US independents coping with consolidation, price volatility, high costs, limited capital

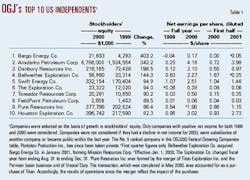

The articles in this special report were written by Senior Staff Writers Steven Poruban and Paula Dittrick. The companies profiled in the sidebar articles are the top 10 fastest-growing US independents, in terms of stockholders' equity growth, according to their ranking in the latest OGJ 200 (see tables this page and OGJ, Oct. 1, 2001, p. 78).

As the US oil and gas supply matrix evolves, so too will the role of the US independent exploration and production company. Since the most recent downturn, industry has been chal lenged by both political and market volatility on its road to recovery. Ultimately, the independent E&P firms that have best met these challenges will continue to be successful and thrive in the ever-changing energy environment.

Thriving will depend on how well independents tackle some of the major challenges that face them. These include:

- Bolstering oil and natural gas reserves while maintaining steady, if not increased, production.

- Actively participating in the escalating merger and acquisition trend.

- Effectively raising capital in an increasingly competitive market.

- Adapting to the increasing cost of doing business.

- Making effective judgments about portfolio assets-both inside and outside the US.

M&A activity

The merger and acquisition trend among independent E&P companies is expected to accelerate in the second half of the year, given market conditions and Wall Street's continuing demands for improved efficiencies.

"Volatility means people have markedly different points of view, and that's when you might be able to get some deals to happen," said William Marko, vice-president and general manager, business development, for Oil & Gas Journal Property Exchange, which incorporates Madison Energy Advisors Inc.

For instance, Marko said, a prospective buyer optimistic about long-term natural gas economics might find a seller who is reluctant to take a wait-and-see approach.

"Devon Energy Corp. must be bullish on North American gas with all the deals it has made," Marko noted. "All the independents seem to be heading to natural gas. I'm not sure I can name an oil deal lately. They've all been gas deals."

The supermajor consolidation wave also spells opportunities for independents, Marko added.

"As the larger companies merge, the food chain is still quite active. As companies disappear at the top, there are companies starting at the low end," Marko said. He sees "built-up energy" because the supermajors have yet to make the bulk of their anticipated asset divestitures.

BP PLC has yet to divest many of its assets from the acquisitions of ARCO and Amoco Corp. Meanwhile, Exxon Mobil Corp. also is expected to sell some properties, while Chevron Corp. and Texaco Inc. are just now finalizing their merger.

"If any of them move just 1-2% of their portfolio, that's hundreds of millions of dollars or billions of dollars in assets that can hit the market. Those may be sold to a company like Apache Corp., and then Apache may sell some of its assets to a smaller company and so on and onellipsethat will reinvigorate the food chain. We haven't seen that yet," Marko said.

Takeover candidates

Petroleum investment advisor Bruce Lazier of Dallas-based Ispyoil LLC said potential buyers are looking for high-quality assets, particularly natural gas assets, with a high rate of return and upside potential that the buyer can operate.

"Mitchell Energy & Development Corp. got bought because it had prime assets. Devon and Apache are premier acquirers of good properties that fit their portfolios," Lazier added.

He urged potential acquirers to be wary of the debt associated with their target companies or target property acquisitions.

Lazier specializes in following the smaller public independents "that are below the radar screen" of many analysts. "There may be undervaluation in these companies that are not covered as much," Lazier said.

Institutional investors like management teams that are willing to sell the company once it reaches a certain size, say a $1 billion market capitalization, Lazier said. He puts Vintage Petroleum Inc., Tulsa, and Pure Re sources Inc., Midland, Tex., in that category.

Looking toward bigger independents, Lazier said he expects that another company eventually will buy Anadarko Petroleum Corp., Houston.

Anadarko CEO Robert J. Allison Jr. said in September that he could not comment on whether anyone had approached Anadarko with an offer, but he also said he could not rule out the possibility.

"With the stock price as low as it is, you've got to be nervousellipseYeah, it's a worry. I think we could be an attractive target to a lot of people," Allison said. "At the same time, with this crazy stock market, there may be attractive targets for us.

"We will do whatever is in the best interest of the shareholders," he continued. "We're not going to sit here and say we absolutely will fight tooth-and-toenail against any offer that comes through the door."

Access to capital

Barring a sudden, unexpected in crease in oil and gas demand, small to mid-sized independents are likely to have a tough time rising capital for the next several months, sources say.

Independents with less than $1 billion of market capitalization typically have very limited access to capital. The public equity market tends to shy away from energy companies in times of soft commodity prices.

Gaining access to the capital markets is the biggest challenge facing Toreador Resources Corp., Dallas, according to Toreador Pres. and CEO Thomas Graves.

"The only way you can access the capital markets is to get bigger," Graves said. "We think there is going to be consolidation amongst the small-cap public companies. Our objective is to be one of the companies that is doing the consolidating as opposed to being one of the companies getting consolidated."

John Walker, CEO of EnerVest Management Partners Ltd., Houston, is an independent very familiar with trying to raise money, particularly money from institutional investors.

As an oil and gas company, EnerVest is active in the acquisition and divestiture market while it also manages oil and gas assets for institutional investors.

Walker said he has raised $800 million since founding the company in 1992. EnerVest operates more than 5,000 wells, he added.

"Our track record is good, but we still have to work at raising money. We've never had anybody come up and ring our doorbell saying, 'I came here to give you money.' It's a lot harder to raise institutional money than people realize," Walker said.

Meanwhile, bank loans are getting fewer and farther between for independents due to bank consolidations. As the banks have gotten bigger, many of them tend to focus on loans of $10 million or more.

"What that has really done is cause fewer and fewer small loans to be available," Walker said. "A few smaller banks have filled that niche, but it used to be the large banks were in that market too. The large banks have moved out of that market."

The cost of capital includes both equity and debt.

"Equity capital is pretty expensive right now, so I can think that a lot of smaller companies are hurting," Ana darko's Allison said.

The average cost of private capital is 20%, Walker said.

Escalating costs

Many independents report that the costs of doing business-such as day rates and the cost of capital-are getting harder to handle as natural gas prices continue a downward trend.

Drilling costs have started to come down compared with earlier in the year, but day rates still haven't fallen as fast as some independents would like.

"The costs better start coming down," Anadarko's Allison said. "We have quit using some rigs with contractors that wouldn't reduce their ratesellipsewe may continue this."

He said drilling contractors must understand that producers cannot afford to pay such high day rates in times of $2.25/Mcf gas as they did when gas was $5-8/Mcf.

Allison predicts a decrease in the number of drilling rigs running by yearend.

"As an industry, we are running out of prospects. That is a problem that needs to be addressed," he said, noting that Anadarko itself has a large inventory of prospects.

Frederick J. Lawrence, director, economics and international projects, for the Independent Petroleum Association of America, said independents must make smart logistical and focused operating decisions in order to manage costs.

"If you know you want to drill four to five wells in an area, you better look at the whole picture. Don't look at it as incremental, look at it as: 'Let's get these rigs over here and drill five wells. Let's not drill one and see what happens, then drill another,'" Lawrence said.

Rig availability is being handled on a "just-in-time" basis so that producers don't risk losing a rig that they might not be able to get back again for 6 months, he said.

"I think that day rates are certainly coming down right now, on one hand, but on the other hand, we've also seen the industry butt its head against capacity constraints and the lack of workers, lack of rigs, lack of trucks to move the rigs, etc," Lawrence said.

Day rates in the shallow Gulf of Mexico have come down by about 50% compared with earlier this year, said Mike Dawson, Global Marine Inc. vice-president, investor relations and corporate communications.

Dawson estimated that rig cost makes up about one third of the producer's cost of drilling a well.

"So, if you say day rates were down half of what they were a few months ago, then well costs are down 15-20%, that's a very significant change in your cost structure," Dawson said.

In April, a 250-ft, independent-leg jack up leased for about $50,000/day compared with a September day rate of about $20,000 for that same rig, Dawson said.

Drilling activity has dampened with a fall in natural gas prices, he said, adding that some companies that were aggressive spenders early in 2001 have already spent their entire drilling budgets.

"I think the drilling pick-up is going to come with the beginning of 2002, when companies get their new budgets," Dawson said.

Natural gas outlook

For the near term, many independents are maintaining a bullish outlook for natural gas markets in the US.

"Although gas prices are going to be volatile over timeellipsethe supply growth opportunities in the low-cost areas-such as in the traditional basins like along the Gulf Coast-are getting smaller and smaller," noted Douglas Manner, chairman and CEO of Houston-based Mission Resources Inc. "The prizes just aren't as big as they used to be," he added.

On the other hand, Manner said, it is going to require at least $2.50-3.00/ Mcf-or even more-to bring gas on stream from the deepwater Gulf of Mexico or from projects outside the US. He said that if gas prices continue to fall, rig availability will loosen, because many operators won't be able to afford to continue their development projects. The result will be a gas market with a base that's significantly higher than what it has been in the past, Manner concluded.

Gareth Roberts, Pres. and CEO of Plano, Tex.-based Denbury Resources Inc., said, "I think that the industry is having a very hard time finding gas. Our decline rates are very steep, [although] we have been working hard over the last year or so to bring gas onellipseWith any slowdown whatsoever, the true decline rate is going to come into play, and it's going to beellipsesharp.

"I am predicting that the world will recognize a big turnaround in natural gas in May of next year. At that point, we'll start see these declines in the storage figures, and it will set off another round of natural gas hysteria. We're really concerned that if the industry slows down too much, it's just going to exacerbate the problem," Roberts said.

William Hargett, CEO of Houston Exploration Co., Houston, said, "We're very bullish on the long-term gas price environment. Pricing this year has been a reflection of the economy and mild weather.

"As the nation's economy grows and as the demand for natural gas as an environmentally friendly fuel increases-and as gas-fired electricity plants continue to be built-we're going to have very strong pricing for gas," Hargett added.

Some independents maintained that the Sept. 11 terrorist attacks on New York and Washington, DC, would have marked effects on natural gas markets, although most likely only for the short term.

Terry Swift, Swift Energy Co. president and CEO, said, "We certainly view in the short-run, as a consequence of the terrible events of Sept. 11, that the economy will take a little bit longer to recover, but it will recover." He said additional softening is possible near term for both gas and oil prices.

But the heating season is looming, and the economy will rebound, triggering a shortfall of gas supplies and higher prices, he added.

"It's more apt to provide for a more sustained recovery of gas prices, be cause it will be riding a wave of economic rebound instead of riding a wave of economic deteriorationellipseIn the 3-5 year scenario, we are extremely bullish about our business," he said.

Anadarko's Allison said, "Clearly, the terrorist attack has hurt our economy and exacerbated the little downturn that we have. I don't really think it will turn into a recession. I think [that] overall the economy is strong, but it is going to be bleak for the next month or two.

"What that means to us is that natural gas prices are going to be soft. There is a lot of gas in storage. More than half of our revenues come from natural gas. That's going to be tough for a while. That is because demand is down. Supply is not really growing. I would be very surprised if 2001 compared with 2000; we had more than a 1-1.15% growth in gas production year-over-year even with all the rigs running. The fact is, we are just not adding enough reserves," he said.

"We are very bullish over the price of oil and gas" for 4-10 years out, Allison added. "There isn't enough gas developed in North America, so the price is going to have to be high. We're going to have to have a pipeline from Alaska and a pipeline from the Canadian market. We're going to have to have LNG imports to sell in the US. None of that is going to come in cheap. None of that is going to come in at $2.25/Mcf; it's going to be more like $4-5/Mcf, so we are bullish on the price of gas."

Oil markets

Even while most US independents' portfolios are weighted more heavily toward natural gas, the search for, and production of, oil will always play a vital role in the US energy supply mix.

"The oil market is a wild card, but if you believe that [the Organization of Petroleum Exporting Countries] has got figured it out-and [the price] has been stable for 18 months-then there's no reason to believe we can't see [an oil price in the] mid-$20s for a number of years, said Mission's Manner.

The peak production of the world's oil is upon us, reckons Denbury's Roberts. "We're at maximum deliverability. From this point on, deliverability around the world begins to decline. Although we have enough today, without any kind of recovery in growth, it will be a real problem.

"That's the only reason that OPEC has control over the market, because there is so little surplus capacity. It's not price that's the problem, it's geology-finding places to drill for it," he noted.

Douglas W. Weir, Toreador vice-president, finance, and treasurer, said, "We see the price of oil remaining relatively firm. We think that you will continue to see oil trading in this current range, and I would expect oil to remain above $25/bbl," for light, sweet crude on the futures market.

Non-US portfolio assets

According to an IPAA survey conducted of its membership in 2000, only 11.6% of the 144 responding independents reported participating in operations outside the US. This figure, IPAA reported, was down 5.2% from a survey conducted 2 years earlier.

"Of those independents that did not participate in [non-US] operations," IPAA noted, "a total of 27.3% of firms plan to do so within the next 5 years." Independents reported capital expenditure and political uncertainty as the two largest factors hampering their operations outside the US.

"The international arena is an area where many independents are considering risking relatively small amounts of their exploration budgets for large reserve payoffs," IPAA said. "However, the low-price commodity environment took a toll on international ambitions over the past 2 years, as companies attempted to consolidate and build more-defensive balance sheets," IPAA added.

IPAA's Lawrence said that many more independents are becoming more aggressive outside the US. For small to mid-sized independents, he noted, projects in Canada and Latin America were often preferred to those schemes located farther away.

Larger firms, therefore, are generally the ones attempting the more capital-intensive and politically risky projects, such as off West Africa or in the Caspian Sea.

"I think companies will always have to look to international prospects, because [the US is] a mature oil and gas province," Lawrence said. "[Inde pendents] are looking at new frontiers: deepwater offshore, coalbed methane, Atlantic Canada, northwestern Canada, especially, but I think you'll see a refocus on hemispheric oil and gas in the Lower 48," he said.

In particular, Lawrence said that Canada will play an increasingly critical role in the US supply matrix in the coming years, especially with natural gas demand expected to climb above the 30 tcf mark over the next decade to 15 years.

"I think that independents, especially, need to look [outside the US] because they have to replace the re serves. You can buy other companies to get their reserves, but at some point, you have to go out and you have to drill a new field with exploratory wells, you've got to replace [production] with new oil and gas. There's only so much you can buy up that's proven," Lawrence said. "There is a degree of risk there, but there's also a degree of risk in terms of becoming too dependent on foreign sources [of oil]."