Deepwater, natural gas, e-commerce top OTC technology agenda

Contributing to this article were OGJ Chief Technology Editor-Pipelines/Gas Processing Warren True, Production Editor Guntis Moritis, Drilling Editor Mike Sumrow, Senior Writer Sam Fletcher, Senior Staff Writer Steven Poruban, and Staff Writer Paula Dittrick

This is the second of two articles rounding up coverage of the Offshore Technology Con- ference. This week: OTC technology highlights.

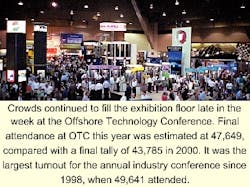

The technical challenges of operating in the offshore oil and gas arena were on ample display at the 33rd annual Offshore Technology Conference in Houston earlier this month.

At the top of the technology agenda for offshore operators and service-supply companies at OTC, which ran Apr. 30-May 3, were industry's movement into ultradeepwater operations beyond 5,000 ft, its growing emphasis on natural gas, and the accelerated "digitalization" of upstream operations through computer interconnections, said Wolfgang E. Schollnberger, OTC chairman.

And oil and gas companies must look beyond themselves when it comes to research and development, panelists in an OTC session agreed.

Meanwhile, the impact of the wave of electronic-business start-ups that surged through the oil and gas industry a little over a year ago-despite the fact that many of those ventures are no longer in existence-will still be strongly felt, according to participants in a general session on the impact of e-business on the industry.

Among the highlights of technical sessions were:

- In drilling, an emphasis on preventing formation of hydrates in wells, a better approach for drilling multilateral wells, and a look at early commercial applications of expandable sand screens.

- In production, a look at technological challenges and opportunities afforded by the forthcoming approval of using floating production, storage, and offloading (FPSO) vessels in the US Gulf of Mexico.

- In pipelines, two case studies of deepwater pipelaying innovations in giant Roncador oil field in the Campos basin off Brazil. Roncador innovations earned operator Petroleo Brasileiro SA the OTC distinguished achievement award for companies, organizations, and institutions. Petrobras dedicated the award to the 11 crew members who died as a result of explosions and fire that crippled and eventually sank the P-36 semisubmersible production platform in Roncador field earlier this year.

Cost containment, lands access, and safety and environmental issues were the overarching general themes at the annual, technology-focused conference (OGJ, May 7, 2001, p. 18).

Offshore technology trends

The trend toward deeper-water exploration and development was evident in the evolution of wellheads, blowout preventers, risers, and other equipment displayed at the oil and gas industry's biggest conference and exhibition. Much of that equipment is de- signed to address the problems of drilling in water depths where the weight of the mud column in a 10,000-ft riser could cause a formation to fracture.

The software systems that now control and connect much of that equipment are "about as important as the hardware itself," said Schollnberger, who also is vice-president of technology for BP PLC.

The industry's growing emphasis on natural gas over oil isn't evident in the hardware displays at OTC, because much of the same equipment is used to drill for and produce either oil or gas. However, Schollnberger said he heard more talk of gas in the hallways and on the exhibition floors as well as in the technical papers presented at this year's OTC.

Much of that discussion centered on new gas-to-liquids conversion technology as a means of dealing with gas produced in association with oil from ultradeep water and other remote sites beyond natural gas pipeline infrastructure or local markets "now that flaring is not acceptable," he said.

There also was more discussion of how the industry might develop deposits of gas hydrates found on the ocean floor in many areas of the world. "If we learn how to produce those hydrates, it could be a major energy source," said Schollnberger.

R&D concerns

Schollnberger noted, "When it comes to sources of technology, we are not shy." - Massive equipment displays, always a hallmark of the Offshore Technology Conference exhibition along with the comprehensive technical presentations, continue to underscore OTC's focus on technological innovations.

R&D budgets are often the first to be cut when oil and gas prices fall, yet the industry relies heavily on innovations to help it cut costs and tap difficult-to-reach resources.

Robert Hemming, Chevron Corp. general manager of strategic research, said technology is a "contact sport" in which people try out their ideas on each other.

"New ideas will come when we start to bring together great ideas from outside our companies," Hemming said. "We need to take the best from wherever we can find the best."

Pete Sigwardt, Texaco Inc. technology manager, said oil companies should share their knowledge about technology re- sources available in universities and national labs.

"We believe in networking toward the best solution," Sigwardt said.

Ricardo Beltrao, Petrobras upstream R&D general manager, said, "The present trend in Brazil is to look to others. We used to do everything internally."

Panelists agreed that operators need the technology provided by service companies, although they disagreed on intellectual property ownership rights.

Schollnberger said BP is willing to let the service company retain ownership of technology and to market that technology.

"Let's not haggle about the value of intellectual property that each party has brought in," Schollnberger said, adding that the speed of implementing the technology is more important than holding up a project by arguing about ownership rights.

Peter Sullivan, Shell Oil Co. director of E&P technology application and research, disagreed, saying the service companies have a different business model than do the oil companies, and that can result in conflicts.

"We have seen many technologies stranded because the technology did not align with the service company," Sullivan said, adding, "The only way to keep control of technology is to keep some ownership. We are willing to dance with all players."

Schollnberger jokingly responded, "I see certain people coming to us because they won't come to Shell anymore, because you want to own it."

E-business impact

A panel of e-business professionals at OTC agreed that much of the hype surrounding the launching of dozens of information technology and other internet-related companies has fizzled. They said that now is the time for industry to evaluate what it should do with the survivors.

"The dot-com meltdown was a necessary event," said Robert Peebler, vice-president, e-business strategy and ventures for Dallas-based Halliburton Co. "But the drivers are still in place-one such driver being the computer."

After a poll of the audience, Peebler concluded that the vast majority of the crowd did not represent e-business suppliers-as had been largely the case at last year's OTC e-business-related talks-but rather, they were primarily the supplier's customers, who were attending the discussion to comprehend the e-business shakeout.

Operator's view

Even though the romance between Wall Street and e-commerce ventures is over, said Greg Vesey, vice-president of e-business for Texaco Inc., there still remain some very important components to e-commerce that industry should reexamine and develop further.

One vital aspect is knowledge management, which he said would improve efficiency and effectiveness of the work conducted by and between companies. "We're going further and further outside our walls" to make the most of the tools that are available, he said.

Texaco has worked to establish "knowledge management communities," which he said would connect workers remotely on a daily basis. Next for development, Vesey said, would be the implementation of "live collaboration," where workers would communicate in real time with one another at an appointed time daily.

Steve Peacock, vice-president of digital business for BP America, said the oil industry possesses the components to fully utilize e-business opportunities. These include being global in scope, information-intensive, and having countless value chains that could be connected more effectively.

And despite the stormy past that e-business has had, Peacock said that, when evaluating its e-commerce options, industry should concentrate on the pace of development rather than current conditions. "At times like this," he noted, "we tend to overestimate the short-term impact [of under a year] and underestimate the long-term impact [of 5-10 years].

Wall Street spin

Michael LaMotte, managing director of equity research with JP Morgan, said one of the most important things to remember when developing an e-business strategy is to "keep moving."

Also, he noted, "Just because Wall Street isn't paying any more attention, doesn't mean you shouldn't." Ultimately, he added, Wall Street would have to recognize achievement.

LaMotte advised that, when starting out, a targeted approach is essential. One of the easiest places for industry to start, he said, is in cutting transaction costs. After that is achieved, other benefits-such as broadening relationships with suppliers and organizing work groups-will add to a company's cost savings. One of the final steps in terms of industry's evolution, LaMotte noted, is integration.

Hydrate concerns

Hydrate blockage of well-control equipment is a major concern, as more wells are drilled at greater water depths. Thierry Botrel, of TotalFinaElf SA, highlighted the problem in a paper presented at an OTC technical session.

Chemical inhibition of the drilling mud is only partially effective at water depths approaching 3,000 m, where sea bottom temperature is less than 0° C.

Subsea blowout preventer systems are giant cooling devices, said the authors, and provide room internally for hydrates to stick and grow. This design is inherently poor for preventing hydrates and remediating them.

Low-cost equipment modifications and devices that enable vertical access to the kill and choke lines from the drill floor can mitigate the risk and help to ensure fast recovery from a hydrate incident.

A new well-control technique, called the additional flow-rate method-which uses a second fluid with rheological properties different from the mud-decreases the risk of hydrate plugging during a gas-kick circulation.

Multilaterals

Premilled window joints replace the old method of cutting windows in casing, as multilateral oil and gas wells gain favor. There will always be a need to mill windows in situ, but if a well is planned as a multilateral initially, the premilled window can be installed as part of the casing string, making lateral construction easier.

The major benefit of premilled windows is that they make it fast and easy to drill out to create the lateral branch. The drilling assembly is controlled more precisely, the geometry of the junction is predetermined, and the debris generated from the window milling operation is easier to control.

The disadvantages, however, are cost, increased risk when running in hole at angles greater than 60°, danger of applying excess torque to orient the premilled window, and the frequent surveys that are required to verify the orientation.

C. Brunet and D. Durst of Weatherford International Inc., Houston, and G. Sotomayor, Petrobras, described a new gravity-based orientation device for premilled, multilateral window joints. It uses a weighted gravity device or guidance unit, run as part of the casing string. It has an offset center of gravity and attaches directly to the premilled window.

Gravity causes the weighted, eccentric portion of the unit to be biased to the low side of the wellbore, as the casing string is run. By the premilled window being fixed on the surface in the correct orientation, it is biased to hold this orientation until it is landed.

Petrobras used the guidance system in the 9-LOR-42D-RN well in Rio Grande do Norte state in northeastern Brazil. It was run on 95/8-in. casing at 967 m MD and 91° inclination, three joints up from the 95/8-in. shoe.

An 81/2-in. lateral was drilled out of the casing shoe. A second, 61/8-in. lateral was successfully drilled horizontally, out of the premilled window, to 1,430 m MD, said the authors.

Expandable sand screens

Gravel packing is a common completion technique in formations that have a tendency to produce sand. If designed properly, the gravel pack not only prevents sand production but also minimizes formation fines migration through the interface between the formation face and the gravel pack material.

The limitation of stand-alone screens is that formation fines are not prevented from migrating into the wellbore and accumulating on the surface of the screen, inhibiting flow. Hole stability can be another problem with stand-alone screens, if the formation is unconsolidated.

Expandable screens provide support to the formation face in applications where gravel packing is difficult. The concept is that once the formation face is supported, fines migration will be minimized, and the screen will remain open to flow.

Bobby D. Sanford and Clinton Terry of Chevron USA Inc. and Michael J. Bednarz, Chris Palmer, and Doran B. Mauldin of Weatherford Completion Systems presented a paper on the first commercial application of an expandable screen in January 1999. As of November 2000, 23,000 ft of expandable screen had been run in over 25 applications.

The first well in the Gulf of Mexico where an expandable screen was run was the G-7 S/T1 well in Chevron's West Delta 117 field. This application was in cased hole, where the expandable screen not only offered the ability to control sand production without a frac pack but also promised to overcome the plugging and erosion problems of stand-alone screens.

It was reasoned that perforation tunnels in poorly sorted sands would become plugged, but for well-sorted sands, a managed ramp-up of production allows the tunnels to pack themselves with formation sand against a properly sized expandable sand screen, enabling the fines to pass through.

GOM deepwater option

Once the US Minerals Management Service issues a favorable decision regarding the deployment of FPSOs, the industry will have another option for developing deepwater Gulf of Mexico oil discoveries, especially marginal fields found farther from the existing pipeline infrastructure.

One such scheme, discussed in two OTC papers, involved a study for installing a split facility with an FPSO near one or more deep-draft, dry-tree units (DTUs) in 2,000 m of water. Alan G. Clarke of Texaco Inc. and Jens P. Kaalstad, Advanced Production & Loading Inc., authored one paper. The other was authored by Bradley J. Clarkston, Nimish P. Dhuldhoya, Michael A. Mileo, and John R. Moncrief, all with Texaco.

From model basin tests, Texaco has determined the behavior of the individual FPSO and DTU units in varying sea states. The test findings confirmed that a DTU closely coupled to a disconnectable FPSO is feasible and cost-effective, reducing development costs to $3.00-3.50/bbl compared with $4.25-4.75/bbl for a conventional deepwater development.

Concept details

The Texaco concept proposes a purpose-built, double-hulled, deep-notch, FPSO barge with 500,000 bbl of storage capacity, fitted with a submerged turret loading system. In the concept, the FPSO handles liquid separation, water treatment, and storage, while the DTU provides space for gas separation, gas dehydration, and compression, thus mitigating hydrate problems when transferring the fluids to the FPSO.

Other equipment placed on the FPSO allows the facility to load oil from the DTU and discharge crude oil to a transfer shuttle tanker by either side or stern discharge. It also provides quarters for a minimum of 20 people.

The concept placed most of processing on the FPSO because it is less sensitive to payload than the DTU. For example, the study determined that, on a DTU, a 1 lb reduction in topsides weight corresponds to a $2-4/lb reduced hull-buoyancy requirement. In other words, a 1,000-ton reduction in topsides weight would save $4-8 million in hull cost.

In the Texaco concept, the topsides will weigh 6,212 tons for an 80,000 bo/d facility, much less than the 15,000-18,000 tons of conventional topsides for the same production rate.

Oil offloading will be to a purpose-built, double-hulled, dynamically positioned (DP), articulated tug or barge shuttle tanker with 500,000 bbl capacity. For the Gulf of Mexico, the shuttle vessel falls under the Jones Act, and therefore it must be US-flagged and US-built, whereas the FPSO is currently not covered under the Jones Act, the study says.

The study found that, in the Gulf of Mexico, a shuttle tanker can improve development economics by reducing oil transportation cost and increasing marketing flexibility by providing multiple sales points along the Texas and Louisiana coasts, rather than to a single customer at the end of the pipeline system. Gulf of Mexico oil pipeline tariffs are about $1.50-2.00/bbl, while the study estimated shuttle tanker transport costs at $0.50-$0.75/bbl.

Because the FPSO and DTU might be installed as close to each other as 700 m, the concept includes an integrated mooring system, consisting of chain and synthetic or wire ropes, connecting the FPSO to the DTU through both independent and common lines. The mooring will allow the FPSO to move off location in the event of a hurricane

Flexible midwater risers will transfer fluids between the DTU and FPSO. The study indicated that midwater lines have significantly better flow assurance parameters, because at a 600 ft water depth, the ambient temperature is about 59° F., which is above the hydrate formation threshold for a typical Gulf of Mexico crude oil at 150 psi.

The study assumed the DTU hull system was a deep-draft floating facility, either with a single or multiple column system. The DTU will support dry trees and either a workover or drilling rig. In drilling operations, the FPSO will store the reserve drilling fluid.

The concept includes a new pipeline for exporting gas to an existing gas pipeline infrastructure, or in some cases, the gas might be injected.

Less attractive options

The Texaco study evaluated this concept, concluding that other alternatives, especially for marginal fields, appear less attractive because:

- Newbuild and very large FPSOs (more than 200,000 bo/d processing and 2 million bbl storage capacities) are expensive.

- Subsea systems have become more complex because of flow assurance issues. These systems now include subsea manifolds, insulated flowlines, dual piggable lines, complex deepwater risers, and controls that may have continuous downhole readouts in each well.

- Deepwater drilling rig shortages have increased day rates. The study found that for large developments (greater than 12 wells), the savings in drilling costs per well more than offset the additional cost of installing a DTU with a dedicated drilling unit integrated into the facility.

The study indicated that drilling and completing a typical 15,000-20,000 ft well in deep water with a mobile offshore rig would cost about $40 million, or twice the $20 million if the well were drilled and completed from the DTU.

- Subsea completions in deep water have high well intervention costs, as well as reliability risks. Such completion technologies as horizontal laterals, gravel packs and packed screens, multilaterals, and extended-reach are better managed from a DTU.

Roncador pipelaying

Pipelay design and installation for Roncador field were the subjects of several pipeline-related papers at OTC.

One presented the overall major challenges and solutions for the pipeline installation that occurred during July-September 2000. The authors were Marcos Morais and Fabio Azevedo of Petrobras and Odd Kvello and Peter Tanscheit of DSND Consub SA.

In a related presentation, E. Neto and J. Mauricio of Petrobras and I. Waclawek of CSO Brazil described the technical solutions in the design of flexible pipelines laid in 1,500-2,000 m of water, with Roncador field experience as a backdrop.

Roncador field

Roncador field, discovered in 1996, lies in the northern Campos basin to the west of Rio de Janeiro off Brazil. Phase 1 of its development consisted of 21 subsea production wells and 5 injection wells. These wells were all tied back to the P-36 semisubmersible production platform, cited on its initial delivery as the world's largest of its kind.

Three of the production wells, east of the platform, were to be connected to the floater by flexible risers, wellhead jumpers, rigid flowlines, and electrohydraulic umbilicals.

Distance from the wellheads to P-36 was about 10 km. The major length of the rigid flowlines was tied in with 120-m long flexible jumpers to wellheads and 2,800-m flexible risers-flowlines to the platform.

Water depth in the installation area ranges from 1,867 m at the wellhead end to 1,360 m at the platform. Installation started in May-June 2000.

Total investment in Roncador has been estimated at $2 billion (OGJ Online, Mar. 15, 2001).

Lessons learned

Morais and colleagues described the pipeline system (three pairs of rigid flow lines, 4 and 6 in. in each bundle), the methods used to install them, and what was learned of value for future similar installations.

During mechanized welding of the 1,000-m pipestalks at the Port of Ubu near Vitoria, Brazil, high weld-rejection rates depressed production rates dramatically, said the authors. Rejections resulted from pipe dimensional tolerances being too wide in diameter and wall thickness and the difficulty of obtaining good pipe beveling with locally available equipment and services.

A solution was derived from results of an engineering critical assessment that allowed for a more-generous defect size and permitted completion of fabrication on an acceptable schedule.

During installation, the presence of several drilling rigs nearby forced modifications to the pipeplay plan. Moreover, stability problems with the pipeline end termination (PLET) structures caused delays. Extensive use of a remotely operated vehicle (ROV) finally secured the PLET to a sloping seabed.

Installation of the flexible flowline risers, umbilicals, and flexible jumpers in 1,870 m of water is believed by Petrobras to have set a depth record. But the installation encountered major problems in the 6-in. insulated risers that resulted in the orientation of the vertical connection modules (VCM) at the seabed, preventing installation to the PLET hubs.

The riser had to be recovered to the surface and the VCM reoriented to land successfully in a later attempt on the PLET.

Among the lessons cited from this project, the authors noted the high cost in both material and installation associated with the very long deadman anchor wires used in the rigid pipelay.

An alternative, they said, would be to perform a free-hanging pipe initiation with a small ROV-operated suction anchor or clump weight attached by a strop to the pipeline start-up head.

For the wellhead connection, they said a swivel could be built into the gooseneck of the VCM to eliminate rotational movement and misalignment of the VCM as a result of the flexibles twisting.

And they said more-detailed soil information and more time for optimization calculations and design of the PLETs would lead to a reduced size for these structures. Among other savings, they said, time and risk for handling and deployment of PLETs offshore could be significantly reduced with reduced sizes and weights.

Moreover, an alternative ROV tie-in system could allow the flexibles to be installed from the rigid-pipe lay vessel during start-up of pipelay, depending on contractor experience and flexibility allowed by the subsea connection system, they said.

And supplying umbilicals in a single continuous length with no need for offshore connections would re- duce offshore installation time and manufacturing costs.

Flexible-pipe installation

In a second paper, this time focusing only on the flexible pipe installed at Roncador, Neto and coauthors de- scribed the technical solutions incorporated in the design of flexible lines of up to 9.2 in. in 1,500 ft of water and 6 in. in 2,000 ft of water, which they said exceeds any previous design.

The authors said that the challenges encountered during flexible pipe development for Roncador Module 1, as well as for Marlim Sul, led to innovations in the structural design. With Petrobras's strategy to promote alternative solutions, CSO developed new flexible-pipe products for ultradeepwater applications.

These have been qualified down to 2,500 m, said the authors:

- A new hybrid catenary riser configuration that consists of a double hybrid riser of two flexible sections and one rigid section.

- Reeled steel catenary risers for deepwater development that allow for onshore welding in a controlled environment and a faster, safer, and less expensive installation.

- A new pipelay vessel, the Deep Blue, that can lay pipe down to 2,500 m of water.