OGJ Newsletter

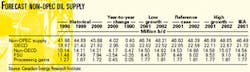

Market Movement

Upturn could last to the mid-2000s

Can the current strength in oil prices be sustained for the longer term, or is another downturn just around the corner?

Looking at the way the stock market is valuing operating company and oil service company stocks, one would have to assume the latter. Built into the current oil share prices is an expectation that oil prices will again slump to $18-19/bbl.

But Weeden & Co.'s Charles T. Maxwell believes oil and service companies' share prices are substantially undervalued-and thus underowned-by institutional investors, which have "completely misperceived" the scope and duration of their profit cycle.

"Market recognition of oil shares as attractive investments has been clouded in recent years by fear of surpluses of crude and natural gas based on four historic collapses of prices and profits in the oil industry-in 1974-75, 1986-87, 1991, and 1998-99," Maxwell said. He expects average quarterly crude oil prices to stay within OPEC's crude marker basket price band of about $24-30/bbl-in WTI-equivalent terms-for the next 3 years at least, and probably longer. He contends that crude oil is making the transition to a surprisingly price-resilient commodity. The present up cycle, unlike the previous four, was not the result of a political or military development that suddenly removed part of the supply from the market, thus creating a temporarily high capacity utilization that spiked oil prices. While production capacity utilization currently stands at 95%, it is not the result of some anomalous geopolitical event, Maxwell noted.

He sees a "golden descent" for oil prices, as WTI slips to $26.50/bbl this year and $24.50/bbl next year from an average $30.30/bbl in 2000. Correspondingly, he sees the average return on capital employed within in the industry as inching down to 19% this year, 17% in 2002, and a low of 16% in 2003 vs. the 20% level in 2000.

And will OPEC cohesion stay the course, a necessity for such an upbeat forecast? Maxwell contends that it will, pointing primarily to the fact that it has already done so for the past 21/2 years. Given the expectation that the world economy is not in for a deep recession, OPEC can remain united on policy and effective on implementing cuts up to at least 4.3 million b/d. Will non-OPEC crude supply make much of a difference in such a forecast? Maxwell contends there are limits to the potential for non-OPEC supply to grow. He points to the recent track record of projections of non-OPEC supply growth as being scaled down each year.

Non-OPEC supply market wild card?

But another view holds that non-OPEC supply could be the market wild card.

Salomon Smith Barney estimates that worldwide E&P spending by publicly traded oil companies rose about 12% last year vs. an 11% drop in 1999. The analyst projected a 20% rise in E&P outlays in 2001. Canadian Energy Research Institute forecast a comparable increase in 2002.

This typically translates into increased non-OPEC oil production, but the rate of growth also has a couple of natural governors on it: oil prices, of course, and exploding service and supply costs.

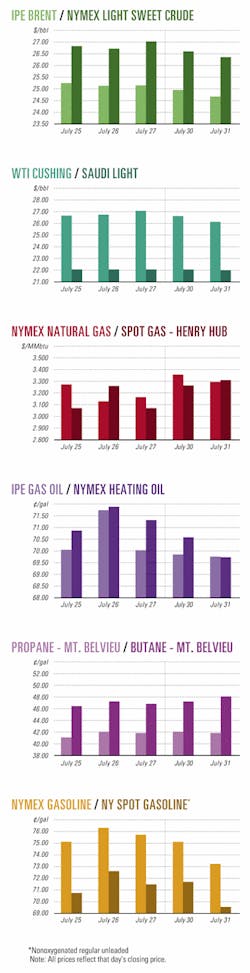

Still, the expectation is for more growth in non-OPEC supply in response to higher prices. CERI noted a jump in non-OPEC oil supply of 1.2 million b/d in 2000, the biggest gain for that category since 1995 (see table).

Given expectations of increased drilling and production activity in 2001 and 2002, CERI predicts "solid non-OPEC supply growth in 2001, albeit not as strong as last year. Non-OPEC supply growth looks to be exceptional in 2002."The Calgary-based think tank projects non-OPEC oil supply will grow by about 930,000 b/d this year to 46.8 million b/d and by 1.6 million b/d in 2002.

Gas storage higher than year ago

Robert Morris of Salomon Smith Barney predicts a further downside to US natural gas prices this fall "when it becomes ever more apparent that storage will be full heading into winter."

AGA reported injections of 77 bcf into storage for the week ended July 27 compared with injections of 63 bcf last year, 26 bcf in 1999, and 84 bcf in the previous week.

null

null

null

Industry Trends

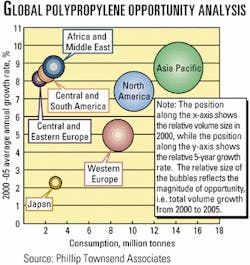

PHILLIP TOWNSEND ASSOCIATES SAID WORLDWIDE POLYPROPYLENE (PP) CONSUMPTION GREW 6% IN 2000 COMPARED WITH 1999.

Townsend predicted growth of more than 7%/year worldwide during the next 5 years in its annual report, which included profiles of more than 50 major PP producers (see chart).

"With further consolidation of the poly- propylene industry, globalization is a hot topic again," said Kevin Smith, the report project manager.

In 2000, PP consumption in North America and Western Europe grew only 1-2%, falling below expectations. The Asia-Pacific region was the largest PP-consuming region, while Latin America recorded the highest regional growth in 2000.

One reason for Latin America's spiraling PP growth was that many countries were rebounding last year from poor economic conditions in 1999, Smith said.

The big opportunities for PP producers are in injection molding and fibers, the report said, adding that it's crucial that companies understand the relative importance of each of these regionally.

"For example, North American converters have not seized the opportunity for blow-molded poly- propylene bottles like other regions-they still prefer alternative materials like HDPE or PET," Smith said.

Smith concluded, "An end-use industry that is already globalized will temporarily apply pressure on its resin converters to use the same grade in all regions. Global producersellipseare well-placed to develop business with these companies."

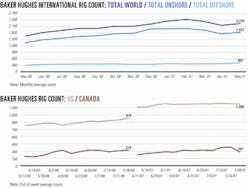

US GULF OF MEXICO RIG UTILIZATON HAS SLIPPED TO A 13-MONTH LOW.

Total US drilling declined slightly, but the utilization rate among mobile rigs in the Gulf of Mexico dropped for the sixth consecutive week. Industry analysts said the gulf utilization rate has not been this low since June 2, 2000.

ODS-Petrodata Group reported 2 more offshore rigs came off contract in the gulf for the week ending July 27, pushing down the fleet utilization rate a full percentage point to 83%, with 176 units contracted out of the 212 available.

The number of rigs under contract in European waters also increased by 2 to 100, boosting utilization a full percentage point to 97.1% in those waters, where 103 units are available for work.

Meanwhile, the global fleet of mobile offshore rigs increased by 1 with the reactivation of a previously retired drillship, said ODS-Petrodata. The result was a net decrease of 2 mobile offshore rigs for the week, reducing worldwide utilization to 88.4%, with 577 units contracted out of 653 total.

Baker Hughes reported 1,266 rotary rigs drilling in the US for the week ended July 27, 12 fewer than the previous week but up from 975 during the same period a year ago.

Government Developments

THE US HOUSE OF REPRESENTATIVES HAS VOTED FOR DRILLING ON THE ANWR COASTAL PLAIN.

Alaska Gov. Tony Knowles got his wish when the House passed a sweeping bill that would open the Arctic National Wildlife Refuge coastal plain to oil and gas E&D.

Knowles had written House members, saying ANWR oil E&D would strengthen the national economy by creating up to 735,000 jobs nationwide and generating billions of federal dollars through increased tax revenues and lease-sale receipts (see related story, p. 60).

The House voted 240-189 early Aug. 2 after defeating an amendment to maintain the existing ban on ANWR drilling. The bill allows drilling in the northeastern coastal strip of the refuge. The victory might be short-lived, given that the Democratic-controlled Senate is likely to oppose some of the drilling provisions.

The Senate bill does not allow ANWR drilling, and it is seen as unlikely the body would approve a final bill that contains an ANWR exploration provision.

THE US HOUSE HAS VOTED TO EXTEND IRAN-LIBYA SANCTIONS FOR 5 YEARS.

The House voted 409-5 last month to extend economic sanctions against companies and countries that do business with Iran and Libya beyond a certain threshold. The Senate previously had approved a similar bill by a 96-2 vote.

After the House and Senate bills are reconciled, the measure will go to President Bush, who had wanted only a 2-year extension. The administration has argued that sanctions should be reviewed frequently to assess their effectiveness and continued suitability.

Congress passed ILSA in 1996 to punish those nations for their alleged support of terrorist activities. It expired Aug. 5 (OGJ Online, July 18, 2001).

The revised law allows the US to apply sanctions against any company investing more than $20 million/year in the energy sector of either nation.

THE UK HAS FORMED A GROUP TO STUDY FUTURE GAS AND ELECTRICITY SUPPLIES.

UK Energy Minister Brian Wilson and Callum McCarthy, chief executive of the Office of Gas and Electricity Markets, said the Energy Security of Supply Working Group will meet for the first time next month. The energy ministry said the group would assess the available data relevant to security of supply to identify the gaps in that data and to develop appropriate indicators.

It will forecast, at least 7 years ahead, the availability of gas supplies, electricity supplies, and fuels used for electric power generation; the adequacy of generating capacity, and the adequacy of the UK's gas and electricity infrastructure.

The group also will determine whether market-based mechanisms are prompting the necessary investments to correct anticipated weaknesses in the supply chain. The working group will issue semiannual reports.

Quick Takes

PHILLIPS ALASKA AND ANADARKO DISCOVERED A SATELLITE NEAR NEWLY DEVELOPING ALPINE FIELD ON ALASKA'S NORTH SLOPE.

They estimate the Nanuq accumulation contains more than 40 million bbl of gross reserves. Another recent Alpine satellite, Fiord, may contain more than 50 million bbl (see map, OGJ, May 28, 2001, Newsletter, p. 8).

The accumulation was discovered in April 2000 with the Nanuq-2 exploration well, which found 50 ft of Cretaceous pay and 9 ft in the Kuparuk zone. A combined-zone production test yielded 1,750 b/d of 40° gravity oil and 1.2 MMscfd of gas.

A delineation well, Nanuq CD1-229, was drilled from the Alpine drillsite during the 2001 winter drilling season. It found 19 ft of vertical oil-bearing sand in the Cretaceous Nanuq reservoir and flowed on test at a rate of 460 b/d of 41° gravity oil and 6.5 MMscfd of gas from a horizontal completion.

Phillips, operator of Alpine and its satellites, is evaluating further delineation and development of Nanuq field.

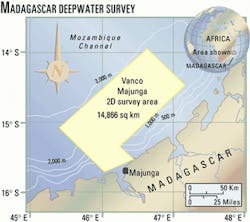

Elsewhere on the exploration front, Vanco En- ergy unit Vanco Madagascar inked a contract with TGS Nopec Geophysical for a 2D seismic survey of its deepwater Majunga block, which lies off the northwestern sector of Madagascar. Vanco will use the Binhai 517 seismic vessel to survey 2,000 km of the deepwater block. In March, Vanco signed a production-sharing contract for the block with OMNIS, Madagascar's petroleum agency. That contract was the first to be awarded in the Majunga basin since 1997 (OGJ Online, Mar. 20, 2001). Vanco's license covers what the company believes to be a salt-prone basin, potentially Cretaceous in age, containing multiple structures. Operator Vanco holds 100% interest in the block, which covers 3.57 million acres with the primary interest areas in 1,000-3,000 ft of water 40 km off the coast (see map). The 6-week survey will delineate the basin by creating a survey grid in the primary interest area beyond 1,000 ft of water.

Husky Energy unit Husky Oil China signed an exploration contract for Wenchang Block 39-05 in the Pearl River basin of the South China Sea. Over a period of 7 years starting in 2002, Husky will drill three exploration wells on the block, which lies 100 km off Hainan Island. During the exploration period, Husky will own 100% interest in the block. State-owned CNOOC, meanwhile, will have the right to participate in development programs with a 51% interest, while Husky would own the remainder. Seismic surveys of the 5,700 sq km block have already been completed. The block is near unappraised discoveries made by CNOOC, for which Husky has obtained the right to participate in development, the Canadian company said. Husky also said it will try to tie those discoveries into the Wenchang 13-1 and 13-2 field developments, now under way.

Apache said it has a gas discovery on its Eugene Island Block 187 in the Gulf of Mexico. On test, the Eugene Island new fault block discovery flowed 9.6 MMcfd of gas and 184 b/d of oil through a 20/64-in. choke with 4,500 psi flowing tubing pressure. Apache holds 100% interest in the prospect. Elsewhere in the gulf, Apache's JD 2 development well logged 71 ft of net gas pay in three zones. It flowed 9 MMcfd of gas and 669 b/d of oil through a 14/64-in. choke with 7,300 psi flowing tubing pressure. The well, drilled from Apache's South Timbalier 295 platform, logged another 140 ft of net oil pay in seven other sands.

MOSAIC ENERGY HAS FIELD TESTED WHAT IT IS CALLING THE WORLD'S FIRST LIQUID-FUELED PROTON EXCHANGE MEMBRANE (PEM) FUEL CELL POWER SYSTEM at a Nippon Mitsubishi Oil-operated retail station in Yokohama, Japan.

This 5-kw, naphtha-fired power plant system uses electricity generated by a fuel cell designed and manufactured by Mosaic. Mosaic partner Ishikawajima-Harima Heavy Industries (IHI) developed and manufactured the fuel processor that converts the naphtha into hydrogen gas. Nippon Mitsubishi said it hopes to eventually create retail stations that are "disaster-resistant," adding that such stations will operate "independently of outside energy sources" for a period of a few days using fuel stored underground.

Mosaic-which is owned by the Gas Technology Institute, NiSource Energy Technologies, and IHI-is making strides towards commercializing such PEM fuel cell power systems.

ROYAL DUTCH/SHELL'S PLAN TO REVIVE OIL PRODUCTION IN THE GULF OF THAILAND has begun with the successful reentry of a well that was shut in more than 4 years ago due to technical problems.

Nang Nuan B01, off the Chumphon coast in 30 m of water, flowed at a combined rate of 7,500 b/d of light crude. Through its local unit Thai Shell E&P, the firm said the test will lead to the redevelopment of the single-well Nang Nuan field by yearend.

The company is trying to farm out its 1,307 sq km Block B6/27, including Nang Nuan, Thailand's first offshore oil field (OGJ Online, Apr. 25, 2001).

Thai Shell has spent $10 million to reevaluate the Nang Nuan structure. Drilling problems prevented testing of another well drilled in the area.

Nang Nuan B01's peak production was 12,000 b/d. It had yielded 4.25 million bbl of oil before excessive water intrusion stopped production in 1997 (OGJ, Nov. 27, 2000, Newsletter, p. 8). F

Elsewhere, Modec International-a joint venture of FMC Technologies and Japan's Modec-inked a $290 million contract with Enterprise Oil to provide the floating production, storage, and offloading system and related subsea equipment for Enterprise's Bijupira and Salema fields development in the Campos basin in 1,575-2,900 ft of water off Brazil. Modec will provide the FPSO vessel, flowlines, and risers. FMC will supply a turret mooring system and five subsea manifolds-a project valued at $56 million. In addition, FMC will receive three-eighths of the profits from the FPSO contract through its ownership in Modec. The vessel will have an oil processing capacity of 70,000 b/d and storage capacity of 1.2 million bbl.

PHILLIPS PETROLEUM AND ITS PARTNERS SAID LATE LAST MONTH THEY HAVE POSTPONED INDEFINITELY A DECISION TO BUILD A GAS PIPELINE FROM BAYU-UNDAN FIELD in the Timor Sea to Darwin, Australia.

The companies said the deferral was prompted by "critical legal, fiscal, and taxation issues arising from the Timor Sea arrangement entered into between the governments of Australia and [Indonesia's breakaway republic of] East Timor on July 5."

Phillips added, "This decision may prevent commercialization of certain Timor Sea gas resources."

East Timor representatives wanted to increase taxes to recoup what they saw as an overgenerous 127% refund of exploration and development expenditures allowed in the production-sharing contract.

The companies plan to proceed with the Bayu-Undan gas reinjection-liquids production recycle project, which the Timor Gap Joint Authority-created by Australia and Indonesia-approved in early 2000 and is expected to begin full commercial production in early 2004. x

Elsewhere in the pipeline sector, Duke Energy Gas Transmission (DEGT) said it will more than double the planned capacity of the proposed Patriot project and expansion of its East Tennessee Natural Gas (ETNG) system (OGJ, Oct. 30, 2000, Newsletter, p. 9). ETNG has filed an application with FERC to build the 510 MMcfd extension. Seven customers have committed to 87% of delivery capacity, DEGT said. The $289 million, 95-mile project will extend the existing line from Virginia into North Carolina. ETNG also will expand its existing system. ETNG asked FERC for a preliminary determination by Nov. 15 and a final certificate by Mar. 27, 2002. ETNG projects it can begin construction in July 2002 to meet an initial in-service date of May 1, 2003. The Patriot project will be built in three phases: the first will have 130 MMcfd of capacity, the second will increase capacity to 310 MMcfd in November 2003, and the third will increase capacity to 510 MMcfd in January 2004.

FERC has authorized the expansion of PG&E Gas Transmission Northwest's (GTN) natural gas pipeline system in the US Northwest. GTN plans to add 21 miles of 42-in. pipeline and 97,500 hp at five compressor stations, increasing by 211,000 dekatherms/day its capacity of 2.7 million dekatherms/day of gas. The system transports gas from western Canada to California. Construction will begin soon, and part of the expansion will be completed by November, with the rest following next summer. GTN also plans a 2003 expansion of 230,000 dekatherms/day. The GTN pipeline system includes 1,335 miles of pipeline along a 612-mile route from the Idaho-British Columbia border across northern Idaho, southwestern Washington, and central Oregon, terminating at a connection with the Pacific Gas & Electric pipeline system at the Oregon-California border.

Noble Affiliates subsidiary EDC Ecuador signed a letter of intent with Horizon Offshore for the installation of 42 miles of 12-in. natural gas pipeline as part of the Amistad development project in the Gulf of Guayaquil off Ecuador (see map, OGJ, Oct. 9, 2000, p. 34). Horizon will use a pipelay-bury barge to install the line. Work will begin in the fourth quarter and should be complete in first quarter 2002. Horizon Offshore did not reveal the amount of the proposed contract but said that the addition of the project brings its backlog to $64 million. Earlier this month, Noble Affiliates said the Amistad-7 well on Block 3 in the Gulf of Guayaquil flowed on test at a rate of 19.4 MMcfd of gas through a 32/64-in. choke at 3,208 psi flowing tubing pressure from 172 ft of perforations. The well is part of a four-well program on the block (OGJ Online, July 12, 2001). Noble Affiliates operates the project and holds 100% working interest. It plans to use the field's production to fuel a 240-Mw power plant.

PETROCHINA PLANS TO CLOSE A NUMBER OF INEFFICIENT REFINERIES WITH CAPACITY TOTALING 320,000 B/D BY 2005.

Most of these refineries are small and use older technology. PetroChina closed six refining units last year, involving a total distillation capacity of 112,000 b/d.

Meanwhile, plans are under way to expand two PetroChina refineries by 2005.

Dalian Petrochemical in the northeast is expected to raise its refining capacity to 400,000 b/d by 2005 from the current 142,000 b/d at a cost of 10 billion yuan ($1.2 billion), while Lanzhou Petrochemical's refinery in the northwest will be expanded to 200,000 b/d from the current 140,000 b/d.

Despite the closure of some refineries, the expansions will raise PetroChina's overall refining capacity to 2.4 million b/d by 2005, up from a present 2.2 million b/d.

China has refining capacity of 5.4 million b/d, of which 2.8 million b/d is controlled by China Petroleum & Chemical.

BERRY PETROLEUM INKED A DEAL WITH SOCAL EDISON AND HAS RESTARTED ITS 42-MW PLACERITA, CALIF., COGENERATION FACILITY.

Under the contract, SoCal Ed will purchase power generated by Berry's cogeneration plant, which is in northern Los Angeles County. Both of the plant's 21-Mw units have been shut down since February and April, "due to nonpayment and contract issues with Edison," Berry said.

Jerry V. Hoffman, Berry chairman, president, and CEO, said, "In the last 8 months, our business has been dramatically impacted by the events surrounding the California electricity crisis; these include nonpayment by the utilities for electricity deliveries, the PG&E Co. bankruptcy, political and regulatory uncertainty, litigation issues, and uncharacteristically high natural gas prices."

Berry's cogeneration facilities are producing electricity for California and steam for the company's heavy oil production operations.