Q3 2013 up 59% over Q2 and markets gaining steam

Brian Lidsky, PLS Inc., Houston

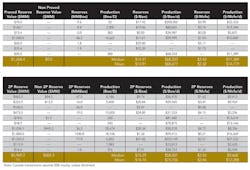

PLS reports that in Q3 2013, global upstream deal value surged 59% over Q2 to $41.8 billion. The US market was up 39% to $12.2 billion, Canada jumped 70% to $3.7 billion and the international market grew by 68%. Globally, these numbers put the markets back on track to more normal levels of activity seen since 2007, after a slow start to the year.

Since 2007, the average pace of deals has been $43.1 billion per quarter globally. The US has seen an average of $16.4 billion, Canada $7.6 billion and international $19.1 billion.

The growing level of deal activity throughout 2013 comes after a slow start for the year attributed to the blistering pace of deals witnessed in Q4 2012 - $138 billion as sellers pulled the trigger to get deals done quickly due to US fiscal uncertainty at the time.

Global highlights in Q3 include strong activity in Africa (15% market share vs. 6% from 2007 through 2012) and South America (11% market share vs. 5%), China accounting for 25% of all the buying (vs. 12% since 2007), and strong participation on the buyside from NOCs, private equity and MLPs.

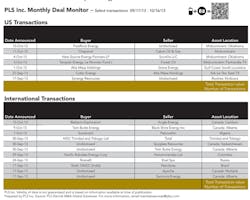

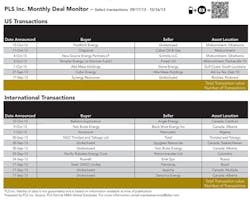

In the US, an accelerating theme is the shedding of conventional assets, including domestic and international positions, to both raise capital and increase corporate efficiencies as companies hone in on their core positions which present years of growth — and very large capital needs - in the onshore resource plays. The stark example in Q3 is Apache's rapid-fire disposition of $7.2 billion of assets (US GOM shelf, partial Egypt, some Canadian assets) to accelerate drilling on their strong position in the Permian basin of Texas and US Midcontinent lands. Recent deals that further illustrate this trend at press time on October 25 include Pioneer Natural Resources selling Alaska ($550 million), Newfield selling Malaysia ($898 million), and Devon monetizing $4.8 billion of its midstream assets via plans for a new MLP jointly created with Crosstex Energy.

Regarding buyers and capital, there is a healthy trio of leaders. NOCs, particularly those in Asia, are scouring the world for long-term oil and gas supply to meet growing domestic demand. Large private equity firms are quite active and expanding their buying. These firms were early investors in the initial land grab phase of the US onshore unconventional renaissance and were rewarded handsomely for their investments. They continue to grow their coffers and are providing today's buyers with capital to acquire assets across the spectrum of opportunities. A case in point is private equity firm Riverstone's backing of Fieldwood Energy for the $3.75 billion buy of Apache's GOM shelf assets. Finally, the MLP sector remains strong as retail investors are drawn to predictable and higher-yielding dividends in this low-interest environment. The MLP buying extends beyond upstream, in particular being very active in the midstream space.

In Canada, while the deal value numbers have slumped dramatically this year ($6.5 billion YTD vs. $40.0 billion for Q1-Q3 2012), the actual number of deals getting done has remained steady. In fact, through Q3, Canada's deal count of 190 is virtually identical to the same period in 2012 (191 deals). Same number of deals, just smaller. Thus far in 2013, deal value for oil sands has totaled $0.8 billion versus $12.1 billion in 2012 and $2.4 billion in 2011. While some analysts speculate Canada's new policy on State-Owned Enterprises has negatively affected deal markets, other factors are in play including low gas prices, infrastructure bottlenecks and price differentials. Outside of the oil sands, PLS sees healthy activity in Canadian resource plays, particularly the Duvernay, Viking and Cardium.

Looking forward, PLS expects Q4 2013 M&A activity to trend higher. Our thesis is that US companies will be looking to shed assets as they dial in capital sources for their 2014 drilling and development plans. The engine driving the market is a high level of deal inventory for sale. Using our proprietary analytics, we estimate that as of October 1 there is $135 billion of assets for sale worldwide, up from $133 billion a quarter ago and also up from just $85 billion on January 1, 2013. In the US, our deal-in-play tally is $33 billion, in Canada it is $25 billion and internationally it is $77 billion.