently utilize the existing field facilities. This milestone was achieved without any production impact to the Kizomba A operations.

Marimba North is one of seven major start-ups for ExxonMobil in 2007. The project will add about 40,000 b/d of peak production capacity to the existing Block 15 production, which includes the Xikomba, Kizomba A, and Kizomba B developments. With the addition of Marimba North, Block 15 will produce about 540,000 b/d with combined estimated recoverable resources of 2 billion barrels of oil. A fourth Block 15 development, the Kizomba C project, is planned to develop an additional 600 million barrels in the Mondo, Saxi, and Batuque fields.

Like other Block 15 developments, the Marimba project encompassed a contracting and construction effort that spanned several continents and involved activities in eight nations. More than $70 million has been spent on local Angolan goods and services including contracts for in-country fabrication, logistics support, training, and development of Angolan personnel. These contracts have resulted in sustained growth for Angolan capacity and expertise to support future oil and gas developments.

ExxonMobil holds interests in four offshore deepwater blocks in Angola covering more than 3 million gross acres with a resource base now estimated at nearly 13 billion oil-equivalent barrels (gross).

In addition to Esso (operator, 40%), other participants in Block 15 are BP Exploration (Angola) Ltd. (26.67%), ENI Angola Exploration BV (20%), and Statoil Angola (13.33%). Sonangol is the Concessionaire.

MAN Ferrostaal opens South Africa’s first oil platform production facility

South Africa has opened its first fabrication yard for oil and gas platforms. The country is exploring this sector in an attempt to become a market participant in the international oil and gas trade. The investment in Saldanha Bay (Western Cape Region) amounts to approximately 30 million Euros and is the largest project which has materialized within the framework of the South African Offset Program. The fabrication yard for platforms was constructed by MAN Ferrostaal within the framework of offset obligations through the sale of three submarines.

The platform fabrication yard will meet the increasing demand for production platforms triggered by the growing West African oil and gas industry. Until now, production platforms for the offshore oil and gas industry in West Africa have been manufactured solely in Europe, the Middle East, the US, and South-East Asia. Heavy demands in these countries have resulted in lead times of up to seven years. The new production site in Saldanha Bay decreases lead times and shortens towing times for the platforms to a fraction of the time currently required.

Due to the sharp increase in oil prices, it must be envisaged that the demands made on production platforms are set to increase further. For this reason, MAN Ferrostaal is in talks with regard to the construction of a second site for the repair and maintenance of oil platforms in Cape Town. Both projects are of social importance for South Africa. In addition to the economic significance, they will lead to the creation of nearly 12,000 new jobs.

At the opening, Dr. Matthias Mitscherlich, CEO of MAN Ferrostaal and member of the executive board of MAN AG, emphasized the local added value in the accomplishment of the project: “Three-quarters of all firms commissioned are South African companies and half of all expenditure went to companies which promote the interests of South Africa’s black population.” Over 900 people from the Western Cape Region were involved in the nine month construction period, and nearly all material used for the construction of the yard came from South Africa.

Saldanha Bay, north of Cape Town, is the deepest and largest natural port in southern Africa. MAN Ferrostaal was the general contractor involved in the development and construction of the fabrication yard there. Atlantis Marine Projects, the South African partner of MAN Ferrostaal, took care of the project development and feasibility studies. The South African company Grinaker LTA, which has a similar plant in West Africa, will serve as the operator.

On the 220,000 square meter complex in Saldanha Bay, components for offshore platforms will be constructed in the future, including bridges, outriggers, decks, mantles and submarine infrastructure, as well as complete offshore modules (platforms). Positive feedback from the international oil industry has already led to a planned capacity increase for the complex in Saldanha Bay.

Due to the accomplishments in South Africa, MAN Ferrostaal has decided to further intensify its engagement in the country. During the official opening ceremony, Dr. Matthias Mitscherlich and Sipho Zikode, acting deputy director general of the Department of Trade and Industry, signed an agreement for a strategic partnership between MAN Ferrostaal and the DTI.

Petrohawk Energy to divest Gulf Coast division for $825 million

Petrohawk Energy Corp. will sell its Gulf Coast division to a privately-owned company for $825 million. The sale is expected to close during the fourth quarter of 2007, subject to customary closing conditions and adjustments. The sale is effective July 1, 2007.

As of December 31, 2006, Petrohawk reported proved reserves of 204 Bcfe for its Gulf Coast division. The properties are currently producing about 100 MMmcfe/d.

Petrohawk will use the proceeds from the sale to finance acquisitions, accelerate development in the Fayetteville Shale and Cotton Valley tight gas plays, and to repay a portion of its revolving credit facility.

At closing, Petrohawk will receive $700 million in cash and a $125 million note. The company intends to report the transaction under the installment sale rules and to utilize a like-kind exchange structure for a portion of the sales proceeds, both of which would result in additional value in this transaction.

Merrill Lynch Petrie Divestiture Advisors acted as marketing and financial advisor to Petrohawk in connection with the sale.

Petrohawk Energy Corp. is an independent energy company engaged in the acquisition, production, exploration and development of oil and gas, with properties concentrated in the Mid-Continent, Gulf Coast, and Permian regions.

Tahiti Project first oil scheduled for 3Q09

Chevron Corp. expects first production from its Tahiti project in the deepwater Gulf of Mexico by the third quarter of 2009, roughly 12 months later than the original date that was planned prior to the discovery of defective shackles in the facility’s mooring system.

With a recoverable resource ranging from 400 million to 500 million barrels of oil-equivalent, the Tahiti field is believed to be one of the Gulf’s largest deepwater discoveries. The field, located about 190 miles south of New Orleans and in more than 4,000 feet of water, is intended to be developed from two subsea drill centers producing to a floating production facility supported by a truss spar. The Tahiti facilities are designed to have a daily production capacity of 125,000 barrels of crude oil and 70 million standard cubic feet of natural gas.

The installation of Tahiti’s truss spar was delayed in June 2007 when testing revealed a metallurgical problem with the mooring shackles.

Marathon Oil completes acquisition of Western Oil Sands

Marathon Oil Corp. has completed its acquisition of Western Oil Sands Inc. through a cash and securities transaction of roughly US$5.8 billion, plus Western’s outstanding debt valued at nearly US$1.1 billion, for a total transaction value of US$6.9 billion.

Under the terms of the agreement, Western shareholders will receive US$3.9 billion and shares of Marathon common stock or securities exchangeable for Marathon common stock aggregating to 34.3 million shares valued at US$1.9 billion.

Commenting on this transaction, Clarence P. Cazalot, Jr., president and CEO of Marathon said, “Marathon’s acquisition of Western will enable us to realize our fully-integrated strategy to link oil sands production with heavy oil upgrade projects at our refineries, and thereby maximize both the recovery and value of these assets. The world-class Athabasca Oil Sands Project provides access to total net resource of approximately 2 billion barrels of mineable bitumen while there is an additional 600 million net barrels of potential in-situ resource, together providing significant future growth opportunities.”

Marathon is an integrated international energy company engaged in exploration and production; oil sands mining; integrated gas; and refining, marketing and transportation operations. Marathon, which is based in Houston, Texas, has principal operations in the US, Angola, Canada, Equatorial Guinea, Gabon, Indonesia, Ireland, Libya, Norway, and the UK.

Breakthrough subsea contract awarded to Aker Kvaerner

Petrobras Americas Inc. has awarded Aker Kvaerner a contract to supply subsea power cables and control umbilicals to its Cascade and Chinook fields in the Walker Ridge area of the Gulf of Mexico.

Aker Kvaerner will deliver around 230,000 feet of high voltage power cables as well as static and dynamic steel tube umbilicals to Petrobras.

“We have extensive experience in developing umbilical technologies for deepwater areas and have used our know-how to develop a high voltage power cable suitable for the same water depths. This deepwater application is groundbreaking, and we are extremely pleased that Petrobras has chosen us as their supplier for this project,” says Erik Wiik, president - Americas, Aker Kvaerner Subsea.

Both the high voltage power cables and umbilicals will be installed at water depths up to 8,800 feet. The umbilicals will be made using Aker Kvaerner’s patented carbon fiber rod technology.

“Petrobras needs dynamic umbilicals that are highly flexible and have good mechanical characteristics that can withstand the environmental challenges in deep water Gulf of Mexico. We can offer this with our advanced carbon fiber rod solution,” adds Wiik.

The project management, engineering, and manufacturing will be performed at Aker Kvaerner Subsea’s state-of-the-art umbilical facility in Mobile, Ala. The scope of work includes the design, qualification, fabrication, and testing of the umbilicals along with all required topside and subsea terminations.

Delivery of power cables and umbilicals is scheduled for mid-2009.