El Paso Energy to purchase Coastal Corp. for $16 billion

El Paso Energy Corp. is acquiring Coastal Corp. for $16 billion, expanding what is already the largest gas pipeline network in the US.

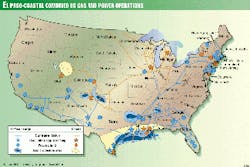

The Houston-based firms claimed the united company would be the world's largest gas transporter. Their combination would create a firm with 56,600 miles of interstate pipelines and 20.7 bcfd of capacity. It would be the nation's second largest gas gatherer and third largest gas producer (after BP Amoco PLC and ExxonMobil Corp.), with reserves of more than 5 tcf of proved gas equivalent.

The combined firm is also poised to take advantage of the converging gas and power markets. Together the companies control more than 12,000 Mw of power generation capacity worldwide.

El Paso says the merger will bring operating savings of at least $200 million/year and add more than 5% to earnings per share in 2001 and 2002.

The companies say the total enterprise value of their combined company would exceed $32 billion, with an equity value of about $19 billion. It would have 17,900 employees, although some layoffs are expected.

The merger is expected to be completed in the fourth quarter of this year.

Potential

William Wise, El Paso president and CEO, said, "With this merger, El Paso Energy will become the only company that is one of the top five companies in every sector of the wholesale natural gas and power arena, including natural gas transmission, production, gathering and processing, marketing, and power generation.

"As power generation becomes the largest consumer of natural gas, we believe integration along the full value chain will enhance profitability in each segment of our business."

Wise added, "Our two companies complement each other in strategically compelling ways. El Paso Energy's coast-to-coast pipeline system reaches from the west coast to the southeastern US and then moves upward along the eastern seaboard to key markets in the Northeast [see map]. Coastal's ANR pipeline system covers strategic areas across the Midwest and Great Lakes regions, and its Colorado Interstate Gas system traverses the Rockies."

David Arledge, Coastal chairman, president, and CEO, said, "This transaction will provide the foundation of assets, personnel, and financial strength to accelerate this growth and create a truly unique company that is a major player in all aspects of the converging North American natural gas and power markets."

Details

The $16 billion deal included $6 billion of assumed debt and preferred equity.

Each share of Coastal common stock and Class A common would be converted on a tax-free basis into 1.23 shares of El Paso Energy common. The outstanding convertible preferred stock of Coastal would be exchanged for El Paso Energy common on the same basis as if the preferred stock had been converted into Coastal common stock immediately prior to the merger.

It is expected that the merger will be accounted for as a pooling of interests.

Ronald Kuehn Jr. will remain El Paso chairman until Dec. 31, when Wise will become chairman of the combined company, in addition to continuing as president and CEO. Arledge will become vice-chairman and will oversee the nonregulated operations of the combined company.

El Paso will designate seven directors and Coastal five for the combined company's 12-person board.

The merger is subject to the usual stockholder and regulatory approvals.

Wise notes that El Paso is experienced with large mergers. It completed a $6.6 billion purchase of Sonat Inc. last fall (OGJ, Nov. 1, 1999, p. 46).

He said transition teams would ensure "that we capture the best ideas, practices, and personnel from each organization and achieve a smooth transition to a single organization immediately upon closing."

El Paso Energy subsidiaries are: El Paso Natural Gas Co., Tennessee Gas Pipeline Co., Southern Natural Gas Co., El Paso Field Services Co., El Paso Merchant Energy Co., El Paso Production Co., and El Paso Energy International Co.

Coastal has assets of more than $14 billion and subsidiary operations in gas transmission, storage, gathering-processing, and marketing; oil and gas exploration and production; petroleum refining, marketing, and distribution; chemicals; power production; and coal.