Drive to lower transportation costs key for many gas projects

Wide fluctuations in energy prices have caused some concern over the viability of new capital-intensive natural gas projects.

While some LNG cargoes, for example, were postponed in the past 2 years, the LNG trade has recently been riding a resurgent wave of new projects.1

The outlook for natural gas continues to brighten in the first decade of the 21st Century. It is clean-burning, efficient, and usually cost-competitive with other fossil fuels.

Production; end use

Proved worldwide reserves of natural gas have been increasing steadily for 20 years, reaching 146 trillion cu m. At current production levels, these reserves will last 63 years.

About 39% of proved reserves are in the former Soviet Union (FSU), and 34% are in the Middle East. North America, Europe, and the FSU consume more than 75% of world gas production.

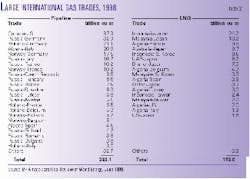

About 446 billion cu m (bcm) of the 2,272 bcm of natural gas produced in 1998, or 20%, was traded internationally. Three quarters of this international trade, or 333 bcm, were transported through pipelines and the rest via LNG (Table 2).

The Russian Federation was the largest gas exporter (120 bcm), the US the largest importer (88 bcm). The largest amounts of gas imported in 1998 were by the US from Canada (87 bcm), followed by Germany from Russia (32 bcm), and Japan from Indonesia (24 bcm).2

Worldwide, natural gas use continues to grow faster than does petroleum consumption. While current natural gas use is about half that of oil, it will likely catch up by 2020 at a level of about 100 million boe/d. And it could grow even faster if environmental drives such as CO2 constraints are translated into economic incentives.

While relatively small at present, use of natural gas as a transportation fuel can grow as fleet users switch to LNG and compressed natural gas. One potential application may be fuel cells in which natural gas (or such natural gas derivatives as methanol) can provide the source of hydrogen fuel. Fuel cells are being considered for transportation, as well as for power generation.

There is also renewed interest in the conversion of natural gas to liquids (GTL) for use as fuels, lubes, and specialty products.

Future success for natural gas depends upon continuation of good safety, reliability, and environmental protection records of natural gas plants and pipelines, LNG ships, and receiving terminals.

At the same time, natural gas prices need to stay competitive with other forms of energy. In some markets, natural gas is priced significantly lower than petroleum on a btu basis because of supply and demand considerations and because the environmental benefits of natural gas are not yet fully recognized in tax policies.

Lowering LNG costs

LNG has evolved under the close scrutiny of regulators and the public. It has demonstrated outstanding safety, reliability, and environmental protection records, which must be maintained.

At the same time, LNG costs throughout the entire LNG value chain must be reduced as worldwide energy prices converge and deregulation continues in major gas markets.

LNG technology continues to be responsive to these pressures, and costs have come down 30-50% in the past decade. Each new project is being challenged to lower costs further.

To continue this trend, it is no longer sufficient to make incremental changes in isolated parts of the LNG value chain. Successful projects will improve the integration between commercial developers, representing the interests of project owners and providing a true picture of customer needs, technologists who continue to challenge today's paradigms, and project managers with a passion to apply value-improving practices in project execution.

These key resources need to be brought together early in the concept-development phase, before committing to formal front-end definition in order to have a real impact on project cost reduction.

A search for opportunities to cut LNG plant costs needs to look at the whole plant. Costs of liquefaction, gas treating, utilities, and storage are each less than 20% of total costs, while infrastructure costs can be as high as 35%. There are cost-savings opportunities in each one of these categories and in their integration.

It is difficult to compare the costs of different LNG liquefaction plants on a consistent basis. Typical LNG plant engineering, procurement, and construction (EPC) costs are now quoted at about $200/tonne of installed LNG capacity. Owner's costs will be higher depending on owner's preferences.

Costs will also vary with location, fiscal terms, execution strategy, contracting environment at the time, and the number of trains. Costs seem to be 50% lower than those 2 decades ago, with the steepest reductions being seen in recent years.

This trend can be attributed to several factors:

- Economy of scale. New technology has allowed significant increase in single-train sizes, from about 1 million tonnes/year (tpy) 2 decades ago, to the 3-5 million tpy/train today.

- Competitive environment. New technologies and increased competition between process licensors and EPC contractors have benefited the industry.

- Better project design. Using more "fit-for-purpose" design strategies, owners and customers can optimize the spread of risk, cost, and rewards throughout the LNG chain.

- Improved project execution. More emphasis on proper front-end definition and better integration between owners and contractors have contributed to lower costs and shorter cycle times.

Cost-savings opportunities are even higher for LNG receiving terminals. Traditional terminals are safe and reliable, but the challenge is to make them more cost-effective. The main challenges for terminals are:

- Lower-cost large terminals built with a "fit-for-purpose" design philosophy, especially in newly deregulated markets, where costs can no longer be passed-through to gas customers.

- Lower-cost scaleable terminals to fit gradual delivery build up.

- Cost-effective small terminals for small markets.

- Cost-effective offshore terminals in areas where onshore terminals are too expensive or not allowed.3

Current LNG supply capacity is nearing 90 million tpy. Indonesia has been the largest LNG supplier followed by Algeria, Malaysia, Brunei, Abu Dhabi, Australia, the US, and Libya.

Newcomers Qatar, Trinidad and Tobago, Nigeria, and Oman have recently joined traditional suppliers. New projects are also being pursued in Australia, Yemen, Sakhalin, Indonesia, Malaysia, and Venezuela, as well as expansions in Trinidad, Nigeria, and Qatar.

Alaska has been exporting more than 1 million tpy of LNG to Japan for more than 30 years through Phillips's Kenai facility. A newly proposed project is the trans-Alaska natural gas pipeline designed to supply North Slope gas to a proposed LNG export terminal in the south.

The viability of that option has increased recently with the granting of more-favorable fiscal terms and lower projected costs. A competing proposal would convert North Slope gas to liquids, through GTL technology, to be exported via the existing oil pipeline.

Project strategy

One key to lowering costs of natural gas projects is cost-effective project execution. In the past, some owners may have been satisfied with measuring project success by how closely the completed project met its cost and schedule targets.

In today's more-competitive environment, additional measures of success can also include:

- Life-cycle cost advantage over competing projects.

- Successfully met challenges of schedule and cost targets.

- An outstanding safety record.

Natural gas projects can be executed in a variety of ways, subject to owner's preferences (usually, a consortium of owners), host-government regulations, approval of lenders, and other complications.

Following internal project development efforts, which can take many years, the owners proceed with a formal front-end definition phase of the project, which can last 6-12 months and cost $5-30 million (Table 1).

Experience has shown that a good front-end definition is crucial to project success. In recent years, there seems to have been an increase in the use of "design competitions" in which the owners contract more than one front-end engineering package.

While design competitions can lead to improved efficiency and lower costs, care needs to be taken by the owners.4 They cannot abdicate their responsibilities or transfer risk to contractors.

It has been shown repeatedly that skimping on engineering work during project-concept definition and front-end definition phases will only lead to future changes, increased costs, and inevitable delays.

Following completion of the front-end definition work, the large project is awarded to an EPC company or in many cases to a consortium of EPC companies.

Three main approaches to project execution seem to dominate:

- Reimbursable contract.

- Competitive lump sum bid with completion guarantees.

- Alliances-variations on a partnership between the owners and the EPC firms.

While the first approach seems to be less in favor today, it is unclear that any one approach is always right for every project. Analysis of more than 2,000 projects by Independent Project Analysis Inc. (IPA), Reston, Va., has shown that companies with good project-execution practices can significantly outperform the competition.

The best companies can transform a 15% return on investment (ROI) project into a 22.5% ROI project, while the bottom tier companies can transform the same project into a 9% ROI.

Project execution has improved in the past 20 years; cost overruns are now significantly smaller, cycle times are 20% faster, and construction safety has improved significantly.

Many projects still fail to meet one or more major objectives, however, and a large gap remains between successful projects and less successful ones.

Although 20 years ago, it was common for large companies to perform detailed engineering and project execution in-house, this is no longer practical nor desirable.

Successful owners find the optimal path for contracting project execution in the type of alliance that is right for each project, without abdicating their responsibilities.5

Long-distance pipelines

Pipeline technology has advanced significantly in the past two decades, overcoming challenges of pipe size, distance, and maximum water depths and leading to lower gas-transportation costs.

Long-distance pipeline costs have come down twice as much as LNG costs,6 extending the economic reach of pipelines. Improved metallurgy, higher design pressures, and better design procedures have contributed to lower costs, and promise to lower costs even further.

It is now believed that large export pipelines will be feasible in water depths greater than 3,000 m. Moreover, industry's ability to fabricate thick-walled pipe and install it is increasing all the time. A general rule of thumb for pipeline EPC cost is currently $2 million/km for a capacity of 10 bcm/year.

The choice of a route for laying a pipeline is very important, especially for deepwater projects. Methods for choosing routes have greatly benefited from new technologies, such as information management, better mapping, remote vehicles, etc. The choice of materials, welding techniques, and laying techniques is also of great importance.

Availability of vessels and pipe-making mills also influences the costs of a pipeline project. More expensive J-laying of pipe is essential for operating in waters deeper than 1,000 m.

There are now two vessels capable of installing pipe in 2,000 m depth, and after proving this capability, it will become possible to attempt deeper waters.

LNG was developed as incremental supply to pipeline gas in the US and European markets, while it evolved into the predominant source of natural gas supply in traditional Asian markets (Japan, South Korea, and Taiwan).

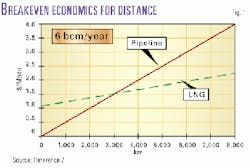

LNG is generally more competitive than pipelines at transportation distances greater than 3,000 km for a nominal quantity of 6 bcm/year, depending on local conditions (Fig. 1).7

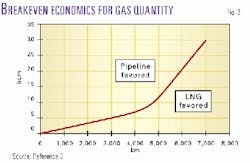

Pipelines can be competitive at longer distances, 6,000 km or more, for very large gas quantities, on the order of 30 bcm/year (Fig. 2).8 The supply of such large quantities of gas is typically an option for well-established markets, such as North America or Europe, although one can envision long-distance, large-volume pipelines in other Asian markets when these markets develop.

The choice between LNG and long-range pipeline transportation is not simple and depends on a variety of factors:7

- An economic comparison (Figs. 1 and 2).

- Geopolitical considerations-pipeline rights of way, political stability, etc.

- Technical stability of pipeline route (mud slides, earthquakes).

- Logistics-LNG is more suitable for step-wise expansion of new markets.

- Finance and fiscal terms considerations.

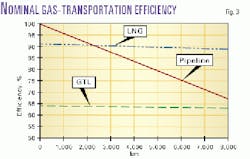

In addition, future carbon efficiency and CO2 emissions considerations may also influence the choice, especially when comparing LNG vs. pipeline vs. GTL. Fig. 3 shows typical carbon efficiencies for these three gas-monetization options.

Many new international gas pipeline projects are in various stages of development. Some examples are:

- Caspian and Black seas. The most challenging deepwater natural gas pipeline project in progress is the Blue Stream project, designed to supply 16 bcm/year of gas from Russia to Turkey by 2010.

Blue Stream is a joint venture between Gazprom and ENI SPA, whose subsidiary, Saipem, has recently begun detailed engineering work on the underwater section of the project. The two 375-km, 24-in. OD subsea pipelines will be laid at a water depth of 2,150 m in the Black Sea.

Significant technological improvements are needed for laying pipe at such depths and over such distances. These include structural modification of vessels, such as the Saipem 7000 that would need a new J-lay tower and improved dynamic positioning.

The fiscal and political challenges may be as important if not more important than the technical ones. Russia's parliament approved tax breaks for Blue Stream, estimated to be worth $1.5 billion, before the project could proceed.

Blue Stream requires financing, which depends on approvals from government export credit guarantees from Italy, Germany, and Japan.

Several other pipeline projects compete with Blue Stream; a land route from Turkmenistan through Iran would probably cost less and face fewer technical challenges but is influenced by political considerations.

Similarly feasible is the Trans-Caspian Gas Pipeline (TCGP), which would run from Turkmenistan under the Caspian Sea to Azerbaijan, through Georgia, to Turkey and possibly beyond.

Project developers are Royal Dutch/Shell, Bechtel, and GE Capital; estimated cost is about $3 billion.

- Persian Gulf. The Abu Dhabi-based UAE Offsets Group plans to establish a regional natural gas grid in the Persian Gulf region.9 The group envisions an estimated investment of more than $8 billion over a period of more than 6 years to develop gas fields, pipelines, and new industrial zones.

The project plans to tap Qatar's huge reserves and deliver 31 bcm of gas to the UAE and later to Oman and Pakistan. Movement to the latter would involve a technically challenging crossing of the gulf, perhaps similar in complexity to Blue Stream.

- West Africa. The proposed West African gas pipeline project will supply Nigerian gas to Ghana, Benin, and Togo.

Nigeria has made natural gas utilization a priority in order to help develop resources and eliminate flaring. Nigerian LNG is being exported as of October 1999 and expansion plans are under way.

Nigeria National Petroleum Co. (NNPC), Chevron Corp., and Sasol, also plan to construct a 30,000 b/d GTL plant.

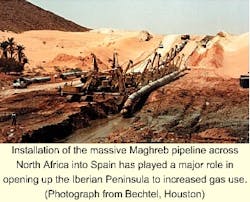

- North Africa. Algerian gas exports have increased to more than 55 bcm with more than two thirds exported via the Transmed pipeline to Italy and via the Maghreb-Europe gas (MEG) pipeline to Spain and Portugal.

Plans are under way to increase capacity in both systems and construct a BP Amoco-led project to export gas from Algeria's southern In Salah region to Italy.

Pipeline export schemes from Libya to Italy and Egypt to Israel and Turkey are also under consideration.

Other options

Not all gas reserves are equally accessible for monetization. One can distinguish among:

- Large gas reserves near major pipeline grids limited by cost and supply and demand considerations (such as in North America and Europe).

- Stranded large gas reserves, limited by development of transportation projects and markets (such as large reserves in the Caspian and the Middle East).

- Problem gas-smaller gas fields, or associated gas, which may be limiting oil production. Gas reinjection may be uneconomic, and flaring is not an option anymore in most regions.

Pipelines are the preferred transportation option for Category 1, and LNG and pipelines are the preferred options for monetizing Category 2 gas. Due to cost, scale, and logistics, pipelines and LNG are usually not the preferred options for monetizing Category 3 gas.

Other options are or may become available. Some are simply end-uses of gas, such as power or petrochemicals production; others are novel proposed transportation methods such as hydrates or CNG.

- Methanol. A specialty chemical, produced from natural gas, methonal is used mostly for the production of acetate. Methanol plant size has increased over the years but is currently limited to about 3,000 tonnes/day because the worldwide market is limited.

Recent advances in synthesis gas and methanol technologies, coupled with the ability to design much larger plants, can significantly lower methanol costs. If that happens, methanol can compete with natural gas as turbine fuel for power generation, or as feedstock to a methanol-based GTL plant.

- GTL. There has been renewed interest in gas-to-liquids technology in recent years as an option to monetize stranded or "problem" gas and produce high-quality, liquid products.

By and large, GTL does not compete with LNG because the end product is different.

GTL technology can convert natural gas into distillate fuels, naphtha, specialty waxes, lubes, drilling fluids, gasoline, LPG, methanol, and chemicals such as ethylene, propylene, and aromatics. The liquid products are virtually sulfur-free and have many other desirable properties.

Several commercial GTL plants have been built. Sasol has been operating and developing Fischer-Tropsch GTL technology in South Africa since the early 1950s.

Recently, Sasol formed a GTL alliance with Chevron and started working on a 30,000 b/d GTL project in Nigeria. Front-end definition work on the Escravos GTL project is scheduled to start in second quarter 2000.

ExxonMobil Corp.'s 14,500 b/d gas-to-gasoline plant in New Zealand, which started up in 1985, is an example of the methanol route to GTL. Shell's GTL SMDS plant in Malaysia (started up in 1993) is another example of the Fischer-Tropsch route.

Other companies have been developing their own GTL technologies. Syntroleum Corp., Tulsa, recently announced plans for a 10,000 b/d GTL plant in Australia. The plant will be designed to produce specialty products such as synthetic lubricants, drilling fluids, and normal paraffins.

Recent studies suggest that GTL costs have come down significantly in the past few years, mostly due to economy of scale. It is now believed that larger GTL plants can be constructed for around $25,000/bbl of product capacity (EPC costs), a significant reduction from GTL costs in 1980s.

This could make GTL competitive with petroleum priced in the range of $20/bbl, depending on natural gas price, fiscal terms, and plant location and size.

- Hydrates. Natural gas hydrates, or methane ice, have long been studied because their formation can cause flow problems in oil and gas production lines. In addition, the world contains massive amounts of natural gas hydrate deposits, which may one day become a major source of energy.

The idea of transporting natural gas as hydrates, as an alternative to pipeline and LNG transport is also being researched. It will involve conversion of natural gas to hydrates, transport of the hydrates by ship, and regasification in a receiving facility.

While an intriguing concept, especially for smaller natural gas plays where pipelines and LNG would suffer from economy of scale, it remains to be fully developed and demonstrated.

- Compressed natural gas. CNG was considered early on as a competitor to LNG. A CNG ship using pressurized bottles was tested in New Jersey in the late in the 1960s, but the economics of CNG transport have not been favorable.

A recent industry effort is attempting to develop a new type of pressure vessel, called a "Coselle." The concept involved large coils of steel pipe for CNG storage (OGJ, Dec. 6, 1999, p. 54. While unlikely to compete with large LNG projects, the CNG approach may be attractive for monetizing smaller amounts of "problem" natural gas.

References

- Avidan, Amos A., "Resurgent LNG rides wave of new projects," OGJ, Dec. 13, 1999, p. 97.

- BP Amoco statistical Review of World Energy, June 1999, http://www.bpamoco.com/worldenergy

- Avidan, Amos A., "Cost-effective LNG Terminals -The Role of Offshore LNG Terminals," 3rd Doha Conference on Natural Gas, Mar. 15-17, 1999.

- Timmermans, Willem K., "Designing a solution to Grandma's puzzle," Houston Energy, Vol. 2, No. 1, 1999.

- "The business stake in effective project systems," Construction Cost Effectiveness Task Force Report, The Business Roundtable, September 1997.

- Voigt, F.R., Silverio, S., Cochrane, D., and Reed, D. "Regionalization of Asian gas demand and supply," LNG 12, Perth, May 4-7, 1998.

- Avidan, Amos A., Silverman, A.J., and Siregar, P., "Lowering the costs of LNG delivery: impact of technology," 15th World Petroleum Congress, Beijing, October 1997.

- Chengwu, M., and Hequn, L., "Northeast Asia gas demand and transportation in the 21st Century," 15th World Petroleum Congress, Beijing, October 1997.

- http://www.uaedolphin.com/faq.htm

The author-

Amos A. Avidan is a consultant to the energy industry who worked for Mobil Corp. for 19 years in natural gas, LNG, exploration and production, petroleum refining, and GTL.

His most recent positions at Mobil were manager of surface engineering at Mobil Technology Co., Dallas, and technology vice-president for Mobil Global Gas & Power. He holds a PhD in chemical engineering.