Earnings droop in 2001 for many US oil and gas firms

US oil and gas firms posted sharply lower financial results for the fourth quarter and full-year 2001.

A sagging economy exacerbated the flabby supply and demand fundamentals that pulled down oil, natural gas, and petroleum product prices, especially in the second half of the year.

Substantially lower oil and gas realizations, which weakened throughout the fourth quarter, wreaked havoc on the earnings of producers. Lower refining margins in the wake of the economic downturn and decreased demand-owing in part to warmer-than-normal winter weather-pressured downstream earnings.

Elsewhere in the petroleum industry, results were mixed. Service and supply companies recorded improved results, while results were mixed for a sampling of Canadian companies.

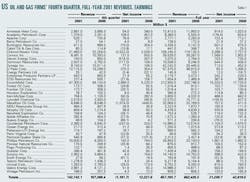

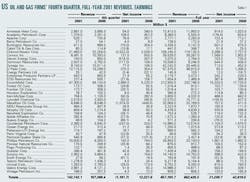

A sampling of US-based firms' financial results shows a 24% drop in revenues for the fourth quarter and a net loss for the group as a whole. Of the 42 companies in the sample, half recorded a loss, whereas only five posted a loss in the same quarter of 2000.

For all of 2001, results were similarly depressed. The group's full-year earnings declined 27%, while revenues were only slightly diminished (Table 1).

Integrated companies

The large integrated companies reported lower earnings as 2001 realizations for oil and gas were substantially lower from year-ago levels. And as the fourth quarter progressed, realizations continued to sink.

Marathon Oil Corp. announced a fourth quarter loss of $1 billion. In addition to lower oil and gas prices, the company attributes the loss to lower downstream margins that resulted from decreased demand for refined products caused by the general downturn in the global economy and warmer-than-normal weather.

Fourth quarter results reported by Phillips Petroleum Co., Amerada Hess Corp., and ChevronTexaco Corp. were less gloomy but fell below analyst expectations.

Phillips reported a 68% year-on-year decline in net operating income for the quarter, largely due to a 36% lower average worldwide crude oil sales price and a 59% lower average natural gas price in the Lower 48. Depressed margins for motor gasoline, distillates, and other petroleum products also sent earnings lower.

Analysts Matthew Warburton and Kevin Anderson of UBS Warburg LLC commented that, despite including the first full quarter from its enlarged downstream portfolio following the company's acquisition of Old Greenwich, Conn.-based Tosco Corp., Phillips's fourth quarter results were hampered by the markedly weaker refining and marketing climate and the absence of inventory gains.

Regarding the reduced Amerada Hess results, Warburton and Anderson said that higher exploration and production costs associated with the recent acquisition of Dallas-based Triton Energy Ltd.-part of the company's upstream growth plan-amplified the impact of lower commodity prices.

The UBS Warburg analysts found ChevronTexaco's results disappointing. For the quarter, the new supermajor recorded a net loss of $2.5 billion. Net income for the year was $3.3 billion, down from $7.7 billion a year earlier.

ExxonMobil Corp. reported diminished results for the fourth quarter and for 2001. Yet the results slightly exceeded Lehman Bros. Inc.'s quarterly estimates, said Lehman analyst Paul Y. Cheng, due to a lower-than-normal effective tax rate and lower-than-expected exploration expenses.

For the quarter, upstream earnings declined 55% year-on-year on weaker oil and gas realizations. For 2001, upstream earnings of $10.4 billion were 16% lower, as strong average natural gas realizations in North America and Europe partially offset lower oil prices and higher exploration expenses.

ExxonMobil's downstream operations posted record earnings in 2001, with a 24% improvement over the previous year. The company attributes these results to higher refining margins, particularly in the US and early in the year; improved non-US refining operations; and higher marketing margins outside the US. As with other downstream players, weak demand dealt the company's chemicals operations a blow last year, however. Most of the earnings reduction in this segment occurred in the US as lower product prices and soft demand pressured margins. ExxonMobil's US chemicals earnings declined to $398 million last year from $644 million a year earlier.

Independents

Lower oil and gas prices also slammed independent producers' results.

Kerr-McGee Corp., Oklahoma City, recorded a $50 million loss for the last quarter of 2001 compared with fourth quarter 2000 net income of $282 million, while revenues plunged 32% year-on-year.

For the year, earnings totaled $486 million vs. $842 million in 2000. Kerr-McGee attributes more than 75% of the earnings decline to lower oil prices. Annual revenues were down 12% last year to $3.6 billion.

Faring much better, however, was Apache Corp. The Houston-based independent posted net income of $704 million for the year, up from $693 million a year earlier, and $74 million for the fourth quarter.

The strong earnings were the result of record production. Apache posted its largest percentage production increase in a decade, boosting output 32% last year. Thomas Covington of A.G. Edwards & Sons Inc. said he believes that Apache's volume growth in 2002 will exceed 5%, particularly if oil prices average more than $20/bbl and Henry Hub gas averages more than $2.50/MMbtu.

Refining, chemicals

The general economic downturn and resulting decrease in demand combined with warmer-than-normal winter weather to devastate the earnings of most refiners and chemicals manufacturers last year.

Lyondell Chemical Co. of Houston reported a $53 million loss for the fourth quarter on revenues of $2.5 billion, and for the entire year the company had a loss of $150 million.

"Unprecedented raw material costs in the first half of the year, inventory reductions that continued through the year, an extended industrial recession, and new Gulf Coast ethylene supply combined to keep the chemical sector in severe trough conditions," said Dan F. Smith, Lyondell president and CEO.

Philadelphia-based refiner-marketer Sunoco Inc. saw its earnings drop to $4 million last quarter vs. $154 million in the same quarter a year earlier. The company said that average margins in its refining and chemicals businesses were below break-even levels, and unscheduled downtime at its northeast refineries in December also contributed to the weaker earnings.

Service-supply firms

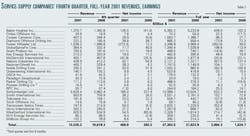

As a group, the OGJ sampling of service and supply companies turned out much stronger results than did operating companies during 2001 and the fourth quarter, despite sluggish drilling in North America in the second half of the year. Four of the 27 firms in the group recorded a net loss last quarter, while six had a net loss in the fourth quarter of 2000 (Table 2).

Net income for the sample of companies was up 76% last year vs. 2000, on revenues that were up 26%. For the last quarter of 2001, earnings improved 28%.

Most oil field service and supply companies ended the year with positive results, including Cooper Cam- eron Corp., GlobalSantaFe Corp., and Schlumberger Ltd.

Cooper Cameron attributed its improved 2001 earnings to strong market conditions in the first half of the year, which combined with improved operating efficiencies and higher margins to offset a weaker energy market and sagging overall economic conditions in the second half of the year.

Drilling contractor GlobalSantaFe reported lower fourth quarter earnings, as strength in areas outside the US was unable to offset weakness in the Gulf of Mexico. Declining natural gas prices deflated gulf drilling activity in the second half of the year, but GlobalSantaFe benefited as major oil and gas companies increased drilling activity outside the US.

Commenting on the results of GlobalSantaFe, analysts James Stone and David Wright of UBS Warburg expect that, in the near term, a stable non-US drilling market will continue to offset weakness in the gulf, where the analysts expect drilling to recover by the second half of this year. "The timing of a recovery in the Gulf of Mexico is the most significant factor affecting GlobalSantaFe's earnings outlook," Stone and Wright said.

Sluggish North American drilling markets put Schlumberger's fourth quarter earnings below analysts' expectations, but for all of 2001, income was up 11%.

Both revenue and net income for the oil field services sector of the company achieved record levels last year.