Producers in unconventional plays are learning how to apply analytics to improve field performance and lower costs.

Industry uses various terms to describe its advanced analytics, including digital oil field, integrated operations, and intelligent oil field. Fig. 1 shows how ConocoPhillips uses integrated data warehouses (IDWs) to coordinate information among operational disciplines such as production engineering, reservoir engineering, and geoscience. IDWs enable more efficient analytics, helping cut drill times, and optimize completion designs.

Engineers access a centralized data repository to immediately analyze data instead of first spending weeks manually collecting data. Patrick Stanley, data analytics lead in ConocoPhillips’ Canada business unit, set up a team in 2016 “to act as a nucleus for data analytics and data integration” supporting the company’s Montney shale asset and Surmont steam-assisted gravity drainage bitumen recovery.

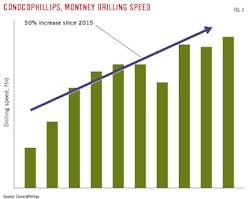

Fig. 2 shows how ConocoPhillips’ data strategy helped accelerate its drilling pace in the Montney. Stanley said analytics also led to more successful completion designs there. ConocoPhillips is drilling a 14-well pad to test stacking and spacing in the Montney this year.

Stanley said ConocoPhillips’s Montney completions are resulting in larger production than its competitors working in the same fairway. He attributed higher production rates to ConocoPhillips’ analytics technology for handling multiple data sets. ConocoPhillips owns about 30 out of roughly 4,600 wells total in the Montney.

“It’s a combination of using traditional, functional tool sets with modern technology as our team analyzes our production,” Stanley said. ConocoPhillips developed a rig-mounted device, called DEEP, that is helping optimize drilling speed. The system, which leverages machine learning and predictive analytics, is being tested in the Montney, Alaska, and the Lower 48.

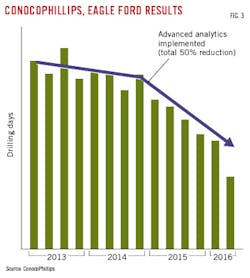

Stanley noted ConocoPhillips started its current IDW approach for unconventional plays with the South Texas Eagle Ford. Fig. 3 shows ConocoPhillips achieved a 50% reduction in drilling days in its Eagle Ford assets, which the company attributed to its IDW and analytics approach.

Unconventional plays generate massive volumes of production, drilling, and completions data, which is suited for advanced statistical and predictive analytics. Stanley said the key is to use analytics to derive value from the data.

Engineers rely on daily information updates to compare well performance, optimize certain shale operations, and make standard practice out of repeatable tasks within a play or subplay.

ConocoPhillips also uses IDWs in the Bakken formation and the Permian basin’s Delaware play. The company is maintaining its unconventional production with 5 rigs total for three plays: the Eagle Ford, Bakken, and Delaware. It plans to add six rigs to increase its unconventional production by 80% during 2017-20.

As of 2017, ConocoPhillips was delivering 50% more wells per rig line than in 2014.

“A user can pull business and technical data from the IDW directly into analytical tools… minimizing what we call personal data curation,” Stanley said. ConocoPhillips’ various business units leverage analytics by using 17 IDWs worldwide.

Stanley said more than 4,000 people have been trained to leverage data analytics and integrated data. The company has reduced its average supply costs for unconventional operations by more than 10%/year since 2016, he said.

ConocoPhillips identified citizen data scientists--petrotechnical staff personally interested in data science. “These are the individuals who were the first to build new tools for their peer groups…to develop their own workflows,’ Stanley said. ConocoPhillips provided them training and tools to augment their traditional work with deep-learning analytics.

Royal Dutch Shell takes thousands of seismic readings before deciding where to drill. Sensors transmit seismic data through fiber optic cables into massive servers. Workers analyze some 3D seismic data at a center in Rijswijk, the Netherlands. Photo from Shell.

Innovative completions

Marathon Oil Corp. has integrated digital technologies into improved operational performance in US unconventional plays. It uses an Eagle Ford asset operations control center, opened in 2016, and associated automation tools to increase production and lower safety risks.

For instance, machine learning enables valves to open if they become plugged with hydrates. Marathon also is setting up a control center in its North Dakota Bakken asset.

Chesapeake Energy Corp. of Oklahoma City is testing new completion designs in the Haynesville, Eagle Ford, Marcellus, and Utica shales.

Jason Pigott, Chesapeake executive vice-president of operations and technical services, told the Bank of America Merrill Lynch Global Energy Conference in Miami during November 2017 that new completion designs developed elsewhere eventually could transition into developing additional prospects in Powder River basin.

Although Chesapeake previously tried to sell its Powder River assets, the independent has reconsidered its development approach for what Pigott calls “a huge asset” that can benefit from Chesapeake’s “big data journey.”

Chesapeake introduced field automation to its producing assets in 2005, gathering big data to optimize development. As of 2017, Chesapeake used remote fracturing monitoring as part of its analytics.

The company is seeking growth by trying to optimize its entire completions strategy from fracturing fluid analysis, proppant loading, perf cluster spacing, and reservoir characterization, to choke management, lateral length efficiency, and formation targeting, Pigott said. Refracturing jobs have improved capital efficiency in Chesapeake’s Gulf Coast business unit, which includes the Haynesville shale, he said.

Analytics helped Chesapeake increase its production by 30% over 2 years in the Haynesville where the company drilled its first 15,000-ft lateral in 2017. Separately, it ran four 10,000-ft laterals from one Bossier well pad, resulting in 133 MMcfd of production.

Chesapeake maintains three rigs and one fracturing crew in Haynesville shale to create what Pigott calls differential performance compared with Chesapeake’s peers, many of which are running several Haynesville rigs.

Regarding the Eagle Ford, Pigott considers it to be Chesapeake’s “oil-growth engine,” saying the company has completed a 16,000-ft lateral with peak production of 2,350 b/d. He noted that Chesapeake’s enhanced completions have helped double its Eagle Ford production since 2015.

Shell’s Smart Fields

Royal Dutch Shell’s Smart Fields approach uses sensors to optimize oil and gas recovery. Shell first used Smart Fields in the late 1960s at High Island 160 in the shallow Gulf of Mexico waters off Texas.

Smart Fields evolved as Shell engineers realized more could be done through automation. Charlie Williams, Shell’s chief scientist for well engineering and production, said much Permian basin production in West Texas and New Mexico depends on beam pump artificial lift.

“It was quite apparent that there was opportunity to not only computer-control, but also computer-optimize, our operations,” Williams said. “We put in control systems that allowed us to optimize production from each artificial lift well and do automatic well tests.”

Shell’s Smart Fields concept started with Smart Wells. The Smart Wells concept involves completions designs that incorporate downhole equipment to control flow in and out of the well, combined with sensors that measure pressure, temperature, flow, fluid composition and potentially seismic events.

Smart Fields resulted from research collaboration with Shell’s partners. The technology has enabled projects to increase production, reduce downtime, and improve recovery rates while reducing costs and minimizing safety risks.

Shell has tight oil and shale gas reserves in the Permian basin, Marcellus. Utica, and Haynesville plays.

Previously, Shell and partner China National Petroleum Corp. developed a well manufacturing system for high-density drilling in coalbeds, tight sands, and shales (OGJ, Oct. 3, 2011, p. 108).

Specialized equipment ensures the drilling trajectory stays inside gas-producing zones. It also enables teams to monitor production in real time.

Rigs can be moved from one well to another and are supervised from a central control room. A combination of speed, automation, and standardized tasks reduces drilling cost and duration, Shell said.

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.