Sliding equity markets, underwriting losses push up rig insurance costs

Substantial underwriting losses in recent years, falling interest rates, declining equities markets, and the terrorist attacks of Sept. 11, 2001, are among the factors leading to more-costly insurance for drilling contractors and the energy industry.

Rig insurance premiums have increased 2.5-3 fold in the past 12 months and, from 1999 lows, have approached levels of 8-10 years ago. Drilling contractors coming off fixed-price insurance deals for the first time in 2-3 years face added financial burden.

Rig-insurance-policy deductibles have increased to $1 million or more levels from $200,000-$250,000. Insurance-company withdrawals from the energy sector have tightened available underwriting capacity or capital available for drilling and energy industry risk.

These were the opinions of industry analysts during a panel session on rising insurance costs of the drilling industry in late September at the International Association of Drilling Contractors (IADC) annual meeting in San Antonio.

"I've been 30 years in this business andUI've never seen an insurance market [as difficult as] we're experiencing today," said John Lloyd of London-based Jardine Lloyd Thompson Group PLC.

Referring to increasing insurance premiums and deductibles, he added, "The 12 months following Sept. 11 [2001] will be the most volatile we've seen in the industry, but for the drilling contractors that market was significantly moving prior to Sept. 11."

Investment returns

Favorable investment returns and accumulation of capital in the latter part of the 1990s led to market competition in energy sector insurance, which in turn has allowed rig insurance premiums to decline.

James Pierce of Aon Corp., Aon Natural Resources Group, Houston, explained that many insurance underwriting concerns began to operate on the premise that it would be acceptable to take in $1 of premiums against $1 of claims loss, in light of the 10-15% investment return they had enjoyed.

He said, "So many underwriting concerns over the last couple of decades actually based their practice onUgenerating capital for investment purposes."

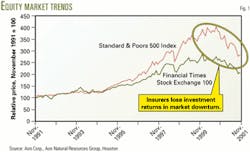

The downturn in equities and interests rates has proven this to be the flawed premise, with capital portfolios generating negative returns for the past 2.5 years.

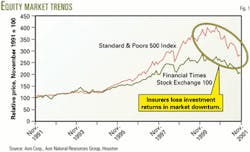

Fig. 1 shows the Standard & Poors 500 Index and the Financial Times Stock Exchange (FTSE) 100 Index climbing through the later part of the 1990s, until dropping dramatically in late 1999 and through to the present day. Interest rates fell at the same time (Fig. 2).

Pierce highlighted that the investment returns, which had previously affected how companies met underwriting obligations, had become a "nonfactor" after 1999 in helping insurance companies manage their portfolios of risk.

Lower insurance premiums, declining investment returns, and surging underwriting losses converged in the last few years to make this an ominous time in the insurance market, which translates to an ominous time for the energy-sector insurance buyer.

Pierce said the pendulum had swung and by late third quarter 2000, the energy service and drilling businesses had started to pay increased premiums and face deductible increases as the insurance market struggled to regain profitability.

Insurance market

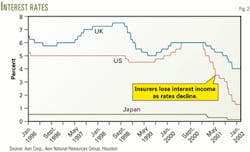

Fig. 3 shows the insurance market trends for the worldwide energy sector during the past 10 years, highlighting the market capacities or capital employed for risk. The straight line across the center serves as a renewal premium continuum with 1992 representing 100%.

The lower line, trending down from 1993 and plummeting to 33% by 1999, represents the dollar premium. For the drilling contractor paying $1 insurance premium in 1993, the cost would have dropped to $0.33 by 1999 for the same coverage and assuming the same risk.

Pierce said obviously there could be exceptions but thought the dollar premium curve represented an accurate median for insurance costs.

The two bell-shaped lines, trending upwards to peak in 1999, highlight the amount of capital that was available to onshore and offshore energy risk (Fig. 3). The amount of capital available for offshore risk increased from $1.66 billion in 1993 to more than $4 billion at the 1999 peak.

Reviewing fundamentals within the energy industry, Pierce explained that massive amounts of capital flowed to the insurance market to provide coverage for specific risks. As example, he cited huge offshore facilities that require coverage such as the Hibernia platform operated by St. John's, Newfoundland-based Hibernia Management & Development Co. Ltd.

At the same time, mergers and acquisitions and the industry's consolidation meant fewer buyers of insurance and a dwindling supply of business.

To generate adequate investment returns, on the other hand, the large capital holdings that the insurance markets had generated in a 6-year time period required underwriting revenue.

In a direct cause-and-effect relationship, premium rates plummeted as insurers chased underwriting business in the energy sector, Pierce explained.

During the same time period, deductibles had stayed the same. With no adjustments for inflation and until their most recent renewal, drilling contractors had enjoyed the same deductible that they had in 1980, according to Pierce.

He said, "What was a significant deductible in 1980, $100,000 up to say $250,000, was a meaningless retention in 2001. You could use that retention with just about any incident offshore.

"From an underwriting perspective, the view became thatUdeductibles were so low that insurance policies were almost maintenance policies," he continued, noting that the insurance markets were not intended for that purpose.

Pierce highlighted that starting in 1999, losses began pouring in from the drilling industry (Fig. 3). He explained that frequency losses or relatively small losses that were in excess of the deductible, by themselves, were eroding more than the total drilling sector's paid-in premiums.

He also noted that big losses, of $15-50 million in magnitude, were coming in after 1999. The events were not necessarily high profile or on the media's radarscope, such as Occidental Petroleum Corp.'s Piper Alpha platform disaster; however, the events were significant.

Pierce said, "These $15-50 million losses over the last 5 years have clobbered the insurance market."

The insurers were not generating the necessary premiums to sustain the losses, he explained. Fig. 3 shows the rapid capital decline with dramatic charges in the billions of dollars, along with the direct correlation with premium rates increasing as the insurers struggled to break even.

Energy, drilling losses

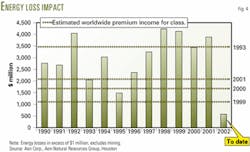

Fig. 4 further highlights that insurance premiums have fallen short of covering claim losses for the worldwide energy sector, particularly in the late 1990s. The premiums flowing to the insurance market for the 3 years 1999-2001 met only about half of the losses that occurred during the same period.

Focusing more closely on the drilling industry, the late 1990s through 2001 have seen significant drilling activity and drilling rig utilization. Lloyd said that was "great news in most cases but at the same time there have been substantial insurance claims going into the market."

He explained that over the past 6 years, excluding 2002, operators of mobile drilling rigs have claimed about $250 million/year from the insurance market. Excluding the Petroleo Brasiliero SA (Petrobras) claim for the P36 platform loss in Brazil, the average would have been $160 million/year.

The Petrobras P36 loss totaled $592 million, with insurance proceeds offsetting $497 million and Petrobras retaining $95 million of the loss.1

More accidents and insurance claims should intuitively accompany increased drilling activity. Higher drilling industry demand could draw less experienced personnel to the industry causing accidents to increase, according to Lloyd.

He thought that other factors also played a part, citing exploration and production driving the industry to deeper and less-successful waters to replace reserves that had declined.

He said the emergence of 3D seismic and imaging technologies has allowed operators to exploit previously overlooked reserves, which has led to more risk exposure rather than less.

Lloyd said, "Claims don't necessarily make underwriting losses as long as insurers charge adequate premiums."

He noted that the market has failed to generate sufficient premium income to come even close to covering losses. Lloyd said, "Uin our estimation, the total premiums generated in 2000 by the offshore drilling industry was less than $100 million and the total claims during the year [totaled] $284 million."

He added, "Clearly that situation has not been sustainable and in early 2001Uthe market began to react."

Underwriters

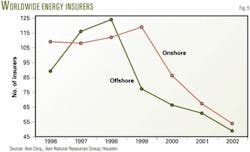

Lloyd said, "The first thing that happened was it started to drive major first players out of the market," referring to the decline in drilling business and energy-sector insurance underwriters that were willing to write new policies (Fig. 5).

The reinsurance market operates behind the direct insurers to spread risk across the market and provide effective capacity through an arbitrage mechanism. This market has undergone significant change or reduction as well, according to Lloyd.

He said, "Uthis has taken place against the backdrop of increasingly bearish equity markets and declining investment returns, which has accentuated those underwriting losses."

Lloyd said that by 2001 the insurance market for contractors was concentrated in four locations, the US, London, France, and Norway.

He said, "Today there is no market in France and Norway and in the US it's significantly diminished. London has held up a lot better but even there, the number of underwriting firms left has declined severely."

He explained that as many as 50 insurers were active and willing to compete against each other in the drilling contracting business 5 years ago. Contrasting that with today, there are no more than 20 active insurers and virtually no competition between those recognized leaders.

Pierce highlighted that the energy markets, hit by the combination of poor underwriting results and virtually zero investment returns, incurred insolvencies. There was too much volatility, and capital had pulled out of the market.

Insurance costs increased, in some cases businesses coverage narrowed, deductibles dramatically increased, and the capacity or amount of capital available for risk declined, he explained.

Terrorist attacks

The Sept. 11, 2001, terrorist attacks had an enormous impact on the diverse and global insurance industry. According to Pierce, the events hit every sector of the economy immediately, including the energy sector and drilling business.

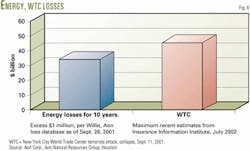

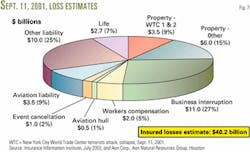

Figs. 6 and 7 add perspective, highlighting the magnitude of the tragic events.

Pierce explained that cumulative losses in the energy sector for the 10-year period to September 2001 totaled more than $30 billion, which he characterized as crippling to the insurance market place (Fig. 6).

Total losses from Sept. 11, 2001, in contrast, were more than $40 billion (Figs. 6 and 7).

Pierce said, "The event sent shockwaves through the insurance community; no sector remained unaffected. It was a deathblow to some [companies] and a near crippling event for many."

He added, "It was not an entirely rational reaction but the insurance market basically didn't know if it was solvent after Sept. 11. Fear drove many decisions that insurers made for at least a couple of months."

To protect against damage from malicious intent, an offshore platform in the North Sea commanded the same additional premium, on a value basis, as a land rig in South Texas after Sept. 11, 2001.

Pierce said it made little sense but insurers charged the same premium indiscriminately, adding that fear of the unknown and the need to get premium dollars in the door for solvency drove the decisions.

Giving his perspective on events, Lloyd said that the insurance market had surged in capacity during the past 10 years, with more capital than was required to underwrite risk. Capital had begun to leave the market, however, before Sept. 11, 2001, particularly for the offshore industry.

"After Sept. 11 and with removal of $40 billion in one fell swoop, the process has been accentuated," said Lloyd. Underwriters were increasing the price of their product and moving their capital to the sectors yielding immediate good returns, he added.

Coverage issues

The coverage options that insurers provide are among the major factors affecting their performance. Lloyd highlighted that insurers are returning to technical underwriting, which implies they are seriously considering and evaluating risks they are insuring and coverage they will provide.

He explained that insurers have begun to pay attention to specific risks, such as rig moves for example, demanding that drilling contractors comply with industry standards or appropriate surveyor recommendations.

Insurers are heavily scrutinizing coverage for risks such as contingent operator's extra expense to control wells or third-party liability, which in previous years have been standard extra coverage, according to Lloyd.

He said, "Similarly, loss of hire or business interruption cover has become so costly that in most cases [drilling contractors] are only buying it where it's a potential requirement."

Coverage for terrorism has attracted a great deal of attention. Lloyd said that for coverage onshore the picture was extremely confused and capacity extremely tight. He said that offshore coverage for malicious intent was a great deal more straight forward but extremely expensive.

With discussion about governmental support to provide a long-term solution to terrorism coverage, Lloyd noted that it was unlikely. He said, "Frankly without a further deterioration in the stability of the world that we live inUwe don't see much government support forthcoming."

Drilling contractors and companies with equipment in the Persian Gulf could expect insurance costs to vary enormously between insurers and remain extremely volatile in the coming months. Lloyd cautions close planning and coordination with intermediaries before entering the market.

Retained risk

Until the most recent renewals, risk-protection deductibles have remained virtually unchanged, in the range $200,000-$250,000, since the late 1980s. Retentions have increased as drilling contractors look to minimize insurance costs and underwriters stem working losses.

"In the last 6-9 months there has not been a single program with a deductible below $1 million and in some cases that varies from $1 million up to $2.5 million," said Lloyd as clients decide to retain more risk.

He added, "That's a significant increase but even at these levels, the deductibles to the drilling contractors are remarkably low in relative terms to other parts of the energy industry."

A specific example is Unit Corp., Tulsa, which earlier this summer renewed its insurance with rig-damage deductibles increasing to $1 million from $200,000.2

Resulting from the increased retentions and with the drilling business downturn, the drillers and underwriters have seen a recent significant downturn in the number of reported losses.

Drilling industry consolidation and resulting greater financial strength allow drillers to insulate themselves from the insurance markets at the lower end of risk. Lloyd makes the case that greater deductibles will help to stabilize insurance costs.

In the context of technical underwriting and considering the coverage provided, Lloyd explained that underwriters arrive at a premium by looking at the expected annual claims activity, making provision for unexpected catastrophe loss, including coverage operating costs, and finally making the margin.

The insurers can influence the operating cost of margins but drilling contractors aspiring to influence the main issues of expected annual claims and the claims frequency can control the activity with significant policy deductibles.

Lloyd said, "Most of the drilling contractors and certainly the offshore drilling contractor industry have the financial strength to do that."

Naïve capital

The energy-sector insurance market will not likely soften in the near future, according to Pierce, who borrowed a recent quote from investor Warren Buffett to highlight that the period of strong pricing is a structural change in market dynamics.

Buffett said, "Uan absolute flood of capital, mostly put up by unsophisticates, is pouring into the insurance industry. You can be sure that this capital will be deployed whatever the levels of rates. Consequently, any period of strong pricing will almost certainly end within a year."

Pierce explained that Buffett was basically correct but that his timing was off and he did not fully appreciate the energy sector's dramatic turn. So few people control the capital that provides energy-industry coverage that overnight business softening will not likely occur.

Pierce said naïve capital would return to the specialty business of energy if underwriters produce double-digit returns for a sustained period of time but it's not there now.

The energy underwriters went through difficult markets in 1984-85 and in 1992-93, but Pierce notes that fundamental differences have changed the nature of the capital supply, extending the time of firm rates and tough pricing.

The insurance market has changed from the buyer's to the seller's market. Pierce said, "Underwriters are very picky about what they write. It's up to us to convince them why they should write to [the drilling contractor]."

References

- The Bassoe Offshore Monthly, "Insurance premiums rocket as underwriting market tightens," Bassoe Offshore Consultants Ltd., Edinburgh, April 2002, p. 3.

- The Land Rig Newsletter, "The Challenge of Rising Risk," Aug. 29, 2002, Vol. 24, No. 8, p. 1, RjM Communications, Lubbock, Tex.