Compositional variety complicates processing plans for US shale gas

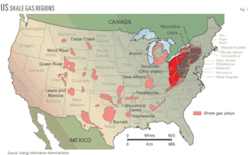

Recently higher gas prices and improved drilling technology have spurred shale gas drilling across the US. Fig. 1 shows the shale plays currently being explored.

Some of the more popular areas are the Barnett, Haynesville, and Fayetteville shales in the South and the Marcellus, New Albany, and Antrim shales in the East and Midwest. These plays represent a large portion of current and future gas production.

But all shale gas is not the same, and gas processing requirements for shale gas can vary from area to area. As a result, shale gas processors must be concerned about elevated ethane and nitrogen levels across a field. Other concerns are the increased requirements of urban gas processing. In addition, the rapid production growth in emerging shale areas can be difficult to handle.

This article reviews which gas processing technologies are appropriate for the variety of US shale gas qualities being produced and planned to be produced and reviews regional gas processing capacities to handle current and future production of shale gas.

Gas processing

Gas processing removes one or more components from produced gas to prepare it for use. Common components removed to meet pipeline, safety, environmental, and quality specifications include H2S, CO2, N2, heavy hydrocarbons, and water. The technique employed to process the gas varies with the components to be removed as well as with the properties of the gas stream (e.g., temperature, pressure, composition, flow rate).

Acid-gas removal is commonly by absorption of the H2S and CO2 into aqueous amine solutions. This technique works well for high-pressure gas streams and those with moderate to high concentrations of the acid-gas component.

Physical solvents such as methanol or the polymer DEGP, or Selexol may also be used in some cases. And, if the CO2 level is very high, such as in gas from CO2-flooded reservoirs, membrane technology affords bulk CO2 removal in advance of processing with another method. For minimal amounts of H2S in a gas stream, scavengers can be a cost-effective approach to H2S removal.

Natural gas that becomes saturated with water in the reservoir requires dehydration to increase the heating value of the gas and to prevent pipeline corrosion and formation of solid hydrates.

In most cases, dehydration with a glycol is employed. The water-rich glycol can be regenerated by reducing pressure and applying heat. Another possible dehydration method is use of molecular sieves that contact the gas with a solid adsorbent to remove the water. Molecular sieves can remove the water down to the extremely low levels required for cryogenic separation processes.

Distillation uses the different boiling points of heavier hydrocarbons and nitrogen for separation. Cryogenic temperatures, required for separation of nitrogen and methane, are achieved by refrigeration and expansion of the gas through an expander. Removal of the heavy hydrocarbons is dictated by pipeline quality requirements, while deep removal is based on the economics of NGL production.

Processing requirements

The following reviews six shale gas plays, their compositions, and processing needs: Barnett, Marcellus, Fayetteville, New Albany, Antrim, and Haynesville.

Barnett

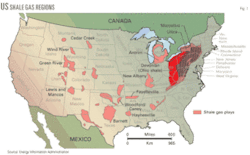

The Barnett shale formation is the grandfather of shale gas plays. Much of the technology used in drilling and production of shale gas has been developed on this play. The Barnett shale formation lies around the Dallas-Fort Worth area of Texas (Fig. 2) and produces at depths of 6,500-9,500 ft. The average production rate varies throughout the basin from 0.5 MMscfd to 4 MMscfd with estimates of 300-350 std. cu ft/ton of shale.1 The most active operators in the region are Chesapeake Energy, Devon, EOG Resources, and XTO.

The initial discovery region was in a core area on the eastern side of the play. As drilling has moved westward, the form of the hydrocarbons in the Barnett shale has varied from dry gas prone in the east to oil prone in the west.

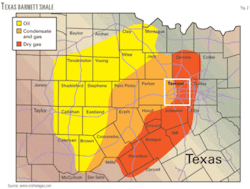

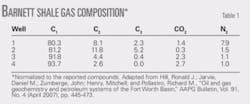

Table 1 shows the composition of four wells in the Barnett. These wells appear from east to west with the eastern most well on the top (Well No. 1). As the table suggests, there is a large increase in the amount of ethane and propane as the wells move west. One well sample on the western edge of the play (Well No. 4) shows a high level—7%—of nitrogen. This level is high enough to require treating, but blending with other gas in the area is the most economical solution.

The gas processing industry has scrambled to keep up with the growth of the Barnett shale. Production has jumped to about 4 bcfd currently from almost nothing in 1999. To sustain this growth, industry has added the equivalent of a 100 MMscfd cryogenic facility to the area every 3 months for 10 years.

Some of the major gas plants processing Barnett shale gas are the Devon Bridgeport (1 bcfd capacity); Quicksilver Cowtown (200 MMcfd) and Corvette (125 MMcfd); Enbridge Weatherford (75 MMcfd); Energy Transfer Godley (300 MMcfd); Crosstex Silver Creek (200 MMcfd), Azle (55 MMcfd), and Goforth (35 MMcfd) plants; and Targa Chico (150 MMcfd) and Shackelford (125 MMcfd). Crosstex has announced plans to add the Bear Creek plant with 200 MMcfd capacity in late 2009.

Most of these plants include compression, CO2 treating with amine units, cryogenic separation, and fractionation. The processed gas heads east toward Carthage, Tex., where it can reach the Midwest via the Perryville hub or the Northeast via the Transco or Texas Eastern pipeline, or the Southeast via the Transco or Florida Gas pipeline.

With the richness of the gas, the Barnett plants remove about 3.5 gal/Mcf of NGL. Based on current 4-bcfd gas production, about 325,000 b/d of NGLs are produced.

One of the greatest challenges to gas processing in the Barnett shale region is operating in an urban environment. As an example, the town of Flower Mound has an extensive list of regulations for the gas processing industry for operations within its city limits. These regulations cover appearance (color, landscaping, fences, and lighting) as well as operations (equipment height and noise level). These extensive regulations force the gas plants to move to less densely populated areas when possible.

Marcellus

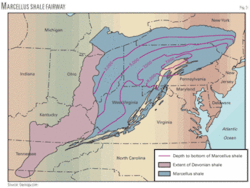

The Marcellus shale lies in western New York, Pennsylvania, Ohio, and West Virginia (Fig. 3) and has tremendous potential. It is shallow at depths of 2,000-8,000 ft and 300-1,000 ft thick. Initial production rates have been reported in the 0.5-4 MMscfd range with estimates of 60-100 std. cu ft/ton of shale.

Table 2 shows the composition for four natural gas wells in the Marcellus shale. The gas composition varies across the field, much as it does in the Barnett: The gas becomes richer from east to west.

From a gas processing point of view, the Marcellus region does not have the gas blending luxury of the Barnett shale because there is little infrastructure. The Marcellus is blessed, however, with little CO2 and nitrogen. The greatest obstacle for the area—a lack of facilities to dispose of wastewater and completion fluids—has limited growth in this region. A complex terrain of hills, trees, and streams creates access and environmental obstacles to drilling and production. Operators compensate with custom rigs to reduce footprints.

Most existing Pennsylvania and Northern Appalachian gas is dry and requires no removal of NGLs for pipeline transportation. Early indications are that the Marcellus gas has sufficient liquids to require processing.

Markwest Energy Partners recently announced installation of a 30-MMscfd refrigeration unit to process Marcellus gas from Range Resources. Markwest is also currently constructing a 30-MMscfd cryogenic processing plant expected to commence operations late in first-quarter 2009. An additional 120 MMscfd cryogenic plant with a fractionation train is planned for completion in late 2009. The liquid propane will be marketed regionally.

Some anticipate that the Marcellus shale could hold as much gas as the Texas Barnett shale. If this is the case, gas processing could generate substantial volumes of NGLs for the region with no clear market or access to the Texas Gulf Coast.

Fayetteville shale

The Fayetteville shale is an unconventional gas reservoir on the Arkansas side of the Arkoma basin (Fig. 4). The shale ranges in thickness from 50-550 ft at a depth of 1,500-6,500 ft and is estimated to hold between 58-65 bcf/sq mile.2

Reported initial production rates are 0.2-0.6 MMscfd for vertical wells and 1.0-3.5 MMscfd for horizontal wells. In 2003 Southwestern Energy discovered the play and has increased its production to about 500 MMcfd.

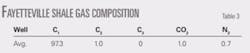

Table 3 shows gas composition of one area of the Fayetteville shale. The gas primarily requires only dehydration to meet pipeline specifications. Lack of infrastructure also has limited growth of this area. Additional pipeline capacity is on the way with the Texas Gas 1.3-bcfd Fayetteville lateral under construction.

An additional 2 bcfd of pipeline capacity has been announced by Kinder Morgan Energy Partners LP and Energy Transfer Partners LP, which is scheduled for completion in 2010-11. Southwestern Energy and Chesapeake have agreed to 10-year commitments to use the 187-mile line.

The full scope of the Fayetteville shale is still unknown. Southwestern Energy has about 850,000 acres leased, while the remainder of the industry has an additional 1 million acres.

New Albany

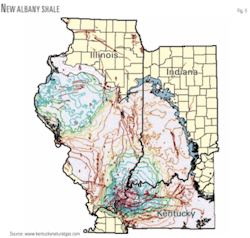

The New Albany shale is a black shale in Southern Illinois extending through Indiana and Kentucky (Fig. 5). It is 500-4,900 ft deep and 100-400 ft thick. Vertical wells typically produce 25-75 Mscfd initially, while horizontal wells can have initial production rates of up to 2 MMscfd.

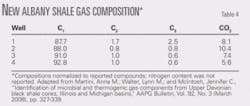

Table 4 shows the composition from four wells in Meade County. In this region the gas contains 8-10% CO2. Low flow rates of wells in the New Albany shale require that production from many wells must be combined to warrant processing the gas.

NGAS Resources announced in October 2008 that it completed field gathering and gas processing facilities in Christian County, Kentucky. The processed gas from 26 wells is flowing into the Texas Gas interstate pipeline. The company has two rigs running in the area with expected recoveries of 135-200 million cu ft/well.

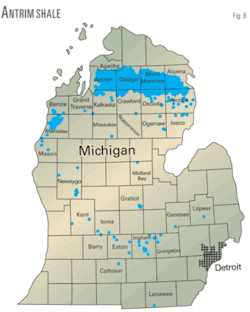

Antrim

The Antrim is a shallow shale gas play in Michigan (Fig. 6) whose development accelerated as a result of unconventional-gas tax incentives of the 1980s. Today, more than 9,000 wells in the Antrim shale have cumulatively produced 2.5 tcf. Individual well production ranges from 50 to 60 Mscfd. Despite these small initial production rates, extremely long well life resulted in substantial production over the life of the well.

The Antrim shale is unique because the gas is predominately biogenic: Methane is created as a by-product of bacterial consumption of organic material in the shale. Large volumes of associated water are produced, requiring central production facilities for dehydration, compression, and disposal.

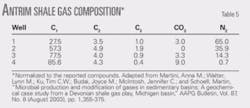

Table 5 shows the compositions of the gas produced from four wells in this area. The CO2 level in these samples varies 0-9%. CO2 is a naturally occurring byproduct of shale gas produced by desorption. As a result, the CO2 levels in produced Antrim gas steadily grow during a well’s productive life, eventually topping 30% in some areas.

MarkWest is the dominant gas processor in this region with 340 MMcfd of capacity at five plants (Kenova, Maytown, Boldman, Kermit, and Cobb). Residue gas is delivered to Columbia Gas Transmission while the NGLs move to the Siloam fractionators for further processing and then are sold by truck, rail, or barge.

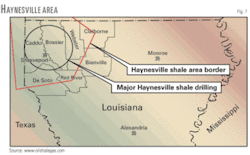

Haynesville

The Haynesville shale play is the newest and hottest shale area to be developed. It lies in northern Louisiana and East Texas (Fig. 7). It is deep (10,000+ ft), hot (350° F. bottomhole temperature), and exhibits high pressure (3,000-4,000 psi). The wells have shown initial production rates of 2.5-20+ MMscfd, with estimates of 100-330 std. cu ft/ton of shale. The Haynesville shale area is believed to hold large potential and projected to draw resources away from the other shale plays in the near future.

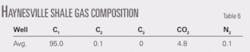

Table 6 shows a field average concentration for the Haynesville play. This gas requires treating for CO2 removal. Operators in this field are using amine treating to remove the CO2 with a scavenger treatment on the tail gas to remove the H2S. Most of the treating is currently performed with traditional amine units with 60-100 gpm capacities. These units are rented or purchased. Most of the processed gas enters the Carthage system, which then distributes it across the country.

One of the biggest problems faced by gas processors in the Haynesville area is the large production addition from each well as it is brought on line. Plants that are oversized today become undersized tomorrow. Area operators suggest designing units that scale up and down easily during the growth process. This includes units that employ valve trays, variable speed pumps, and multiple trains.

Chesapeake announced that the initial production rate for the last seven horizontal Haynesville wells averaged 16 MMscfd each. If the pipeline announcements are any clue, industry is anticipating a scramble for processing plants for Haynesville much like the rapid growth of the Barnett.

DCP Midstream Partners and M2 Midstream LLS have recently announced a joint venture for a 1.5-bcfd pipeline to be completed in early 2010. Energy Transfer Partners and Chesapeake announced plans for the 42-in. Tiger pipeline to connect from Carthage, Tex., to near Delhi, La., to be completed by mid-2011. ¿

References

The authors

Keith A. Bullin ([email protected]) is a consulting engineer for Bryan Research and Engineering, Bryan, Tex. He holds a PhD in chemical engineering from Texas A&M University.

Peter E. Krouskop (P.Krouskop @bre.com) is a consulting engineer for Bryan Research and Engineering, Bryan, after an industrial postdoctoral appointments with Accelrys Inc. and PPG in Pittsburgh performing molecular-level, computational modeling of coatings. Krouskop holds a PhD (2002) in chemistry from Michigan State University and a BS (1995) in chemical engineering from the University of Houston.