OGJ Newsletter

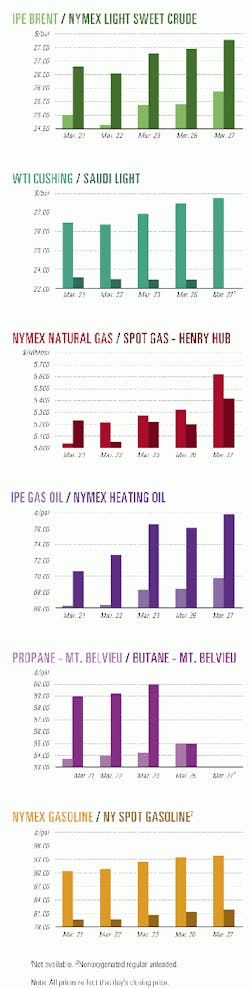

Market Movement

OPEC defending oil prices with output strategy

Is "just-in-time" production the new buzzword that defines OPEC's approach to oil markets?

Simply put, this term merely reflects OPEC's aggressive efforts to cut or hike production quotas in response to anticipated demand levels, not merely the lagging reactionary approach of the past. Others have called it "fine-tuning" or "micromanagement"-but not necessarily in approving tones.

In any event, "OPEC continues to assert that the world economy can handle $25/bbl oil prices and that, if there is any concern about where this puts end-user prices, then consumer governments should reduce the taxes they impose on oil," said UBS Warburg.

But for the short term, OPEC is bent on aggressively defending its target price-or at least the official price band, should the market conspire against OPEC by not fulfilling the group's expectations that demand will not unduly suffer.

There is ample evidence of this recent trend within OPEC toward aggressive defense of target prices on the downside vs. the upside. It is even structural in nature, noted UBS Warburg.

"The first small signs of this bias [toward defending against price declines] were apparent in mid-2000, when OPEC designed its price control mechanism," the analyst said. "This calls for a quota increase after the price has been above $28/bbl for 20 days and a quota decrease after it has been below $22/bbl for just 10 days.

"Even so, OPEC moved ahead with cuts at its Jan. 17 meeting, although the basket price had been below the bottom of the band for only 7 days and had already climbed back to $24.50/bbl (see chart). In 2000, in contrast, prices were above the top of the band continuously from Aug. 14 to Dec. 4."

EIA: World energy use to grow 59% by 2020

Worldwide energy consumption is projected to grow 59% over the next 2 decades, EIA predicts

Half of the projected growth is expected to occur in the developing nations of Asia and Latin America.

EIA's reference case holds that oil prices will remain at the current $25-28/bbl until 2003, when they will begin increasing.

Persistently high world oil prices, strong economic recovery in Southeast Asia, and robust economic growth in the former Soviet Union (FSU) have impacted the outlook for world energy use, the agency said.

Demand in the recovering economies of southeast Asia last year rebounded more rapidly than anticipated after their 1997-99 recession, it noted.

EIA said the improved economic outlook for Russia and the rest of the FSU prompted it to forecast a 42% increase in energy consumption in the region during 1999-2020.

Natural gas remains the fastest-growing component of primary world energy consumption. The reference case predicts gas use would nearly double, to 162 tcf in 2020.

Oil is expected to remain the world's primary energy source, retaining a 40% market share in the forecast period, rising to 120 million b/d in 2020 from 75 million b/d in 1999.

Middle East LPG exports declining

Uncertainty about LPG supplies exists in many parts of the world, with Middle East LPG exports declining while Far East LPG demand is growing, particularly in China and India, S. Craig Whitley, senior principal of Purvin & Gertz, said at an LPG seminar in the Woodlands, Tex., late last month.

"We really have a 200 million [tonne] international marketplace now," Whitley said, adding that North America last year was the world's largest LPG market with 59 million tonnes/year.

Asia consumed 55 million tonnes/year in 2000 and is expected to overtake the North American market by 2005. Worldwide LPG demand is expected to be 237 million tonnes/year in 2005.

Middle East LPG export volumes are dropping because of growing demand in the Middle East for petrochemical feedstocks, Whitley said.

He also noted that the world east of the Suez Canal historically has had surplus LPG and has been a net exporter to the region west of the canal.

But high LPG demand growth in the Far East, along with increased petrochemical demand in the Middle East transformed East-of-Suez into a net importer of LPG last year. P&G reckons that this pattern will continue until 2004-05, when additional LPG supplies will be available to make East-of-Suez a net exporter again.

null

null

null

Industry Trends

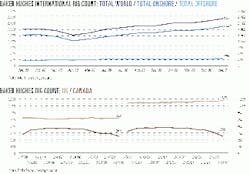

OFFSHORE DRILLING PROFITABILITY CONTINUES TO CLIMB.

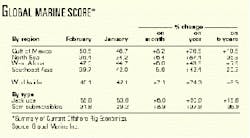

Houston-based offshore drilling contractor Global Marine reports its worldwide Summary of Current Offshore Rig Economics (SCORE) for February increased 7.1% over January-the 18th consecutive month of increases in the rating.

Global Marine Chairman, Pres., and CEO Bob Rose said, "While semisubmersibles enjoyed a strong gain this month, the big news is that the SCORE for offshore jack up rigs now stands at double the level of a year ago [see table]."

SCORE compares the profitability of current mobile offshore drilling rig rates with the profitability of rates at the 1980-81 offshore drilling cycle peak, when speculative rig construction was common.

The oil industry is working toward developing a form of gasoline that could power fuel cell cars.

Hydrogen and methanol are competing options for rapidly advancing fuel cell technology, but both appear less suited for the nearer term marketplace than technology fueled by gasoline, API chief Red Cavaney told a conference in New Orleans late last month.

Companies within the petroleum industry are working in partnerships with automobile industry counterparts to develop and adapt fuel cells for highway vehicles, he said.

"In our industry's vision, an advanced gasoline provided by our industry is the fuel of choice," Cavaney said. "Our evolving new fuels will be the stepping-stones to the next generation of gasoline that we hope will serve as the feedstock for fuel cell-powered vehicles."

Cavaney said numerous reasons exist to believe fuel cell technology will achieve commercial viability within a decade. Prototype fuel cell vehicles are being pilot-tested in California.

The oil industry is on the verge of another dizzying round of mergers and acquisitions, Wall Street analysts and investment fund managers predicted at the annual Howard Weil energy investment conference. Robust prices gave an air of excitement to the proceedings in New Orleans, with attendance by institutional investors and fund managers up dramatically from past years.

"These are the best fundamentals that I've seen in 30 years in the business," William Wise, chairman, president, and CEO of El Paso Corp., told the group.

And it's clear that major oil companies, which have spent the last decade unloading North American oil and gas properties, might want to get back in the game.

Royal Dutch/Shell's attempt to buy Barrett Resources is just the beginning, analysts predicted.

Wall Street analysts said other companies believed to be under the active eye of majors include: Burlington Resources, Devon Energy, Evergreen Resources, Forest Oil, and Triton Energy.

Government Developments

UK Energy Minister Peter Hain last month set out the government's three-prong strategy to deal with the problem of sharply rising natural gas prices in Britain.

The strategy, he said, will involve collaborating with the European Commission to accelerate full gas market liberalization, improving the "functioning and design" of the market through greater access to information, and acting against anticompetitive behavior-especially related to the Interconnector gas pipeline that links Britain and the continent.

Earlier this year, a report for a government-industry task force said European natural gas prices were the most important factor influencing British gas prices and were indirectly responsible for a price spike last summer (OGJ Online, Feb. 6, 2001).

Hain said the government plan aims to remedy what he called the "disturbing" rise in gas prices over the last year.

"I am disturbed at the way wholesale prices have more than doubled since early 2000, undermining our wider policy for a competitive gas market," he said. "One of the main causes of the price increase is the lack of open markets in Europe and arbitrage across the Interconnector with oil-related gas prices in Europe. Industry is hurting," he added. "It breeds suggestions about anticompetitive irregularities in the way the market is operating."

US Senate Democrats have offered to compromise on an energy bill.

US Senate Democrats want to work with their Republican colleagues to pass a comprehensive energy bill this year, Senate Minority Leader Tom Daschle (D-SD) said last month, as Democrats filed their own energy legislation. The Democratic energy policy package is similar to the Republican bill in that it seeks to boost domestic production (OGJ Online, Feb. 23, 2001).

Unlike the Republican bill, it would allow a 25¢/MMbtu production tax credit for gas produced and delivered to an Alaska gas pipeline, provided one is built before Jan. 1, 2009. The Democrats' proposals are included in two bills. The Energy Security Tax and Policy Act of 2001 focuses exclusively on tax incentives aimed at increasing domestic supply and reducing demand.

Also, the bill would permit producers to expense their payments to hold a lease prior to initiation of production. It also allows expensing of geological and geophysical costs. The bill also offers various tax credits for homeowners installing renewable energy technology. Utilities would get a 10% investment tax credit for clean coal technology projects.

The second Democratic bill, the Comprehensive and Balanced Energy Policy Act of 2001, contains nontax measures.

It has a controversial provision to place temporary price caps on wholesale transmission of electricity in the West.

The second bill is different from the Republican package in that it does not include a provision to open the coastal plain of the Arctic National Wildlife Refuge to drilling.

Quick Takes

Exploration continues to sizzle in the Gulf of Thailand.

Chevron Offshore (Thailand) reported the discovery of an oil field in the historically gas-prone Gulf of Thailand, supporting Chevron's strategy to more than double oil production off Thailand to more than 70,000 b/d by 2004 (see related item, p. 44).

Chaba field, about 225 miles south of Bangkok, was confirmed following the testing of three wells in the southern portion of Block B8/32.

Gas production from Block B8/32, covering the 2,900 sq km area, is also expected to rise in the same period, to more than 250 MMcfd from 145 MMcfd (OGJ Online, Feb. 15, 2001).

The discovery well, designated Kung 2, was drilled to 10,775 ft in 240 ft of water and cut 120 ft of oil and 12 ft of natural gas pay in 6 reservoirs.

A second successful well, Kung 6, went to 9,413 ft. It flowed more than 3,200 b/d of oil through a restricted choke from two zones. Kung 6 had more than 160 ft of combined oil and gas pay in 9 reservoirs.

The third well, Kung 7, drilled to 9,235 ft, had almost 200 ft of oil and gas pay in 5 reservoirs. Chevron said it would continue to appraise Chaba.

In other exploration action, Santos announced a natural gas discovery in the Queensland sector of the Cooper basin, 135 km south of the Ballera gas center. The wildcat, Quasar-1, had a flow rate of 10.8 MMcfd, the fourth highest recorded in southwestern Queensland, said Santos. Ellice Flint, Santos managing director, said, "It is the fastest gas wildcat drilled to date, with drilling time of 7.8 days compared with 9 days for the previous fastest well." The well flowed gas to surface in 4 min from the Patchawarra sand at 2,317-34 m through a 13-mm surface choke. The indicated net pay for the well is 26 m. The well will be connected to a proposed pipeline that would connect Chiron field with the Cooper basin gas-gathering system. x The second well drilled by the North Caspian Sea consortium on the giant Kashagan structure off Kazahkstan has detected hydrocarbons, the development's single operator, ENI, said on behalf of subsidiary Agip Caspian. The Kashagan West 1 well, spudded last October by the Sunkar rig, was drilled to a TD of 4,982 m. Once the Kashagan West 1 well is completed in the second quarter, the Sunkar will return to east Kashagan, where hydrocarbons were discovered last year, to conduct an appraisal drilling campaign. While the consortium hasn't offered reserves estimates for the field's size, government officials in Kazakhstan have pegged the Kashagan find as holding as much as 25-60 billion boe.

Helmerich & Payne has ordered 15 new land rigs, worth $9 million each, with delivery slated for March 2002 through February 2003.

It said the order was prompted by high levels of E&P activity, attractive economics, and recent contracts for other rigs under construction. The 15-rig order comes in addition to a 12-rig order last year (OGJ Online, Jun 14, 2000).

H&P said it tested and proved the Flex Rig concept with its first order of six rigs in 1998 and 1999. The original six rigs are working, while six of the current order of 12 rigs are under 2-year and 3-year contracts.

Currently, H&P has 39 US land rigs, 10 US platform rigs in the Gulf of Mexico, 32 rigs in South America, and 20 rigs under construction or modification. H&P estimates that its US land rig fleet will total 51 rigs by December 2001 and 65 rigs by December 2002.

Elsewhere on the drilling scene, Transocean Sedco Forex said its Discoverer Deep Seas ultradeepwater drillship has completed acceptance testing and has begun a 5-year, $374 million contract to work for Chevron USA Production in the US Gulf of Mexico. The 10,000-ft capacity vessel incorporates Transocean's proprietary dual-activity drilling design of two complete drilling systems within one derrick.

An old UK North Sea find is targeted for development.

TotalFinaElf and its partners said they have agreed on plans to develop Otter oil field in the northern UK North Sea, with production start-up slated for fourth quarter 2002.

The plan remains subject to approval by the UK Department of Trade and Industry. Otter was discovered in 1977, and its projected production plateau is 30,000 b/d. The development plan represents an investment of $206 million.

The development plan calls for five subsea wells. Three subsea wells will produce oil and two will be water injection wells equipped with electrical pumps and tied back to the neighboring Eider platform, operated by Shell.

Technip takes center stage this week in petrochemical news.

Enichem awarded a turnkey contract to Technip to revamp instrumentation and automation at its ethylene plant at Porto Torres, Sardinia.

The lump sum contract, valued at 8 million euros, covers basic and detailed engineering, procurement, construction, commissioning, and start-up. The work will be completed without any major shutdown of the plant, officials said.

Completion of the work is scheduled for April 2002, while start-up will be completed by December 2002, said Enichem.

Meanwhile, Copene Petroquimica do Nordeste awarded a contract to Technip for the front-end engineering design of a major expansion of its Ethylene II plant in the large Camaçari petrochemical complex about 40 km from Salvador in northeastern Brazil. Brazilian officials plan to increase capacity of that unit to 800,000 tonnes/year from 670,000 tonnes/year. The expansion, expected to cost about $100 million, will retrofit major equipment items in both the hot and cold sections. The Technip contract represents the first phase of the project. Copene's scheduling calls for the future award of a second phase, covering detailed engineering and procurement services, with construction expected to start in March 2003.

The US House has altered the oil spill law.

The US Coast Guard will be allowed to borrow up to $100 million from the Oil Spill Liability fund for additional emergency cleanups under legislation passed by the US House of Representatives Mar. 22.

The 1990 Oil Pollution Act, passed following the 1989 Exxon Valdez oil spill, created the $1 billion fund through a 5¢/bbl tax.

Rep. Don Young (R-Alas.) filed the bill, the Coast Guard Personnel and Maritime Safety Act of 2001 (H.R. 1099). It would let the Coast Guard borrow from the fund "for removal of a discharge or the mitigation or prevention of a substantial threat of a discharge." If the Coast Guard elects to take money from the fund, it would have to notify Congress within 30 days why it needed the money, how much it spent, and when the funds would be repaid.

Young's plan sets no deadlines on when the money must be returned to the fund. However, the Coast Guard would be expected to recover money from the parties held liable for incidents.

Norwegian North Sea pipeline projects top this week's pipeline news.

Norsk Hydro awarded Stolt Rockwater-a JV of a unit of Halliburton and Stolt Offshore-a $22 million contract to perform subsea tie-in work for the Vesterled pipeline project. Last year, Norsk Hydro chose European Marine Contractors for the $8.7 million contract to build and install the 32-in. pipeline.

Vesterled pipeline, which will link together the Norwegian gas network and the Frigg Norwegian Association (FNA) pipeline in the Norwegian North Sea (OGJ Online, Oct. 18, 2000), will be installed this year.

The Vesterled pipeline will connect the existing Heimdal and Frigg FNA lines. The offshore work will be carried out in July and August.

Meanwhile, Statoil said it started the gas export line that eventually will supply 25 million cu m/day from the Gullfaks area in the Norwegian North Sea to the Karsto gas complex prior to send-out to the Statpipe trunkline for transport to Europe. The 35-km pipeline linking the Gullfaks A and C platforms on Block 34/10 with Statpipe will secure capacity and accommodate rising natural gas production from the entire Gullfaks area as oil output declines, said Statoil. Gas deliveries from Gullfaks, until now exported via Statfjord field to Statpipe, will rise to 20 million cu m/day in October from the current 13 million cu m/day. Statoil expects to reach plateau export levels in 2004. Development operations will continue until 2003, said Statoil.

Rounding out pipeline news, a unit of Williams announced an expansion project on its Kern River pipeline that will cost more than $1 billion and will more than double the amount of natural gas transported on the 926-mile pipeline system. The project will provide 900 MMcfd of additional transportation capacity from Wyoming to California by May 2003. The project will loop 700 miles of the existing Kern River system. Williams plans to apply with FERC in June. Previously, Williams filed a California Emergency Action application with FERC to install and operate emergency facilities on Kern River to increase capacity by 19%. That $81 million emergency expansion would add 135 MMcfd of firm transportation service into California by July 1 to help meet energy demand this summer.

The Gas Technology Institute (GTI) announced plans to construct a testing facility for evaluating protective coatings applied to buried steel pipelines. The $1 million facility will include a field site for in-ground accelerated short-term and long-term testing of pipeline sections, plus a laboratory for detailed analysis of pipe and coating specimens. Construction of the pipeline coatings test facility will begin this spring, and test operations are slated to start in September or October. Currently, no national, independent, or third-party evaluation exists for evaluating pipeline coating materials and methods, said Daniel Ersoy, materials scientist in GTI's Gas Operations Technology Group.

The US government last month praised an agreement that would allow Turkey to buy gas from Azerbaijan's Shah Deniz field. The US state department said the agreement "further strengthens the East-West Caspian transportation corridor that includes the emerging Aktau-Baku-Tbilisi-Ceyhan oil pipeline, the Baku-Supsa pipeline, the Baku-Novorossiisk pipeline, and the Caspian Pipeline Consortium pipeline. The US has supported a gas export pipeline parallel to the planned oil pipeline as an alternative to proposals to export natural gas through pipelines crossing Iran. Turkish President Ahmet Necdet Sezer and Azerbaijani President Haidar Aliyev signed the 15-year contract for 233 billion cu ft/year of gas, beginning in 2004.

NL Bulletin

Royalty relief incentives to drill deeper for natural gas in shallow waters, along with the continuing attraction of major oil firms to the deepwater Gulf of Mexico, were the drivers in a strong central gulf lease sale held last week.

MMS said that $505.4 million in high bids were submitted by 90 companies on 547 tracts. A total 780 bids were cast.

"Strong bidding by the independent oil and gas companies was a major part of the sale," said Acting MMS Director Tom Kitsos, adding that the agency was "pleased" with the high level of interest shown in the shallow-water gulf-338 tracts in less than 200 m of water received 502 bids, or 64% of the sale total, MMS said.

The highest bid, submitted by Exxon Asset Management Co. for Mississippi Canyon Block 912, was for $26,115,000. The ExxonMobil unit also waved the most money, with $89,460,000 exposed on 22 bids.