ARCO Persists in North Slope Oil Output Goal: 'No Decline after '99'

The recent collapse in oil prices and the impending disappearance of one of the two main Alaskan North Slope operators into the bowels of another has had a surprisingly modest effect on plans to halt the decline in North Slope oil production.

ARCO Alaska Inc., soon to disappear as a result of its parent's acquisition by new supermajor BP Amoco plc, insists that its recent battle cry of "No decline after '99" nevertheless still holds true. It still expects a turnaround, just one that is diminished from earlier expectations.

The company this year continued to press efforts to turn around the production slide on the North Slope, long the core of its parent's production and reserves base. Those efforts include an ambitious enhanced recovery project, significant new satellite developments, and a continuing exploration campaign.

Production goal

Start-up of the new Alpine field development on the North Slope in mid-2000 is expected to increase ARCO's Alaska production from an expected 317,000 b/d of oil in 1999 to 325,000 b/d in 2000 and 347,000 b/d in 2001, ARCO Alaska Pres. Kevin Meyers said last spring in a speech to the Anchorage Chamber of Commerce.

"Despite record low oil prices and the resulting spending cuts, we can still achieve our Alaskan production goal of 'No Decline After '99,'" Meyers said. "However, the oil price environment has led to a lower level of production turnaround than we previously expected."

"Longer term, with oil price recovery and continued exploration success, we expect to hold our share of North Slope production above 330,000 b/d for the foreseeable future."

ARCO Alaska plans capital spending of $450 million in 1999, down $120 million from 1998. The company has halted development of the West Sak heavy oil reservoir and, with its partners Exxon Corp. and BP Amoco, has slowed the pace of development drilling at Prudhoe Bay, Point McIntyre, and Kuparuk River oil fields. The Point McIntyre EOR project, a major expansion of the Prudhoe Bay EOR project, and the Alpine development are moving forward.

MIX project

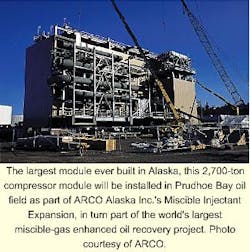

ARCO's $160 million Miscible Injectant Expansion (MIX) project represents a new watershed in Alaskan North Slope EOR.

Miscible injectant is used for the Prudhoe Bay Unit (PBU) miscible enriched-gas enhanced oil recovery project, which already is the world's largest miscible injection EOR project. The MIX project will increase the amount of miscible hydrocarbon injectant made at Prudhoe Bay by 20%.

The MIX project will also increase the amount of natural gas that can be produced, processed, and reinjected into the Prudhoe Bay reservoir to 8 bcfd from 7 bcfd. This increased gas handling capacity will boost oil production by 18,000 b/d by allowing the field operators to produce from a larger number of wells at any given time.

It will also increase natural gas liquids production by 2,000 b/d. The MIX project will also increase ultimate Prudhoe Bay liquids recovery by 50 million bbl.

The MIX project team includes ARCO and BP personnel. Costs of the project will be divided according to Prudhoe Bay oil ownership interests, with BP paying about 50%, ARCO and Exxon each paying about 20%, and other minor owners paying the remainder.

The project includes the construction of a 2,700-ton compressor module, the largest oil field production module ever assembled in Alaska, according to Henry Magee, ARCO Alaska's vice president of Prudhoe Bay operations. That module was recently loaded out for sealift to the North Slope (OGJ, Aug.2, 1999, p. 29).

As Alaska's newest industry, the Prudhoe Bay MIX project will contribute to the development of a new module fabrication industry in Alaska. The 14-month VECO Construction project will create an estimated 120 jobs in Anchorage. The VECO Construction contract for modification of the gas plant and installation of the compressor module will create an additional 60 jobs on the North Slope. Flowline Alaska will fabricate a 135-ft pipe rack at Fairbanks that will tie the next MIX module into the giant Central Gas Facility-which houses the world's largest gas processing plant. MIX engineering and services contractor is Parsons Energy & Chemicals Group, Pasadena, Calif. ARCO Alaska manages the project for the PBU partners and will operate the facilities once it has been installed on the slope.

Alpine project

Alpine accounts for almost half of ARCO Alaska's 1999 capital budget.

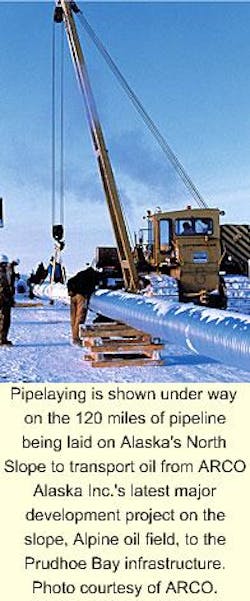

More than 1,200 people are now at work in Alaska on the Alpine project, fabricating production facilities, building necessary gravel infrastructure, and installing more than 120 miles of pipeline. Development drilling will begin next April.

"Alpine is key to stabilizing our Alaska production, " Meyers said. "The project is on schedule and will begin production in midyear 2000, ramping quickly to 70,000 b/d in 2001."

Alpine contains estimated proven and potential reserves of 365 million bbl. ARCO Alaska has a 78% working interest in the field, and Anadarko Petroleum Corp. holds the remaining 22%.

Alpine also represents another step forward in how North Slope operators are continuing to use advanced technology to hold down development costs and to reduce the size of industry's "footprint" on the sensitive arctic tundra.

One of the technological advances leading ARCO's effort to enhance the economics of its North Slope development is the use of 3D animation graphics. Adapting 3D graphics used in the auto and aeronautics industries, designers in ARCO's Alpine operations group are able to see firsthand on their computer screens how various modules will function in the arctic environment. The technology also provides almost instant opportunities to see the effects of suggested changes.

The 3D technology being applied to Alpine development also enables designers to look at and "operate" a virtual module before it is built. The result is improved safety performance and reduced operating costs when the module is brought on line in the field.

"What is special about this system is that it has taken 3D design one step further, combining engineering design with actually building the modules," explained Craig Dotson, manager of ARCO's Alpine project. " There is a lot of engineering design and construction savings with this process. And the system gives us better construction estimates, saving the cost of surplus materials."

ARCO expect that advances in facility design and construction, along with the use of 3D seismic and high-performance extended-reach drilling, will enable it to reduce historic North Slope oil field development costs by 30% at Alpine. Development costs for satellite fields, which are produced through existing production facilities, are even lower.

Focus on satellies

The focus on low-cost development is also driving a number of smaller so-called satellite projects involving fields such as Tarn, Tabasco, and Midnight Sun. They are fields that only a few years ago would not have been economic to produce. But today, because of reduced per-barrel costs, they play a big part in ARCO's North Slope future.

"We used to refer to satellites as puddles," said ARCO's Susan Harvey, former supervisor of Prudhoe Bay satellite development who recently took a new job supervising Prudhoe Bay waterflood efforts. "But that's really a misnomer. Many of these satellites are 30-100 million bbl fields. Those would be huge discoveries in the Lower 48."

On Mar. 23, 1999, ARCO Alaska, Exxon Co. USA, Mobil Alaska E&P Inc., and Phillips Petroleum Co. announced the discovery of a new Prudhoe Bay satellite field.

The V-200 well encountered a 58-ft vertical section of oil-bearing sand in the Kuparuk River formation. This accumulation, which will be named Aurora field, flowed on test at a rate of over 1,900 b/d of 30° gravity oil and 1.3 MMscfd of gas per day. The discovery well is located on a lease in which ARCO and Exxon each owns a 50% interest.

The accumulation is estimated to contain 20-35 million bbl of recoverable oil, including adjacent leases held by ARCO, Exxon, Mobil, and Phillips. Plans for additional appraisal activities at Aurora during 1999 were still being evaluated at presstime.

The Aurora field extends the recent string of successful Prudhoe Bay satellite discoveries. Eight other wells were drilled within the past 18 months to discover and delineate the nearby Midnight Sun, Sambuca, Northwest Eileen Kuparuk and S and W Pad Schrader Bluff satellites.

In July 1999, ARCO Alaska confirmed what looks like a new North Slope oil field discovery on the Fiord prospect, with potential reserves pegged at 50 million bbl of oil. ARCO has 78% interest in the field, Anadarko holds 22%. Mike Richter, ARCO's vice-president of exploration, noted that the Fiord field is 6 miles north of Alpine oil field, on the Colville River area just east of the National Petroleum Reserve-Alaska.

Exploratory drilling plans

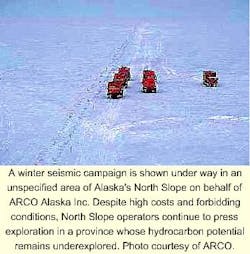

The North Slope's huge untapped potential still draws a sizable number of explatory and appraisal wells each year, despite the harsh and remote operating conditions and their attendant high costs.

Permits granted by the Alaska Oil and Gas Conservation Commission on the drilling scene from January 1999 through May 1999 opened the door for 50 new wells.

Four permits were for North Slope exploratory wells: BP Exploration (Alaska) Inc., Red Dog No. 1, 34-10n-21-e; ARCO Alaska, Meltwater South No.1, 33-7n-7e; ARCO Alaska, Fiord No. 4, 22-13n-5e; and ARCO Alaska, Fiord No. 5, 32-13n-5e.

Other drilling plans through May 1999 included permits for 37 development or appraisal wells in Prudhoe Bay, Kuparuk River, Alpine, Badami, Tarn, and Tabasco fields.