OGJ Newsletter

Market Movement

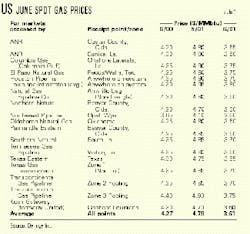

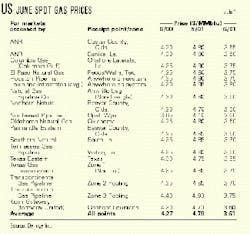

Natural gas prices take a plunge

US natural gas market observers are getting a rude awakening about the outlook for gas supply-demand and prices: Demand for gas is a good deal more elastic than many of the market bulls have presumed.

In a dramatic turnabout, US gas prices have fallen by almost $2/MMbtu in the past 2 months, and the bottom is not immediately in sight. Spot prices are down by more than $1/MMbtu in the past month alone and are even lagging year-ago price levels (see table).

Lofty prices for natural gas that were expected to persist through the spring and summer managed to put a pretty substantial squeeze on demand. And those same lofty prices sparked a pretty fair ramp-up in US production and imports of natural gas.

The upshot is that a US gas storage level that looked in the first quarter like it might approach zero in terms of working gas deliverability at the end of the last heating season has not only become a surplus, but one that threatens to linger to the next heating season. The slippage in prices from softening demand has sparked a frenzied pace in storage injection rates in the past 2 months. The rate of injection into storage since Mar. 31 has roughly tripled the rate of last year and is half again the average rate for the preceding 7 years.

Unless gas prices fall further, the likelihood is that storage could even top 3 tcf come Nov. 1, over the traditional ceiling expected for the start of the heating season.

Supply-demand shift

Lehman Bros. estimates that the supply-demand curve for US natural gas has shifted by as much as 6-7 bcfd, propelled by massive fuel switching to oil and curtailments.

At the same time, early data-from 46 producers that account for perhaps 70% of total US output-suggest that US gas production may have increased by as much as 1.3% from the fourth quarter and 0.6% from the same time a year ago.

In addition, DOE estimates that imports of gas, from Canada via pipeline and from a variety of sources (mainly Trinidad and Tobago) as LNG, rose by as much as 1 bcfd in the first quarter.

Meantime, while the consensus was that a surge in power demand for cooling would put a prop under gas prices, that has not happened yet, and it still may not happen to the extent that gas prices could regain the lofty levels of last winter. Lehman Bros. estimates that increased gas-fired power generation will boost demand for gas this summer by about 125-150 bcf. But so far, it's been a cool spring in the US, and the weather forecasts have indicated that summer isn't in a rush to get here.

"Gas prices many need to fall to allow increased consumption," the analyst said. "If consumers need to be induced to use an additional 500-550 bcf [less increased power generation demand of 125-150 bcf], natural gas prices may need to fall further."

So it follows that, in order to revive gas demand, natural gas prices will need to fall enough to spur a reversal in the fuel-switching trend, back to gas from residual fuel oil.

Without a revival in gas demand, working gas inventory levels could climb as high as 3.4-3.5 tcf by Nov. 1, estimates Lehman Bros.

null

null

null

Industry Trends

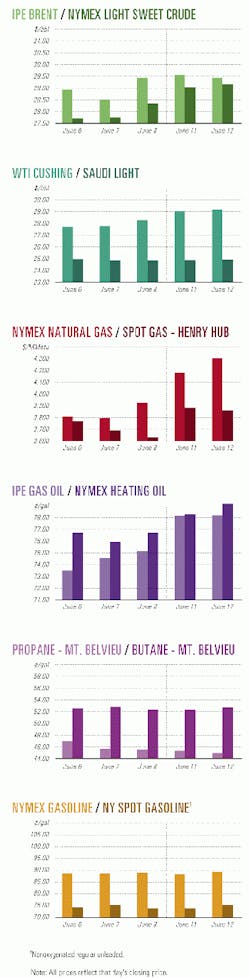

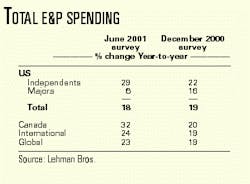

OIL AND GAS COMPANIES' GLOBAL E&P SPENDING WILL BE 23% HIGHER IN 2001 VS. THE SAME TIME A YEAR AGO, ACCORDING TO A LEHMAN BROS. SURVEY.

Based on a midyear update to its annual E&P survey of more that 350 companies, Lehman Bros. said the rise compares with the 19% rise in global E&P budgets seen in December 2000 (see table). Two factors are driving the increase, the analyst said: higher rig and services costs and increased cash flow due to higher commodity prices.

"Rig rates-particularly land rigs in the US and jack ups in the Gulf of Mexico-have risen more rapidly than companies estimated when putting together their E&P budgets. Thus, to drill the same number of wells in the original program, it is costing more money." Lehman Bros. said.

In addition, the firm found that the average commodity price assumptions on which 2001 budgets are now being based is a WTI price of $26/bbl for oil and an average wellhead price of $4.40/Mcf for natural gas.

THE SPAWNING OF US LNG PROJECTS CONTINUES.

Cheniere Energy said it is acquiring three land-lease op tions to develop LNG terminals along the Texas Gulf Coast. Cheniere declined to identify the locations.

Estimated to cost $300 million each, Cheniere said each terminal would be able to process 200 bcf/year initially and is slated to be operational within 6 years.

Regulatory permits from FERC as well as state, local, port authority, and the Coast Guard are expected to take 2-3 years, making the projects construction-ready in late 2003. Initial LNG imports are anticipated to start in late 2006.

Cheniere's announcement follows several others by companies looking to establish new US LNG terminals.

El Paso Corp. said in March it tentatively agreed to begin purchasing LNG from a Phillips Petroleum plant near Darwin, Australia, and ship it to California or Mexico. El Paso is still evaluating potential terminal sites.

Chevron also reported it is studying plans to ship LNG from Australia to the US West Coast by 2005. And in January, Enron said it is considering a new LNG import terminal in the Bahamas, connected by a 90-mile pipeline to Florida.

CMS Energy already operates an LNG terminal at Lake Charles, La., while Cabot Oil & Gas has an LNG terminal at Everett, Mass. Two other US LNG import terminals-at Cove Point, Md., and Elba Island, Ga.-are expected to reopen in 1-3 years.

Government Developments

A CONTROVERSIAL LAW DESIGNED TO PUNISH FOREIGN OIL COMPANIES THAT INVEST IN IRAN OR LIBYA SHOULD ONLY BE EXTENDED 2 YEARS the White House told the House Committee on International Relations last week.

House Subcommittee on the Middle East Chairman Benjamin Gilman (R-NY), the author of the Iran-Libya Sanctions Act, introduced a plan last month to renew the legislation through August 2006. Congressional leaders have pledged to renew the law before it expires in August (OGJ Online, May 23, 2001).

The Department of State said leaving the law in place for the full 5 years "would tie all our hands" as the administration seeks to formulate a new sanctions policy for Iran, Libya, and other countries that the US has labeled as rogue nations. It said a 5-year period would also "precipitate trans-Atlantic tension," because some US allies in Europe vehemently oppose the current legislation.

Both the House and Senate bills give President Bush wide latitude on whether to impose economic sanctions. The Clinton administration chose to use a provision in the law that allows the president to waive sanctions if that were deemed in the national interest.

No country or foreign company has ever been formally sanctioned under the law.

The oil industry opposes the legislation, saying it leaves US companies at a competitive disadvantage, angers allies, and does not discourage behavior the US finds objectionable.

THE UK LABOR PARTY named Brian Wilson-currently Minister of Parliament for the Shetland constituency of Cunninghame North-to succeed Peter Hain as Britain's energy minister, after Hain was promoted to the post of minister for Europe.

The move comes in the second wave of a cabinet shuffle by Prime Minister Tony Blair following his party's reelection June 7.

Wilson comes to his new post from the Foreign and Commonwealth Office, where he was a minister of state. He was previously at Scottish Office in 1999-2001 and a minister for trade at the Department of Trade and Industry in 1998-99.

THE CALIFORNIA PUBLIC UTILITIES COMMISSION last week issued a draft decision to exempt the state's refineries from rolling blackouts this summer.

In recent weeks, several California refineries had petitioned PUC for waivers after a commission rule in April failed to automatically exempt them from blackouts.

Gov. Gray Davis urged PUC to ensure electric power for refiners (OGJ Online, June 8, 2001): "Even a brief disruption of electricity can force a refinery into total shutdown for weeks. As a result of curtailment, the production and supply of critical petroleum products...can be jeopardized for several weeks."

Commissioner Carl Wood issued the draft decision, which PUC will consider at a June 28 meeting. Comments on the draft decision are due June 20.

Quick Takes

TOPPING REFINING NEWS IS SINOPEC'S PLAN TO REVAMP ITS NANJING REFINERY TO RUN MORE SOUR CRUDE.

Sinopec plans to expand to 13 million tonnes/year the 8 million tonne/year Jinling Petrochemical Corp. refinery. The changes will increase sour crude processing capacity to 7 million tonnes/year from its current 4 million tonnes/year.

The project will cost 1.412 billion yuan ($17 million), Sinopec said.

In recent years, the refinery upgraded its main units to handle Middle Eastern crudes with a sulfur content higher than that of domestic crudes.

As part of a 5-year plan, the plant will revamp its No. 3 crude distillation unit for more sour crude processing. Its other two crude distillation units will still run domestic crudes and low-sulfur foreign crudes.

Sinopec will build a 40 million tonne tank farm in Ningbo, Zhejiang province, and a pipeline from there to Nanjing to move the imported oil. Currently, crude is moved to the refinery by sea and the Yangtze River.

The 5-year plan also calls for construction of a 1.5 million tonne/year hydrocracking unit in two stages, an 800,000 tonne/year delayed coker, and other units.

Sinopec's goal in revamping the refinery is to satisfy domestic fuel demand and export some low-sulfur fuel oil.

Meanwhile, Sinopec Engineering let a subcontract to Siirtec Nigi for the revamp of the sulfur recovery units of two Iranian refineries. Siirtec will supply the basic engineering design package, proprietary equipment, and technical assistance to upgrade the 225,000 b/d Tehran refinery and the 112,000 b/d Tabriz refinery to allow for processing of crudes from the countries bordering the Caspian Sea.

Milan-based engineering contractor Siirtec said the Claus-type units will be able to recover up to 95% of sulfur.

The contract is part of Iran's oil swap program, an effort to provide a competitive export route for Caspian oil to outside markets. It involves the transportation of oil by pipeline from the port of Neka, on the Caspian coast, to the Tehran and Tabriz refineries in northwestern Iran.

In other refining news, Lyondell Chemical said all refining units at Lyondell-Citgo Refining near Houston are expected to be fully operational by June 20. This will allow LCR to return to full crude oil processing rates of 260,000 b/d. A coker unit had a flash fire on June 9 that was related to power failures associated with Tropical Storm Allison. As a result, the refinery has been running at half its rated capacity. LCR, a venture of Lyondell Chemical and Citgo Petroleum, operates a full conversion refinery on the Houston Ship Channel, processing crude oil to produce gasoline, low sulfur diesel, and jet fuel.

Australia's InterOil signed financing documents with the Overseas Private Investment Corp. for an $85 million loan for the construction of a refinery in Napa Napa, Papua New Guinea, on the western side of Port Moresby. (OGJ, Mar. 19, 2001, p. 46). Made of relocated, refurbished, and new equipment, the hydroskimming refinery will have capacity of 32,500 b/d. The $180 million refinery will be the first in Papua New Guinea.

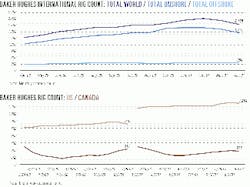

IN DRILLING NEWS, GMX RESOURCES HAS HIRED TWO NEIGHBORS RIGS FOR development drilling in East Texas starting this month.

GMX signed a 24-month exclusive contract for two of Nabors Drilling's land rigs and crews. The contact, valued at more than $20 million, covers payments to Nabors of $14,000/day for each rig, with the right to substitute other operators if it is unable to use the rigs continuously. More rigs may be added if warranted.

The company is targeting proved, undeveloped reserves, predominantly natural gas. It has an inventory of more than 400 drilling locations in East Texas, which it believes have potential in the Pettit, Travis Peak, and Cotton Valley formations at 6,000-10,000 ft.

The two rigs committed to GMX are working in Harrison and Panola counties of the East Texas basin. Each heavy-duty rig can drill to 12,000 ft.

CMS OIL & GAS DRILLED A WELL IN ALBA FIELD OFF EQUATORIAL GUINEA THAT HAS HELPED TO NEARLY DOUBLE PROVEN AND PROBABLE RESERVES, said field partner Noble Affiliates.

Alba Nos. 8 and 9 wells have established the field's estimated proven and probable reserves at more than 300 million bbl of liquid hydrocarbons associated with 4.6 tcf of natural gas.

Alba No. 9 is 2.4 miles from the nearest producing well in the gas-condensate field. It found 1,000 ft of gross pay and 732 ft of net pay. The well flowed 37.5 MMcfd of gas and 2,400 b/d of 46° gravity condensate through a 1-in. choke with 2,473 psi flowing tubing pressure and 197 psi bottom hole pressure drawdown.

The flow came from 120 ft of perforations. Noble estimated the well is capable of producing 100 MMcfd of gas and 6,200 b/d of condensate. Current Alba production is 16,000 b/d of condensate, 2,400 b/d of NGL, and 240 MMcfd of gas.

In other exploration news, PanCanadian Petroleum reported the discovery of oil in the Buzzard prospect in the UK North Sea. The well, 100 km northeast of Aberdeen, was drilled in 320 ft of water and encountered a 360-ft oil column. On test, the well flowed 6,547 b/d of light oil. The plan is to sidetrack the well to gauge the extent of the accumulation. The discovery lies on License P986, which PanCanadian operates with a 45.01% interest. Partners are Intrepid Energy North Sea, 30%; BG Group, 19.99%; and Edinburgh Oil & Gas, 5%. BG drilled and tested the well on the partnership's behalf.

Vaalco Energy reported the Etame 4V delineation well confirmed a large, apparently commercial discovery on the Etame Marin concession off Gabon, adding the company will develop the field on a fast-track basis. The well was drilled 1.5 miles from the discovery well to a depth of 2,222 m, and log analysis indicates a gross oil column of 32 m with net pay of 24 m. The well was cored and recovered 17 m of pay in the Gamba and Dentale formations. It cut 14 m in the Gamba sand, 30% more than other wells had found.

Kerr-McGee said a well on the Durango prospect on Garden Banks Block 667 in the Gulf of Mexico may enhance prospects for the Gunnison subbasin. Kerr-McGee said the subbasin includes Garden Banks Blocks 667, 668, and 669. Gunnison field is on Garden Banks Block 668. The Durango well, in 3,150 ft of water, found 200 ft of net gas pay. Kerr-McGee said the find could increase estimated reserves for the subbasin by 120 bcfe of natural gas. Previously, the company pegged Gunnison reserves at 150-250 million boe.

PLUSPETROL PERU PLANS TO HIKE OIL PRODUCTION FROM PERUVIAN BLOCK 1-AB BY 25% OVER 3 YEARS UNDER A NEW DEVELOPMENT CONTRACT.

The block is now producing 38,000 b/d. Pluspetrol plans to drill 14 new development wells and rework 30 wells over the 3-year period.

Under a new agreement with state oil agency Perupetro, Pluspetrol will market oil production from the block and pay royalties, rather than deliver the oil to the agency in exchange for a fee.

Pluspetrol will pay royalties of 8-20%, increasing progressively, on the incremental oil production. Production from existing wells pays 35% royalties.

Perupetro has also extended the contract to 2015; previously, it was set to expire in 2006.

PLANS TO DEVELOP ORMEN LANGE GAS FIELD IN THE NORWEGIAN SEA HAVE BEEN DELAYED TO PINPOINT PLACEMENT OF WELLS FOR THE DEVELOPMENT, operator Norsk Hydro said.

The project's partners-Hydro, Statoil, Esso E&P Norway, BP Amoco Norge, and Norske Shell-expect to submit the development and production plan for Ormen Lange to Norwegian authorities in autumn 2003.

Bengt Lie Hansen, head of Hydro's mid-Norway E&D sector, said studies of the area's seabed topography suggested more extensive mapping and preliminary work are needed to draft the best development concept for the Block 6305/5-1 field. "The area's complex sea topography and extreme subsea conditions have prolonged the process of gathering and evaluating data associated with the pipeline route," he said.

First gas from Ormen Lange is forecast for autumn 2007.

Elsewhere on the development scene, Statoil and its partners in Mikkel gas and condensate field, which straddles Blocks 6407/6 and 6407/7 in the Norwegian Sea, have awarded three contracts for the field's commissioning. FMC Kongsberg Subsea will design and manufacture subsea production systems, such as subsea templates and wellheads. The contract is worth nearly 400 million kroner ($42.4 million). Reinertsen Engineering, under a 6 million kroner contract, will design subsea systems such as pipelines and control cables. And under a 30 million kroner agreement, Kværner Oil & Gas will design modifications for the Åsgard B platform, which will receive Mikkel production. The field is planned to come on stream in 2003 (OGJ Online, Feb. 26, 2001).

AUSTRALIA AWARDED MAJOR PROJECT FACILITATION STATUS TO A PROPOSED DIMETHYL ETHER PLANT IN WESTERN AUSTRALIA'S PILBARA REGION.

That status level indicates federal and state approvals will be coordinated.

A consortium of Japanese companies, including Mitsubishi Gas Chemical, JGC, Itochu, and Mitsubishi Heavy Industries, are considering building the plant at a cost of $500-600 million (US).

Australia said that, to date, DME has only been used as a propellant or solvent, but it could also be used for other purposes, including feedstock for other plants and possibly as an alternative to diesel fuel and LPG.

The proposed plant would produce 4,000-7,000 tonnes/day of DME. If all approvals are granted, construction could be completed by late 2006.

CONSTRUCTION OF THE $2.8 BILLION BAKU-TBILISICEYHAN OIL EXPORT TRUNKLINE COULD BEGIN IN THE SECOND QUARTER OF 2002, if Georgia grants a right-of-way, according to Azerbaijan state-owned oil firm SOCAR.

SOCAR said that 7 months of basic engineering work on the 1,743 km pipeline is complete, and the year-long, $150-million field engineering work is set to start on June 20, if Georgia joins Turkey and Azerbaijan in approving the route mapped out for the line (see Watching the World, p. 30). The 42-in., 1 million b/d oil pipeline would include seven pumping stations and three metering systems.

The Azerbaijani government on June 5 approved the 500-m wide corridor needed for the pipeline's construction phase, building on the earlier clearance from Turkish authorities.

On current schedules, the line would be filled mostly with first phase production from Azerbaijan International Operation Corp.'s Azeri-Chirag-Guneshli oil field development, beginning at the end of 2004.

In other pipeline happenings, Kinder Morgan Energy Partners plans a $9 million expansion of a 550-mile products pipeline from California to Nevada. The expansion will increase the jet fuel supply to McCarran International Airport in Las Vegas. The Calnev pipeline transports gasoline, jet fuel, and diesel fuel to Las Vegas from Colton, Calif. It consists of an 8-in. jet fuel line that runs directly to McCarran and a 14-in. line that has excess capacity to transport products to the Las Vegas market. The project will expand the capacity of the 14-in. line to 128,000 b/d from 108,000 b/d. More handling and storage facilities will also be built at KMP's Las Vegas terminal. The expansion project is under way and is expected to be completed in the second quarter of 2002.

Correction

Tulsa-based Unit Corp.'s revenues and earnings appeared in the wrong columns in the table listing US oil and gas companies' first quarter 2001 financial results (OGJ, June 4, 2001, p. 21). Unit's first quarter revenues and net income, for 2001 and 2000, respectively, were $70.4 million vs. $37.2 million and $19.2 million vs. $3.6 million.