OGJ Newsletter

Market Movement

Increased OPEC output

erodes spare capacity

Efforts by the Organization of Petroleum Exporting Countries to satisfy world demand for crude this summer had the "unintended consequence" of reducing its spare production capacity, analysts said.

If the 10 OPEC countries still subject to production quotas maintain their projected June output level of 27.5 million b/d, the group's spare crude capacity will shrink to an estimated 800,000 b/d in the third quarter from 1.6 million b/d in May, according to a June 30 analysis by Edinburgh-based consultant Wood Mackenzie Ltd. Only Iraq is currently exempt from quota restrictions.

"As a result, the capacity crunch has indirectly heightened the potential impact of any terrorist attack or political unrest on supply flows and international oil prices," Wood Mackenzie analysts said.

In a separate report on the same date, analysts at Merrill Lynch Global Securities Research & Economics Group, New York, also noted the erosion of OPEC's spare production capacity. "Disappointing non-OPEC supply growth and surging demand growth have significantly increased the call on OPEC oil," they said. "While higher output levels should eventually lead to a restocking in inventories, the higher oil production level has significantly reduced the spare capacity cushion within OPEC." Merrill Lynch analysts reported, "Current spare capacity of 1.3 million b/d is the lowest it has been over the past 3 years. The last time OPEC spare capacity was challenged to this degree was during the December 2002-March 2003 time period, when disruptions in Venezuela and Iraq reduced output from those two countries by as much as 2.7 million b/d combined."

The key difference between that earlier period and the current environment "is that today there are no short-term supply disruptions that will soon reverse. Instead, today's lack of spare capacity is a result of much higher-than-expected demand," Merrill Lynch analysts said.

"The risk of further geopolitical threats to OPEC nations' oil production infrastructure remains significant," said Ann-Louise Hittle, head of macro oils at Wood Mackenzie. "Iraqi oil exports remain vulnerable to attacks on both its southern and northern export outlets. Elsewhere in the [Persian] Gulf [area], continued assaults against Saudi Arabia's expatriate community are occurring, and damage to its oil infrastructure cannot be ruled out. As the source of the largest share of spare capacity, interest is focused particularly on events in Saudi Arabia," officials said. Venezuela also is a political risk, with President Hugo Chavéz facing an Aug. 15 recall referendum that may trigger civil disturbances, which could threaten oil exports once again.

Higher prices forecast

Merrill Lynch raised its 2004 average oil price forecast to $34.40/bbl (New York Mercantile Exchange) from $31.60/bbl previously, on the assumption of no major supply disruptions. "Given limited spare capacity, a price spike above $40/bbl is possible should prolonged production outages occur in Iraq, Venezuela, or Nigeria," analysts said.

However, Wood Mackenzie analysts said there are three distinct trends emerging that should lessen the impact of any loss of oil supplies as the year progresses:

Futures market rebounds

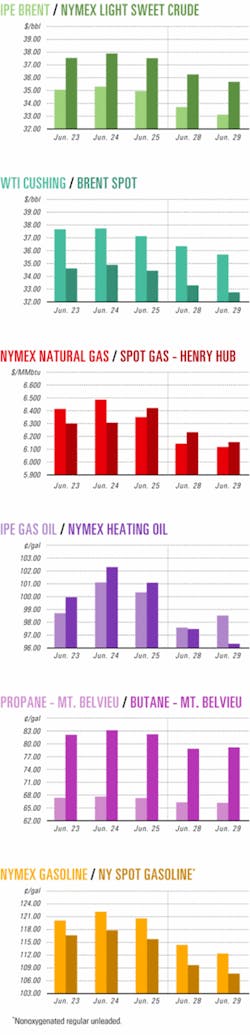

Energy prices rebounded strongly June 30 in New York and London markets after traders earlier guessed wrong on US inventories of crude and petroleum products.

Prices had fallen in the three previous trading sessions, hitting an 11-week low by June 29 on the NYMEX as supply outages in Norway and Iraq were alleviated. Traders were expecting a build of 1 million bbl in commercial US crude inventories ahead of the Fourth of July holiday weekend in the US. Instead, the US Energy Information Administration reported June 30 that oil stocks fell by 500,000 bbl to 304.9 million bbl during the week ended June 25, despite a jump in crude imports to 10.6 million b/d, the fourth highest weekly average ever. US gasoline inventories were unchanged at 205.1 million bbl during the same period. Only distillate fuels increased, up by 500,000 bbl to 110.9 million bbl, with a gain in heating oil more than compensating for a drop in diesel fuel, EIA said.

Industry Scoreboard

null

Industry Trends

WORLDWIDE EXPLORATION AND PRODUCTION spending is being increased more this year than oil and gas companies previously anticipated, said a midyear update to an E&P Spending Survey by Lehman Bros. Inc., New York.

The midyear survey participants plan 2004 worldwide E&P expenditures of $157.8 billion, an 8.8% increase compared with 2003 spending. In the December survey, companies expected a 4% increase, Lehman Bros. noted (OGJ Online, Dec. 8, 2003).

The latest survey—taken May 15-June 7—involved 347 companies, while the December survey involved 335 companies.

The higher spending numbers largely reflect increases in international budgets, said Lehman Bros. analyst James D. Crandell. Strong commodity prices are a driving force.

He said 2004 E&P budgets are based on an average oil price of about $28.44/bbl (West Texas Intermediate) vs. $25.29/bbl in the yearend survey.

Natural gas price assumptions are $4.76/Mcf (Henry Hub) at midyear vs. $4.17/Mcf last December.

When asked about 2005 spending plans, 60% of the companies surveyed said they intend to increase E&P spending, with about half of them planning double-digit increases. Most of the companies anticipating double-digit gains are smaller independents, he said.

E&P spending outside the US and Canada is estimated to grow 11.9% in 2004 for the 94 companies surveyed in that category at midyear, compared with 6.1% estimated by 92 companies in the December survey. This is happening despite weaker-than-expected spending among the Russian companies.

"The greater growth in 2004 spending vs. 2003 is driven by government-owned companiesUand by majors," Crandell said. Among the government-owned companies, Petroleos de Venezuela SA expects a 51% spending increase, Petroleo Braziliero SA expects a 29% increase, and Petroleos Mexicanos expects a 22% increase.

Among the majors, Spain's Repsol YPF SA expects an 85% spending increase, BG PLC expects a 32% increase, and Royal Dutch/Shell Group expects a 23% spending increase.

E&P spending in the US is forecast to grow 4.3% in 2004 for the 276 companies surveyed at midyear. That compared with a flat outlook expected by 270 companies participating in the December survey.

"The gains are being driven partly by companies that spend less than $50 million, as their spending is estimated to grow by about 20%.

"However, several larger independents have boosted their budgets, reflecting increased cash flows, and in some cases, the availability of prospects," Crandell said.

These include 2004 budget increases of more than $200 million each by Apache Corp., Houston, and Chesapeake Energy Corp., Oklahoma City. In the US, independents as of the midyear survey planned spending gains of 4.2% vs. the 2.5% increase they indicated in December.

Meanwhile, the majors estimate a 4.4% increase in 2004 US E&P expenditures, a reversal from the 3.9% decline they expected in the earlier survey.

Canadian E&P spending is expected to be weaker in 2004, primarily due to the overspending of 2003 budgets, Crandell said. For 62 companies surveyed at midyear, spending is estimated to be down 2.2% for 2004, compared with a flat spending expectation by 58 companies surveyed in December.

Government Developments

THE US SUPREME COURT essentially delayed a decision on whether documents pertaining to the White House energy task force should be made public until after the November presidential election (see Editorial, p. 17).

On June 24, the court voted 7-2 to return the case to a federal appeals court. The Supreme Court advised the lower court to examine the White House's argument that information related to a policy task force was protected from public disclosure laws.

The case involves a lawsuit filed by an unusual coalition that included the environmental group Sierra Club and the conservative legal foundation Judicial Watch Inc.

The two organizations said the 2001 task force—led by US Vice-Pres. Dick Cheney—should publicly identify industry representatives who were consulted during preparation of a May 2001 policy document. The advocacy groups, as well as the General Accounting Office, also want documents and meeting details to be made public. But the White House has refused to release specifics, saying it has no legal obligation to do so.

The White House welcomed the high court's recent action, but the administration could face another test next year, depending on what the appeals court decides.

"We believe that the president should be able to receive candid and unvarnished advice from his staff and advisers. It's an important principle," a White House spokesman said.

Meanwhile, campaign officials for Democratic presidential candidate Sen. John Kerry (D-Mass.) said that the White House's actions demonstrate that the administration has something to hide.

THE NORWEGIAN GOVERNMENT imposed compulsory arbitration in the dispute over pensions and job security between two offshore unions and the Norwegian Oil Industry Association (OLF).

A bill by Norway's Council of State on June 25 put an immediate end to a strike by offshore workers that had started June 17. As a result, the striking members of the two unions involved—the Federation of Oil Workers Trade Unions (OFS) and the Norwegian Association for Supervisors—had to return to work.

The OFS escalated the strike June 23, threatening to shut in 720,000 b/d of oil production and 30 million cu m/day of natural gas production. OLF retaliated June 24 with plans for a June 28 lockout at all facilities on the Norwegian continental shelf.

That would have triggered an almost complete shutdown of production from the Norwegian continental shelf, which normally produces some 3.3 million b/d of oil and 7.3 bcfd of natural gas. The strike previously had shut in 400,000 b/d of oil production.

The threatened lockout by oil companies generally was seen as a tactic to force the government to intervene in the strike. During a strike in 2000, the Norwegian government stepped in to compel arbitration, forcing strikers back to work after industry announced a planned lockout.

The oil industry is the biggest revenue producer for Norwegian government. Any prolonged shutdown would have a significant impact on revenues for both the government and oil companies (OGJ Online, June 24, 2004).

Quick Takes

SHELL EXPLORATION & PRODUCTION CO. resumed production June 28 from its Mars tension leg platform on Mississippi Canyon Block 807 in the Gulf of Mexico, following a gas line flex joint replacement and temporary repairs to its oil export pipeline flex joint. The TLP's production had been shut in since May 22 (OGJ Online, June 8, 2004). Shell said production was expected to reach its preshutdown level of 150,000 b/d of oil and 170 MMcfd of gas by early July. The company expects to shut in production later this summer for about a week to install refurbished flex joints. Statoil (Orient) Inc. has awarded Lufeng Development Co. ANS, a unit of Bluewater Energy Services BV, the Netherlands, a contract extension for Lufeng field production in the South China Sea. The contract provides for the Munin floating production, storage, and offloading vessel to return to Lufeng field early in second quarter 2005 for at least 3 years. The Munin FPSO, now operating in Lufeng field, will undergo minor modifications and maintenance and relocate to Xijiang field to produce for ConocoPhillips China Inc. for 5-6 months while sidetrack drilling on three existing Lufeng field wells takes place. Apache Corp. has awarded Wood Group Production Services (WGPS) a contract to operate an additional 21 platforms in the Gulf of Mexico, bringing to 36 the number of facilities that WGPS operates for the Houston-based independent. United Heritage Corp. subsidiary UHC Petroleum Corp., Cleburne, Tex., received a Texas state permit to inject nitrogen into leases in Val Verde basin to recover more of the estimated 168 million bbl of OOIP in the area. The site work has been completed, and a nitrogen generator is on site. UHC said it is on schedule to have 4 injection wells and 26 producing wells for Phase 1 of the project. That could be expanded to 6 injection wells and 86 producing wells. The total injection of nitrogen during the first phase could be 100 Mscfd or the equivalent of 2,900 b/d of fluid injected.

NIUGINI GAS & CHEMICALS PTE. LTD. of Papua New Guinea, I&G Venture Capital Co. Ltd., Seoul, and Rentech Inc., Denver, have signed a memorandum of understanding with Papua New Guinea's Ministry of Petroleum and Energy for development of an integrated methane complex and natural gas pipeline at Wewak in northern Papua New Guinea. Pending results of a feasibility study, the complex could include facilities to produce LNG, compressed natural gas, ammonia, and urea and a 15,000 b/d gas-to-liquids plant that would utilize Rentech's proprietary Fischer-Tropsch GTL process technology. Papua New Guinea holds estimated gas reserves exceeding 15 tcf that the government wants to see monetized.

DOMINION EXPLORATION & PRODUCTION INC., operator of Thunder Hawk prospect in the deepwater Gulf of Mexico 150 miles off New Orleans, made an oil discovery with its Mississippi Canyon Block 734 well No. 1 ST1. The well, in 5,724 ft of water, encountered 300 ft of net oil pay in two reservoir zones that earlier were found to be water-bearing. Dominion's current estimate of reserves, based on the two penetrations, is 50-150 million boe. The sidetrack well reached 24,831 ft TMD and 23,101 ft TVD subsea. Dominion holds 25% interest; partners are Murphy Exploration & Production Co. 37.5%, Spinnaker Exploration Co. 25%, and Pioneer Natural Resources Co. 12.5%. A consortium led by Total SA was awarded a license to explore Blocks 6406/7 and 4606/8 in the Haltenbanken area of the Norwegian Sea during Norway's recent 18th licensing round. Total, which will be operator, will hold a 40% interest in the blocks, which lie in 300-380 m of water. Coventurers are Royal Dutch/Shell Group, Statoil ASA, and ENI SPA.

Heritage Oil Corp., Calgary, operator of the Turaco-2 well on Block 3 in Uganda, reported that the well was drilled and logged but abandoned after wellbore instability caused the drillstring to stick while reaming in preparation for testing. Heritage and 50:50 joint venture partner Energy Africa Ltd. identified another rig for immediate mobilization to Uganda to accelerate the drilling program. The JV also plans to acquire for $6 million a 350 sq km 3D seismic survey to delineate structures identified by three previous surveys. The survey will identify additional drilling targets for the two rigs that will be in Uganda. Saudi Aramco has awarded WesternGeco, Houston, a contract to acquire surveys over two unidentified fields in Saudi Arabia. WesternGeco, managed by Schlumberger Ltd. and owned jointly by Schlumberger and Baker Hughes Inc., said it would use its Q-Land seismic acquisition and processing services to accomplish the project. Seismic activities were slated to begin in June and be completed within 6 months.

Texaco Ltd. has successfully processed its first shipment of Chad Doba crude at Pembroke refinery in southwestern Wales, following completion of a $12.8 million plant reconfiguration. The heavy, acidic Doba crude is similar to the North Sea crude that Pembroke currently refines, but Doba has a higher calcium content—250 ppm. To enable Pembroke to refine Doba crude, which comes from oil fields in southern Chad, Texaco coated pipe interiors with a chemical inhibitor to provide a protective film that is regularly monitored. With BakerPetrolite chemical company, Texaco also devised a process to treat the calcium in the refinery's desalter. Tulsa-based Citgo Petroleum Corp. has completed construction and started up the second of two identical gasoline hydrotreaters at its Lake Charles, La., refinery. The units will maintain the gasoline stream's octane value while removing sulfur to meet the new Tier II federal fuel regulations that will be phased in over a 3 year period. Both new units are operating at their 35,000 b/d design capacities. Citgo, owned by Petroleos de Venezuela SA's US subsidiary PDV America Inc., said it is planning additional investments at the refinery during the next 5 years to meet future environmental regulations. PetroChina Co. Ltd. awarded a contract to Topsøe SA, Lyngby, Denmark, to supply technology for two large flexible-feed hydrogen units at PetroChina's Dalian Petrochemical Co. complex at Dalian, China. Topsøe will supply the license, engineering, catalysts, and critical equipment for the units. The hydrogen units will be part of a major expansion of PetroChina's refinery capacity in Dalian, and the hydrogen product will be used for the production of high-quality transportation fuels.

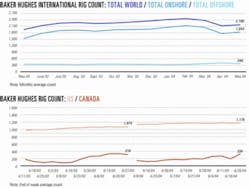

CANADA registered a major rebound in drilling activity the week ended June 25, up by 138 rigs to 334 working that week, wiping out the previous week's loss of 77. That compares with 310 rotary rigs working in Canada during the same period last year. US activity also rebounded slightly, up by 5 rotary rigs with 1,176 working, compared with 1,074 during the same period last year, Baker Hughes Inc. reported. Land operations, up by 8 rigs, accounted for all of the US increase with 1,063 making hole. Offshore operations were down by 1 rig to 92 in the Gulf of Mexico and 95 for the US offshore as a whole. Inland waters drilling dipped by 2 rigs to 18.

BP PLC has awarded FMC Kongsberg Subsea AS, a unit of FMC Technologies Inc., Houston, a contract to supply subsea systems and related services for the BP-operated Greater Plutonio project on Block 18 off Angola. The initial contract value is about $270 million. The FMC unit's scope of supply for the entire project is expected to include 45 subsea trees and associated structures, manifolds, and production control systems, as well as connection systems for flowlines and umbilicals. FMC Technologies also will supply technical services related to installation and start-up. Deliveries are slated to begin in early 2005. Global Energy Development PLC, the international unit of Harken Energy Corp., Houston, plans to drill as many as four wells within a year in Palo Blanco field in Colombia based on a recent test of a new zone in its Estero 2 well. On test, the Upper Mirador zone at 7,664-68 ft flowed at a maximum rate of 432 gross b/d of 37° gravity oil. Following additional tests, Global expects to commingle production from the Upper Mirador with the Ubaque formation, already producing 160 b/d from the Estero 2 well, in which Global owns 100% interest (OGJ Online, Apr. 21, 2004). Global also plans to recomplete two producing wells in the Ubaque.

Paramount Resources Ltd., Calgary, is producing oil and natural gas from Cameron Hills field in the Northwest Territories just northeast of the northwest corner of Alberta. The 2004 program calls for drilling three development wells and two exploration wells at Cameron Hills. Oil and gas are found in structural and stratigraphic traps in the Middle Devonian age Slave Point, Sulphur Point, and Keg River formations. Paramount sees significant potential in the area. It holds subsurface rights for close to 80,800 acres of land, including 19 surface leases, 12 significant discovery licenses, 5 commercial discovery declarations, and 7 production licenses. Gas production began Mar. 29, 2002, from discoveries made 10-35 years ago. Paramount installed a $5 million tank battery at Cameron Hills and began light oil production in April 2003 from five wells through a 72-km pipeline to Bistcho Lake, Alta., and then through a new $5 million, 55-km, 4-in. pipeline to a connection with the Rainbow Pipeline at Zama Lake. Target rate of 1,500 b/d of oil was reached in November 2003, but first quarter 2004 net production averaged 15 MMcfd of gas and 547 b/d of oil due to mechanical and operational difficulties.

SONATRACH, Algeria's state oil and gas company, awarded Atlanta-based GE Energy a $35 million contract to upgrade control systems and instrumentation on natural gas compression trains in Algeria. Existing GE gas turbine control systems will be upgraded on 75 compression trains using gas turbine prime movers, with most of them involving combined control of both the gas turbine and its associated compressor. The project, which will upgrade Sonatrach's pipeline network for transporting gas to its LNG facilities on the Mediterranean coast for export to Europe and the US, is slated to begin in the third quarter. Gasoductos de Tamaulipas (GT), a special-purpose company formed by Pemex Gas y Petro- quimica Basica of Mexico and Houston-based El Paso Energy Corp., awarded GE Energy's pipeline integrity operations unit a multimillion-dollar, 6 year contract to provide maintenance and inspection services for GT's 120 km, 36-in. San Fernando natural gas pipeline in northeastern Mexico. The line extends from a connection with existing Pemex pipeline assets in Los Indios, Tamaulipas state, to San Fernando. The contract also covers two new compression stations at Los Indios and El Caracol. The pipeline is transporting 1 bcfd of gas from the US, but ultimately will carry gas from the onshore Burgos basin gas fields.

TAIWAN'S state-owned Chinese Petroleum Corp. has announced that it will construct a 2.2 million tonne/year methyl methanol plant in Qatar. Completion of the project is expected to take 31/2 years. A CPC official said that when the $540 million plant begins operating at full capacity it will be the largest facility of its kind in the world. Lurgi AG of Germany has been selected to oversee construction of the new plant. Qatar Petroleum and ExxonMobil Chemical Co. agreed to conduct a joint feasibility study for the construction of a world-scale, ethane cracker and ethylene derivatives complex in Ras Laffan Industrial City, Qatar. The study will define the technical and commercial aspects of a world-class petrochemical business in Qatar, the companies said. The complex will use ethane feedstock from new gas development projects in Qatar's North field. End products will be marketed to Asia and Europe. Egyptian Linear Alkyl Benzene has awarded a contract to Fluor Corp. to manage development of a new linear alkyl benzene facility in Alexandria, Egypt. The project is part of a 20 year "petrochemical master plan" for Egypt, a Fluor spokesman said. Preliminary work on the project began in December 2003, and Fluor started work on the project in February. The team expects to complete the project in 30 months.

PAKISTAN NATIONAL SHIPPING CORP. (PNSC) plans to buy from a Greek company a fourth oil tanker to expand its oil import operations with three state-owned Pakistani refineries and possibly compete for international oil transportation contracts. PNSC has three other tankers transporting crude from Saudi Arabia to Karachi for the refineries. The single-hull tankers—to be banned by the International Maritime Organization by 2007—would enable PNSC to increase income enough by then to recover tanker costs and eliminate existing deficits totally, PSNC said. The company also disclosed a long-term plan to manufacture other oil tankers for international transport and to help China meet its national requirements.