Company News - Plains Exploration to acquire Nuevo Energy

Plains Exploration & Production Co. has agreed to acquire Houston rival Nuevo Energy Co. in a stock transaction valued at $945 million. Upon closing, Nuevo stockholders will own 47%, and Plains Exploration stockholders will own 53% of the combined company.

In other upstream news:

- BG Group has agreed to acquire El Paso Oil & Gas Canada Inc. for $345.6 million from El Paso Corp., Houston.

- Several principals of the former Matador Petroleum Corp.— including founder Joseph Foran—have formed Matador Resources Co., a privately held Dallas-based independent focused on the southwestern US. (See Personnel Moves and Promotions, p. 34)

In downstream and midstream news:

- Valero Energy Corp., San Antonio, has agreed to buy the 315,000 b/d Aruba refinery and related operations from El Paso Corp. for $465 million.

- Kinder Morgan Energy Partners LP has agreed to buy seven refined petroleum products terminals in the Southeast US from ExxonMobil Corp. The terminals have a combined storage capacity of 3.2 million bbl for gasoline, jet fuel, and diesel.

null

Plains-Nuevo deal

The Nuevo Energy acquisition will increase the scale of Plains Exploration's largest operating area, California, as well as its holdings in Texas. Pro forma proved reserves are expected to increase to 489 million boe, of which 83% is oil and 71% is proved developed.

New York-based Standard & Poor's Ratings Services placed its "BB-"ratings on Plains Exploration and Nuevo on credit watch with positive implications.

The transaction is expected to qualify as a tax-free reorganization. The boards of both companies have approved the merger agreement, and each has recommended it to their respective stockholders for approval.

Plains Exploration plans to issue up to 37.4 million shares to Nuevo shareholders and to assume $234 million of net debt (as of Dec. 31, 2003) and $115 million of trust convertible preferred securities.

Transaction terms call for Nuevo stockholders to receive 1.765 shares of Plains Exploration common stock for each share of Nuevo common stock, based on the Feb. 11 closing price of $15.89/share for Plains Exploration, which equates to $28.05/share for Nuevo stock.

BG-El Paso Canada

El Paso Canada holds 690,000 net acres, of which 630,000 is undeveloped oil and gas acreage.

The properties are in four core areas in the Western Canadian Sedimentary Basin, mostly in Alberta and northeastern British Columbia.

British Gas US Holdings LLC Pres. Martin Houston said the acquisition provides "a strong platform on which to develop a Canadian exploration and production business." Subject to regulators' approval, the transaction is expected to close in the first quarter.

The acquisition also includes gross working interest production of 80 MMscfed, as of Dec. 31, 2003. A third party evaluator has said the properties contain 132 bcfe of proved reserves, of which 84% is natural gas.

BG already had interests in one US LNG facility and is working to develop a second one.

BG LNG Services LLC (BGLS), a wholly owned subsidiary of BG Group, has rights over 100% of the capacity at the Lake Charles, La., LNG facility, which has the capability to receive, store, vaporize, and deliver an average daily send-out of 630 MMscfd.

In March 2003, the US Federal Energy Regulatory Commission gave approval for expansion of the terminal to 1.2 bcfd.

This first-phase expansion is expected to commence operations at the beginning of 2006.

BGLS, in conjunction with Keyspan Corp., New York, also is seeking to develop an LNG terminal at Providence, RI.

Matador Resources

The primary focus of Matador Resources is on natural gas operations in East Texas, North Louisiana, South Texas, and the Permian basin of West Texas, and southeastern New Mexico.

Tom Brown Inc., Denver, bought Matador Petroleum last year (OGJ Online, May 15, 2003).

The executives of Matador Resources said they will focus their exploration and drilling efforts on natural gas reserves in well-established, historically productive basins. They also plan to acquire properties with significant reserves potential and drilling opportunities.

The new company has attracted more than $52 million in start-up capital since July 2003.

Valero-El Paso

The boards of both companies already approved the transaction, in which Valero is paying El Paso $365 million for the Aruba refinery and $100 million for related marine, bunkering, and marketing operations. In addition, Valero is paying $250 million in working capital.

Valero's purchase of the Aruba refinery is expected to close by Feb. 29. As part of the closing,

El Paso will retire a $370 million lease financing associated with the refinery. The estimated $265 million of remaining net cash proceeds will be used to retire debt.

Bill Greehey, Valero chairman and CEO, said the Aruba refinery has a replacement value of $2.4 billion, noting that more than $640 million has been invested in the last 5 years to improve safety and profitability.

"What's more, this refinery is a great fit for Valero because it processes heavy, sour crude oil, which typically sells at a big discount to sweet crude oil, and it produces a high yield of valuable intermediate feedstocks," Greehey said.

The acquisition is expected to "be highly accretive to our earnings in 2004," he said, adding that the transaction will be funded with cash and equity so that Valero's debt-to-capitalization ratio of 40.3% will remain unchanged.

Greehey said the Aruban government agreed to give Valero an existing income tax holiday on all earnings, except retail, through 2011. Greehey said Valero would work with the government to extend the agreement.

El Paso Pres. and CEO Doug Foshee said the Aruba refinery sale marked "another major step" in his company's long-range plan, which involves a series of divestitures (OGJ Online, Dec. 15, 2003).

"With the net proceeds from this transaction, we will have announced or sold approximately $636 million of petroleum assets since Dec. 31, 2003, exceeding the $500 million to $600 million target established in our plan," Foshee noted.

Kinder Morgan-ExxonMobil

The terminals are in Collins, Miss.; Knoxville, Tenn.; Charlotte and Greensboro, NC; and Richmond, Roanoke, and Newington, Va.

ExxonMobil also entered into a long-term contract with Kinder Morgan to use the terminals upon closing.

Kinder Morgan Chairman and CEO Richard D. Kinder said the transaction complements the company's recent acquisition of seven other liquids terminals in the US Southeast, a burgeoning natural gas market.

All seven terminals connect with Plantation Pipe Line Co.'s system, operated by Kinder Morgan, which holds 51% interest.

Two of the terminals also are tied to Colonial Pipeline Co. Kinder Morgan will fully own and operate all of the terminals.

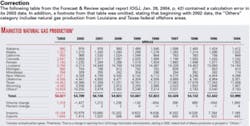

Correction

The table from the Forecast & Review special report (OGJ, Jan. 26, 2004, p. 42) contained a calculation error in its 2003 data. In addition, a footnote from that table was omitted, stating that beginning with 2002 data, the "Others" category includes natural gas production from Louisiana and Texas federal offshore areas.