Near-term oil price outlook an oxymoron: volatile stability

The short-term outlook for oil markets is one of "relative" price stability, according to DRI-WEFA.

Such stability is relative because the forecast encompasses a high potential for volatility because of perceived or real mismatches in supply and demand-especially uncertainty about demand. Through early next year, however, there is not likely to be a sustained oil price spike-and certainly not a price collapse.

Essentially, says DRI-WEFA, the Organization of Petroleum Exporting Countries' production cuts that kick in on Sept. 1 will be offset by a weak global macroeconomic performance. While demand rises in the second half, as it always does, the scope of that increase is a huge question mark. International Energy Agency last month ratcheted back its forecast of demand for the seventh time this year and now sees worldwide demand rising by only 500,000 b/d this year. With Iraqi oil exports resuming under the United Nations' oil-for-aid program and demand sputtering, the rest of OPEC (the OPEC 10) cobbled together a quickie production cut for September that sent the right signal to markets-that is, enough to buoy its targeted marker oil price close to the $25/bbl through January, by DRI-WEFA's forecast.

While other analysts have expressed concern that the OPEC action could mean a spike into the $30s/bbl (New York Mercantile Exchange futures contract) this fall and winter, DRI-WEFA sees the cut as being necessary to keep oil prices from falling while overall demand remains weak. By the end of the year, the analyst's forecast pegs the OPEC marker basket as struggling to meet the magical $25/bbl threshold that OPEC (and the Saudis in particular) wants. As yearend approaches, under this forecast, rising seasonal demand should be offset by rising non-OPEC production and stepped-up quota cheating from OPEC.

Demand concerns

DRI-WEFA's own forecast calls for global demand growth of 1.3% this year, more than IEA's forecast.

"Severe uncertainty reigns about macroeconomic performance over the next 2 quarters, as what had been seen as a temporary pause in the internet sector has now spread to telecoms, hurting a number of Asian economies and raising the specter of contagion," DRI-WEFA said. "Outside of oil-exporting economies, demand is expected to be weak and, in some areas, negative during the third quarter."

The analyst noted a sizeable stockbuild in the early part of the summer, despite declining production and increased demand, which points to a stockdraw in the non-OECD importing countries. This would suggest expectations of continued poor economic performance. While product stocks in the US have dwindled a bit, they remain above historically normal levels, even with a surge in gasoline demand later in the summer.

(It's worth noting here that American Petroleum Institute data this week show that US crude stocks fell by 3.3 million bbl-while still about 10% above year-ago levels-far outstripping expectations of 150,000 b/d. Similarly, the US gasoline stockdraw beat predictions by falling for the fourth week in a row, by 1.81 million bbl. Gasoline stocks are now only 2.3% higher than a year ago, and the indications are that gasoline demand is up aout 350,000 b/d from a year ago-thanks to the drop of about a quarter in gasoline prices coming during the peak driving season.)

Pitfalls

The two major pitfalls ahead for any upside forecast of oil prices are questions over the state of the global economy and the continuance of OPEC cohesion.

If, in fact, the US economy is starting to show real signs of recovery, the ripple effects are likely to be felt in Asia and Latin America-the currently worrisome trouble spots-as an improvement would tighten markets quickly in response to increased demand and an urgent need for restocking.

As for OPEC cheating, DRI-WEFA contends that this remains "more anticipated than actual."

The analyst noted, "A sign of future discipline will be the August behavior of countries that increased production in June. If they truly were only acting to offset the loss of Iraqi crude exports, then their production should return to their previous level in July and August. If not, it is a sign of discipline weakening."

However, the betting here is that tensions will continue to worsen in the Palestinian-Israeli conflict, which will further embolden Saddam Hussein to undertake increasingly bolder steps to assert himself in the eyes of the Arab world. It bears noting that each attack by Israeli forces on Palestinians-especially the assassinations of Hamas leaders that have had the "collateral damage" of dead Palestinian civilians-is met with pledges of support and money from Saddam.

At the same time, Saddam continues to test US resolve militarily, and the Bush administration has already put Iraq on notice that it will not show forebearance for long and won't engage in a tit-for-tat series of exchanges but will undertake more demonstrative military action. One suggestion already making the rounds in Washington is the deployment of a US strike force to Kuwait-in part to backstop a sustained series of surgical air strikes intended to knock out much of Iraq's air defense but also to provide some protection to anti-Saddam forces within Iraq.

In addition, the US is likely to introduce its proposal-made jointly with the UK-to revise the sanctions against Iraq to a regime of "smart" sanctions that would punish Iraqi civilians less but step up monitoring of Saddam's weapons programs.

Would Saddam again pull his oil-for-aid supplies off the market in either or both circumstances? It's probably a better than 50-50 chance that he would.

So a reasonable expectation is that the market will, indeed, face a likely price spike past the $30/bbl (NYMEX) watershed. But such a spike probably would not be sustained, as OPEC simply rolls back its production cuts to accommodate the loss of Iraqi supplies. It would not surprise to see this very eventuality dominating the agenda of the OPEC ministerial meeting in late September.

Hence the oxymoron for the oil price outlook: Seen over the spread of 6 months or so, the average oil price likely will be about flat with what it is today. But there are apt to be a lot of jagged lines on that graph between now and then.

OGJ Hotline Market Pulse

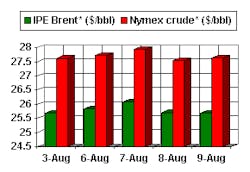

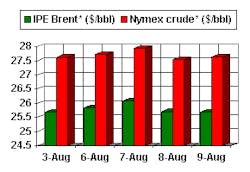

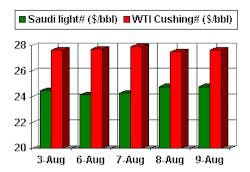

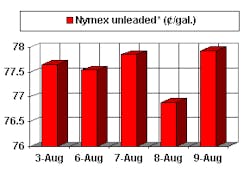

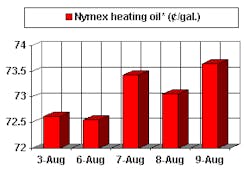

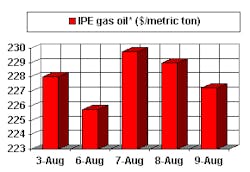

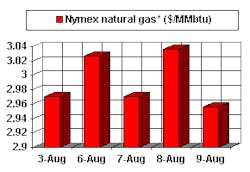

Latest Prices as of August 10, 2001

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE Gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.