Three Forks vs. Bakken

How do well results compare?

Hanwen Chang

IHS

Houston

The Three Forks formation lies below the Bakken in many of the same areas in Montana and North Dakota. It is a thicker and more extensive horizon than the Bakken, extending further east across North Dakota, further west into Montana, and as far south as South Dakota. However, only about 5% of the formation is said to have been tested, compared with 14% to 33% in some of the better-known parts of the Bakken. Continental Resources has done more development in the Three Forks formation than any other operators active in the area. The company has delineated the play into four separate zones, or benches, and has drilled thirteen successful wells into the lower Three Forks in different areas on its acreage.

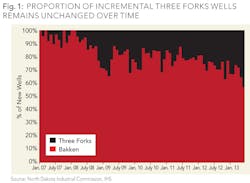

Integrating North Dakota state data on reservoirs with an IHS data set shows that roughly 20% (as of August 2013) of currently producing wells in the North Dakota Bakken play are producing from the Three Forks set of reservoirs, with the remainder tapping the Bakken group of reservoirs. While companies and investors have begun to focus significant attention on the Three Forks recently, the number of new wells brought on stream each month has remained flat (Fig 1).

Three Forks dependence by company is uneven: of the 25 largest operators, only eight rely on the Three Forks for more than 35% of their producing well base: Continental, Whiting, ExxonMobil, Halcon (formerly Petro-Hunt assets), QEP, SM Energy, Samson, and Baytex.

Productivity

To compare productivity of producing wells more efficiently, IHS standardizes well performance based on peak production per lateral foot of wellbore for horizontal wells and peak production for vertical/directional wells. Peak production is used as a proxy for overall well economics and near/medium-term productivity, and analysis has shown this to be an effective and accurate substitution. Within the context of a specific play, we then divide the wells into quintiles based on this metric.

Companies have experienced a wide variety of peak per lateral foot well productivity levels when tapping into the two sets of oil-bearing rocks, with some operators more likely to be able to plausibly develop the Three Forks more fully. For the eight listed previously, Three Forks wells' productivity has approximated that of their Bakken-tapping wells, with two exceptions: Whiting's Three Forks wells are significantly less productive than the company's historic Parshall-area wells; QEP's Three Forks wells have exhibited materially higher peak output per lateral foot than its Bakken wells.

Thus, with a few exceptions, peak per lateral foot between the two reservoirs is roughly equivalent for those operators whose production base is made up of at least 35% of Three Forks contribution. Whiting's Three Forks wells underperform due to the inability of their Three Forks wells in the south to match up against their historical sweet spot acreage in the Parshall-Sanish region of Mountrail County.

On average, Three Forks has a peak per lateral foot 20% below Bakken wells for operators that have not drilled a significant proportion of Three Forks wells. Important exceptions include Kodiak, Hess, ConocoPhillips, and Marathon, whose Three Fork wells more closely approximate the Bakken results, but who have not drilled a high proportion of Three Forks wells.

Three Forks hotspots

The footprint of existing Three Forks wells is quite different from that of the Bakken reservoir wells. Large parts of the play have very few Three Forks wells, and we still view those areas as being in the de-risking process.

What Three Forks well control does exist is concentrated in four pockets. Three Forks peak per lateral foot productivity is not improving noticeably in any of the areas, but the IHS North American analytical team was impressed to find that it is roughly equivalent to nearby Bakken wells in three of the four areas (Fig 2).

In the north in Divide County, the key players are Samson, Baytex, and Continental. Three Forks wells are common, and a peak per lateral foot comparison shows them to be equal to Bakken wells (~40 barrel/day per 1,000 lateral foot) in the area, though both are average to poor in the context of the overall play. Drilling here is mostly due to companies that have acreage only in this sub-area (e.g. Baytex and Samson).

On the far southwestern flank of the play, Whiting is relying almost entirely on the Three Forks to drive performance. At ~ 30 b/d per 1,000 lateral foot, the entire area shows mostly poor rock productivity relative to the overall play, but the Three Forks approximates the closest Bakken wells a few miles away.

In the Parshall area – easily the sweetest spot for Bakken well productivity in the entire play – results have been poor, with Three Forks productivity (~40 b/d per 1,000 lateral foot) consistently lagging wells tapping the Bakken reservoirs (down significantly from the glory days above 125 b/d per 1000 lateral foot but still at ~70 b/d per 1,000 lateral foot). Productivity is relatively low, consistent with wells on the periphery of the play overall.

Finally, Three Forks drilling has proliferated in a band running down the eastern side of the Nesson Anticline (mostly in eastern MacKenzie County) in a part of the play that IHS calls the New Fairway. The area contains the bulk of the recently drilled 1st and 2nd quintile wells outside of the mature Parshall. At ~75 b/d per 1,000 lateral foot, Three Forks productivity is higher here than in any other three Forks area and is also able to match its Bakken neighbors. Rising Three Forks activity – driven by ExxonMobil, Halcon/Petro-Hunt, and QEP – in the area has lifted the overall Three Forks average productivity in the play and may account for some of the excitement we see convening the ability of companies to extend their inventory by tapping into this deeper reservoir in addition to the primary target of the Bakken.

The net effect of the trend so far, then, has been to show that the Three Forks is a viable reservoir. And while it has not outperformed the Bakken in any locality, its ability to roughly equal the Middle Bakken well productivity over a large part of the play's areal extent means that the already large inventory of undrilled wells in the play may become materially larger as companies can drill and drain the Three Forks.

About the author

Hanwen Chang is a senior analyst at IHS. Hanwen holds a bachelor's degree from Northeastern University and a master's degree from Texas A&M University. Hanwen is a CFA charter holder and a member of the CFA Institute and CFA Society of Houston.