US reserve values rise as acquisition activity declines

US reserve values rose in the second half of 2000, despite the slow pace of merger and acquisition (M&A) activity, according to Cornerstone Ventures LP's latest report.

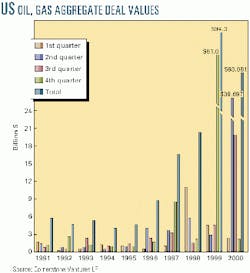

US oil and gas M&A transactions that closed during 2000 were worth a total of about $64 billion. Included in that total were BP Amoco PLC and ARCO's $25.6 billion merger, and Anadarko Petroleum Co. and Union Pacific Resources Group Inc.'s $12 billion merger. This is a 30% decrease from 1999's revised aggregate deal value of $94.3 billion, in which Exxon Corp. and Mobil Corp.'s $81 billion merger took the lion's share of the aggregate value, according to the Houston-based investment-banking firm.

Value changes

"In terms of the unit value of domestic onshore oil and gas transactions, 2000 was characterized by fluctuations in quarterly values rather than any consistent trend line, but the year ended higher than it began," said Cornerstone (see chart).

The median reserves value for the 80 deals in the second half of 2000-for which transaction values and reserve quantities were disclosed-was $4.87/boe, a 10% increase from 1999's revised median value of $4.41/boe.

According to Cornerstone's data, transaction activity during 2000 was the lowest of the decade, with only 156 deals closing, a decrease of 24% from 1999's revised figure of 205 deals.

Of the 156 transactions completed during 2000, 126 reported dollar values. Of those 126, 75 fell below $25 million and amounted to only 0.97% of the aggregated deal value, 18 were valued at $25-50 million, and 22 were greater than $100 million and represented $59.089 billion, which was 96.7% of the total.

"These incremental breakpoints generally reflected a progressive increase in the median value from $4.89/boe for deals under $25 million to $5.87/boe for deals over $100 million," said Cornerstone. "Deals between $50 [million] and $100 million experienced a median value of $5.89/boe, slightly higher than the larger deals."

Natural gas, oil statistics

Gas-dominated transactions accounted for 69% of the disclosed transactions in 2000. In terms of actual reserves traded during 2000, gas accounted for 35% vs. 59% of the total transaction volume in 1999. The median value for gas-dominated deals during 2000 was $0.80/Mcfe, a 5.3% increase from 1999's revised value of $0.76/Mcfe.

The median value for oil-dominated deals during 2000 experienced "sporadic changes" from the first quarter's $4.93/boe to the fourth quarter's $4.58/boe, reported Cornerstone. In the second quarter, there was a significant decrease from the first quarter's $3.89/boe vs. the fourth quarter's $3.78/ boe. The overall median value for oil-dominated transactions during 2000 was $4.55/boe, a 13.75% increase from 1999's revised median value of $4.00/boe.

Offshore asset transactions

Based on 14 US offshore asset transactions during 2000, in which transaction values and reserve quantities were disclosed, the median reserves value reached $6.40/boe, a 6.7% increase from 1999's revised median value of $6.00/boe.

Cornerstone noted that the 29 US offshore asset deals that closed during 2000 decreased by 17% from 1999's total. In fact, the firm said that the 2000 total was almost even with the annual average of offshore asset transactions (30) that closed in the past decade.

For offshore transactions during 2000, the aggregate deal value totaled $2.9 billion, which more than doubled 1999's revised figure of $1.4 billion. "Both 2000's and 1999's aggregate value figures were strongly impacted by the closing of two significant deals. ENI SPA's $1.8 billion acquisition of British-Borneo Petroleum PLC comprised 62% of 2000's aggregate value, while Apache [Corp.]'s approximately $715 million acquisition from Royal Dutch/Shell constituted 51% of 1999's aggregate value," the firm said.

Gas-dominated transactions in 2000 accounted for 92.9% of the total offshore number of transactions disclosed-an increase from 1999's revised 90.9%. In terms of actual offshore asset transaction reserves, gas accounted for 30.14% of the 367 million boe of reserves that was traded offshore in 2000, vs. 53.75% of reserves in 1999.

Canadian deals

Based on 63 Canadian oil and gas transactions in 2000, the median reserve value decreased by 35% to $5.88/boe (Can.) from 1999's median value of $9.09/boe (Can.). Transaction activity in 2000 mirrored 1999's activity of 87 deals closed-85 reported dollar values-compared with 85 deals closed in 1999-in which 63 disclosed dollar values. The aggregate deal value for 2000 was $14.231 billion (Can.), a 33% drop from 1999's $21.291 billion (Can.). Corner- stone said, "However, 1999's aggregate value was strongly impacted by a significant deal. Excluding the approximate $4.3 billion Canadian portion of Exxon's merger with Mobil, 1999's aggregate value was just under $17 billion."

Gas-dominated transactions accounted for 63% of the disclosed transactions in Canada during 2000. In terms of actual reserves traded in 2000, gas accounted for 41%, a decrease from 1999's figure of 61%. The median value for gas-dominated deals for 2000 was $1.19/Mcfe (Can.), a 26% increase from 1999's median value of $0.94/Mcfe (Can.), said Cornerstone. Oil-dominated deals in 2000 reached a median value of $5.20/ boe (Can.), a 17% increase from 1999's median value of $6.30/boe (Can.).