OGJ Newsletter

Market Movement

First half stockbuild almost erased

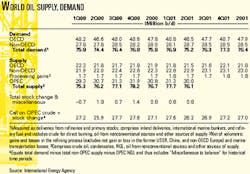

OECD stocks declined in July, reports IEA, nearly erasing the large stockbuild that occurred in the first half of this year and putting inventories below year-ago levels. Also, the Paris-based agency has left its forecast of 2001 global oil demand at 76.4 million b/d, unchanged since July.

Though released on Sept. 12, this latest IEA report was produced prior to the Sept. 11 terrorist attacks on the US and therefore does not take into account any repercussions.

Stock changes

Preliminary estimates for July show that total industry stocks in OECD countries dropped 25.5 million bbl in July, a reversal from the usual seasonal trend. Strong draws of crude stocks account for the bulk of this drop, as draws of product stocks were more moderate. The decline in global tanker arrivals following the OPEC production cuts that went into effect in April and the interruption of Iraqi exports in June began to affect the Atlantic basin in July. Regionally, total oil stocks in Europe and the Pacific fell below July 2000 levels, while in North America stocks of crude and products have continued to grow and remain above year-ago levels.

The OECD countries in the Pacific region sustained the largest draw on crude stocks during July, down 15.7 million bbl. Weakness in demand has prompted cuts in purchases and inventories, and refining runs were decreased in an attempt to prop up margins. Still, total product stocks increased 190,000 b/d during July.

IEA says that crude stocks in the Pacific will probably continue to tighten, as imports peaked in February at 13.9 million b/d before declining to 12 million b/d by July. "Regional refiners replenished stocks earlier in the year ahead of OPEC cuts in production. With lower than expected oil demand, the region will move into turnarounds in the third quarter in order to draw down surplus crude stocks."

In Europe, shipments of crude were lower during the second quarter, as increased imports from the former Soviet Union were unable to offset the decrease in Middle East liftings. Combined with higher refinery runs in response to rising import demand in the US for gasoline, this contributed to a 9.6 million bbl decline in European crude stocks in July, leaving them 8.7 million bbl short of last year's level.

Total product stocks in OECD Europe fell 19.5 million bbl in July, as more gasoline exports and growth in heating oil deliveries outpaced the increase in throughputs. Middle distillate stocks were pressured, as German households began filling tanks 2 months earlier than usual in preparation for winter.

North America

North American crude stocks were up 6.8 million bbl in July, not yet affected by Iraq's cutback because of the typical 6 week sailing lag. The jump came from an increase in Mexican inventories, as US stocks dipped nearly 1 million bbl. Product stocks moved up 5.7 million bbl for the month.

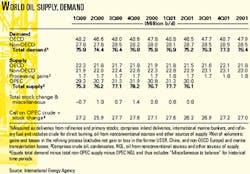

API figures show that product supplies in the US have dropped since peaking in July. Still, at the end of August, total petroleum stocks were 31 million bbl ahead of a year ago. In light of this month's terrorist attacks, some market analysts warn that demand for products-most notably jet fuel-could fall, further boosting inventories and putting downward pressure on prices.

null

Industry Trends

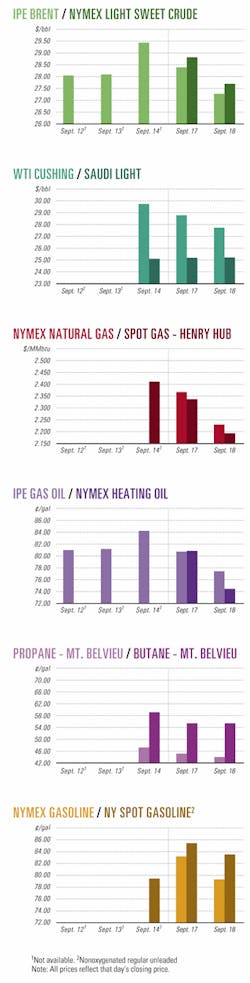

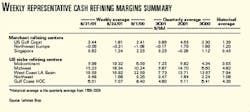

REFINING MARGINS remain "considerably" higher than historical averages in every US region except in the Northeast, says Lehman Bros. analyst Paul Cheng (see table).

"Not surprisingly," Cheng said, "the Gulf Coast region re ceived support from the Midwest market, as gas oline moved out of the area, causing inventories in PADD III to drop to 4.5% below last year.

"In contrast, margins in the Northeast declined, as the region continues to receive product imports from Europe despite an oversupply of gasoline in the area," Cheng added.

Despite week-to-week volatility, US margins will remain above historical averages in most regions for the foreseeable future, with the best-performing markets expected to be in the Midwest, Midcontinent, and West Coast, he said.

WITH COMMERCIAL FLIGHTS grounded in the US for much of the week following the Sept. 11 attacks on New York and Washington, DC, refiners were left scrambling to either store or blend into other products more than 1 million b/d of unused jet fuel, industry observers noted (see related story, p. 29).

London-based Centre for Global Energy Studies said that market fundamentals have been weakened by the attacks. Increased security measures and fear of further terrorist attacks are expected to sharply reduce commercial air traffic for many months.

That could reduce demand for jet fuel by as much as 400,000 b/d through the winter, although that drop may be partially offset by increased consumption of a different category of military jet fuel, said CGES, which foresees greater risks on the demand side vs. supplies.

Commercial airlines in the US burned an average 1.3 million b/d of fuel in 2000, vs. 150,000 b/d of US military jet fuel. Andrew Rosenfeld, an analyst for the Prudential Securities, said, "We believe that the demand for jet fuel will decline for the remainder of the year but should be offset by an increase in demand for distillate fuels and gasoline as consumers switch modes of transportation due to recent events."

Government Developments

SOME US STATES are taking more active roles in energy issues within their boundaries.

The Michigan Oil & Gas Association applauded recently proposed oil and gas leasing guidelines that include rules for directional drilling under Lake Huron and Lake Michigan.

The new procedures still await final approval by the Michigan Department of Natural Resources.

Michigan ceased leasing beneath the Great Lakes in 1997 to conduct a review of its leasing process. At the same time, the Michigan Environmental Science Board began a study of technical, environmental, and social issues associated with directional drilling.

ESB concluded: "...There is little to no risk of contamination to the Great Lakes bottom or waters through the releases directly above the bottomhole portion of directionally drilled wells into Niagaran reef and deeper reservoirs."

Any contamination, said state officials, would likely occur upland at the drill site. New procedures require a minimum 1,500 ft setback from the lakes for directional drilling.

The updated procedures have new provisions ensuring greater input from local interests. The state will study existing wells, pipelines, and access roads before granting a bottomland lease in the area; provide lease application and local industry data to local governments for approval; and take public comment on proposed leases and wells.

Former Gov. James J. Blanchard, who is running for reelection, called the decision "reckless and irresponsible."

He charged, "Today's decision violates the spirit of the 1986 ban on oil and gas drilling in the lakes agreed to by the Great Lakes governorsellipseIt's almost certain that Michigan's next governor, regardless of party, will ban directional drilling [under] the Great Lakes."

MEANWHILE, the California state power authority approved plans to proceed with 2,000 Mw of new gas-fired electric peaking capacity and 1,000 Mw of renewable energy power projects.

The agency will enter into agreements for the gas-fired projects and to negotiate for 1,000 Mw out of 1,800 Mw of proposed renewable energy projects. The capacity is expected to be on line by summer 2002.

The state got into the electricity business, creating the California Consumer Power and Conservation Financing Authority in June after experiencing rolling blackouts this past winter. The state's power grid has operated with less than a 15% reserve margin, with demand almost outstripping available generation for the past 2 years.

The authority's goal is to own power plants to ensure adequate supply is available and avoid paying too much for power. "If the authority owned several thousand megawatts of resources for reserves, these services could be had for half the current cost," it said.

The agency has received more than 60 proposals to build gas-fired peaking units, which would be used to satisfy electricity demand when intermittent renewable power sources cannot produce.

Fourteen letters of intent have been signed for construction of the renewable power plants, mostly wind and biofuel.

Quick Takes

A LONG-AWAITED PHILIPPINES development is about to start production.

Shell and the Philippines government have signed a final agreement to set up the necessary multipartite environmental monitoring team that will allow the $4.5 billion Malampaya deepwater gas-to-power project to begin production on Oct. 1, several days ahead of schedule.

The project entails development of Malampaya field, which has reserves totaling 3 tcf of gas and 120 million bbl of condensate, with five subsea wells in 850 m of water. Production will move to a caisson-design concrete gravity platform in shallow water for processing and storage of liquids for tanker loading.

The gas will move via a 504 km pipeline to an onshore terminal at Batangas for further treatment before shipping to three gas-fired power plants.

In other production news, Anadarko Petroleum has started a second oil production train at Hassi Berkine South field in Algeria, which eventually will boost output to 135,000 b/d from 74,000 b/d. Anadarko's project partners are Sonatrach, Lasmo Oil (Algeria), and Maersk Olie Algeriet. "This is the first of several new oil production facilities in Algeria we'll be bringing on line over the next 2 years," said Anadarko Pres. and Chief Operating Officer John N. Seitz. "When all these units are up and operating, our gross production cap acity in Algeria will exceed 500,000 b/d." The project entails four production trains at the field. The first train was completed in May 1998.

The partners have drilled 24 production wells, 12 water injection wells, and 3 gas injection wells. De velopment drilling continues and eventually will total 53 wells. Meanwhile, Ana darko and partners are pre paring to resume ex ploration drilling during the first half of 2002 under a contract signed with Sonatrach.

AMERADA HESS (FAROES) has contracted Transocean Sedco Forex's Sovereign Explorer semisubmersible to drill an exploration well off the Faroes, the self-governing Danish islands.

The well is expected to take 2-3 months and will be the last well drilled in the area this year.

Amerada Hess operates the Faroes Partnership, which includes BG, DONG, and Atlantic Petroleum.

The Faroes Partnership holds License 001 on the boundary between the Faroe Islands and the UK continental shelf, where the water depth is 950 m (see map, OGJ, July 23, 2001, Newsletter, p. 9).

Elsewhere off the Faroes, BP is drilling on License 004. Statoil Faer yene recently announced that the Longan well on License 003 was dry. Statoil Faer yene held a 35% stake in License 003.

In other exploration news, PetroChina discovered oil and natural gas in northwestern China's Junggar basin in the Xinjiang region. Spudded earlier this month and drilled to 4,340 m, the Pen 5 well flowed on test at a rate of 730 b/d of oil and 300,000 cu m/day of gas. PetroChina estimates the block has probable oil reserves of 146 million bbl. This was PetroChina's first discovery on the Maqiao acreage of the basin following five dry holes drilled in 50 years. PetroChina will drill four more exploration wells to confirm reserves before deciding whether to develop the field.

Italian company ENI said the Blacktip-1 well on the WA-279-P Block off Australia found a gross hydrocarbon column of 339 m. Three production tests had a combined flow rate of 2.53 million cu m/day of gas. The well is in Bonaparte basin 300 km southwest of Darwin.

INTEREST IN LNG projects is picking up worldwide.

CNOOC is considering building LNG terminals in eastern China's Fujian and Shandong provinces.

Prefeasibility studies are under way between CNOOC and officials of the two provinces. The next step will be submission of project proposals for government approval.

CNOOC has major gas operations in Bohai Bay, off Shandong, while PetroChina plans to move gas production from western China by pipelines through Beijing to Shandong.

CNOOC's original plan called for building LNG terminals in Shanghai city and Zhejiang province. However, CNOOC scrapped the plan following PetroChina's decision to move gas from Xinjiang to eastern China, including Shanghai and Zhejiang. PetroChina will start construction of the 4,000 km pipeline later this month, with completion scheduled for mid-2003.

Elsewhere on the LNG front, Spanish utility Union Fenosa has awarded SN Technigaz, a wholly owned subsidiary of Bouygues Offshore, a contract to build two LNG storage tanks in the northern Egyptian port of Damietta. The tanks are for the LNG plant Union Fenosa is building, expected to be operational in midyear 2004. The $1 billion project calls for a single-train LNG complex with an estimated capacity of up to 4 million tonnes/year. M.W. Kellogg, the London affiliate of Halliburton's Kellogg Brown & Root, was awarded the front-end engineering design services contract. The design project contract award followed the July 2000 signing of a contract for the supply of natural gas between Union Fenosa and Egyptian General Petroleum Corp.

A FINAL CONTRACT is expected to be announced in mid-October on a $350 million project to build an ethylene plant at the Jubail United Petrochemical olefins complex in Saudi Arabia.

Three bidders are vying for the project now that Stone & Webster has withdrawn from the competition.

ABB Group unit ABB Lummus is competing against a consortium of Japanese company Chiyoda and Kellogg Brown & Root and a partnership of Germany's Linde and South Korea's Samsung Engineering. Organizers asked the companies to resubmit proposals on some parts of the package.

In other petrochemical news, BP Chemical Investments, Sinopec, and Shanghai Petrochemical signed a joint venture agreement to build an ethylene cracker and derivatives complex in Shanghai. The Chinese government approved a feasibility study for the project (OGJ Online, Aug. 30, 2001). BP holds 50%, Sinopec 30%, and SPC 20%.

The JV plans to produce 900,000 tonnes/year of ethylene, plus combined polyethylene, polypropylene, and polystyrene production of more than 1 million tonnes/year. Styrene monomer, acrylonitrile, and other olefins derivative units also will be built.

ESSO EXPLORATION Angola (Block 15) has awarded ABB a contract to design, build, and commission a deepwater tension leg platform for the Kizomba A project off Angola.

The Kizomba TLP will be anchored in a water depth of 1,250 m and is slated for completion in third quarter 2003.

ABB said the Kizomba TLP represents the next generation TLP design, a four-legged concept allowing customers to adjust surface wellhead solutions to sea conditions.

The hull and topsides will be integrated in the Netherlands.

Elsewhere in development news, Conoco (UK) will seek UK government approval for fast-track development of a recent natural gas discovery on Block 49/16 in the North Sea. The discovery, some 80 miles east of Lincolnshire, is on the Vanguard Extensions (VE) prospect. BP is a 50% partner. Conoco said the field is an example of its "snuggle" exploration and development effort, the pursuit of oil and gas prospects that can be developed quickly because they are near existing processing and transportation facilities. Discovery well 49/16-13 was drilled in 109 ft of water to 9,456 TD by the Ensco 92 jack up last summer. It found a gross 700 ft interval in the Rotliegendes, of which 242 ft was gas-bearing.

DEEPWATER PIPELAYING for Williams Cos. in the Gulf of Mexico dominates pipeline news this week.

A new deepwater pipelay and subsea construction vessel has started working for Williams units responsible for gathering and transporting oil and natural gas produced from Boomvang and Nansen fields in the gulf.

Kerr-McGee Oil & Gas, Enterprise Oil, and Ocean Energy are partners on Boomvang and Nansen fields.

Coflexip Stena Off shore said its CSO Deep Blue will install export pipelines from the two fields in 1,100 m of water on the East Breaks Blocks 643 and 602 to a platform in 110 m of water on Block 244 off Galveston, Tex.

The contract work scope for the vessel includes installation of more than 100 miles of rigid pipeline and steel catenary risers and tie-ins to the fields' spar platforms.

Williams will construct and operate the Seahawk Gathering System to carry gas from the fields and will build and operate the Boomvang and Nansen Joint Oil (Banjo) system to carry oil from the fields.

Meanwhile, Williams Energy Services has awarded CSO a contract for two 18-in. export lines from Devils Tower field in the Gulf of Mexico.

Dominion Exploration & Production and partner Pioneer Natural Resources signed a project management, engineering, procurement, and installation contract agreement with Williams (OGJ Online, Sept. 5, 2001).

CSO is responsible for laying 160 miles of export lines in 5,700 ft of water on Mississippi Canyon Block 773 to shallower-water tie-ins near the edge of the continental shelf.

The contract includes 12 miles of 14-in. pipeline and two 14-in. steel catenary risers (SCRs). CSO will hook up the SCRs to the newbuild Devils Tower spar, perform diving in shallow waters, and handle the precommissioning of the oil and gas export lines.

Installation is scheduled for the second half of 2002, with the riser hook-up slated for completion in January 2003.

In other pipeline news, Sasol has signed a deal with Mozambique that would govern construction of a $1.2 billion pipeline to move gas from that nation to South Africa. The two nations and Sasol also signed a deal governing ownership of the line. If the project wins final approval, construction would take 3 years, with completion expected in the first half of 2004. The project consists of a gas field development in Mozambique, a 660 mm pipeline extending 865 km to Secunda in South Africa, the conversion of Sasol's current town gas pipeline network, and the supply of gas to Sasol customers in South Africa. In October 2000, Mozambique's state oil agency ENH and Sasol signed a deal to provide access to Temane and Pande gas fields as well as the granting of pipeline rights in Mozambique. Sasol and the two governments are finalizing a shareholder agreement for the pipeline company.

Enbridge Energy Partners late Sept. 20 was expecting to restart a Michigan pipeline carrying 380,000 b/d of crude from Canada. A routine inspection found lakebed erosion where Line 5 crosses the Straits of Mackinac, requiring supports for the pipe. The 645-mile, 30-in. pipeline carries light Canadian crude and natural gas liquids from Superior, Wis., to refineries in Sarnia, Ont. Enbridge informed federal regulators and Michigan public officials about the maintenance on the pipeline, which was shut down Sept. 13. A spokeswoman said the line supplies crude to Sarnia refineries, but some goes to the 74,000 b/d Marathon Ashland refinery at Detroit and the Sunoco refinery at Toledo, Ohio, both of which have alternative supply sources. A spur partly supplies the 66,700 b/d United Refining plant at Warren, Pa.

This special analysis of the IEA's Oil Market Report and its effects on the international oil market was provided by Marilyn Radler, Economics Editor