Indonesia's 337 tcf CBM resource a low-cost alternative to gas, LNG

Indonesia has identified a potentially lower-cost alternative for meeting its domestic demand for natural gas and its liquefied natural gas exports. The authors recently completed a study that identified 337 tcf of coalbed methane (CBM) resource potential in 11 Indonesian coal basins-about two-thirds the size of the US CBM resource base.

This article summarizes the non-confidential results of this first comprehensive assessment of CBM resources in Indonesia. Advanced Resources International Inc. and PT Caltex Pacific Indonesia conducted the study, using data that Pertamina and the Indonesian Directorate of Coal provided.

Indonesian resources

Indonesia produces and exports significant volumes of natural gas. In 1999, conventional reservoirs in Indonesia produced 9 tcf of gas, most of which was exported as LNG.

As Indonesia's crude oil production declines, the country is intensifying its natural gas development and utilization. Its largest gas pipeline currently links South Sumatra to the Caltex Duri steamflood, and in 2003 it will connect to the Singapore market. Two other proposed lines would connect the islands of Sumatra and Kalimantan to demand centers on Java.

Although coalbed methane is an established gas supply source in the US, it has attracted scant attention in Indonesia, even though operators there have often reported gas kicks while drilling through coal seams towards deeper targets. Indonesia's 150 tcf of proved conventional gas reserves-much of it stranded-appear to make further gas exploration unrewarding.

However, the study indicates that Indonesia's CBM potential is highly prospective, could be developed in tandem with conventional high-carbon- dioxide gas reserves, and may be lower in overall cost.

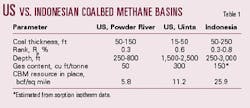

Indonesia's CBM potential resembles a supercharged Powder River basin, currently the hottest onshore gas play in North America. Some Indonesian coal basins are as large as the Powder River play but contain even higher-rank coal that is thicker and deeper (Table 1). Per-well gas recovery could be 10 times higher than Powder River's-as much as 5 bcf/well.

Shift towards low-rank

Coalbed methane has emerged as a reliable and low-cost natural gas supply in the US. Nearly a decade after expiration of the Section 29 tax credits for new wells that helped to jumpstart the CBM industry, its status is robust:

- 3.5 bcfd of CBM production from nine US coal basins accounts for 7% of total US gas production.

- Over 8 tcf of CBM has been produced to date in the US.

- Another 12 tcf of proved reserves remain, with 1-2 tcf of annual reserve additions.1

As development continues, ultimate recovery is likely to exceed 50 tcf in the US alone. Worldwide, CBM production pilots are also under way in Australia, Canada, China, India, and other coal-rich countries.

The excellent performance of lower-rank CBM plays bodes well for Indonesia's potential. Two of the most active US CBM plays are the Powder River basin of Wyoming and Montana, which has a vitrinite reflectance (Ro) of 0.3%, and the Uinta basin of Utah, where Ro=0.6%.

Indeed, the subbituminous Powder River is the most active individual gas play in the US, with 4,700 new wells completed in 2000 alone and 600 MMcfd of coal seam gas production at mid-2001. The Uinta basin, a low-to-moderate rank coal area, produces 215 MMcfd from over 400 CBM wells.

The success of these new basins shattered the paradigm that coals had to be moderate-rank bituminous (Ro = 0.8-1.3%) in order to be productive. Other low-rank areas, such as the greater Green River, Wind River, and Hanna basins, are now undergoing testing. Outside the US, Texaco recently leased three low-rank CBM blocks in China's Ordos basin.2 3 Canada and Australia also are experiencing development of low-rank coals.

Deep data crucial

Indonesia has some of the world's most extensive low-rank coal deposits. But the technical literature has focused almost exclusively on its shallowest coals. Coal mined in Indonesia is generally of very low rank and mostly excavated from surface mines. Not surprisingly, Indonesian strip mines report negligible methane content. There is little at the surface to excite the CBM explorationist.

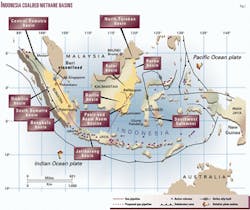

However, the study of deep oil and gas well and seismic data from throughout Indonesia indicated two important trends: Coal rank increases rapidly with depth in many Indonesian basins, and gas kicks frequently show up on mud logs during drilling through thick coal seams at depths of 1,000 ft or greater.

Indeed, reports from Indonesia's only underground coal mine complex-at Sawahlunto in central Sumatra-show high methane influx while mining below 300 ft, leading to premature mine abandonment. The evidence for CBM in Indonesia is indirect, requiring confirmation by in situ gas content or permeability measurement, but it is encouraging nonetheless.

CBM geology

Indonesian coal geology is well documented, but no comprehensive analysis of CBM potential has been published. Early screenings identified the coal basins with CBM potential, including a preliminary resource estimate of 213 tcf of gas in place.3 4 5

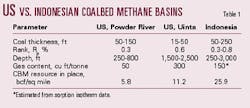

Basins with multitrillion cubic feet potential include the Barito, Berau, Kutei, Tarakan, South Sumatra, and Central Sumatra basins.

Our study focused on 11 onshore coal basins with significant CBM potential (Fig. 1, Table 2). The basins may be grouped into two tectonic settings: the relatively undeformed cratonic setting of eastern and southern Kalimantan and the more active transpressional-to-backarc tectonic setting of Sumatra- Java. Other basins, including extensive offshore coal deposits, were excluded from the study.

The principal coal units are the Eocene Tanjung, Oligo-Miocene Talang Akar, and Mio-Pliocene Muara Enim formations and their equivalents. These deposits are much younger and shallower than the conventional oil and gas targets in Indonesia, thus an extensive data set of well logs and seismic already exists.

Many deep petroleum exploration wells in Indonesia encountered gas kicks while penetrating coal seams (Fig. 2). Although an indirect indication that does not prove gas saturation, which must be confirmed by core retrieval and desorption, gas kicks are positive indicators that were also noted early in drilling the San Juan basin.

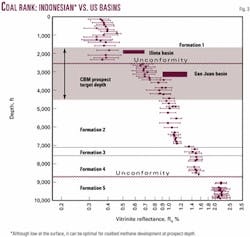

Coal rank increases with depth in Indonesia, most rapidly in back-arc settings with high heat flow. Lignite and subbituminous coal at the surface (Ro=0.3%) can increase to bituminous levels at CBM target depths of 3,000 ft (Fig. 3).

Coal seam permeability, perhaps the single most important reservoir requirement for commercial CBM production, has not been measured in situ in Indonesia. Cleating is generally poorly developed, despite high vitrinite content, although available samples are biased toward low-rank surface mines and outcrops rather than from thermally mature CBM depths, where cleating may be better developed. Fracture permeability could locally enhance areas undergoing tensional stress, such as strike-slip fault bends in Sumatra.

Coal gas characteristics

Conventional gas fields in Indonesia frequently are high in CO2. Levels can exceed 30% within the Corridor PSC area of southern Sumatra and 70% at supergiant Natuna D-Alpha field in the South China Sea. CO2 removal is costly and a significant risk for CBM operations. Encouragingly, the data show that shallow CBM deposits in Indonesia (<3,000 ft) are low in CO2 (<5%).

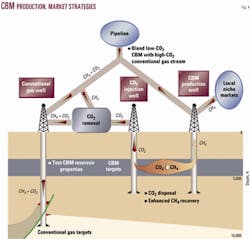

In a future carbon-emission-constrained world, waste streams from CO2 processing facilities in Indonesia could be reinjected beneficially into coal seams for simultaneous enhanced CBM recovery and CO2 sequestration (Fig. 4).7

The better CBM areas in Sumatra and Kalimantan have the following characteristics:

- Depth is 1,000-5,000 ft. Even in folded basins, broad flat synclines containing thick coals at optimal depth (2,000 ft) are apparent from seismic.

- Coal thickness averages more than 100 ft, reaching 325 ft in one well. Coal seams are remarkably continuous: individual 50 ft seams have been mapped over a distance of tens of miles. The study considered only coals that could be stimulated using a 3-frac/well completion, while excluding stratigraphically dispersed coal seams that may contain gas but are impractical to complete.

- Coal rank is low at surface (Ro=0.3%) but can increase rapidly to bituminous rank (Ro=0.7%) at CBM target depths.

- Gas content, based on initial coal adsorption analyses, is estimated at 100-300 scf/tonne, varying with rank and depth. Gas kicks suggest but do not prove that the coals are gas-saturated.6

- Vitrinite content is high-generally over 90%-which may promote good cleating and gas storage capacity in thermally mature coals.

Prospective basins

Repeatedly, CBM exploration in the US has confounded conventional wisdom, while benefiting prescient operators such as Evergreen Resources Inc., River Gas Corp., and Barrett Resources Corp. Further study and testing of CBM resources in Indonesia undoubtedly will reveal similar surprises. With this caveat in mind, we consider the most prospective basins to be (in geographic order):

Kalimantan:

- Kutei basin. Located in northeastern Kalimantan, the Kutei basin contains similarly thick, low-rank coal in the Miocene Prangat, Kamboja, and Loa Kulu formations. Structure is moderately complex, with large-amplitude folds caused by gravitational sliding (extension). E&P services and pipeline access are good in this major LNG export center. Completable CBM resources were estimated at 50 tcf within a 10,000 sq km area.

- Jatibarang basin. Although comparatively small, deep, and structurally complex, Jatibarang is a producing oil field located close to the Jakarta gas market. Strategically located coal basins such as Jatibarang warrant further study for near-term development. Jatibarang may have 1 tcf of completable CBM resource within a 500 sq km area.

- Central Sumatra. Low-to-moderate-rank coals occur in the Korinci formation but are generally quite deep (>6,000). Potential gas markets include Singapore, Malaysia, and Duri steamflood, the world's largest. Completable CBM resources could be as much as 50 tcf within a 15,000 sq km area.

- South Sumatra basin. Targets include thick, low-rank coals within the Mio-Pliocene Muara Enim and Oligo- Miocene Talang Akar formations. The Corridor-Duri gas pipeline currently transports 310 MMcfd of deeper conventional production, often high in CO2 at the wellhead.

PGN plans a gas pipeline from Sumatra to Java. Completable CBM resources were estimated at 120 tcf within a 15,000 sq km area, constrained by numerous wells and seismic lines.

In all, we estimate that accessible CBM resources total 337 tcf in Indonesia. About 4% of the CBM resource base in the US has been converted into proven reserves (20.5 tcf of proven reserve additions out of an estimated 560 tcf of gas in place). As drilling continues in existing and new basins, this conversion factor will likely grow to 10% or more. Applying this 10% factor to Indonesia, we estimate a CBM reserve potential of approximately 30 tcf.

Development outlook

Despite generally favorable geologic conditions, CBM development faces many challenges in Indonesia. Obstacles confronting Indonesia's natural gas industry are well known: political unrest and uncertainty that followed the Asian financial crisis of 1997-98, heavily subsidized domestic prices for competing petroleum products, and Parliament's inability to pass the long-awaited Oil and Gas Law to restructure the petroleum sector.

However, with the recent change in leadership it appears that Indonesia's focus will turn from domestic politics to a more balanced approach of economic management. Job creation and economic stability are stated themes of the new leadership. It now appears that approval of the new law will come by yearend.

Coalbed methane regulations are still under development in Indonesia. A CBM working group was established in 1999 to formulate detailed regulations guided by international practice. The group is considering modifying the conventional production-sharing contract to provide incentives for CBM development. A draft presidential decree on CBM development and the provisional Oil & Gas Law show movement towards a CBM regulatory framework.

Perhaps the biggest challenge, however, will be CBM's ability to compete with Indonesia's stranded conventional gas reserves. Production from CBM "sweet spots" could be cheaper to develop than deep and structurally complex conventional reservoirs with elevated CO2 content.

Codevelopment of CBM with conventional gas also may be feasible, including injecting waste CO2 into coal seams for enhanced methane recovery and CO2 sequestration (Fig. 4).8 Another CBM market niche could be local development adjacent to the high-value Jakarta, Central Sumatra, or other demand centers.

To compete with stranded gas, CBM operators in Indonesia must develop and produce at total costs of $1/Mcf or less-comparable to the better US plays. Large shallow-well programs at Duri field demonstrate that Indonesia's service industry has the capability to support CBM developments consisting of hundreds or thousands of low-cost wells. Operators may further reduce cost and risk by testing CBM reservoir properties as part of ongoing operations in conventional fields. A phased approach of in situ testing for gas content and permeability, followed by multiwell production pilots, represents a low-risk but potentially high-reward strategy for developing Indonesia's vast CBM resource base.

Acknowledgments

The authors thank Pertamina, the Directorate of Coal, and PT Caltex Pacific Indonesia for support of and per- mission to publish this study. We also acknowledge the contributions of Richard A. Fuller with Pendawa Energy Consultants.

References

- US Department of Energy, "US Crude Oil, Natural Gas, and Natural Gas Liquids Reserves," 1999 Annual Report, Washington, DC, 2000.

- "China awards more coalbed methane PSCs," OGJ, Nov. 27, 2000, p. 34.

- Nugroho, W., and Arsegianto, "Economics of Coalbed Methane Field Development: a Case Study of Jatibarang Field," SPE 25311, Society of Petroleum Engineers, 1993.

- Nugroho, W., and Arsegianto, "Future Prospect of Coalbed Methane in Indonesia," Proceedings of the 1993 International Coalbed Methane Symposium, University of Alabama, Tuscaloosa, May 17-21, 1993, pp. 721-26.

- Suyartono and Ginting, N., "The Possibility of Coalbed Methane Recovery in Indonesia," United Nations International Conference on Coal Bed Methane Development and Utilization, Beijing, China, Oct. 17-21, 1995, pp. 187-194.

- Saghafi, A., and Hadiyanto, "Methane Reservoir Properties of Indonesian Coals," AAPG International Conference and Exhibition, Bali, Indonesia, Oct. 15-18, 2000.

- Stevens, S.H., "Enhanced Coalbed Methane Recovery by Use of CO2," Journal of Petroleum Technology, October 1999, p. 62.

- Stevens, S.H., "Coalbed Methane in Indonesia: An Overlooked Resource," AAPG International Conference and Exhibition, Bali, Indonesia, Oct. 15-18, 2000.

The authors

Scott H. Stevens is vice-president of Advanced Resources International Inc., where he performs geologic and financial analyses of petroleum projects worldwide, particularly for coalbed methane. Formerly an explorationist with Texaco and Getty, he holds a BA degree in geology from Pomona College and graduate degrees from Scripps Institution of Oceanography and Harvard University. E-mail: [email protected]

Kartono Sani is senior geologist with the New Business Ventures group of PT Caltex Pacific Indonesia, conducting evaluations of oil and gas projects. Sani received geology and engineering degrees from the University of National Development, Yogjakarta. He has conducted extensive field mapping and geologic analysis of coal and petroleum basins throughout Indonesia.

Sutarno Hardjosuwiryo is exploration manager of the Directorate General of Oil and Gas, Department of Energy and Mineral Resources of the Republic of Indonesia. He has been directing the establishment of CBM regulations in the country since 1996. Sutarno graduated from the University of Gajah Mada Yogyakarta in central Java and holds a post-graduate diploma in petroleum prospecting and reservoir evaluation from the Norwegian University of Science and Technology, Trondheim.