An Evolving Ecosystem

This sponsored supplement was produced by Focus Reports. Project Publisher: Ines Nandin. Project Director: Kirsty Avril Jane Walker. Editorial Coordinator: Roslan Khasawneh. Contributors: Fraser Wallace. For exclusive interviews and more info, log onto www.energyboardroom.com or write to [email protected] |

Despite a complete lack of hydrocarbon resources within the sovereign territory of Singapore, the city-state has been linked to the oil and gas sector for more than a century. Singapore has been an oil trading hub for over 120 years, and since the 1960s, the country has been a major refining base. Nonetheless it is in the last generation that Singapore's oil and gas industry has really undergone a major revolution, with a boom in oil and gas related activities on both the hardware and software side of the business: from storage, shipping, manufacturing and offshore services, to financial and legal services. How does a country with no oil and gas resources of its own achieve this position of regional leader, or justify such an evolution? Is the shift a result of top-down policies or bottom-up business strategies? Finally, yet perhaps most importantly, how will Singapore continue its evolution?

Evolutionary recap

On the tangible, ‘hardware' side, Singapore has grown to become a major energy and petrochemicals hub for Southeast Asia as a result of its solid infrastructure and strategic positioning. Singapore is also one of the world's top three export refining and oil and gas trading centers, with a refining capacity in excess of 1.3 million barrels per day (bpd) in 2012. In 2012, oil exports accounted for 21 percent of total exports. Furthermore, the so-called ‘little red dot' is one of the world's busiest marine bunkering hubs and a major oil and oil product pricing center.

In addition to this, Singapore is recognized as a premier global offshore hub. Located along one of the most important shipping lanes in the world, the Strait of Malacca, Singapore has enjoyed a maritime tradition for decades. Lim Kok Kiang, assistant managing director of Cluster Group Engineering at Singapore's Economic Development Board (EDB), highlights how the offshore sector in Singapore began to take off in the 1960s. "Part of this emergence was down to Singapore's longstanding position as a marine hub for Southeast Asia. In the 1970s and 1980s, Singapore started to develop its vessel conversion capabilities, prior to building a footprint in the offshore oil market through jack-up rigs in the 1990s. It was an incremental evolution, which followed a natural skill-set transition." In effect, the country's strategic position along the trade route has enabled it to gradually develop its maritime engineering and manufacturing capabilities.

Today, Singapore is the undisputed global market leader in the construction of jack-up rigs and conversion of Floating Production Storage and Offloading Vessels (FPSOs). Michael Chia, chairman of the Singapore Maritime Foundation (SMF), summarizes that "Singapore will maintain itself as both a shipping hub and a port city; we try to leverage our strength as a trans-shipment port. Combined with the fact that Singapore is also a world leader in rig building and FPSO conversions, it is very much a formidable contender on the hardware side and we fully intend to continue along that path."

Singapore has also made significant leaps in the development of the ‘software' side of the oil and gas industry. As a crucial trading hub for refined petroleum products and petrochemicals and a leading supplier of a range of offshore assets, Singapore offers a wealth of engineering expertise and is has often been a source of innovation for the global oil and gas industry.

Singapore has also made significant efforts to use its positioning as the world's fourth largest financial center, and fully applies this to its oil and gas ecosystem. Singapore's exchange, the SGX, has implemented a number of initiatives to attract energy companies seeking to raise capital to the island state. Moreover, in 2013, Singapore was designated by the Baltic and International Maritime Council (BIMCO) as the third named seat for maritime arbitration in BIMCO's Standard Shipping Forms. On that topic, Chia of the SMF proudly notes that "this is quite a feather in our hat and demonstrates that Singapore has grown into a critical node in the global maritime network."

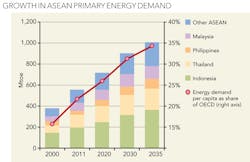

Despite its resounding success, Singapore has never stood still. The IEA's Southeast Asia Energy Outlook report boldly states, the region's "energy demand [will] increase by more than 80% in the period to 2035." As a result of the accompanying increase in competition across the refining and offshore manufacturing industries, Singapore is constantly reassessing its competitive position and building upon its strengths. In order for Singapore to maintain its regional energy leadership and global competitiveness, it must actively promote and develop each branch of its oil and gas industry and assert its value on the global energy scene.

Riding the Offshore Wave

Following the emergence of the offshore industry in the 1970s, Singapore was able to convert its traditional skills in the marine and ship repair industry into ship conversions and rig building with great success. To some extent, this reflects Singapore's capacity to respond to the marine and offshore industry's constantly evolving market dynamics, in line with its national motto "Majulah Singapura" (Malay for "Onward, Singapore"). In the offshore industry's latest upturn, for instance, Singapore was the first mover to secure a slew of rig orders.

Singapore's two largest offshore rig builders, Keppel Corporation Limited's subsidiary Keppel FELS and Sembcorp Marine's units PPL Shipyard and Jurong Shipyard, account for 70 percent of global jack-up rig construction. Singapore also controls the market for the conversion of FPSOs, with two-thirds of the global share.

A Two-way Springboard

Given the positive industry outlook in the region and Singapore's business environment - conducive for international operations has and with an ability to attract top global talent - it is easy to see why so many international players have established regional, or even global, operations in the country.

In this regard, Singapore is often cited as the ideal springboard for Western based companies into the East. However, the opposite holds equally true. As Jin Qingyong, president of COSL Drilling Pan-Pacific, the international branch of COSL China for the jack-up division, puts it, "Singapore has proved to be the ideal launching pad from which COSL can work towards these long-term goals and establish itself as a truly international company. In terms of its policies and human resource management, among others, Singapore offers a Western style business platform in an Asian environment. There is a great balance between Mandarin and English speaking people. As a Chinese company, Singapore provides us with the ideal platform from which we can make the transition into Western markets."

Despite the rising costs of business in Singapore, Jack Zhou Minghua, executive director at COSL Pan-Pacific, agrees. "Although the costs associated with doing business in Singapore have been on the rise in terms of office or land space and human resources, the country more than makes up for that with the structural advantages it offers. Companies based in Singapore are exposed to a thoroughly international environment, seamless and transparent legal and financial systems and an efficient regulatory environment that is highly supportive of business development."

Going further, COSL Pan-Pacific is looking to leverage Singapore's oil and gas ecosystem with the establishment of a global supply base in Singapore. Minghua notes that "not only will we be able to take advantage of Singapore's excellent logistics infrastructure and geostrategic location, but the supply base will position us closer to offshore manufacturers including the world's largest rig producer, Keppel."

Asserting its Competitive Position

Speaking at the opening ceremony of the Offshore Southeast Asia Conference and Exhibition (OSEA) in November 2012, Second Minister for Trade and Industry S. Iswaran highlighted that "with rising offshore drilling and production activities, the demand for offshore rigs, platforms and support vessels is set to increase. Singapore is well placed to ride this offshore wave as our shipyards have built up a sound track record of providing cost-effective, safe and timely deliveries. We are also able to meet customer's needs by offering a full spectrum of customized products and in-house proprietary designs for offshore rigs."

Singapore's supremacy in rig construction could, however, be diluted: its yards must now contend with existing competition from established Chinese yards such as Cosco Corporation (which have recently gained significant traction in rig building through aggressive pricing), as well as South Korean yards. In addition to this, they must also compete with new players that have moved into the sector due to a glut in yard capacity in Asia from the downturn in shipbuilding.

Nevertheless, Singaporean rig builders appeared unfazed by the competition from Asia as the flow of new orders continues. During the first nine months of 2013, Keppel heads forward with a USD $10.95 billion order book. The company is slated to deliver 20 offshore rigs this year, a record number for any shipyard worldwide.

Despite the stiff cost competition, Choo Chiau Beng, CEO of Keppel Corporation, expects that offshore clients will place greater emphasis on having products delivered on time, rather than risking the costs associated with project delays. "Chinese yards were desperate because they ran out of conventional ships to build," Choo told Bloomberg News. "They were offering crazy terms to attract customers."

Bobby Wong, country manager at the American Bureau of Shipping (ABS) Singapore, states that "although cost is an important consideration for rig owners, brand track record and quality are also key concerns. In this regard, Singapore has earned its recognition as the hallmark of safety, quality and innovation in the marine and offshore industries."

As a leading marine and offshore classification society and key partner of Keppel and Sembcorp in Singapore, Wong highlights his company's role in helping clients to achieve some of the industry's fastest rig delivery times. "As an integral part of the production process, ABS has a dedicated team of proactive surveyors and engineers on the ground that provide customers with the full range of services in a timely and efficient manner while maintaining the highest attention to detail. Our efforts support our clients' ability to consistently deliver quality and reliable assets on schedule or even ahead of schedule, as is often the case. The potential losses that would result from delayed projects help to offset the cost premiums relative to the competition."

Simultaneously, Singapore's yards are moving up the technological ladder and focusing on niche market segments that require significant investments in R&D and innovation. For instance, Keppel Offshore & Marine (Keppel O&M), and ConocoPhillips are jointly designing a first-of-its-kind ice-worthy jack-up rig to operate in the Arctic Seas, one of the harshest marine frontiers.

This push towards innovation and R&D is also supported by a slew of international organizations in the industry that have made significant investments in establishing knowledge and research centers in Singapore. Other world leading classification societies that have recognized the benefits of locating their activities alongside their clients. Det Norske Veritas (DNV), for instance, has established two technology centers in Singapore; the Clean Technology Center and the Deepwater Technology Center, in 2010 and 2012, respectively. Ernst Meyer, vice president and regional manager for DNV South East Asia and Pacific, notes that these investments were "a result of DNV's ambition to continue along its growth path and spread its innovation genes instilled in the company towards Asia. Historically, our Asian operations have not played a big role in innovation but this is something we intend to change."

Meyer goes on to explain that "this corresponds well with Singapore's national ambition to be a regional competence center for deepwater and clean energy technologies. As such, we have been working closely with the EDB in order to realize this shared ambition."

As a company associated with offshore survey, site investigations and engineering works, Fugro has also grown into a globally recognized technological leader. For its Singaporean offices, 2013 marks forty years since incorporation. Jerry Paisley, regional manager for Asia Pacific Offshore Geotechnics, Fugro, explains the regional offices role in promoting innovation and R&D.

"The National University of Singapore (NUS) has a Center for Offshore Research & Engineering (CORE) which carries out a significant amount of research programs. The establishment of CORE in 2003 marked the first step in NUS's plan to help shape the development of Singapore into a center for offshore and maritime research. Within the few years since its inception, CORE has established strong links with the offshore oil and gas industry, and has established an enviable track record in R&D and education in offshore technology. Some of the high-end research topics taking place there today are mainly centered on the engineering space, as opposed to exploration and production, and ranges from arctic engineering to methane hydrate research.

In that respect, Fugro engages in and funds a number of joint industry projects with various research and academic institutions and industry players. With over 130 jack-up rigs in operation in the Asia Pacific region, we carry out a good deal of survey and geotechnical engineering work to ensure the safety of the sites. Because it constitutes such a large proportion of our work, we are conducting a fair amount of research into improving the prediction and avoidance of jack-up punctures and are actively funding these joint industry projects with NUS."

Similarly, Lloyd's Register has recently inaugurated its Global Technology Center in Singapore, one of two in the world which is exclusively focused in the energy sector. Although only inaugurated in September of 2012, Claus Myllerup, senior vice president of energy technology at Lloyd's Register, outlines the advancements the GTC has made already. "We have made significant contributions towards publishing the first floating offshore rules in terms of structures that can be used for drilling units from a safety and operational view point," he says. "In addition to this, we are in the process of developing some rather interesting concepts in relation of subsea units and the ways in which they can be monitored and in turn interpreted. Furthermore, we are working closely with a number of universities and A-Star to provide insights for the very large hydrodynamic test facility that is being built here."

Best Place to do Business

Singapore has historically been a commodity and refining hub as well as the world's largest bunkering point. This enabled the country to play a critical role in the development of the region. Today, Singapore remains central to the regional development from a financial perspective as well.

The Singapore Exchange (SGX) has made clear its intentions to become a regional center for oil and gas firms seeking to raise capital. Lawrence Wong, executive vice president & head of listings at SGX, explains that for any country to develop itself into a successful exchange hub, a number of fundamental factors are necessary. "For a country to be an effective exchange platform, it must have an affinity to the industry in question while offering an attractive business environment," says Wong. "As a destination with a number of flourishing industry clusters that was ranked ‘best country to do business' for the seventh year running by the World Bank, Singapore fits the bill perfectly. From an oil and gas perspective, Singapore is an oil hub, a refinery hub and a commodities hub, and gives Singapore the crucial background it needs to become a leading exchange platform for oil and gas companies."

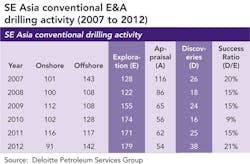

When compared to global exchanges such as those in Australia, Tokyo or London, some might view Singapore as a minnow. However, Simon Crellin, director at Deloitte Petroleum Services, sees this as an advantage. Although smaller independents on those exchanges might have a good story to tell, their share prices have been flat-lining. Crellin explains that "there are simply too many companies listed, each one is like a tree in a forest, unable to stand out. By contrast, the SGX has a concentrated list of oil and gas E&P companies, and because of this, a good story will get a lot more traction than on the larger exchanges."

KrisEnergy, an independent upstream company focused on exploration, development and production in the basins of Southeast Asia, pioneered Singapore's efforts in attracting energy companies to raise capital in the country. Having previously been involved in the flotation of two oil and gas companies including Pearl Energy, which was subsequently acquired by Abu Dhabi's Mubadala Petroleum in 2008, the company's founding trio made a calculated decision to list their latest company, KrisEnergy, on the SGX. Richard Lorentz, co-founder and director of business development at KrisEnergy, admits that their ability to stand out on the SGX was a key motivating factor behind their Singapore listing.

A Steep Learning Curve

By making capital more accessible for regional energy companies, the emergence of Singapore as a regional financing center is creating further opportunities for junior players to capitalize on the region's oil and gas resources.

Many of the oil and gas assets in Indonesia and Malaysia, for instance, are now at a rather mature stage, smaller companies are needed to develop smaller fields and rehabilitate the older fields. Singapore is positioning itself well to provide opportunities for investors looking towards these brownfield developments.

Singapore does boast a great blend of economic, fiscal and legal regimes that provide for an excellent business environment, but the challenge for Singapore positioning itself as a regional financial hub for energy companies "relates to the absence of an oil and gas listing track record and the unfamiliarity of investors with the particularities of the upstream sector," says Ben Arnott, director of project finance for oil & gas at Standard Chartered.

In order to overcome these hurdles, the SGX introduced a set of new admission rules and continuing listing obligations to facilitate the listing of mineral, oil and gas (MOG) exploration companies. To achieve this, the SGX first had to develop rules that would cater specifically to the MOG industries, while simultaneously raising the financial requirements and standards of any company looking to list on the SGX as part of its market development strategy. Second, the SGX invested significant resources in educating investors, holding more than a dozen training events over the course of a few months, spearheaded by industry experts, including companies such as energy consultants RPS, that altogether helped craft the listing rules for MOG companies. Among other initiatives, RPS aims to help educate investors and routinely advises non E&P companies who are considering getting involved in E&P projects in South East Asia. At the outset, many new entrants into the E&P business might not understand the financial risk. Wong reinforces that the "aim is not only to educate ourselves about the dynamics of the MOG industry, but also the financial researchers and retail and institutional investors. That is how you build an ecosystem."

As one of the first companies to reach compliance with the new MOG rules on the SGX Mainboard, Lorentz, of KrisEnergy, acknowledges that the process was not entirely seamless. During the development phase, the SGX, along with the Monetary Authority of Singapore (MAS), shaped the regulations governing the listing of MOG companies. "These are not even rules yet," Lorentz stresses, "so during the KrisEnergy listing process we had to figure out what would satisfy the SGX and MAS based on the guidelines put forward from a consultation paper. We drafted the prospectus in accordance with the highest standards of the SGX guidelines that we knew to work. At the same time, we also consulted with the SGX on those points which we knew to be operationally counterproductive or inapplicable to our industry to help them understand the specific nature of the upstream oil and gas business."

Lorentz goes on to say that "KrisEnergy's prospectus set the precedent and may be viewed as the most likely guidelines that would apply to upstream oil and gas companies looking to list on the SGX Mainboard." Wong shares these views, saying that the listing allowed the SGX to gain "an invaluable insight into the functioning of the industry and how companies operate at their different stages of development." As a reflection of Singapore's pragmatic and open approach to promoting business, Wong admits that "when it comes to the technical aspects, we are not experts in the field. Instead, we rely on experts who share their knowledge and insights to help us to understand the particular issues at hand."

Re-engineering the Talent

Due to a lack of natural resources, Singapore is highly dependent on its workforce. This is particularly true for Singapore's talent intensive maritime, construction, engineering and manufacturing sectors. As is the case with the rest of the global oil and gas industry, Singapore's growth in the energy industry is mired by an aging workforce and a shrinking talent pool.

As Arno Bracco Gartner, energy division director at Brunel, a provider of specialist knowledge to the international oil & gas, petrochemical, power generation and construction industries, explains, "a decade ago there was a push by the government to develop ICT, pharmaceutical and financial services. This coincided with a lot of graduates being steered in that direction. As a result of this restructuring, Singapore has lost its edge in the engineering space and many companies have been affected by the expanding talent gap. In this sector, Singapore is rapidly losing ground to Kuala Lumpur."

The issue in Singapore's case is exacerbated by the government's push to control the inflow of foreign workers across a number of sectors. Robert Dompeling, group CEO of Singapore-based PEC Ltd, explains that "this was initially brought about with the governments' ambitions to improve labor productivity through The National Productivity and Continuing Education Council (NPCEC)."

In 2012, the NPCEC identified four new sectors of interest where it intended to boost national productivity, including the process construction and maintenance sector. Essentially, these policies aim to improve productivity and raise wages through innovation and automation while introducing tighter foreign labor restrictions. "To put it simply, Singapore businesses are expected to boost productivity so that they can employ fewer workers while offering them better wages," explains Dompeling.

A Regional Context

Singapore's refining sector has also come under pressure as a result of increased costs in Singapore, and importantly, increased regional production capacity in countries like China and Vietnam, as well as from the Middle East. However, to what extent are these developments a threat to Singapore's downstream industry and how can it grow considering Singapore's land constraints?

In overcoming its space limitations, Howard Pang, general manager at Dubai-based Horizon Singapore Terminals, points towards the ‘great Singapore area' expansion project as a potential remedy. Pang explains that "the idea primarily revolves around some of the Indonesian islands that surround Singapore as well as the south Malaysian territory bordering Singapore offering land area that can accommodate the construction of a variety of terminals and ports that will complement Singapore's limited land and shoreline availability. "As such, they will provide traders and oil companies with greater capacity in peak times," explains Pang. He continues: "Singapore has historically been the region's entrepôt which has for long developed and honed the skills and infrastructures needed to support that. In this respect, it would be very difficult to match and overcome the momentum that the island-state has gained over time."

Clive Christison, director & CEO of Integrated Supply & Trading for the eastern hemisphere at BP Singapore believes that, "Singapore will remain a leading downstream location due to its well engrained and sophisticated petrochemical complexes… one of the main challenges Singapore faces as of now are attempts by other hubs to mimic infrastructure and support systems here. However, the city-state has a clear advantage of years of investments in its physical assets created through honing the specific regulatory policies and cultivating human capital needed to create a synergistic ecosystem. By any measure, these attributes are all very difficult to recreate."

Despite Singapore's leadership, the island-state faces stiff competition across the oil and gas value chain from aspiring and energy hungry regional nations. However, where some might see a threat, Singapore sees opportunities. The country has demonstrated its aversion to complacency and is continuously looking towards the horizon, seeking to always punch above its weight and champion the industry forward.

These measures will have further implications on safety. As a company focused on the Engineering, Procurement and Construction (EPC) and maintenance services to the oil and gas and petrochemicals sectors, among others, Dompeling stresses that, "our people are often working in high risk environments. If our most experienced people have to leave as a result of these policies, this could potentially contribute to the higher workplace incidents due to replacements with inexperienced staff."

As a potential remedy, Dompeling suggests that, "in order to limit the negative effects of these hurried policies, the government must tailor its approach towards the needs of the different targeted industries. The authorities should consider relaxing its stance on tightening the foreign labor supply to allow businesses more time to absorb the changes."

Despite concerns surrounding the lack of locally trained engineers, Dompeling, in line with strong industry-wide opinion, still maintains that Singapore is a great place for business. Gartner, for instance, shares these views. "Holistically, I do not think the region has ever been so busy," he says. "The variety of projects and clients is immense, and it is an aspect which illustrates the thriving and developing energy ecosystem of the region."

Thomas McNutt, head of regional and public affairs at the American Chamber of Commerce (AmCham), insists that "Singapore is not turning off the spigot of non-nationals entering Singapore." The governments' primary goal is to increase the quality of life of its citizens and it is using foreign labor policies as the lever with which to do this. "It is important to stress that the business-government relationship is not an adversarial relationship, but a collaborative one," McNutt goes on to say. "As a result, I am sure the Singapore government understands that its policies are increasing costs, but I am also just as certain that the government will closely monitor the effects of those cost increases and adjust its policies as appropriate."