OGJ Newsletter

Market Movement

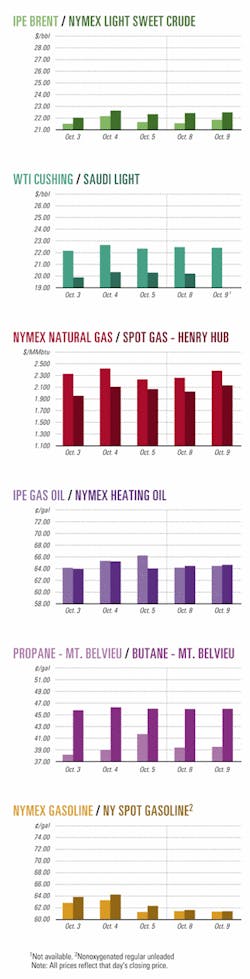

OPEC contemplating oil quota cut

OPEC officials confirmed member nations are discussing whether to cut the group's oil production quotas. The organization has been assessing the impact on the oil markets of the US and British military strikes against Afghanistan.

Chakib Khelil, OPEC president and Algerian energy and mines minister, told reporters in Sudan last week that there is the possibility of an OPEC meeting being called before the next scheduled meeting Nov. 14 in Vienna.

The basket of OPEC crudes was $19.86/bbl on Oct. 10, representing the third week that the price has remained below the group's targeted floor of $22/bbl.

OPEC officials can order immediate production cuts of 500,000 b/d to move the price back into the target $22-28 price band. The basket price is calculated retrospectively after the markets close.

Traders said the market has discounted attacks on Afghanistan as price drivers, although any spread of military activity or massive protests in Persian Gulf nations would concentrate attention very quickly. Afghanistan does not export oil or control any shipping or pipeline routes.

The oil market has been uncertain since the Sept. 11 terrorist attacks on the US, due more to fears of recession than of output interruptions.

Middle East geopolitics

The possibility of a major oil supply disruption cannot be discounted. Some analysts have concluded that the US response will be limited and will not affect any major oil exporter. But the geopolitics of the Middle East and the dynamics of today's oil markets might suggest otherwise. Many seem to be overlooking the emphasis President George W. Bush placed on the new, even revolutionary, aspects of the US military campaign. While Bush administration officials have presented a clearly identifiable villain in Osama bin Laden, it is clear that they have not tipped their hand entirely.

That was evident in the emphasis Bush placed on the open-ended nature of the campaign. Reports are that hawkish elements within the administration wish to take the battle to Iraq (and perhaps even Syria and Iran), concurrent with the strikes against Bin Laden's cells in Afghanistan and the Taliban. Sec. of State Colin Powell has not excluded Iraq from consideration in this campaign, and Defense Sec. Don Rumsfeld has not ruled out the use of nuclear weapons.

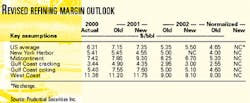

Refining margin outlook raised

The next 12 months are expected to bring higher US refining margins along with improved earnings and cash flow.

Andrew Rosenfeld, senior analyst for Prudential Securities, has raised his 2001 refining margin forecast to $7.35/bbl and his 2002 refining margin forecast to $5.50/bbl. Since the beginning of July, gross refining margins have increased 131% to $6.50/bbl.

"Based on recent actions by the refining industry, we believe that refiners are likely to reduce operating rates, therefore decreasing gasoline and heating oil production, in response to a slowdown in demand and potentially high product inventories," Rosenfeld said. "This could lead to low heating oil inventories going into the winter heating season and low gasoline inventories going into the driving season next summer," he said.

Rosenfeld expects near-term refining margins will decline slightly from their current levels as several refineries resolve unplanned operating problems and return to normal operations.

Meanwhile, Lehman Bros. sees unprecedented volatility for the downstream sector.

"We forecast that our 16 North American-based major oil companies' downstream segment may earn $2.71 billion in the current third quarter, down 43% sequentially. However, results will be relatively higher compared to its year-ago period of $2.68 billion," analyst Paul Cheng said.

The refining market experienced "an abrupt downturn in June due to steadily rising supply and weak demand," he said.

Declining US gasoline stock levels set the stage for a recovery in US refined product margins in early September. But Cheng said Sept. 11 terrorist attacks on the US have "partially stalled" the market's positive momentum, particularly in the Gulf Coast and Northeast regions.

null

null

null

Industry Trends

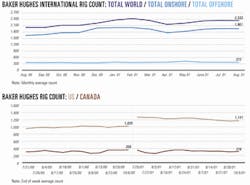

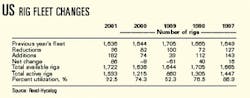

INCREASED DRILLING ACTIVITY has pushed rig utilization to a 20-year high, according to the latest annual census by Schlumberger's Reed-Hycalog division.

"The decline in the number of rigs that began 19 years ago has leveled off and begun an upturn," said John Deane, vice-president of drilling technologies with Schlumberger Oilfield Services.

Reed-Hycalog surveyed 1,593 active rigs during May 5-June 18. That was up 31% from last year and the largest tally since 1990. The utilization rate for the US fleet, including land and marine rigs, jumped to 92.5% in 2001 from 52.3% in 1999 (see table). The Reed-Hycalog census makes a cumulative count of all rigs active at any point within a 45-day period, making it always higher than the weekly tally by Baker Hughes.

Schlumberger executives said high natural gas prices earlier this year prompted the increased drilling activity.

Deane said, "Activity will probably slow by 5% or so since those incredible gas prices have dissipated, causing utilization to drop to about 85%."

THE NUMBER OF AMERICANS who favor increasing energy production to improve national security has increased dramatically since the Sept. 11 terrorist attacks on the US. That word comes from a Wirthlin Worldwide poll sponsored by Arctic Power, a group lobbying for oil development on Alaska's Arctic National Wildlife Refuge coastal plain.

Wirthlin surveyed 1,006 adults in the Lower 48 Sept. 15-17. The poll has a margin of error of plus or minus 3.1%.

The survey found that 61% of the respondents believed that the positives of exploration and production in ANWR outweigh the negatives, up from 39% in July.

It found that 71% favored increasing domestic supplies of traditional energy sources, including oil, natural gas, coal, and nuclear power. Also, 38% of the respondents cited protecting national security by ensuring stable energy supplies as the reason to act on a comprehensive national energy plan, up from 19% in July.

Arctic Power spokesman Roger Herrera said, "We believe war is imminent, we believe our people are at risk of further attacks, and we believe energy security is a key component in the effort to improve our national security."

TWO MULTIBILLON-DOLLAR deals last week marked the latest stage in the continuing boom in North American merger and acquisition action.

Burlington Resources offered to buy the stock of Canadian Hunter Exploration for $2.1 billion.

In an announcement that cleared finalization of the Chevron-Texaco merger, Shell Oil agreed to buy Texaco's 44% of Equilon Enterprises. The deal also provided that Shell and Saudi Refining will acquire Texaco's 35% share of Motiva Enterprises, making each a 50% holder in Motiva.

Previously, Shell owned 30% of Motiva, and Saudi Refining owned 35%. The two transactions involved a combined $2.1 billion in cash, $1.4 billion in debt, and $300 million in pension liabilities.

Government Developments

Supporters of a proposed pipeline to move natural gas from Alaska's North Slope to the Lower 48 have asked the US Congress for tax incentives and a streamlined permitting process to enhance the $20 billion project's attractiveness for industry and investors.

Alaska Gov. Tony Knowles outlined three key incentives in Oct. 2 testimony before the Senate Committee on Energy and Natural Resources (see related story, p. 26).

Knowles wants pipeline owners to have an accelerated depreciation at a 7-year rate rather than the 15-year rate. He also asked for a 10% investment tax credit and for a natural gas production tax credit tied to a floor price.

Alaska wants to see the pipeline incentives included as part of a proposed $75 billion economic stimulus package aimed at helping the overall economy.

Budget planners say the cost of the proposed pipeline tax incentives is unknown. Pipeline advocates argue that the incentives could help industry make a more-informed decision on whether to proceed. Current weak natural gas prices are a concern, even though long-term natural gas demand projections are robust.

Committee Chairman Jeff Bingaman (D-NM) vowed that he is prepared to help develop legislation paving the way for the pipeline.

"We will never be able to produce enough oil to be independent of the world oil market, but we have the potential to retain the security of a North American gas market," said Bingaman.

Meanwhile, some lawmakers who favor drilling on the Arctic National Wildlife Refuge coastal plain have suggested they could lose support for ANWR if Congress improves tax incentives for an Alaska gas pipeline.

The Alaska congressional delegation vehemently denies that assertion, but delegation members also said they do not want a federally subsidized project.

Sen. Frank Murkowski (R-Alas.) said he supports a federal tax change allowing an accelerated depreciation rate. But he expressed caution about the federal government providing "huge" subsidies.

Murkowski said another issue is whether the state of Alaska can commit to provide the producers with "long-term fiscal certainty. A project of this magnitude must have the certainty that the whims of the state's taxing authority are tied in real terms to the market price of gas," he said.

Meanwhile, oil companies that own reserves on the North Slope have yet to finish their feasibility studies. BP, Phillips, and ExxonMobil are considering possible pipeline routes.

The House passed energy legislation that includes an ANWR leasing provision. It does not address favorable tax treatment for a gas line.

Quick Takes

The Malampaya project off the Philippines has delivered first gas to the Batangas gas handling plant, more than a week before the official inauguration of the gas-to-power scheme.

Considered the biggest and most significant foreign investment to date in the Philippines, the Royal Dutch/Shell-operated field is a national flagship project of the Philippines government.

The project is expected to generate $10 billion for the Philippines over the next 20 years and cut the country's dependence on fuel imports, mainly high-sulfur coal and fuel oil, by 20-30%.

That will eliminate an estimated $670 million/year from the Philippines' annual energy import bill of $2.5 billion, as well as bring in $420 million/year until 2021 in royalty payments from the 515-km, 24-in. pipeline extending from the offshore production platform near the island of Palawan.

Gas supplies from the field will fuel three power plants with a total generating capacity of 2,700 Mw. Some $2 billion was invested in development of five subsea production wells in the Malampaya field and the pipeline connecting to the shore terminal.

India's Essar Oil plans to invest $31 million in an exploration and development program in Rajasthan, northwestern India.

Following an oil discovery with Nanuwala-1 in the Bikaner-Nagaur basin, Essar plans a second wildcat near Raisinghnagar.

Nanuwala-1 flowed 35° gravity oil and opened production in an unexplored area of Rajasthan, Essar said. The Indian firm is planning to drill 15-20 development wells over 2 years to develop reserves that could be as much as 150 million bbl.

In 1996, Essar signed a production-sharing contract for two blocks with the Indian government and Oil India.

There has been little exploration in Rajasthan, although the geology is on trend with hydrocarbon production across the border in Pakistan.

Elsewhere on the exploration front, Corridor Resources said it farmed out interests in its McCully natural gas discovery area in New Brunswick to EOG Resources Canada. The farmout covers Corridor's 100% interest in two exploration licenses and its 50% interest in a third exploration license. The farmout does not include the four-section area where the first three McCully wells were drilled, nor does it include the quarter section area containing the fourth McCully well (OGJ Online, Apr. 16, 2001). Under the farmout, EOG will drill, test, and complete three wells. EOG has options to drill additional wells to earn an interest in all of the farmout lands. Upon completion of 12 wells-or the expenditure of $50 million in seismic, drilling, and development on the farmout lands-EOG will have earned 50% of Corridor's interest. Corridor will retain a 15% override on production during the payout period.

Ocean Energy made an oil discovery on its East Zeit concession in the Gulf of Suez. The East Zeit A-21 wildcat was drilled to 16,300 ft TD and found 745 ft of oil pay. Ocean-which holds 100% working interest in East Zeit field-expects first production from the well to begin before the end of the month. Further development and delineation drilling in the field is planned for 2002. Ocean said the discovery could yield another 40-80 million gross bbl of oil, which would add to the 87 million bbl of oil produced from the field to date.

DEVELOPMENT OF MIKKEL gas-condensate field is reaching completion stages.

Field operator Statoil has awarded European Marine Contractors an 80 million kroner contract to lay a 40-km, 18-in. pipeline between Mikkel gas-condensate field in the Norwegian Sea and a subsea template on Åsgard field's Midgard deposit. Pipelaying is expected to reach completion in August 2002, Statoil said.

This fall, Statoil will award contracts worth a total of 300-400 million kroner for work in Mikkel field, which straddles Blocks 6407/6 and 6407/7 in the Norwegian Sea. These contracts include surface treatment of the Midgard pipeline, laying of a 70-km hydraulic cable from

Mikkel is expected to come on stream on Oct. 1, 2003; a development plan for the field was submitted earlier this year (OGJ, July 16, 2001, Newsletter, p. 9). Production will be transferred via Midgard to Åsgard B for further treatment. The gas will be transported through the Åsgard Transport line to the gas treatment complex at Kårstø north of Stavanger, while the condensate will be sent through existing pipelines to the Ågard C storage vessel for export.

Meanwhile, ExxonMobil and its partners signed contracts totaling 375 million kroner for development of Sigyn gas-condensate field in the North Sea. ExxonMobil is Sigyn operator, but Statoil will execute Sigyn drilling and subsea work, in addition to topsides modifications on Sleipner platform. Under a 200 million kroner contract, ABB will carry out the alterations and modification work on the Sleipner A platform, which will be hooked up to production from Sigyn. And under a 175 million kroner contact, Coflexip Stena Offshore will install a seabed template, flowlines, and control cable and connect the flowlines and control cable to the platform. The template is due to be installed in November. The Sigyn East and Sigyn West deposits will be produced by means of one and two wells, respectively, via the same template. The wells are due on stream in the first quarter of 2003. The field, on Block 16/7-4, has an estimated lifespan of 10 years (OGJ Online, July 6, 2001).

Kerr-McGee reported that, despite an incident affecting the hull of the Boomvang spar, both Boomvang and Nansen field development projects in the Gulf of Mexico are continuing on schedule. Kerr-McGee is using the truss spar design for both fields. The company said that a ballasting incident occurred Sept. 27 as the Boomvang hull was being loaded onto the Dockwise Mighty Servant 1 transport vessel in Pori, Finland, resulting in the shift of the spar. The hull suffered only superficial damage. The spar should arrive in the gulf late this month and will be installed 9 miles from the Nansen spar hull, which is now under tow to its planned location in the gulf for upending and topsides setting. First production from Nansen is expected by yearend, and production from Boomvang is expected in early 2002. Kerr-McGee operates both developments.

LNG TERMINAL operator CMS Energy and utility holding firm Sempra Energy inked a deal to jointly develop an LNG receiving terminal on the Pacific Coast north of Ensenada, Baja California.

The proposed plant will have a send-out capacity of 1 bcfd of natural gas, the companies said. The gas will flow north into Baja California and the southwestern US via a new 40-mile pipeline between the terminal and existing pipelines in the region.

The companies have secured a 300-acre site for the terminal in an industrial zone.

The project will bring gas competition to a market that has long been at the "end of the pipe," said Sempra, which meant customers often had to pay higher prices for gas than in other markets.

The joint venture will develop, finance, build, and own the LNG facility and related port infrastructure, which are expected to be completed in late 2005.

In other gas processing news, Indonesia's Pertamina is negotiating with El Paso Natural Gas to supply LNG from its proposed Tangguh plant in Irian Jaya Province to the US. Pertamina and BP Indonesia are developing the Tangguh LNG plant, with production expected to start within a few years. Construction would begin on another train when an LNG sales contract is finalized. El Paso plans to build three LNG receiving terminals in the US, including one in California or Baja California (OGJ Online, Mar. 9, 2001). Pertamina and BP Indonesia also are seeking LNG contracts in China, which is expected to import 3 million tonnes/year of LNG beginning in 2005 at the Guangdong receiving terminal in southern China. The $1.5 billion Tangguh LNG project is designed to produce 6 million tonnes/year from two trains, drawing on 14 tcf from the Offshore Irian Jaya fields (OGJ Online, July 11, 2001). Pertamina also operates LNG plants at Arun in northern Sumatra and Bontang in East Kalimantan.

Foster Wheeler, meanwhile, has revealed more information about its front-end engineering design contract for an $800 million gas-to-liquids plant in Ras Laffan Industrial City, Qatar. The $30 million contract was announced in July (OGJ Online, July 10, 2001). The GTL scheme will start up in 2005. It will convert 330 MMscfd of natural gas from Qatar's North field into 34,000 b/d of liquids-24,000 b/d of fuel oil, 9,000 b/d of naphtha, and 1,000 b/d of LPG. Foster Wheeler will also select long lead-package vendors, conduct a geotechnical survey, prepare the invitation to bid, and prequalify engineering, procurement, and construction (EPC) contractors. The company will assist in bidder selection and lender evaluation and award the EPC contract. Foster Wheeler is the first contractor to be involved in a Sasol GTL technology plant outside South Africa.

MARITIMES & NORTHEAST PIPELINE said an open season indicated "strong interest" in the proposed Phase IV expansion of its gas pipeline from Nova Scotia to New England.

M&NP said local distribution companies, electric power generators, and third-party marketers nominated more than 1.7 bcfd for transportation service on its Canadian facilities and nearly 1.3 bcfd in nominations was received for transportation service in the US.

The Canadian nominations requested deliveries along the mainline and laterals to Point Tupper, Halifax, and St. John. The US nominations requested deliveries of "substantial" volumes into Algonquin Gas Transmission's proposed HubLine interconnection in Beverly, Mass. The majority of the nominations seek services during 2004-06.

Earlier this year, M&NP agreed to move as much as 400 MMcfd from PanCanadian Petroleum's Deep Panuke project off Nova Scotia. M&NP will invest $380 million to expand its capacity to 1 bcfd, nearly doubling the existing system capacity.

Phillips Petroleum-through its Polar Tankers subsidiary-let contract to Marine Spill Response to serve as Polar Tankers's primary response contractor on the West Coast and in Hawaii.

The Phillips unit will operate five Millennium-class, double-hulled vessels, all of which will be dedicated to the Alaskan crude trade.

Earlier this year, Polar Endeavour-the first of these tankers to be constructed and delivered to Polar Tank- ers-made its maiden voyage to Alaska to take on its first shipment of Alaskan North Slope crude (OGJ, Aug. 6. 2001, p. 69).

Polar Tankers anticipates delivery of its second ship, Polar Resolution, in early 2002.

In other tanker news, the December 1999 Erika tanker spill occurred under a series of "major irregularities," according to a maritime expert report requested by a Parisian judge. The conclusion bodes ill for TotalFinaElf, which had chartered Erika. The spill affected 400 km of France's coastline. The regions affected are demanding 6 billion francs in damages. The company refused to comment on the report. Maritime experts said that the tanker's navigation authorizations were good only until Nov. 21, 1999. The report also said the change of charter during the year should also have meant its legal suspension. The report said that BP had refused use of the tanker in 1997 and that a Royal Dutch/Shell affiliate had refused the tanker in 1998. The report also noted that the consignment level of the ship had been exceeded and that there was not enough bunker fuel to preserve maneuvering capacity in case of need. The report also blamed the state and maritime authorities, saying they believed for so long that the incident was a false emergency that the proper procedures for control and intervention were not activated in time.

Correction

An error occurred in the main table of the OGJ200 list of company financial and operating performance for the year 2000. Net income for Shell Oil Co., the US unit of Royal Dutch/Shell Group, should have been $3.007 billion, not $23.007 billion as published (OGJ, Oct. 1, 2001, p. 88). Using the correct net income figure, Shell's US net income ranks No. 4 after that of ExxonMobil Corp., BP PLC, and Chevron Corp., in that order. Footnote 4 of the same table should have identified Shell Oil as being one of the Royal Dutch/Shell Group of companies, owned 60% by Royal Dutch Petroleum and 40% by Shell Transport & Trading Co.