International deals come alive and deal pace increasing

Brian Lidsky,PLS Inc., Houston

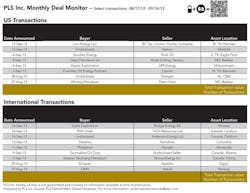

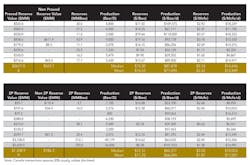

PLS reports that from August 17 to September 16, the international upstream deal market rallied with $15.9 billion in deals (up from $1.7 billion the prior period) while the US slipped slightly to $4.9 billion (from $5.2 billion) and Canada declined to $0.9 billion (from $1.9 billion).

In addition, as of press time on September 17, the Q3 2013 upstream global tally ($36.3 billion) is already up 40% versus the Q2 total of $25.9 billion. International is up 35%, the US is up 44% and Canada is up 67%.

Internationally, thus far in Q3, there have been 7 deals greater than $500 million. Of these, 4 have been sold by large US companies. This trend of harvesting well-developed assets and/or selling down large discoveries in the international arena remains a strategic source of cash for US companies needing to redeploy the capital into domestic resource plays. In Kazakhstan, ConocoPhillips sold (Sept. 2013) a 8.4% WI in its North Caspian PSA for $5.0 billion to China's CNPC. In Egypt, Apache sold (Aug. 2013) 1/3 of its holdings to China's Sinopec for $3.1 billion. In Mozambique, Anadarko sold (Aug. 2013) a 10% interest in its Rovuma Area-1 discoveries for $2.6 billion to India's ONGC. And finally in Angola, Marathon (Sept. 2013) sold its 100% interest in offshore Block 32 to Sonangol for $0.6 billion.

Apache's partial sale of its Egyptian assets presents a nice case study highlighting this trend of US companies selling assets and re-deploying the cash towards US resource plays with predictable growth and attractive rates of returns. Just last May, Apache announced a goal to sell $4 billion in assets by year-end 2013 and use proceeds to pay debt, buy back shares under a 30 million share repurchase authorization and fund capex. Since then Apache has sold nearly $7.2 billion. According to Apache chief G. Steven Farris, the Egyptian sale (along with its Gulf of Mexico shelf sale) allows Apache to take "meaningful steps to rebalance our portfolio to better deliver the full potential of our deep North America onshore resource inventory." In 2010, Apache's production included 31% onshore North America, 25% Egypt and 17% Gulf of Mexico shelf. Pro-forma for the Gulf and Egypt sales, Apache's production mix is now shifted to 55% onshore North America and 15% Egypt. In North America, Apache is ramping up horizontal development in the Permian where it lays claim to being the #1 most active driller and is seeing "explosive growth" from horizontal drilling in its central region primarily in the Anadarko basin.

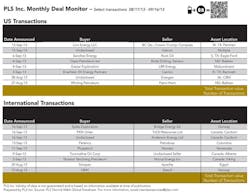

Domestically, the Bakken takes center stage for deals this period with pure-play Oasis Petroleum striking 4 separate deals for $1.515 billion – one of which is a $1.45 deal with privately-owned Roda Drilling and Zeneco Inc. These deals increase Oasis's Bakken acreage by 48% to nearly 500,000 net acres and its production by 28% to 43,000 boepd. In the Oasis/Roda-Zenoco deal, PLS values the acreage component at $7,400 per acre which is located in the "heart of the Bakken play." Also in the Bakken, Whiting paid Petro-Hunt $260 million for 17,282 net acres and 2,420 boepd located in and around its highly successful Hidden Bench and Missouri Breaks projects. PLS values this acreage at $5,500 per acre.

In Canada, the largest deals this month are also occurring within the resource plays. Novus Energy agreed to sell the company to Yanchang Petroleum for US$291 million including debt assumed. Novus' focus is on the Viking light oil play. Also TriOil Resources agreed to be bought by ORLEN Upstream, a large energy company in Poland. TriOil's focus is on the Cardium light oil play.

Markets are well-supplied with deal inventory and we expect deal flow to continue gaining momentum towards year's end. In Canada, recent large deals in play include KNOC rumored to be shopping Harvest and Imperial marketing 15,000 boepd (51% oil) in several fields across western Canada. In the US, Laredo and Primexx are marketing select Permian assets, Exco is selling assets and several deals are in play in Colorado and North Dakota. Internationally, new deals in play are available in Argentina, Gabon and the North Sea.