OGJ Newsletter

Market Movement

Oil market slowly rebalancing

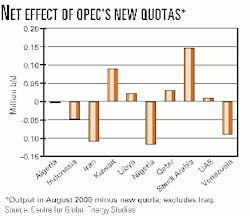

While the announcement of an 800,000 b/d OPEC output hike effective Oct. 1 may have done a little to improve oil consumer anxiety and take a bit of the wind out of the oil price sails, the real production increase is pretty negligible. Because a number of key OPEC producers are already exceeding their quotas, the increase is likely to be more along the lines of 300,000 b/d, estimates the London-based Cen- tre for Global Energy Studies (see chart).

For now, OPEC's decision to meet again in November and review the market effect of its increased output is a wise one, declares CGES: "By then, we should know more about the stock position going into the winter.

"What is becoming clearer is that, while products will remain tight, the crude market is slowly rebalancing itself as more oil heads for the refining areas following OPEC's 1.3 million b/d increase between June and October."

OPEC's output increases since the first quarter have added 3 million b/d of crude to global oil supplies this year, resulting in an overall global stockbuild of 500,000 b/d, CGES calculates. This stockbuild has been critically needed to replenish stocks that have been at dangerously low levels while demand continues to rise.

But if OPEC continues to produce at this higher level-which, counting Iraq, CGES pegs at about 29.3 million b/d in October-that will result in a global stockbuild of 2.2 million b/d in the first half of next year. Consequently, this increase will create another overhang of surplus inventory and put downward pressure on oil prices again. So CGES advises that, if OPEC wants to avoid a situation where Brent is starting to head south from $20/bbl again, OPEC should refrain from putting more oil on the market in November and even consider steep cuts next March.

The analyst contends, "To keep the price near $25/bbl in 2001, OPEC will need to react more quickly to developments than it has done this year."

Increased drilling won't quell natural gas prices

Despite increased gas drilling, producers have warned that supply will be insufficient to avert further gas price spikes in the US this winter. But energy company officials-speaking at a natural gas summit of state governors last month in Columbus, Ohio-said gas shortages were unlikely.

Producers at the summit, sponsored by the Interstate Oil & Gas Compact Commission, said they were responding to $5/Mcf prices with stepped-up drilling activity, but they contend the resulting production increases won't come in time to take the pressure off prices this winter. In fact, producers suggested that, even for the mid-term, prices will remain higher than they have averaged recently.

The possibility of gas shortages this winter was downplayed but not ruled out.

"We're trying to play catch-up, but we can't turn it around overnight," said Robert Allison, chairman and CEO of Anadarko Petroleum.

He said current high prices are the result of the price collapsing to about $1.50/Mcf a couple of years ago. He noted that the industry infrastructure was damaged and exploration and drilling were slashed as a result of that price slump. Allison said there is a deliverability problem brought about by low and volatile energy prices. "The resulting lack of deliverability is behind today's high prices," he said.

When prices fell, drilling was insufficient to maintain-much less increase-deliverability. Demand for gas continued to increase, as did prices. Producing company executives at the conference predicted gas prices will come down as deliverability increases, and they insisted the government should let supply and demand determine the market equilibrium price.

Jack Golden, group vice-president, exploration, for BP, is optimistic that supply could be sufficiently increased in a 3-year time frame by infill drilling in western Canada, the shallow Gulf of Mexico, and onshore basins.

Golden painted a bright picture for long-term gas supply. He said significant supplies could be made available from the deepwater Gulf of Mexico and North American arctic regions and from LNG imports. He said some studies estimate there are 1,200-1,600 tcf of untapped gas resources in the US.

null

null

null

Industry Trends

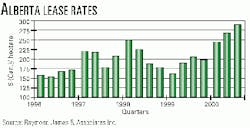

Competition for Canadian exploration acreage is driving lease prices to levels not seen since the 1980s, reports Raymond James & Associates Inc.

The firm said higher oil and gas prices have prompted Canadian producers to pay close to $300 (Can.)/hectare, topping the 1997 peak of $250/hectare.

Raymond James said, "The increase in drilling should translate into new highs for oil service capacity utilization and the number of wells drilled in the country."

It said that, over the past 2 years, prices for Canadian leases in Alberta, which represents 80% of the Canadian market, have risen more than 80% (see chart).

Raymond James noted that with gas prices above $5/Mcf and oil prices surpassing $35/bbl, Canadian producers are generating record cash flows for reinvestment.

The analyst said robust leasing levels suggest that producers expect a sustained market for high oil and gas prices that would compensate them for the current lease prices. "This would also suggest much higher levels of drilling activity on the horizon."

The government-directed push for renewable energy has taken another key step forward.

The G8 governments' task force on renewable energy sat down for the first time, in Rome, with the stated aim of mapping out a plan to expand use of renewables on a global scale-with a "particular" emphasis on developing countries, where an estimated "2 billion people do not have access to reliable sources of energy."

First set up at the G8 summit in Okinawa, the task force is cochaired by Royal Dutch/Shell Chairman Mark Moody-Stuart and the Italian Ministry of the Environment's Corrado Clini. It is charged with "recommending practical actions that G8 governments can take to help remove the barriers [to use of renewables]."

"The task force is charged with indicating the way to 'square the circle' of the environmental, social, and economic sustainability of renewable energy," said Clini.

"The 'new' renewable technologies, such as solar, wind, biomass, small hydro, geothermal, and hydrogen generated by renewable energy," he suggested, "can meet a significant part of the future demand for primary energy in developing countries."

Moody-Stuart echoed that view but remarked that, for the "use of renewable sources to expand rapidly, they must be made commercial, so that investment is attached."

First up for the task force is the creation of an advisory group and a website. It is scheduled to next meet in The Hague, the Netherlands, on Nov. 20, when the global climate treaty-related COP 6 (Conference of the Parties) meetings are held, before making its recommendations to the G8 heads of governments summit in Genoa, Italy, next year.

Government Developments

The Clinton Administration last week said it will release 30 million bbl from the US Strategic Petroleum Reserve over 30 days to reduce crude oil prices and increase heating oil and gasoline stocks (see Editorial, p. 27, and Watching Government, p. 35). Oil could be taken as of Oct. 8, and all 30 million bbl will be released by Nov. 1.

Energy Sec. Bill Richardson said, "The president's reasons for taking this action are very clear. Portland, Me., will be in the 50s. So will Minneapolis. And it snowed in the Rockies last week. We need to make sure that American families keep warm this winter."

He said US distillate stocks are 19% lower than they were a year ago. On the East Coast, where 36% of homes use heating oil, stocks are 40% under year-ago levels. In New England, they are 65% lower.

Richardson said, "The temporary infusion of 30 million bbl of oil into the market will likely add an additional 3-5 million bbl of heating oil this winter, if refineries could match higher runs and yields seen in the past. Increased supplies will also help our diesel truck drivers, who deliver the sole source of supplies for 70% of America's communities."

Richardson said that because companies will return more crude to the SPR than they took, "This will further increase the nation's protection against potential or actual energy supply disruptions. That's good energy policy."

Vice-Pres. Al Gore had urged Clinton to draw down part of the SPR to force down oil prices before the onset of winter. The Democratic presidential nominee also urged Congress to appropriate $400 million in additional energy assistance for low-income families and tax credits to heating oil distributors to help them build stocks.

Gore's proposal had called for about 5 million bbl of oil to be offered from the 571 million bbl SPR initially, with more sales later "to further stabilize prices."

Gore again attacked oil companies when making the proposal. "Crude oil prices are at a 10-year high, while the big oil companies have seen their profits increase by two to three times in the past year."

US House Majority Whip Tom DeLay (R-Tex.) said, "Al Gore provided his comprehensive energy strategy-shift the blame and tap the reserve. Tapping the SPR will not lower the price of home heating oil, since American refineries are producing home heating oil at near full capacity already."

API said, "This country's current situation has been a long time coming, and it cannot be remedied overnight. The SPR was established by Congress to address supply disruptions. It was not intended, and should never be used, to manipulate prices.

Quick Takes

CHINA'S PETROCHEMICAL EXPANSION LOOKS TO BE BACK ON TRACK after a slowdown the past few years in the wake of the Asian economic meltdown.

China has approved a proposal to develop a multibillion-dollar petrochemical complex at a refinery in Fujian Province, China, said ExxonMobil.

The project-which includes an expansion of the Fujian Petrochemical oil refinery-will involve the construction of a 600,000 tonne/year ethylene steam cracker, a 450,000 tonne/year polyethylene unit, and a 300,000 tonne/year polypropylene unit, together with chemical derivatives manufacturing units and related distribution and marketing facilities.

The petrochemical complex will be integrated with the existing refinery, which will expand its capacity to 240,000 b/d from the existing 80,000 b/d. The venture will be a partnership of Fujian Petrochemical, 50%; ExxonMobil, 25%; and Saudi Aramco, 25%.

BP said that its Yangtze River Acetyls Co. (Yaraco) JV submitted a feasibility study to the Chongqing municipal government for a project to produce acetate esters in China. The proposed plant will have a capacity of 80,000 tonnes/year of ethyl and butyl acetate. BP expects the plant to be commissioned during the first half of 2002.

The plant will be in Chuanwei, Chongqing, and will be fully integrated into the existing Yaraco 200,000 tonne/year acetic acid facility in Chongqing, said BP. The Yaraco JV consists of BP Chemicals, 51%; Sinopec Sichuan Vinylon Works, 44%; and Chongqing Investment & Construction, 5%.

Chevron Chemicals began commercial production at its polystyrene plant at Zhangjiagang in eastern China's Jiangsu province, near Shanghai.

Chevron will export about 50% of the 100,000 tonne/year output; the rest will be sold in China.

Construction of the $80 million project started in 1998 and finished in April 2000. Chevron plans to expand the plant's capacity to 200,000 tonnes/year in 2003 or 2004.

In other petrochemical action, Shell Chemicals placed an $8.5 million order for TotalPlant Solution (TPS) controls, transmitters, engineering, and installation from Honeywell's industrial automation and control business to be used as part of an expansion project at its Geismar petrochemical plant near Baton Rouge, La. (see photo). The order is part of a 4-year global supply agreement that Honeywell recently signed with Shell Services, said Honeywell. Geismar will use the TPS system to expand process operations and maintenance. - Geismar petrochemical plant complex.

TOPPING REFINING NEWS this week, Sunoco plans to begin routine maintenance on a 93,000 b/d FCCU at its Marcus Hook, Pa., refinery.

Sunoco's Marcus Hook and Philadelphia refineries make up Sunoco's 500,000 b/d capacity Delaware Valley refinery complex.

Other associated processing units at Marcus Hook, including the gas plant, the alkylation unit, and an 85,000 b/d crude unit, will also be shut down for scheduled maintenance, which is expected to take 4 weeks.

Sunoco expects to complete repair and turnaround work on the 140,000 b/d crude unit at its Philadelphia complex right away. The crude unit, which consists of 50,000 b/d and 90,000 b/d sections, was damaged in a Sept. 7 fire.

Agip Nigeria plans to invest $1 billion in the Nigerian oil industry in the next 3 years to increase its production there to 360,000 boe/d from 240,000 boe/d, said Gros Pietro, chairman of Agip's parent firm, ENI.

Pietro said that Agip's worldwide production currently stands at 1 million b/d. The company plans to increase its global output to 1.8 million b/d.

Pietro was in Nigeria to witness the official inauguration of Nigeria's $3.8 billion LNG project by Nigerian Pres. Olusegun Obasanjo. Agip holds 10.4% equity in the Nigerian LNG project.

Pietro said the company is also determined to end gas flaring from its operating areas in Nigeria by 2004. It would do this through reinjecting gas and using gas for power generation. Agip Nigeria plans to build a power generating plant in Kwale in southwestern Nigeria within the next 30 months.

In other production action, Saudi Aramco awarded General Dynamics Worldwide Telecommunication Systems a $27.8 million contract to build a new fiber-optic network connecting its Persian Gulf offshore oil platforms to the mainland. Design and procurement work is slated to begin in November, followed by installation and commissioning of the new network, plus removal of the existing microwave equipment, in 2001. Project completion is slated for August 2002. The synchronous digital hierarchy network will support high-bandwidth voice and data communications, allowing land-based monitoring of the offshore platforms.

Triton continues to press its Equatorial Guinea search despite a dry hole.

Triton said it would plug and abandon its Ceiba-6 delineation well off Equatorial Guinea after initial logs failed to find oil and gas.

Ceiba-6, a significant step-out well outside and southeast of the Ceiba field in Block G, was drilled to 10,388 ft TD about 2.5 miles south of the Ceiba-4 well.

Next up is the G-2 wildcat, which will test a prospect at a greater depth than Ceiba field-about 3 miles north and east of the field along the same fairway.

Depending on the well results, the G-2 well could be followed by up to five additional exploration wells through the first half of 2001.

Triton plans to produce 120,000 b/d of oil from Ceiba field by 2001. Operator Triton holds an 85% working interest in Block G and F, while Energy Africa holds the remaining 15%.

In other happenings on the exploration front, Halifax-based Corridor Resources reports a natural gas discovery with its McCully No. 1 wildcat, drilled about 7 miles northeast of Sussex, NB. Operator Potash Corp. of Saskatchewan will pay Corridor's costs on the project to earn a 50% interest in Corridor's oil and gas rights in 3,459 acres in the immediate area. The McCully well will be the first to test a petroleum prospect in the Maritimes basin based on use of 3D seismic, PCS said.

Indo-Pacific Energy reported that Phillips Petroleum, operator of permit ZOCA 96-16 in Australia's Timor Sea, will begin drilling the Coleraine-1 exploration well with the Ocean General semi. Indo-Pacific said it would take at least 4 weeks for the well to reach TD at 11,000 ft. Indo-Pacific has a 10% interest in Coleraine-1, fully carried by Phillips through the cost of drilling and testing the well.

Qatargas plans to expand its annual lng capacity to 8.2 million tonnes from 6 million tonnes.

Qatargas owns and operates the country's first and largest LNG plant, which uses gas from the country's giant North field.

The company's managing director, Faisal al Suweidi, said he expects approval by yearend from the firm's board of directors for a debottlenecking operation that would help in raising production.

Currently, LNG produced from three trains is supplied to eight long-term customers in Japan.

While efforts would be made to expand its spot sales, the company's contractual obligations to supply LNG to Japan, other parts of Asia, and Europe, as well as the US, are the company's priorities, said al Suweidi.

Woodside Energy unveiled its development plan for Echo-Yodel gas-condensate field on Australia's North West Shelf.

The field-in 140 m of water, 120 km northwest of Dampier, Australia, and 23 km southwest of the Goodwyn Alpha platform-will be developed via subsea facilities.

The scheme calls for two subsea production wells to be tied back to Goodwyn Alpha via a 12-in. pipeline. Production will be commingled with production on the Goodwyn platform, processed, and exported to shore in an existing trunkline. Echo-Yodel is expected to produce 4 tcf of gas and 37 million bbl of condensate over its 4-5-year life span.

Slated to begin in 2002, Echo-Yodel production will help compensate for the natural decline in gas output from the much larger Goodwyn field, said Woodside.

In other development action, Petro-Canada reported that development of Terra Nova oil field on the Grand Banks off Newfoundland will have cost overruns, with production start-up delayed until mid-2001. The estimated cost of development has increased by $300 million (Can.) to $2.5 billion. The company says overall costs of the project increased because more work than anticipated was needed to complete an FPSO vessel for the project. Reserves are estimated at up to 400 million bbl of oil at Terra Nova field-which is 217 miles southeast of St. John's, Newf.-and initial production will be 49,000 b/d in 2001, increasing to 129,000 b/d by the end of 2002. Petro-Canada holds a 34% interest in the project.

Coflexip has completed fuel-recovery work from the sunken erika tanker.

Coflexip Stena Offshore wrapped up the delicate subsea operations aimed at pumping out some 11,245 tonnes of heavy fuel from the Erika tanker, which sunk in high seas off the coast of Brittany, France, last December (OGJ, Dec. 20, 1999, p. 38).

TotalFinaElf awarded the consortium of CSO and Stolt Offshore a clean-up contract in April to "recover and neutralize" the fuel remaining in the two sections of the Erika wreck, separated by some 10 km in 125 m of water. CSO's work on the Erika started in June with a survey of the wreck sections using a Triton XL ROV and with preparations to its hull involving drilling and installing 64 valves though which the fuel could be safely recovered.

TotalFinaElf plans to spend 850 million francs on clean-up operations linked to the accident, including 500 million francs on "neutralization" of the wreck, and 200 million francs on disposing of the heavy fuel and waste materials onboard.

In other tanker happenings, BP awarded General Dynamic's subsidiary National Steel & Shipbuilding a $630 million contract for the construction of three double-hulled tankers for the carriage of crude oil from Valdez, Alas., to US West Coast ports. The contract includes options for three additional vessels. The design includes redundant diesel-electric propulsion systems in independent engine rooms, two propellers, and twin rudders. The new 185,000-dwt design will have capacity of 1.3 million bbl.

Topping pipeline news, Enterprise Products Partners plans to expand its Gulf Coast midstream system with a recent acquisition.

Enterprise agreed to buy Acadian Gas, a unit of Shell Oil affiliate Coral Energy, for $226 million.

The move allows Enterprise to meld the Acadian assets-which include the Acadian, Cypress, and Evangeline natural gas pipeline systems in southern Louisiana-with its Gulf Coast gas processing and NGL fractionation, pipeline, and storage system.

The purchase is expected to be immediately accretive to earnings and cash flow, said the company. The three systems include more than 1,000 miles of pipeline and more than 1 bcfd of capacity. The systems have interconnects with 12 interstate pipelines and four intrastate pipelines, plus a bidirectional interconnect with the Henry Hub, said Enterprise. Enterprise anticipates closing the deal in fourth quarter 2000.

Elsewhere on the pipeline front, if Alberta Energy (AEC) and its partners receive approval to build an $850 million (US) heavy crude oil pipeline in Ecuador, AEC says, they could begin the project within several months. The Ecuadorean government has granted two parties-Williams, Tulsa, and an international consortium led by AEC-the right to bid on the project. It rejected a proposal by the Ecuadorian Army Corps of Engineers and a Brazilian combine including Petrobras on grounds of financing. The AEC group includes Repsol-YPF, Agip, Occidental, and Kerr-McGee. The 311-mile crude line would run from Lago Agrio in Ecuador's Oriente jungle region across the Andes to the seaport of Esmeraldas. The Williams proposal calls for a 500-km, 310,000 b/d heavy oil pipeline it estimates would cost no more than $575 million. AEC interest in the project, if approved, is expected to be 25-33%.