Consolidation trend seen for midstream MLPs

Master limited partnerships—a proven business model for pipeline and other midstream petroleum companies—are known for aggressively acquiring assets.

Now, say analysts, the MLP sector faces a round of consolidation itself as a period of mergers and acquisitions looms.

Meanwhile, credit rating agencies list an overall stable outlook for MLPs as a sector. However, the relationship between any individual MLP and its general partner has come under increased public scrutiny, in part stemming from the credibility questions that rocked the overall energy industry after the Enron Corp. debacle.

MLP history

MLPs have evolved since publicly traded limited partnerships were created decades ago. That experience proved that US exploration and production companies' cash flow and assets are too cyclical to work as successful MLPs.

One of the first MLPs was Apache Petroleum LP, created in February 1981, to gain the tax advantages of a partnership with the liquidity of a New York Stock Exchange-listed security (OGJ, Sept. 22, 1986, p. 17). After a 1987 tax law change, Apache Petroleum LP converted into a corporation, Key Production Co., because administrative costs exceeded tax benefits. Key Production later became Cimarex Energy Co., Denver.

Many exploration and production companies that organized as early MLPs turned out to be self-liquidating. Others were recapitalized and became corporations, including Western Gas Resources Inc., Denver.

Ralph Pellecchia of New York, a senior director in Fitch Ratings Ltd.'s global power group, noted that the MLP model works best for companies having a low-maintenance capital spending level that remains very consistent from year to year.

"In the 1980s, several oil and gas producers were capitalized as MLPs. However, in retrospect, these companies were not well suited for the MLP structure, given their sensitivity to oil and gas price volatility and [producers'] need for large and varying amounts of capital to be reinvested in order to maintain stable cash generation during down cycles," he said.

MLPs pay out high volumes of cash flow as distributions to investors, leaving the MLP with little capital available for reinvestment into capital-hungry E&P activities. The business model works better for pipeline owners and midstream companies because these firms generate large, predictable cash flows with limited commodity price exposure.

Currently, most MLPs involve pipeline transportation of natural gas, crude oil, and refined products; storage of liquids and bulk materials; oil and gas gathering, processing and marketing; and retail propane distribution. In the past few years, more pipeline and midstream companies have adopted the MLP structure, Pellecchia said.

Some large energy companies realized a higher value from certain assets by spinning them off into MLPs. Today's more-established MLPs began with refined product pipelines, including Buckeye Pipeline Partners, LP, Radnor, Pa., Kinder Morgan Energy Partners LP, Houston, and Kaneb Pipe Line Partners LP, Dallas.

MLP primer

The legal structure, income distribution practices, and tax considerations governing an MLP differ from that of a publicly traded corporation. MLPs raise capital by trading limited partnership units on publicly traded exchanges.

Wachovia Capital Markets LLC midstream analyst Yves C. Siegel in Washington, DC, noted that tax law requires limited partnerships to earn income from specific qualifying sources, including oil and gas.

MLPs' unique tax structure provides them a lower cost of capital than corporations, enabling the partnerships to achieve higher rates of return.

"During the past year and 5 years (as of May 10), our MLP composite has delivered total returns of 19.4% and 16.5%, respectively, vs. the S&P 500 Index total returns of 18.5% and -2.7%, and the Dow Jones 15 Utilities Index returns of 16.7% and -3.5%, respectively," he said.

An MLP also has a competitive advantage over a corporation in the pursuit of expansion projects and acquisitions, Siegel noted.

"For example, the partnership can derive more value than a corporation from an identical acquisition or effectively pay more for acquisitions and realize the same accretion that a corporation could only achieve at a lower purchase price," Siegel said.

Mihoko Manabe, Moody's Investors Service vice-president and senior credit officer, New York, said Moody's rates 16 oil and gas MLPs. Moody's rated 2 new MLPs in 2003, down from 5 new ones rated in 2002. The agency has not rated any additional MLPs this year.

"The MLP business model is based on putting stable, free cash-flow generating assets in a tax-advantaged vehicle. The focus is on maximizing cash distributions, and one way of doing so is by wringing out costs from these mature assets. Another way is by regularly making acquisitions, since MLP assets typically are mature and hold limited growth prospects," Manabe said.

She noted that the MLP model carries some risks. These include high payouts, acquisition-event risk, and a reliance on external funds. Pressure to increase unitholders' distributions also has caused MLPs to diversify, investing in higher-risk businesses.

Mark Easterbrook, a Dallas-based analyst with RBC Capital Markets, noted that MLP unit prices dropped in April and May because of rising US interest rates.

"Higher interest rates are having a negative impact on MLPs, just as higher interest rates are having a negative impact on other high-yield securities," Easterbrook said.

Consolidation

Late last year, GulfTerra Energy Partners LP and Enterprise Products Partners LP announced merger plans, and the resulting MLP will form the second largest MLP after Kinder Morgan. GulfTerra will become an Enterprise subsidiary upon closing, which is expected in the second half.

J. Vincent Kendrick, a partner with Akin Gump Strauss Hauer Feld LLP of Houston, represented GulfTerra in the pending transaction. He expects to see more consolidation within the MLP sector "than at any time before."

Kendrick said the concept of MLPs acquiring other MLPS is fairly new territory, compared with corporations where "there are years and years of M&A jurisprudence out there for us regarding what happens in the merger context."

Easterbrook said further MLP consolidations could begin to emerge, although he foresees no such deals on the short-term horizon.

"Over the next 12-18 months, as unit prices come down, I think you may start to see some of that consolidation," Easterbrook said.

Pellecchia said, "An acquirer's ability to use high-yielding, tax-advantaged partnership units often gives an MLP a competitive advantage in purchasing privately owned companies, particularly ones with a low-tax basis."

Kendrick said that new, smaller players also are preparing to enter the MLP arena: "We are seeing a lot of smaller companies that are trying to aggregate assets so that they can do an initial public offering. Right now, the energy sector is a sector that a lot of investors have their eyes on—especially the hedge funds and the private equity funds that have raised a lot of money for investment. There is a general expectation within the industry that the new types of investors are going to be partnering with groups that ultimately become MLPs."

Meanwhile, Moody's Manabe noted that the midstream MLP sector took a respite last year from rapid growth of asset acquisitions made during the past few years. She said MLPs needed time to "digest" these assets, adding that MLPs also used 2003 as a year in which to concentrate on incremental organic growth.

"Acquisition activity may pick up," Manabe acknowledged, adding that, "Assets sold are more likely to be selectUassets of major and independent oil and gas companies and generally smaller than the marquee distressed sales of 2002. As MLPs develop and more sharply define their scope, there may be swapping of assets or a consolidation of smaller MLPs with larger ones. The level of M&A activity will depend on the assets that come to market, multiples paid, and the financing available."

Hugh Welton, a senior director in Fitch Ratings global power group, said that MLPs typically are aggressive asset acquirers.

"A lot of it has to do with MLPs' cost of capital being lower than corporations, and a lot of it has to do with MLPs being nontax-paying entities. They are able to outbid the corporations," Welton said.

Moody's Investors Service Vice-Pres. Mihoko Manabe "The MLP business model is based on putting stable, free cash flow generating assets in a tax-advantaged vehicle. The focus is on maximizing cash distributions, and one way of doing so is by wringing out costs from these mature assets."

Corporate governance, general partners

The relationships between the MLPs and their owners, operators, and related affiliates can become quite complex.

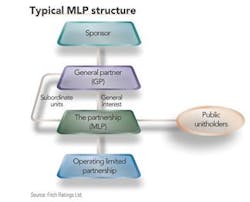

An MLP generally has two partnership tiers. The first tier is the traded MLP, and its primary asset is the second tier, called the operating limited partnership, which owns and operates the MLP's assets. In most cases, both partnerships have the same general partner (see chart).

The GP's owner is called the sponsor, and the sponsor can range from large corporations to individual investors. The sponsor owns the GP interest and can own a substantial portion of the MLP interest.

Moody's Manabe noted, "Increased public scrutiny of intercompany transactions between the MLP and its GP has also contributed to the cooling of this sector's growth rates. Moody's will continue to monitor a GP's influence on an MLP's strategic direction, risk tolerance, and financial policy."

Meanwhile, Kendrick said there always will be some sensitivity because of the GP's control of the MLP. "What we have seen, especially in the last 12 months, is that the market is requiring a level of corporate governance that is not otherwise required by lawU. I think you are seeing that the MLPs are reacting to that very positively and very promptly because, if they don't, they may be penalized in the marketplace."

Some GP interests have changed hands as large energy companies sought to reduce their overall debt.

Under an amended agreement in the GulfTerra-Enterprise merger, El Paso Corp. will retain 9.9% of the merged entity and the right to exchange its GP interest for Enterprise common units (OGJ Online, Apr. 22, 2004). El Paso's net cash proceeds from the overall transaction will be $1.35 billion.

"With the proceeds from this transaction, we have now announced or sold $3.4 billion of assets, putting us within the range of the $3.3-3.9 billion of asset sales we originally targeted for sale by the end of 2005," said El Paso CEO and Pres. Doug Foshee.

In an earlier example, Williams Cos. Inc. sold its entire 54.6% GP interest in Williams Energy Partners (now Magellan Midstream Partners LP) for $554 million in cash and debt. The buyers were a new entity formed jointly by private equity firms Madison Dearborn Partners LLC and Carlyle/Riverstone Global Energy & Power Fund II LP (OGJ Online, April 21, 2003).

"A change in GP or the dilution of its interests brings into question what the new GP owners' strategy is in keeping its stake," Manabe said. "The GP owner mix could affect an MLP's strategy (a strategic partner interested in expanding commercial opportunities or a financial investor seeking certain returns within a certain investment horizon) and the pressure to increase distributions (LP distributions as well as the GP incentive payout, depending on the mix of equity stakes held)."

Wachovia's Siegel noted that there have been seven private market transactions in 2 years involving the sale of the GP interest of MLPs.

"We expect more GP transactions will occur in both the private and public marketsU. Some of the recent acquirers of GP interests have been financial players. We expect these private equity investors will look to monetize their investments in coming years," he said.