Market Movement

Market Movement

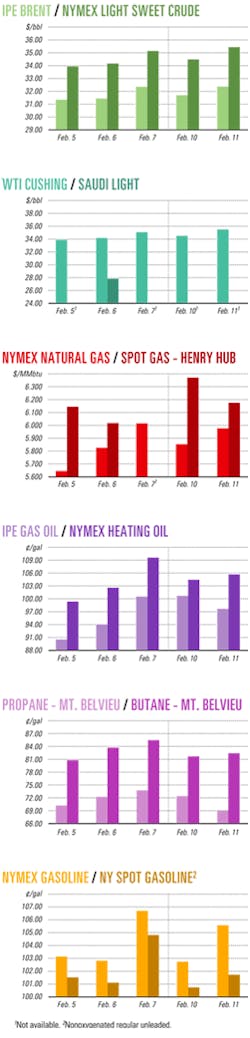

Fly-up of energy retail prices sparks US public concern

The American Automobile Association last week reported the highest retail prices for gasoline ever recorded during the month of February, up 13.4¢ since mid-January to an average $1.605/gal for regular at US self-serve pumps. That's the highest US average retail price for gasoline since June 2001, when prices averaged $1.661/gal, said AAA officials in a Feb. 11 report.

"The level and speed of increase of energy retail prices (have) now reached the stage where it is a matter of public concern and hence has become a political issue," observed Paul Horsnell, head of energy research for JP Morgan Chase & Co., London.

In a Feb. 12 report, Horsnell put US retail gasoline prices even higher, up "by 8¢ last week to $1.607/gal. This takes the rise over last year to exactly 50¢, with the current month-on-month rise running at 10.5%." He reported diesel prices were up 12.5% from January, "with a 12¢ increase in the last week alone taking the average to $1.66/gal."

Heating oil

A survey of the Massachusetts retail heating oil market showed a 21¢ increase to $1.75/gal, with "a 14% rise in just 1 week," Horsnell said.

Heating oil prices jumped nearly 20%, or 18¢/gal, through the week ended Feb. 7, with the US Department of Energy predicting a 52% rise in consumers' heating bills this winter. Futures prices for heating oil briefly hit a 23-year high at $1.10/gal during Feb. 7 trading on the New York Mercantile Exchange (OGJ Online, Feb. 10, 2003). However, the NYMEX closing price for heating oil futures was down to $1.03/gal by Feb. 12.

Meanwhile, Heat USA, a consumer group representing more than 30,000 heating oil users, asked New York State Attorney General Elliot Spitzer to investigate the dramatic increase in wholesale prices for heating oil (OGJ Online, Feb. 7, 2003). Supply shortages in the Northeast US, the world's biggest heating oil market, prompted the New England Fuel Institute, a coalition of fuel oil delivery companies, to ask US Energy Sec. Spencer Abraham to release supplies from the Northeast Home Heating Oil Reserve (OGJ Online, Feb. 7, 2003).

Former US President Bill Clinton established a 2 million bbl reserve of emergency heating oil in four US Northeast terminals between New Jersey and Rhode Island. While that reserve is "trivial," said Horsnell, "It should be released . . . although it will not make any dramatic amount of difference, given the extent of the tightness in heating oil."

While the US tries to muster support from its allies for military action against Iraq, the March contract for benchmark US light, sweet crudes "has the freedom to roam where it will and spike away from the April contract" prior to its Feb. 21 expiration, Horsnell said. Indeed, NYMEX crude futures prices on Feb. 11 briefly hit a 26-month high with the March contract at $35.60/bbl as a result of war jitters and expectations of a sharp fall in US oil inventory numbers (OGJ Online, Feb. 12, 2003). The next day, it closed at $35.77/bbl (OGJ Online, Feb. 13, 2003).

Tight inventories

The US Department of Energy reported US oil inventories fell by 4.5 million bbl to 269.8 million bbl during the week ended Feb. 7. It said US distillate stocks were down 3.9 million bbl to 108.2 million bbl, while gasoline inventories increased by 3 million bbl to 212.6 million bbl in the same period. The American Petroleum Institute registered a smaller drop in US oil stocks, 939,000 bbl to 271.6 million bbl, for that week. It reported US distillate stocks fell by 4.2 million bbl to 110.2 million bbl, with gasoline stocks increasing by 3.7 million bbl to 212.5 million bbl.

Based on DOE numbers, Horsnell said, "US crude oil inventories have fallen below 270 million bbl for the first time since 1976. The damage was done by a hefty 1.2 million b/d fall in imports down to just 7.2 million b/d, combined with a slight uptick in refinery runs."

He said, "Oil inventories are currently lower than normal by about 60 million bbl in Japan, 65 million bbl in Europe, and 70 million bbl in the US. That total of about 200 million bbl below normal explains most of why prices are so high." Moreover, Horsnell said, "This does not represent a particularly secure base for entering what are perhaps the most geopolitically uncertain few months there have been for some 40 years."

Industry Trends

Continuing political tension in the Middle East as well as turbulent times in Venezuela have served to create an unprecedented unpredictability in worldwide oil supplies, according to Global Oil Trends 2003, a study conducted by Cambridge Energy Research Associates in collaboration with Accenture and Sun Microsystems. The study was released to the press Feb. 12 at CERA's annual week-long energy conference in Houston.

"Geopolitical and market uncertainty across the globe have led to a destabilization in the world oil supply network, challenging the industry to explore the prospects for doing business in new and more efficient ways," said CERA Pres. and CEO Joeseph A. Stanislaw.

One of the most significant changes that the study found was the large increase in world oil reserves last year. Estimated world proven oil reserves, as of December 2002, rose to 1.213 trillion bbl, up 181 billion bbl from yearend 2001, the study said.

"Most of this dramatic rise reflects a reporting change in Canada that now includes 175 billion bbl of previously unreported extra-heavy oil in Alberta's oil sands," CERA noted (OGJ, Dec. 23, 2002, p. 113).

Canada's expanded definition of heavy oil reserves to include Alberta's vast oil sands subsequently increased North America's share of global reserves to 18% in 2002 from 5% in 2001.

"In the meantime, demand growth in 2002 over 2001 was a minuscule 20,000 b/d—the weakest growth since 1983," according to CERA.

CERA found that oil production by members of the Organization of Petroleum Exporting Countries averaged 25.4 million b/d in 2002, which was a decrease of more than 2 million b/d from 2001. Meanwhile, "A 1.1 million b/d rise in non-OPEC production was the largest annual gain since 1984, with Russia, Canada, Brazil, Angola, Kazakhstan, and Equatorial Guinea accounting for the largest individual country shares," CERA noted.

For the first time since 1999, CERA said, world oil production fell. Production of oil, condensate, and NGLs averaged 73.7 million b/d in 2002, down 800,000 b/d from the 2001 average.

World refining capacity increased as well, by nearly 1 million b/d to 82.5 million b/d in 2002 from the previous year.

"Growth in regional demand spurred increases in local capacity in areas such as China and North America, while regions of stagnating demand (such as Europe) saw little or even negative capacity growth," CERA said.

Regarding prices, CERA noted, "Although the average price of (West Texas Intermediate) crude in 2002 posted the smallest percent change since 1970, the quarterly trend through the course of the year was one of significant volatility. In the first quarter, WTI averaged $21.54/bbl, but by the third quarter, prices had risen to an average of $28.29/bbl.

"The fourth quarter average was $28.28/bbl for WTI, but prices moved in fits and starts during the quarter, ranging from $3 below to more than $4 above the quarterly average."

Government Developments

US REGULATORS are urging pipeline operators to accelerate a new industry standard aimed at minimizing internal corrosion in steel pipelines.

The National Transportation Safety Board's recommendation was part of a report issued last week outlining the causes of an Aug. 19, 2000, fatal accident near Carlsbad, NM, involving a 30-in. natural gas line owned by El Paso Corp.

The pipeline's explosion and subsequent fireball killed 12 campers (OGJ Online, Aug. 20, 2000). NTSB said the system ruptured because of severe internal corrosion and a significant reduction in pipe wall thickness.

Investigators blamed El Paso for "failure to prevent, detect, or control internal corrosion within the company's pipeline." In addition, ineffective federal inspections of the company's internal corrosion control program contributed to the accident, the board said.

NTSB noted that the pipe section involved could not accommodate mechanical cleaning "pigs" used to remove water scale and other contaminants that cause pipeline corrosion. The board also noted a partial clogging of the "drip," or stub line, that branches off the bottom of a gas pipeline and collects liquids and solids that build up in the pipeline during normal operations.

NTSB said its investigation revealed some liquids bypassed the drip and continued through the pipeline, further weakening the line. The board faulted El Paso for not having an internal corrosion control program that identified or mitigated the problems before the accident.

"Had (El Paso) effectively monitored the quality of gas entering the pipeline and the operating conditions in the pipeline and periodically sampled and analyzed the liquids and deposits for corrosivity that were removed from the line, it would likely have detected the potential for significant corrosion to occur within the pipeline," the board said.

But federal regulators also are to blame for the accident, the board concluded.

Congress passed and President George W. Bush signed into law last December stronger pipeline safety rules (OGJ, Feb. 3, 2003, p. 70). The Department of Transportation's Research and Special Programs Administration, including the Office of Pipeline Safety, is promulgating rules to meet the new, stricter requirements.

NORTHEAST STATES have asked the US Court of Appeals for the District of Columbia Circuit to stop federal regulators' plan to streamline certain clean air rules for refinery and power plant emissions.

The Environmental Protection Agency last year issued both proposed and final revisions to the 1977 New Source Review provision of the Clean Air Act. Current NSR regulations require industrial facilities to upgrade pollution control equipment when major plant modifications are made (OGJ, Dec. 2, 2002, p 34).

The 10 states participating in the stay motion are Connecticut, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, and Vermont.

EPA's proposed rule clarifies definitions for "routine repair and replacement." Plant repairs generally are not supposed to trigger a permit review under NSR. But regulators and companies often disagree over what is maintenance and what requires a new permit application.

A final rule, effective Mar. 3, would change the way the agency measures actual emissions. The states argue that the proposed and final rules violate federal clean air rules.

Quick Takes

AN OFFICIAL of Petroleo Brasileiro SA (Petrobras), requesting anonymity, told OGJ that the company has discovered in the Santos basin off Rio de Janeiro state, Brazil, a super giant field containing reserves estimated at 800 million-1 billion bbl of 40° gravity crude oil.

Petrobras declined to confirm this information officially for public dissemination.

According to the source, the 1-RJS-582 discovery well was spudded in August on Block BS-500 in 1,500 m of water and drilled to 6,000 m TD. Additional wells will have to be drilled to delineate the field, the official said. As of March 2002, Petrobras had reported 14 hydrocarbon strikes on the block.

Petrobras technicians considered initial tests successful, the official said, and additional tests are under way to evaluate the field's commerciality.

The Santos basin, Brazil's largest, occupies 352,000 sq km off Santa Catarina, Paraná, São Paulo, and Rio de Janeiro states. The basin has reservoirs varying in age from Tertiary to Cretaceous.

Last year, then-Petrobras Exploration & Production Director José Coutinho Barbosa hypothesized that there are large amounts of light crude in the Santos basin.

João Carlos França de Luca, president of Repsol-YPF SA in Brazil and a former Petrobras E&P director, said the confirmation of these new reserves could open a new frontier for Brazil's oil activities. "If the commercial viability of the area is confirmed, further multinational oil companies will set up shop in Brazil," he added.

In other exploration news, BHP Billiton's US unit BHP Petroleum (Americas) Inc. has reported that operator BP PLC found thick pay zones with the Atlantis-6 (GC 743-5) appraisal well on Green Canyon Block 743 in the Gulf of Mexico, confirming the presence of hydrocarbons in the previously unexplored northern part of the Atlantis structure. BHP also said it has approved full funding for Atlantis field development. The Deepwater Horizon rig drilled Atlantis-6 in 5,405 ft of water to 20,131 ft TD. The well found 605 ft of gross oil pay (460 ft net) and 360 ft of gross gas pay (200 ft net). Additional appraisal drilling will help assess the impact on overall reserves, BHP said. Before Atlantis-6 was drilled, gross proven and probable reserves at Atlantis had been estimated at 635 MMboe. BP holds a 56% interest in Atlantis field, and BHP has a 44% working interest. BHP said it has approved its $1.1 billion share of Atlantis oil and gas reserves development, including $355 million approved last May for detailed engineering and design work, purchasing of long-lead items, and contract awards. The funds will cover the completion of project engineering, predrilling activities, and completion of the initial producing wells, and construction and installation of production facilities and subsea equipment. First oil is targeted for third quarter 2006. Atlantis will be developed using a moored semisubmersible production facility with gross design capacity of 150,000 b/d of oil and 180 MMcfd of natural gas. The system design contains provisions for future capacity expansions. x‡ TotalFinaElf SA, operator of the Block B joint venture off Brunei about 50 km north of the capital Bandar Seri Begawan, reported a gas and condensate discovery that confirms the block's deep horizon potential. The discovery was made at a TVD of 4,400 m below the currently producing gas and condensate reservoirs of Maharaja Lela Jamalulalam field. The MLJ1-06 well encountered a 100 m hydrocarbon column. TotalFinaElf holds a 37.5% interest in Block B. Partners include Royal Dutch/Shell Group 35%. In addition, TotalFinaElf said it has been selected to operate Brunei's ultradeepwater Block J.

CSPC, the joint venture of China National Offshore Oil Co. and Shell Petrochemicals Co. subsidiaries, has awarded to JGC Corp., Yokohama, Japan, and its JV partner Stone & Webster Inc., Baton Rouge, La., a $500 million contract for engineering, procurement, and construction of an 800,000 tonne/year (t/y) ethylene plant at CSPC's planned Nanhai petrochemical complex at Huizhou, in Guangdong Province, China.

The plant will form the core of a $4.3 billion petrochemical complex that will produce about 2.3 million t/y of products. The complex will include a cracker, an 857,000 t/y TCG hydrogenation unit, a 255,000 t/y benzene extraction unit, and a 130,000 t/y butadiene extraction unit.

The ethylene and propylene produced will be used as feedstock in the polyethylene and polypropylene plants, which also are to be constructed within the complex.

Project completion is targeted for September 2005.

CSPC is a JV of CNOOC Petrochemicals Investment Ltd. and Shell Nanhai BV.

In other petrochemical activities, UOP LLC, Des Plaines, Ill., said it has started the basic engineering design for a methanol-to-olefins (MTO) unit as part of a natural gas-to-polymers project in Nigeria. Eurochem Technologies Corp. Pte. Ltd., Singapore, will be the plant owner-operator. UOP and Norsk Hydro ASA, Oslo, developed the technology called UOP/Hydro MTO, UOP reported. UOP's contract is with Eurochem Technologies, which has yet to develop bids from engineering, procurement, and construction contractors. The project will use natural gas to produce 400,000 t/y of high-density polyethylene and 400,000 t/y of polypropylene. The complex at Ibeju Lekki, 65 km east of Lagos, is expected to come on stream in 2006. Plans call for the complex to include a methanol unit to convert natural gas into methanol, an MTO unit to convert methanol into ethylene and propylene, and polyolefin units to convert ethylene and propylene into polyethylene and polypropylene. Nigeria offers vast reserves of underutilized natural gas and demand for polyolefin products, UOP said F Yangtze River Acetyls Co. Ltd. (Yaraco) has awarded Aker Kværner the front-end engineering design (FEED) phase for its project to expand an acetic acid facility at Chongqing, China. The amount of the contract was not disclosed. The work will entail redesign within the core processing plant, including incorporation of BP Chemicals' Cativa process technology to expand the capacity of the existing acetic acid plant to 350,000 t/y. The contact also covers design of a new carbon monoxide plant to provide additional feedstock. Aker Kværner will carry out the FEED contract for the acetic acid plant as well as coordinate the total core plant FEED scope for both projects. Frankfurt-based Lurgi Oel Gas Chemie GMBH, meanwhile, will work as a subcontractor to carry out the FEED contract for the CO plant.

SNØHVIT OPERATOR Statoil ASA recommended Spanish fabricator Dragados Offshore SA to the eight-member Snøhvit partnership Feb. 5 for a 1.45 billion kroner contract to construct and install the group's LNG plant. The plant, which will liquefy natural gas from the isolated giant Snøhvit gas field—and nearby Askeladd and Albatross fields—in the Barents Sea off northern Norway, will be installed on a prefabricated barge currently under construction at Spain's Izar Fene shipyard, Statoil said.

Snøhvit is the first LNG export development planned in Europe. Snøhvit field, discovered in 1984, lies in 300-340 ft of water. Natural gas from the three fields will be piped through a 160 km multiphase pipeline to Melkøya, an island at the entrance of the shipping channel into Hammerfest, Norway, where the LNG plant will be located. Germany's Linde AG is the main contractor.

Dragados will install the processing plant at its Cadiz facility, after which the barge containing the plant will be towed in 2005 to Melkøya. The three fields are expected to produce 5.75 billion cu m/year of gas (OGJ, Nov. 25, 2002, p. 38). Production is set to start in 2006.

Statoil Chief Executive Olav Fjell said total investment in the Snøhvit development is now 45.3 billion kroner (OGJ Online, Dec. 12, 2002).

Statoil holds a 22.29% interest in the project. Other partners are Petoro AS 30%, TotalFinaElf Exploration Norge AS 18.4%, Gaz de France Norge AS 12%, Norsk Hydro Produksjon AS 10%, Amerada Hess Norge AS 3.26%, RWE-DEA Norge AS 2.81%, and Svenska Petroleum Exploration AS1.24%.

VENEZUELA'S Energy and Mines Ministry has selected ChevronTexaco Corp. and Statoil separately to operate two of the five offshore blocks in the northeastern Deltana Plataforma, a major natural gas prospective area on Venezuela's Atlantic continental shelf. The energy ministry speculates that the area potentially could contain as much as 38 tcf of natural gas.

The award is the first initiative toward extracting nonassociated gas in the Delta Amacuro 200 km off Venezuela and near the maritime border with Trinidad and Tobago. Venezuela hopes to begin generating revenue from the blocks in 2007.

ChevronTexaco will operate Block 2, for which it offered $19 million. Block 2 contains the significant undeveloped gas accumulation known as Loran field, which was discovered in 1982 by state-owned oil firm Petroleos de Venezuela SA.

ChevronTexaco said that once the license is issued, the company has 3 years to complete the exploration and delineation program to determine Block 2 commerciality.

ChevronTexaco also has a 50% interest in Block 6d off Trinidad, which contains the cross-border extension of Loran field.

Statoil will operate Block 4, which encompasses about 1,435 sq km in 200-800 m of water. The company submitted a winning bid for the block in December, with a signature bonus of $32 million.

Statoil said it has committed to drilling three exploration wells, at an estimated cost of $60 million, over the next 4 years to define the resource potential of the area.

"We've worked closely over many years with Venezuela's Ministry of Energy and Mining, PDVSA, and a wide range of supply and service companies," said Richard Hubbard, executive vice-president for Statoil's international exploration and production business area. "With our joint success, this project can make a significant contribution to Venezuela's offshore industry development."

TotalFinaElf SA had bid $100,000 in December for Block 3, which has not yet been awarded.

CHEVRONTEXACO has reported that its proprietary system for estimating and managing greenhouse gas emissions and energy utilization data is now available free of charge to the worldwide energy industry. The company said it released the system to promote standardization of methodologies used and comparability in the gathering of greenhouse gas inventory information.

ChevronTexaco, which has used the system successfully since January 2002, began developing the improved reporting system in January 2001.

Sangea Energy & Emissions Estimating System 2.0 is an automated, electronic data management information system designed to gather greenhouse gas emissions and energy usage data from exploration and production, refining and marketing, petrochemicals, transportation, electricity generation, manufacturing, real estate, and coal activities.

The calculation methods and emission factors of the system are based on the American Petroleum Institute's Compendium of Greenhouse Gas Emissions Estimation Methodologies for the Oil & Gas Industry, which ChevronTexaco considers to be one of the best practices for the petroleum industry.

STATE-OWNED Oman Oil Co. (OOC) will supply UAE's Dolphin Energy Ltd. (DEL) with as much as 135 MMcfd of natural gas for 3.5-5 years, beginning in the fourth quarter. The gas will fuel the Fujairah state-owned Union Water & Electricity Co.'s 656 Mw power generation plant and associated 100 million gpd desalination plant.

OOC will deliver the gas at the Oman-UAE border near Al-Ain in Abu Dhabi, following construction of a 48 km pipeline spur that will join Oman's Fahud-Sohar line at Mahdha and terminate at Buraimi (OGJ Online, Jan. 22). From Al-Ain, Omani gas will flow through a 182 km, 24-in. pipeline to power UWEC's facilities.

Currently under construction, the Al-Ain-Fujairah gas pipeline is DEL's first initiative under the Dolphin Project and is scheduled for completion by yearend.

DEL's Dolphin Project involves the production and processing of natural gas from Qatar's North field and transportation of the gas to the UAE by subsea pipeline beginning in 2006.

Oman's gas will be replaced in 2006 when DEL's supplies begin flowing from Qatar, and the UAE-Oman border pipeline connection may later be used to supply Qatari gas to Oman.

Omani officials earlier said the bidirectional Mahdha-Buraimi pipeline spur would link the sultanate's gas network with a regional gas grid planned by DEL, allowing for future gas imports.

The UAE Offsets Group holds a 51% stake in DEL, while TotalFinaElf and Occidental Petroleum Corp. each hold a 24.5% share.