Chile seeks partners for 21 mature fields

Chilean national oil firm Empresa Nacional del Petróleo (ENAP) is seeking joint venture partners to help it reactivate mature oil and gas fields in the Magallanes basin, also known as the Austral basin.

ENAP is seeking to form strategic partnerships for the purpose of increasing, and in some cases restarting, production from these aging fields. The fields are Chile's largest. ENAP is hoping that an influx of new technology will help it increase Chile's oil production and reduce the need for imports. The country now produces only a small fraction of the crude needs of its three refineries, which have a combined capacity of 205,000 b/d.

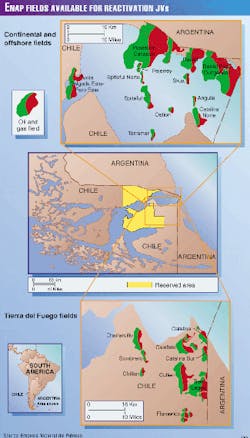

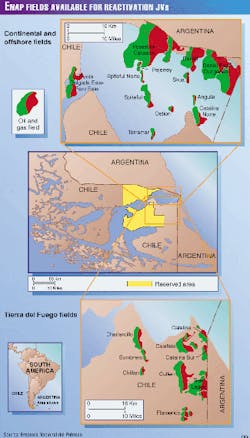

The fields on offer include four on the mainland, eight offshore in the Strait of Magellan, and nine on Tierra del Fuego (see map). Prospective partners can take single or multiple fields, says ENAP. All zones are included, as are exploration and development opportunities.

"We want companies with new technical ideas and solid field reactivation expertise interested in forming mutually beneficial, strategic partnerships," said ENAP.

The firm has some data available at the Houston office of Sipetrol USA Inc., its international subsidiary. It is bringing even more data to Houston, and the full data set can be viewed at Punta Arenas, Chile. ENAP is envisioning a service contract-type arrangement for the projects.

"We are currently preparing a model-form contract," said Daniel J. Reid, ENAP's Consulting Project Director on the 21-field offering. "We envision, however, a service contract not unlike Venezuela, whereby the joint venture partner is a contractor that applies its efforts toward increasing existing production-or re-establishing production, as the case might be-and is compensated on the basis of a negotiated percentage of the increased production over an agreed baseline."

The price of the crude will be based on an international basket of crudes, says Carlos Herrero Pisani, director of exploration for ENAP.

"Unlike Venezuela, however," said Reid, "all aspects of such an arrangement will be negotiable." This includes the extent of a "buffer zone" around each field.

Technological challenge

The 21 Chilean fields available for reactivation are quite mature. If production were to continue without intervention, they would be considered near or at the ends of their respective production decline curves.

Technology is the clear solution to this problem.

Only one 3D seismic survey has been shot in these areas, and that was over Calafate field. And one horizontal well was drilled in the early 1990s on the north side of the strait. But the target was not Springhill, the primary producing formation. It was Lower Cretaceous fractured shales, and the well never produced, said Herrero.

Two of the fields have been water-flooded: Sombrero in the mid-1970s and Catalina in the mid-1980s. There have been no other advanced or enhanced recovery techniques employed, only gas reinjection, says Herrero.

ENAP envisions reactivation projects to involve use of techniques such as 3D seismic, development drilling, infill drilling, horizontal drilling, secondary recovery, and enhanced oil recovery. For this reason, major international service companies are a prime target of ENAP's, says Reid. While companies can negotiate on more than one field, ENAP would prefer to form JVs with several companies in order to bring in a variety of technical ideas and ensure that the projects advance simultaneously.

Original oil in place for all the reservoirs is 1.2 billion bbl. Current ENAP production from the area is 45 MMcfd of gas and 6,900 b/d of oil. Well spacing is 1,000 m for gas, 400-500 m for oil.

Remaining reserves data on the fields are confidential, says Reid, "but (the data) may not be very relevant, since we are looking for new ideas to increase reserves and production."

There are two major plays associated with the fields on offer: the Springhill and fractured Jurassic volcanics. But there are some other possibilities beneath the Springhill, says Herrero.

Some typical water cuts (instantaneous) for Springhill sandstone reservoirs are: Spiteful field, 60%; Terramar, 85%; and Cullen, 60%. For the Tobifera (Jurassic volcanics), they are: Sombrero Este, 70%; Caviote Norte, 80%; and Cisne, 90%. Some GORs (instantaneous) are: Spiteful, 200 cu m/cu m; Terramar, 267; Cullen, 757; Sombrero Este, 125; Caviote Norte, 383; and Cisne, 1,307.

The most attractive fields, according to Reid, are Spiteful, Daniel, Daniel Este-Dungeness, Cullen, Calafate, and Tres Lagos.

ENAP production and processing facilities include: 20 onshore gathering centers, 45 offshore platforms, four marine terminals for shipping liquid products, two gas processing plants, an oil processing plant, and a network comprising more than 3,000 km of oil, gas, and gas liquids pipelines. The platforms are mostly production platforms, and all well slots are filled. Maximum water depth in the strait is 60 m.

Available for drilling and workover are three land rigs capable of drilling to 4,000 m, three workover rigs, and one modular offshore rig rated to 4,000 m.

Herrero estimates the cost to drill a well to 2,000 m or less at $600,000-800,000, including logs, casing, and tubing.

Response

ENAP publicly revealed its fields offering in early December. At that time, Sipetrol USA Pres. Alberto Harambour said his firm had already received some inquiries from well-known companies based on private communications.

In early January, Reid said, "The response has been quite good so far, with many companies calling for more information. We anticipate setting up a preliminary data room in Houston that will contain much of the core information needed to evaluate the fields. This should be ready by Jan. 14."

The operational aspects of the offering are attractive, says Reid, because in Chile, "Corporate taxes are reasonable, contracts are guaranteed, and funds are readily exported." He added, "ENAP is very progressive, in terms of other national oil companies, as can be seen by the types of ventures it is willing to negotiate. Everything is truly negotiable," he stressed. "We are not charging for data packages or for the right to negotiate, etc. No bidding scenarios are anticipatedellipse

"We will keep the process open until we feel reasonable avenues for industry participation have been accomplished," Reid said. "ENAP will begin direct joint-venture negotiations on single or multiple fields with any interested and qualified parties as soon as they indicate a desire to do so."

Chilean exploration

Reactivation of mature fields is, of course, not the only upstream opportunity available in Chile. The government is in the process of negotiating with various Chilean and foreign companies for exploration agreements on acreage not involved in the reactivation program.

In early December, Herrero said Chevron Corp.'s San Jorge unit was expected to sign an exploration agreement with the government for Caupolican block within a few weeks. And a company called Norbay is negotiating for Victoria field on Tierra del Fuego. Meanwhile, Chilean power producer Gener SA has signed an exploration agreement for Fell block. And Lago Mercedes field on Tierra del Fuego is on offer, says Herrero.