WEST AFRICA-2: West Africa second only to Russia in non-OPEC supply contribution

This is the second of two parts on the exploration and production outlook for the West African countries that border the Gulf of Guinea and Congo Delta.

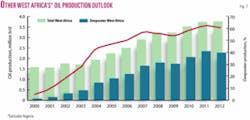

In the period 2001-05, West Africa’s oil production (excluding Nigeria) increased 130,000 b/d/year, while total non-OPEC oil supply increased 800,000 b/d/year. The rate of growth in non-OPEC production is the strongest in the last 20 years and is underpinned by the expansion of E&P activity worldwide due to two key reasons.

First, rising oil prices have resulted in a twofold increase in global E&P investments since 2000.

Second, the benefits of political stability and reforms in the Former Soviet Union, the start of large and challenging projects in deep water, unconventional oil projects, and the exploitation of marginal opportunities made a significant contribution to non-OPEC supply. The West African region has been a key beneficiary of rising E&P activity, and not surprisingly it was the second most important contributor to non-OPEC after the FSU (Fig. 4).

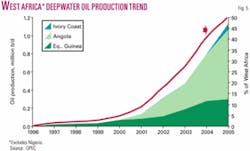

The main source of growth has been deepwater fields. In 2005, all of the deepwater production (1.13 million b/d) in West Africa excluding Nigeria came from 8 large projects. Angola was the largest producer with the most projects on stream in deep water (5 projects: Xikomba, Kizomba A and B, Girassol, and Jasmin), followed by Equatorial Guinea (2 projects: Zafiro and Ceiba) and Ivory Coast (1 project: Baobab); all but one project came on stream after 2000 (Fig. 5).

Looking at Nigeria, oil production capacity also rose 400,000 b/d between 2001 and 2005. It could have risen more if not for the destruction of some oil facilities in parts of the Niger Delta in 2003. During this time two deepwater fields made small contributions-Abo, which started in 2003, and Bonga, which started in 2005.

At the end of 2005 these two fields had combined capacity of 130,000 b/d; however, in late 2005 Bonga was ramping up to its design capacity of 200,000 b/d. The rest of the increase came from offshore fields in shallow water.

Projects and supply outlook

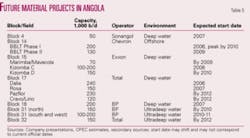

Over the 2006-12 period at least 26 new material oil projects are expected to come on stream in West African countries (excluding Nigeria), most of which are in deep water.

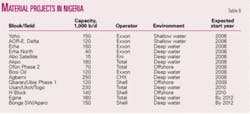

The cumulative capital investment is $39 billion, which is 50% higher than the cumulative E&P investment in oil and gas in 2001-05. In Nigeria are over 15 large developing oil projects with an estimated combined capital investment of $35 billion, the majority of which are also deepwater projects. The cumulative investment of these projects is also 60% higher than the cumulative E&P investment seen in the 2001-05 period.

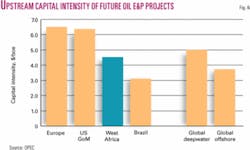

Roughly 15 billion bbl of total oil reserves are under development. Based on the estimated capex for projects and comparing it with those in other regions on a dollars per barrel of oil equivalent of reserves basis, it is clear that the future projects in West Africa are capital intensive. This is because many of the projects require the drilling of expensive wells and installation of complex infrastructure.

We estimate that future development costs for new projects average $5.70/boe in Congo (Brazzaville), $5.20/boe in Angola, $4.80/boe in Nigeria, and $3.80/boe in Equatorial Guinea (Fig. 6).

In terms of timing, most of the projects that have a start year before 2009 appear to be broadly on track. However, beyond 2010 the start year of most projects is less certain, and there is no method to predict potential delays, but they will come on stream. In fact, over 95% of the projects with a start year before 2008 are under construction, but this falls to around 30% and less for the following years.

In the current environment this appears to be normal given that services are limited, and the industry generally starts actual construction of projects 4 years ahead of the expected production start year. Having said that, some operators have signed contracts for deepwater drilling units to 2015 and even to build new rigs, which shows the industry’s long-term commitment to bringing West Africa’s field’s on stream.

Cumulative new gross oil from all projects in West Africa (excluding Nigeria) is estimated at 2.5 million b/d, of which Angola accounts for 2 million b/d (Table 5). Of the total for the region, 2.1 million b/d or over 70% will come from deepwater fields.

In Nigeria the cumulative gross oil of all developing projects is 1.7 million b/d, and the bulk of this is also coming from deepwater fields (Table 6). Additionally, 5 projects are expected post-2010, but their timing remains uncertain.

With regard to the supply forecast for each of the main producers in West Africa (excluding Nigeria), the first point to make is that the rate of growth will be stronger than in 2001-05 even if projects are delayed (Table 7). Production from offshore fields is expected to account for the bulk of the growth, of which deepwater fields play the leading role. Simply put, plenty of projects are in the pipeline.

Oil production will rise in Angola, Equatorial Guinea, and Congo (Brazzaville) underpinned by deepwater developments (Fig. 7).

In Angola, deepwater oil production started in 2001, was 800,000 b/d in late 2006, and is to reach 1.7 million b/d by the end of 2012. Operators have chosen to combine several fields into few large developments, bringing on large volumes almost each year. Several discoveries in ultradeep water are expected to support new developments by 2012.

Deepwater oil production in Equatorial Guinea is expected to remain broadly flat through 2012 at around 300,000 b/d. Several satellite projects are expected to start, and more are under evaluation, particularly small tiebacks to large Zafiro and Ceiba fields.

Congo (Brazzaville)’s oil production is expected to increase, driven by deepwater projects (Moho-Bilondo, Mer Profonde), new start-ups offshore, and the expansion of Mboundi field (onshore). E&P activity in Congo (Brazzaville) has risen considerably, and prospects for more projects are improving rapidly.

The combined production of Gabon, Ivory Coast, and Cameroon is expected to remain broadly flat. Gabon has no deepwater production, but exploration is under way. Ivory Coast’s oil production rose with the start of Baobab deepwater field in 2005, but maintaining future production will depend on improving the performance of this field and small tiebacks to existing shallow offshore infrastructure as no other deepwater fields are expected to come on stream.

In Cameroon, renewed offshore activity and tiebacks will slow the decline trend of the last few years. E&P activity is taking place in deep water, and a recent discovery might be commercial.

In Mauritania, oil discoveries have been made in deep water, and one field (Chinguetti) began producing in the second quarter of 2006. However, the performance of the reservoir has been poor, and this has resulted in lower production than expected from the field; we understand that until more studies are completed and wells drilled, the field’s production will remain below capacity.

A second deepwater field (Tiof, 50,000 b/d) is expected to come on stream in 2009 using an early production scheme or as a tieback to Chinguetti. Beyond Tiof, no more potential oil fields are in the foreseeable future.

Based on available information, none of the nonoil producing countries in the region is expected to bring a new field on stream in this time horizon. However, E&P activity has been increasing in some countries such as Sao Tome and Principe and Senegal, and this could lead to the discovery and development of fields in the future. Most of the activity will remain concentrated in deep water.

Nigeria’s output

Nigeria’s oil production capacity is expected to increase to 4-4.2 million b/d by 2012 (Fig. 8).

New production from offshore fields is expected to account for the bulk of the growth, of which deepwater fields play the leading role. Deepwater production averaged 130,000 b/d in 2005, will rise to 500,000 b/d in 2006, and is expected to reach 1.3 million b/d by 2012. New production from deep water is also likely to translate into improved supply reliability.

The 14 large oil projects under development or with plans in advanced stages of engineering include Yoho, Erha, Additional Oil Recovery (AOR), Erha North, Abo Satellite, Akpo, Ofon Phase II, Agbami, Bosi Oil, Gbaran/Ubie, Usan, H Block, Egina, and Bonga SW/Aparo.

Another five projects (Nsiko, Ikija, Bolia, Doro, and Chota) are in early engineering, and given the long lead time and tightness in the service sector, we have not included any of these in the forecast, but this could clearly change.

Acknowledgments

The authors thank OPEC Secretariat. The views expressed in this report are those from the authors and do not represent those of OPEC or the Nigeria government.

Bibliography

Tuttle, Michele L.W., Charpentier, Ronald R., and Brownfield, Michael E., “Assessment of Undiscovered Petroleum in the Tertiary Niger Delta (Akata-Agbada) Petroleum System (No. 719201), Niger Delta Province, Nigeria, Cameroon, and Equatorial Guinea, Africa.”

Brownfield, M.E., and Charpentier, R.R., “Geology and total petroleum systems of the Gulf of Guinea Province of West Africa,” US Geological Survey Bull. 2207-C, 2006.

Brownfield, M.E., and Charpentier, R.R., “Geology and total petroleum systems of the West-Central Coast Province, West Africa,” US Geological Survey Bull. 7203, 2006.

Company web sites: ExxonMobil, BP, Shell, Norsk Hydro, Statoil, Total, Petrobras, Chevron, Eni.

“Nigeria: Oil and Gas Ventures, Issues and Risks,” unpublished paper, London, 2003.

OPEC Review, Joint OPEC/IEA Workshop on Oil Investment Prospects, June 2003.

Offshore Magazine (www.offshore-mag.com).

Stark, P., “The Role of Petroleum Exploration in Shaping Africa’s Energy Future,” World Petroleum Congress, Johannesburg, 2005.

Sandrea, Ivan, “Deepwater oil discovery rate may have peaked, production will follow in 10 years,” OGJ, July 26, 2004, p. 18.

“Deepwater investment to show strong growth,” OGJ, Nov. 28, 2005, p. 25.

US Geological Survey, World Petroleum Project (2000), AAPG Memoir 86.