Energy litigation trends

The chief attorneys for US energy companies believe that the number of lawsuits is going to increase in coming years—particularly environmental and toxics tort actions, according to a national litigation trends survey commissioned by Fulbright & Jaworski LLP (F&J).

Greenwood Inc., a Houston research firm, conducted the US Corporate Counsel Survey of Litigation Trends during the first quarter. Out of 300 respondents representing various industries, 83% were either general counsel or chief legal counsel. The rest were staff attorneys.

Specific trends cited included more class-action lawsuits, earlier settlements via arbitration, increased litigation costs, and more tort reform.

The fact that F&J commissioned the survey and launched a public relations effort to promote its results as a marketing tool is an affirmation of how litigation is big business.

Litigation changes

Survey results showed that 41% of the polled energy attorneys believe that litigation will increase in the future, 37% expect that litigation volumes will stay the same, and 22% forecast that litigation will decrease.

The survey represents one of the largest samples of in-house counsel for a study of corporate litigation issues, said Layne Kruse, a partner and chairman of F&J's litigation department's emerging-issues committee.

Energy was the second largest industry represented in the litigation survey, with manufacturing being the largest.

The energy industry ranked with the third-highest number of cases in litigation, behind insurance and finance.

All segments of the energy industry were represented, from small companies to major corporations, Kruse said. Additional details about the energy companies participating are unavailable because Greenwood vowed to protect participants' anonymity, he said.

The overall survey showed that companies having annual gross revenues of $1 billion or more reported their median number of pending cases was 86, up from 70 cases in 2001. The pace of lawsuits is expected to increase, said 41% of in-house attorneys canvassed.

The companies surveyed acknowledged that often they are the plaintiffs. Of the overall survey respondents, 88% reported initiating lawsuits during the past 3 years. Of the energy respondents, 87% said they initiated litigation.

Contract disputes were the reason for 56% of the litigation initiated by energy companies. Bankruptcy and reorganization issues constituted 13%, and intellectual property rights accounted for 9%.

Environmental concerns

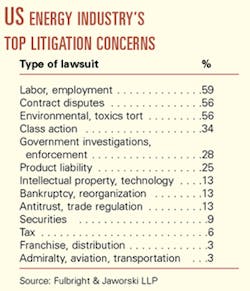

The top areas of litigation concerns overall for energy companies are labor-employment, contract dispute, and environment/toxics tort (see table). Energy companies listed environment/ toxics tort actions as the area most likely to increase in the future, saying it could increase at a level of twice as much as any other area of litigation.

Kruse noted that the energy industry cited environment and toxics tort litigation as a concern more often than any other industry included in the survey.

"These cases can arise in a variety of waysU. A lot of these environmental cases go back decades," said Osborne J. Dykes, an F&J partner and director of the firm's energy litigation practice. "There is an increasing awareness of the environment and the problems that go with it. There are increasing enforcement efforts, both on the national level and the state levelU. It's not just governmental enforcement. People are more aware now than they used to be, and they are bringing more claims."

Up to 33% of Dykes's case docket involves environmental cases, he estimated, adding that environmental litigation affects upstream and downstream companies as well as pipeline companies.

Litigation costs

Increasing volumes of litigation mean a higher cost of doing business.

The survey also examined the ways that respondents are managing litigation costs. Dykes and Kruse said energy companies are among the most aggressive in looking for ways to use outside law firms more efficiently and to save costs.

Just as the industry has streamlined procurement of goods and services for operations, energy companies also are narrowing the number of outside law firms that they hire, selecting preferred providers having expertise in particular types of litigation, the survey showed.