More than $4 billion committed for new MODUs

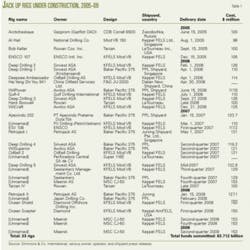

Operators have committed more than $3.7 billion for 33 jack up drilling rigs on order, and nearly another $1 billion for three of the five new semisubmersibles under construction. Singapore has 29 rigs under construction at three yards; the US has 5 rigs at two yards; China, Iran, Russia, and South Korea each has offshore rig under construction. There are also a number of shipyard construction options under existing contracts that may be exercised.

In a May 24 report on the jack up rig market, Simmons & Co. energy analyst Scott B. Gill said there in five years, there will be potential worldwide shipyard capacity to produce 25 jack ups/year.

The worldwide MODU fleet is controlled by six major drilling contractors, all US-based: Diamond Offshore Drilling Inc., Ensco International Inc., GlobalSantaFe Corp., Noble Corp., Pride International Inc., and Transocean Inc. (including TODCO), but these companies have ordered only 4 (12%) of the 33 new jack ups and no new semisubs.

These companies already have a lot of capital invested in large fleets and have spent money purchasing or upgrading existing rigs and consolidating their balance sheets. GlobalSantaFe has recently accepted delivery of two new jack ups and two semisubs.

The majority (64%) of the new jack ups (21) and 80% of the semisubmersibles (4) were ordered by eight smaller competitors, several of which are speculative investors: Norway’s Awilco Offshore ASA, Odfjell Drilling AS, Petrojack ASA, Sinvest ASA, and Smedvig ASA; Maersk Drilling, a subsidiary of Denmark’s A.P. Moller-Maersk AS; Cyprus-based Seatankers Management Co. Ltd.; and US-based Rowan Cos. Inc.

About 24% of the new jack ups (8) were ordered by regionally-focused nationals, including Russia’s Gazprom; China Oilfield Services Ltd.; Abu Dhabi’s National Drilling Co.; Qatar’s Gulf Drilling International; Vietnam’s PV Drilling; Mexico’s Perforadora Central SA de CV; Indonesia’s PT Apexindo Pratama Duta Tbk; and Japan Drilling Co. Additionally, the National Iran Oil Co. (NIOC) ordered one of the new semisubmersibles.

Jack up fleet

Utilization of the jack up fleet is now around 95%. Despite fears of pricing power erosion with the incremental fleet additions, particularly the orders from Norwegian speculators, Simmons analyst Gill believes that customer demand will easily outstrip the growing jack up supply in the next 12-18 months.

In a presentation at the NAPIA/ PIRA Joint Conference in October 2004, Rowan Cos. Inc. Chairman Danny McNeese said that 79% of the 387 rigs in the worldwide jack up fleet are more than 20 years old. By 2007, he said, 89% of the fleet will be more than 20 years old. At the time, only nine jack ups were under construction; 24 additional construction contracts were initiated in the past 8 months.

The Keppel OM group plays a predominant part in the newbuild market because of its worldwide network of shipyards, its ability to offer market-standard and modified jack up rigs, and finally its flexible financing, including the role of speculative investor. There are 18 jack ups under construction at the Keppel FELS yard in Singapore (Fig. 1), and 1 rig at the AmFELS yard in Brownsville, Tex.

The Sembawang group maintains a share of the newbuild market due to the specific expertise of the PPL and Jurong shipyards in Singapore, where nine jack ups are currently under construction.

Other yards, including Dalian New Shipyard in China, Zvezdochka in Russia, and Keppel AmFELS in the US, each has one jack up rig under construction. LeTourneau Inc. has four jack ups under way at its yard in Vicksburg, Miss.

Gill believes that rig-building capacity will expand in China, with a new yard slated for Qingdao, part of China Shipbuilding Industry Corp.

Premium Drilling

There are eight jack ups under construction in Singapore to be operated by Premium Drilling (Table 1). According to a press release on Apr. 29, 2005, the new Houston-based company will be created to operate rigs on behalf of Awilco Offshore AS, the offshore division of Norway’s Anders Wilhelmsen Group, and Deep Drilling Invest Pte Ltd., a subsidiary of Norway’s Sinvest ASA.

Bjarne Skeie, chairman of Sinvest, said that the new rig management structure will give Sinvest a strong position in a “very attractive” market segment and that the new rigs will replace part of the aging jack up fleet.

Sigurd E. Thorvildsen, chairman of Awilco, said that by joining forces with Sinvest in establishing Premium Drilling, they are creating a drilling contractor with “the most modern fleet in the industry.”

Five of the jack ups will be delivered in 2006, three in 2007, and the companies have options to build six more jack ups under the existing contracts.

Four of the rigs, all Baker Pacific 375 design, are being built at the PPL Shipyard: Deep Drilling 1 (April 2006 delivery); WilPower (June 2006); Deep Drilling 4 and WilSuperior (both second-quarter 2007).

The four other rigs, all KFELS Mod V-B design, are being built at the Keppel FELS shipyard: Deep Drilling 2 (February 2006 delivery); Deep Drilling 3 (September 2006); WilCraft (December 2006); and Deep Drilling 5 (mid-2007).

Rowan, LeTourneau

Houston-based Rowan Cos. has two Tarzan-class jack ups under construction and a third planned at its LeTourneau Inc. yard. The Bob Keller is scheduled for delivery Sept. 15, 2005. In March, Rowan announced a 7-month, $20 million contract with McMoRan Exploration Co. for the Bob Keller to drill a deep well in the Gulf of Mexico right after delivery. The Hank Boswell (Tarzan III) semisub should be complete in late 2006. The construction start has not yet been announced for the Tarzan IV, but it could be finished by late 2007.

On May 4, Rowan announced that LeTourneau had contracted to build a jack up for Mexico’s Perforadora Central SA de CV, the first time it has built an entire rig for an outside company since 1992. The super 116E class jack up will be an enhanced version of the 116C design, with greater load capacity, upgraded environmental systems, and 511-ft legs. The new rig will be able to work in water up to 350-ft deep.

Perforadora Central’s most recently added rig is the Central Tonala jack up, KFELS Mod V-B class, delivered by Keppel AmFELS in February 2004.

In a presentation at the RBC Capital Markets North American Energy Conference in Boston on June 7, 2005, Rowan’s McNeese said that the drilling industry has not kept up with the rig attrition rate, averaging 6 rigs/year over the past 20 years. There need to be a lot of super premium jack ups built, he said; “we’ve got to replace our equipment to keep the oil companies in business and let them find more reserves.”

McNeese noted that Rowan’s average contract rate was $62,000/day, better than the industry average of $48,000/day for jack ups. He said that most newbuilds will not come to the Gulf of Mexico because day rates are lower than in other regions.

Semisubmersible fleet

According to a list maintained by Maritime Business Strategies LLC, there are 175 semisubmersibles in the worldwide drilling fleet, of which 75 (43%) were built before 1980. Although the fleet is aging, only 17 semisubs (10%) have been built since 2000.

Given the current demand for deepwater drilling units and the steady rise in contract rates, it’s not too surprising that there are five semisubs under construction, and three of the contracts were announced since the beginning of the year (Table 2).

An additional semisub, the SBX-1, is being outfitted for Boeing Integrated Defense Systems in Texas, but it will not be used for drilling. That CS-50 bare-deck hull, previously named Moss Sirius, was constructed at the Vyborg Shipyard, a member of the AKO BARSS group, and delivered in May 2002 to the Norwegian investment company Moss Arctic Production, according to The Naval Architect.1

After being built on spec, the 389 ft x 231 ft x 133 ft hull was stored at Sandefjord, Norway, before being sent to Texas, first to the Keppel AmFELS yard and then to the Kiewit Offshore Services yard in Corpus Christi. It will be used as a mobile XBR radar platform as part of the US Missile Defense Agency’s ballistic missile defense system.2

NIOC

The Iran-Alborz semisubmersible is under construction at the Caspian Sea yard of the Iran Marine Industrial Co. (Sherkate Sanati Daryai Iran, SADRA) outside of Neka, Iran.

The National Iranian Oil Co. will be able to use the rig for drilling in water as deep as 1,000 m in the Caspian Sea (OGJ, Nov. 22, 2204, p. 51). According to SADRA, the Khazar semisubmersible drilling unit project (KSSDUP) began June 23, 2001.3

ODS-Petrodata estimated the cost at $226 million, and said delivery was expected in second-quarter 2005.

In an interview with Hamdollah Mohammad-Nejad, Iran’s deputy oil minister for technology and engineering affairs, but previously deputy oil minister for Caspian Sea affairs (2003-05), NetIran reported that the Iran-Alborz construction cost $350 million and the rig is expected to start operating “in the second half of the Iranian calendar year, 1384 (2005-06).”4

The deputy oil minister said, “Exploration drilling in [the] southern waters of the Caspian Sea will be carried out at a depth of about 800 m and more.”

According to IranOilGas.com, on June 4, 2005, Iran’s North Drilling Co., a subsidiary of the NIOC, reissued a tender for deepwater drilling management services for the Iran-Alborz semisub. The original tender was posted on Jan. 1, 2005, and called for a 3-year, extendable contract to provide personnel, training, and rig maintenance.5

Norway’s Gann Mekaniske AS supplied mud treatment equipment for the Iran-Alborz, including shale shakers, agitators, a GMD-350 degasser, desander, centrifugal pumps, HP shear unit, dump valves, mud guns, and screw conveyors.

Smedvig

Smedvig Asia Ltd, a subsidiary of Smedvig ASA, Stavanger, contracted with Keppel Offshore & Marine Ltd. to build a new semisubmersible drilling tender SSDT at the Keppel FELS yard in Singapore. The SSDT3600-GOM-C42 design was developed by Keppel O&M’s Deepwater Technology Group (DTG) in Singapore.

The West Setia will be fourth in a series of six-column SSDTs that includes the West Alliance, the West Menang, and the West Pelaut, according to the May-June 2004 issue of Offshore Marine.

Delivery was originally planned for third-quarter 2005, at a cost of $94 million (OGJ, Nov. 22, 2004, p. 51) but has been delayed to fourth-quarter 2006 and the cost estimate increased to $105 million.

In April, Smedvig announced an agreement with Norway’s Eastern Drilling ASA to purchase 10% of the company for $27.5 million. On June 7, Smedvig announced that it had increased its investment to $50 million, for a 25% share in the company. CEO Arve Andersson leads Eastern Drilling with Chief Technical Officer Gunnar Skjelbred. Eastern Drilling has a $550-million contract with Samsung Heavy Industries Co. Ltd. in South Korea to build a new sixth generation semisub and a 12-month option to build a second, identical rig (Eastern 2).

Smedvig will participate in construction supervision, marketing, and operations management of the new rig. Smedvig’s current fleet includes 11 tender rigs, 3 semisubs, and 1 drillship.

The new Eastern 1 semisub was designed by Norway’s Moss Maritime AS (part of the ENI-Saipem Group) for winter operations in northern areas, with dual derricks, dynamic positioning systems, a 6,000-ton variable deck load capacity, and zero-discharge mud systems. It will be capable of operating in water depths to 3,000 m. Delivery is scheduled for fourth-quarter 2007, and operations can begin first-quarter 2008.

Moss Maritime also created the Bingo, Yatzy, Vision, and ME 4500 (Scarabeo 5) semisub designs, as well as the Sea Launch rocket-launching platform (OGJ, Nov. 3, 2003, p. 17). Lars Martin Sorhaug, vice-president for offshore at Moss Maritime AS in Norway, told OGJ that the new Moss CS50 is a further developmentof the ME 4500, CS45, and CS50 designs. Several new features distinguish the sixth-generation design of the Eastern 1, including larger displacement volume (nearly 55,000 tonnes); ultra deep water duel operation drilling capability; harsh environment and zero discharge capabilities; and state-of-the-art equipment.

Maersk semisubmersibles

Keppel FELS announced on May 30 that Maersk Contractors, a subsidiary of A.P. Møller-Maersk AS had signed a contract to build two new semisubmersible drilling platforms for $469 million. Maersk chose the new DSS 21 design (Fig. 2), developed by DTG in Singapore and Netherlands-based Marine Structure Consultants (MSC).

Keppel said the design is for moderate environmental conditions such as West Africa, Brazil, the Gulf of Mexico, and Southeast Asia and the rigs will be able to operate in water depths to 3,000 m using dynamic positioning. They will be able to attach to prelaid mooring systems and each will accommodate up to 180 people.

Under the new contract, Maersk has an option for a third semisub of the same design, which must be exercised within 12 months.

In 2003, Maersk took delivery of the Maersk Explorer semisub in the Caspian Sea, the first DSS-20-CAS-M design built by Keppel FELS. That rig was designed by DTG and MSC for harsh conditions and high reservoir pressures. It was constructed in sections and transported from Europe and Singapore, then assembled by the Caspian Shipyard Co. in Azerbaijan.

The February 2001 contract price was $167 million, and Keppel Offshore & Marine received a $500,000 bonus from Maersk at delivery in 2003. The Maersk Explorer is working on a 3-year drilling program in the Caspian under contract with Exxon Azerbaijan Operating Co. LLC and Chevron Overseas Petroleum Azerbaijan Ltd.

New investments

It seems to be less costly to invest the unanticipated income garnered from current contracts to build new rigs, rather than using it to upgrade working rigs. Contractors appear loath to pull working rigs out of the market.

Large drilling contractors will probably continue to buy back stock but will eventually upgrade more of their rigs as they come off long-term contracts. We will probably see orders for additional jack ups and semisubmersibles as options are exercised.

Many analysts believe shipyard capacity is the limiting factor in increasing the number of rigs under construction, but Rowan’s McNeese said that the availability of 110-130,000 high-yield steel for jack up legs is the main constraint. McNeese told analysts at the RBC conference that this steel is only rolled at three mills worldwide, in Germany (Dillinger Hütte DTS), Japan (JFE Steel Corp.), and Longview, Tex. (LeTourneau Steel Group), and that the mill owners have no incentive to expand production.

Simmons analyst Gill noted another limitation-there are only three primary suppliers of jacking systems for rigs: Brissonneau & Lotz Marine (France), LeTourneau (US), and Keppel FELS’ supplier (Germany).

Newly built rigs will enter the market gradually and are not expected to affect day rates for the next several years. Only 4 jack ups will be delivered the remainder of this year, 9 in 2006, 13 in 2007, and 7 more after that. Iran’s new semisub is due to be delivered this year but is limited to the Caspian Sea market. Only one new semisub is scheduled for delivery in each of the ensuing years, 2006-09, which should not radically affect the floater market. ✦

References

1. “Russian shipbuilding: a sleeping giant re-awakes,” The Naval Architect, September 2002.

2. “Missile defense gets a lift at Kiewit Offshore,” Apr. 6, 2005, http://www.marinelog.com.

3. www.sadragroup.com/shipbuilding.html.

4. Mashal, “Clear Horizons for Caspian Oil and Gas,” Fortnightly Magazine, No. 285, Jan. 1, 2005, pp. 6-9.

5. Notice for Prequalification, http://www.netiran.com.