Gulf lease sales attract $3.7 billion in high bids

Two federal sales of offshore oil and natural gas leases in the eastern and central planning areas of the Gulf of Mexico have attracted a total of more than $3.7 billion in apparent high bids. Central Gulf Lease Sale 206 and Eastern Gulf Lease Sale 224, both conducted by the US Department of the Interior’s Minerals Management Service, were held back-to-back Mar. 19 in New Orleans.

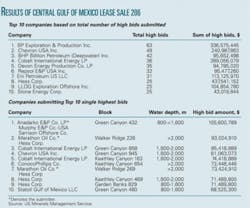

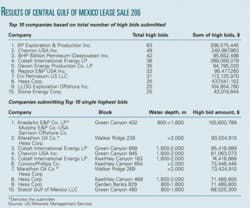

Central Lease Sale 206, held first, attracted $3,677,688,245 in apparent high bids, setting a record in US leasing history for high bids since area-wide leasing began in 1983, MMS reported. In Sale 206 the agency received 1,057 bids from 85 companies on 615 tracts.

For Eastern Lease Sale 224, held second, MMS received 58 bids from 6 companies on 36 tracts resulting in $64,713,213 in apparent high bids.

“Today’s lease sales mark an important milestone in sharing substantially increased revenue from offshore oil and gas development with states willing to support it,” said Interior Sec. Dirk Kempthorne. “Beginning with Lease Sale 224, Louisiana, Mississippi, Alabama, and Texas will receive a greater share in all these revenues, including bids, rental payments, and royalties,” he said.

Sale details

Central Sale 206 offered 5,569 tracts comprising about 29.8 million acres in federal areas off Louisiana, Mississippi, and Alabama. The acreage lies 3-230 miles offshore in 3-3,400 m of water.

About 34% of the tracts receiving bids in this sale are in ultradeep water, more than 1,600 m. The deepest tract to receive a bid is Lloyd Ridge Block 286, which lies in 3,076 m of water. The highest bid received on a block was $105,600,789 submitted by Anadarko Exploration & Production Co. LP, Murphy Exploration & Production Co.-USA, and Samson Offshore Co. for Green Canyon Block 432.

Eastern Sale 224 encompasses 118 whole or partial unleased blocks covering 546,971 acres in the gulf’s eastern planning area. The acreage is 125 miles and more offshoresouth of the Florida panhandle and west of the Military Mission Linein 810-3,113 m of water.

The sale is the first in which the revenue-sharing provisions of the Gulf of Mexico Energy Security Act of 2006 (GMESA 2006) will start immediately. The states of Alabama, Mississippi, Louisiana, and Texas will share in 37.5% of the high bids on whole and partial blocks in the eastern planning area. These four gulf producing states also will share in 37.5% of all future revenues generated from the acreage leased today in the gulf’s eastern planning area.

The enhanced revenue-sharing program was mandated by GMESA 2006, and no royalty relief will be issued with these leases.

With Central Sale 206, the royalty rate for blocks in all gulf water depths is increased to 183⁄4% from 162⁄3%, MMS said.

In addition, 12.5% of revenues from today’s lease sales will be deposited into the Land and Water Conservation Fund for use by states to enhance parklands and for other conservation projects.

Eastern Sale 224 is the only sale scheduled to be held in the eastern gulf under the current 5-Year Outer Continental Shelf oil and gas leasing program. The acreage included in this latest eastern sale was last available for lease in 1988.

Currently there are more than 7,000 leases in the gulf that account for 25% of the nation’s domestically produced oil and 15% of the domestically produced natural gas.

Top bidders

The top five companies submitting the highest dollar amount of high bids for Central Sale 206 included Hess Corp., 25 bids, $437,541,152; Cobalt International Energy LP, 36 bids, $389,056,079; BP Exploration & Production Inc., 63 bids, $336,575,445; ConocoPhillips Co., 20 bids, $323,891,298; and Chevron USA Inc., 49 bids, $240,987,863.

The top five companies submitting the highest dollar amount of high bids for Sale 224 included BHP Billiton Petroleum (Deepwater) Inc., 27 bids, $47,858,420; Anadarko E&P, 7 bids, $12,754,728; Murphy Exploration & Production Co., 7 bids, $3,188,682; Eni Petroleum US LLC, 1 bid, $527,006; and Shell Offshore Inc., 1 bid, $384,377.