GCC petrochemical industry must unite to compete

The Gulf Cooperation Council (GCC) petrochemical producers, particularly small ones, need to cooperate with one another to counter the global trend of fewer and larger companies.

To compete effectively, these regional producers should combine their production, marketing, and research and development (R&D) efforts within the framework of a regional petrochemical producers' association.

Some GCC producers have implemented some elements of this business strategy. For example, Saudi Basic Industries Corp.'s (SABIC) restructuring merged several similar business activities: two fertilizer companies, Saudi Arabian Fertilizer Co. (SAFCO) and National Chemical Fertilizer Co. (Ibn Al-Baytar), and two petrochemical companies, Arabian Petrochemical Co. (Petrokemya) and National Plastic Co. (Ibn Hayyan).

Since the commissioning of Qatar's ethylene and polyethylene plants in 1981, the petrochemical industry in GCC states, particularly in Saudi Arabia, has been constantly expanding. SABIC, a majority owned government enterprise in Saudi Arabia, is one of the top ten global petrochemical players today.1

Bahrain began producing petrochemicals in 1985, and Kuwait in 1997. In 1999, the annual petrochemical production of these four states reached 22 million tonnes.2

GCC member states are Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE.

By 2004, the states will have an additional 19.8 million tonnes of petrochemical production capacity, or 41.8 million tonnes.3 Abu Dhabi and Oman will be GCC petrochemical producers by that time.

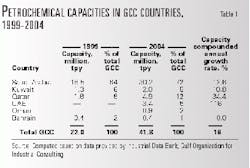

Table 1 presents the petrochemical production capacities in the GCC states in 1999 and 2004. Petrochemicals included in Table 1 include basic an intermediate petrochemicals and polymers and excludes fertilizers. Saudi Arabia currently accounts for a major share (84%) of total GCC petrochemical output; Kuwait accounts 6%; Qatar 8%; and Bahrain 2%.

By 2004, Saudi Arabia's share of the GCC petrochemical industry will drop to 72%, Kuwait to 5%, and Bahrain to 1%. Qatar's share will grow to 12%, the UAE's to 8%, and Oman's to 2%.

The highest capacity growth will be in the gas-rich southern GCC States. During this 5-year period, the overall compounded annual growth rate (CAGR) of petrochemical capacities in the GCC states will be 18%. In the same time span, Qatar will have the highest CAGR in the region, 34.4%.

Needed coordination

Today, seven players in the region produce both basic and intermediate petrochemicals. They include SABIC (through its 10 affiliates) and Saudi Chevron Petrochemical LLP in Saudi Arabia, Equate Petrochemical Co. and Boubyan Petrochemicals Co. in Kuwait, Qatar Petrochemical Co. (QAPCO) and Qatar Fuel Additives Co. (QAFAC) in Qatar, and the Gulf Petrochemical Industries Co. (GPIC) in Bahrain.

By 2004, the number of producers in the region will more than double, primarily as a result of private investment. At that time, there will be 15 producers: six in Saudi Arabia, four in Qatar, two in Kuwait, and one each in Bahrain, Abu Dhabi, and Oman.

The increasing number of petrochemical producers in the GCC states reflects their objective to reduce their reliance on volatile oil revenues. To date, each state has worked separately to develop its petrochemical production. Future coordination among GCC petrochemical producers is essential to maximize profitability.

The GCC petrochemical industry has intrinsic characteristics that make coordination among the producers necessary. These include the complexity of the industry, its large capital investment requirements, the great number of products, costly R&D, and the need for substantial marketing.

In addition, the industry's reliance on economies of scale and export orientation support the need for regional coordination.

Economies of scale

GCC petrochemical producers rely on the economies of scale of large production facilities to enhance their competitive advantages. Their plants are generally larger than those in other regions.4

GCC producers will likely further exploit economies of scale in the future. The potential for greater penetration in and expansion of local and global markets support the development of larger-scale complexes in the region. Saudi Arabia's ownership of the three largest single-train plants in the world illustrates this drive (Table 2).

Large steam crackers reduce the fixed cost/tonne of production and enable the GCC ethylene producers to have the lowest unit production costs in the world.1

Two phases describe the development of ethylene capacity in the GCC region (Table 3). The first phase represents the capacity that came on stream between 1981 and 1994. During this period, cracker sizes, except in Saudi Arabia, were below world scale. The average cracker in the GCC states then had a capacity of 750,000 tonnes/year (tpy).

Today, the average cracker size is 520,000 tpy in the US, 410,000 tpy in Japan, and 380,000 tpy in Western Europe.1

Profitability of petrochemical operations in 1996 and 1997 spurred the second expansion phase, 1995 to 2004.5 This phase, which consists of crackers that are both operational and under construction, has an average size greater than 740,000 tpy, which is larger than the world scale.

The Middle East may benefit from studying the competitive ideas of overseas petrochemical producers. For example, US producers Lyondell Chemical Co., Union Carbide Corp., and Millennium Chemicals Inc. introduced the condo-cracker concept in 1996 to enhance their competitiveness. In this strategy, each partner shares the same output of a large-scale plant that it shares in the capital cost.6

Although never implemented, the condo-cracker is one way to invest in a relatively small amount of capacity, while benefiting from the economies of scale that a large plant provides. GCC producers should consider employing similar concepts in their future projects.

An 800,000-tpy ethylene plant, built by three GCC producers, would give about 270,000 tpy of ethylene to each partner at a cost well below that of a standalone plant. Such large-scale ethylene plant requires about 1 million tpy of ethane feedstock. The region is one of the few locations in the world where this much ethane is available in one location.7

Export orientation

The establishment of large-scale plants in the region and the small size of the local market dictated an export-oriented strategy for the petrochemical industry in the Middle East. The region has relatively good access to export markets in both the West and East.

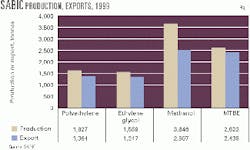

Fig. 1 illustrates the export performance of SABIC in 1999. Its performance represents the other GCC petrochemical producers. SABIC sold considerable amounts of polyethylene, ethylene glycol, methanol, and methyl tertiary butyl ether (MTBE) abroad in 1999. Exports ranged from 69% of its methanol production to 93% of its MTBE output.8

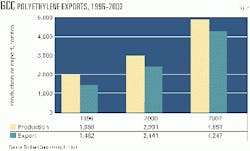

With the massive capacity additions in the region, the trend towards exports is likely to increase. Fig. 2 shows that polyethylene exports represented 75% of total GCC polyethylene output in 1996. This figure is projected to increase to 82% of total output this year and 88% in 2002.9

The export orientation has rendered the profitability of the GCC petrochemical industry vulnerable to changes in international market conditions. Close coordination is required among the producers to protect their traditional markets and to develop new ones.

Status of cooperation

Cooperation among global petrochemical companies grew steadily in the 1990s because it offered numerous technical and economical advantages. Cooperation has also increased as a result of shrinking trade barriers and improved communications among nations all over the world.10

Compared to the global trend of cooperation, however, cooperation in the GCC petrochemical industry is only modest. One reason is that the GCC countries developed their petrochemical industries in isolation from one another.

Also, the shares of the GCC petrochemical enterprises are entirely or mostly owned by governments, which make the decision-making process lengthy and cumbersome.

The increasing private-sector participation in the petrochemical industry, however, will encourage increased cooperation in the near future. The GCC region has experienced a few cases in which cooperation prevailed, however. Table 4 shows the ways they have cooperated, which include the areas of production and marketing.

Production cooperation

Despite the existence of several downstream regional joint-venture (JV) projects, the coordination in production capacities in the GCC petrochemical industry is weak, particularly at the basic and intermediate petrochemicals levels.

At this level, cooperation has been limited to one case, namely that of the Gulf Industrial Petrochemical Company (GPIC), which is a JV equally owned by the governments of Bahrain, Saudi Arabia, and Kuwait. The Saudi and the Kuwaiti governments are represented, respectively, by SABIC and the Petrochemical Industries Co. (PIC).

Since the commissioning of GPIC's plant in 1985, no other regional investment of this magnitude has occurred in the region. The growing penetration of the private sector in the petrochemical industry suggests that a sounder cross-border investment picture in petrochemical projects is emerging. Planned regional JVs exemplify the increasing number of cross-border cooperation (Table 4).

Cross-border cooperation will likely extend to involve Middle Eastern producers outside the GCC region. A sign in this direction is the recent announcement that SABIC is studying the possibility of an aromatic JV in Iran with the National Petrochemical Company (NPC).11

In addition, NPC is reportedly planning a JV with the private Qatari firm United Development Co. (UDC) to build a linear alkyl benzene (LAB) plant in Bandar Abbas.12

Cooperation in production capacities among regional producers in the future will fill in gaps in the industry's feedstock supplies and product range.

Marketing cooperation

GCC petrochemical producers market about 80% of their petrochemicals output to overseas customers. Either the local firm or the JV foreign partner carries out the overseas marketing in accordance with the marketing agreement. It requires the marketer to market about 50% of the output and allocate a portion of the product to the firm's captive market.

The GCC partners have established marketing firms to sell in both their domestic and overseas markets. These marketing firms often compete to sell their products in the domestic and international markets.

Given the small domestic market size and the similarity of the product slate, competition is often strong. Although less fierce, competition also characterizes the overseas marketing because GCC producers target the same overseas markets.

More than 50% of GCC petrochemical exports flows to Asian markets. Asia's logistics costs are small, and its markets are large.1

Given the increasing competition in global petrochemical markets, there is a need for a closer marketing cooperation among the GCC producers. A marketing alliance for a given product or market would avoid damaging competition and allow the partners to increase their market shares and geographical spread.13

At present, there is only one marketing alliance in the region: between GPIC, Bahrain, on one side, and SABIC and PIC on the other side. Through this alliance, SABIC markets GPIC's methanol output and PIC markets its ammonia output.

This alliance was easy to form because the involved companies have equity shares in GPIC. Its success, however, may encourage the establishment of more marketing alliances among the GCC producers.

To be successful, an alliance needs compatible partners. Since the GCC petrochemical industry is generally disunited, successful alliances may take a long time to be realized.

In the meantime, the GCC producers, particularly the smaller ones, may consider joint-marketing operations with SABIC, which has a well-established sales network in Asia and Europe, the major markets for the GCC petrochemical exports. Such cooperation would lower costs and better serve their customers, who are increasingly located all over the world.

Other cooperation

On a national level, there is a satisfactory level of coordination and integration among petrochemical producers. This is particularly applicable to SABIC's affiliates in Saudi Arabia.

On a regional level, however, cooperation among petrochemical producers depends on several factors, including genuine willingness, the extent of development of these areas, and how well one producer can satisfy another producer's needs.

Table 5 summarizes the results of a questionnaire designed to assess the cooperation among the operating GCC petrochemical and fertilizer producers. The responding parties are SABIC, PIC, Equate, QAPCO, QAFCO, and GPIC.

Cooperation in areas such as the exchange of chemicals and common spare parts is predominant among the regional producers. The exchange of nonconfidential information exists whenever the need arises.

The areas that deserve more attention are R&D and training. Given that R&D requirements greatly exceed what a petrochemical company in the region can afford on its own, it was surprising to find that there are no cooperative research projects between several producers to share the cost of R&D.

Obstacles to cooperation

Despite the obvious advantages that GCC petrochemical producers can gain from cooperation, there are two major problems that arise from cooperation: one predominant feedstock and technological obstacles.

- One predominant feedstock. Natural gas is the predominant feedstock used to produce the basic petrochemicals in the GCC petrochemical industry.1 Use of natural gas is justified by its availability and low cost.

Its use limits the slate of the basic petrochemicals that can be produced, however. As a result, the GCC downstream industry imports many intermediate-based products derived from the other basic petrochemicals.14

The common feedstock results in identical petrochemical production lines throughout the GCC region. For example, there are nine methanol projects at different development stages distributed among four GCC states with a total annual production capacity of 6.86 million tonnes. Table 6 lists the methanol plants and their production capacities.

Surplus quantities of methane primarily motivated the duplication of the production capacities for methanol in the GCC states. The GCC producers have a cost position that enables them to compete with methanol producers in the worst and the best market conditions.

Thus, methanol exports represent the overwhelming portion of captive demand. For the most part, the states export the methanol volumes for MTBE production as well.

As a basic petrochemical, methanol has limited downstream opportunities in the region (MTBE and formaldehyde), and therefore creates few opportunities for integration among the GCC methanol producers.

- Technological obstacles. The GCC petrochemical industry relies on foreign partners to supply the advanced production technologies. These sources are either foreign partners with whom it has JVs or licenses of advanced production technologies.

Both modes of technology transfer are subject to legal provisions which govern the proprietary rights of the technology provider and can represent a major obstacle to coordination among the regional players.

In addition, the different sources of production technologies limit the scope of coordination among the GCC players.

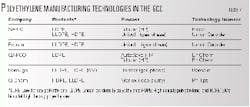

For example, the GCC region uses several manufacturing technologies to produce polyethylene resins. The primary reason is that there are several JVs with different partners who use their own technologies, as part of the JV arrangements.

These alliances make technical cooperation difficult because of the different aspects and needs of each technology. Also, the foreign partner may discourage such technological cooperation and instead encourage further dependence on his contribution, particularly with regard to technology.

Table 7 lists the different production technologies used in the manufacturing of polyethylene resins in the region.

An industry association

Any cooperation in the GCC petrochemical industry should include the adoption of an effective information-exchange system.

The formation of a petrochemical producers' association will provide such a communication system. Through an association, the GCC producers would share information, expertise, and resources regarding common functions, such as marketing and production.

The association would serve as a platform to reach a collective response from the GCC producers. Overall, it would seek to:

- Ensure coordination among the GCC producers, particularly with regard to marketing policies, new projects plans, and the transportation of marketed products.

- Promote the development of the downstream industry in the region.

- Promote joint-research programs which focus on application-oriented research activities.

- Promote the acceptance and understanding of the GCC petrochemical industry and its products in local and international communities. This goal can be achieved by adopting initiatives such as the Responsible Care and the Sustainable Development Programs, which assist the industry's image building.

Although unsuccessful attempts were made in the past to establish a producer's association in the region, the Gulf Organization for Industrial Consulting, on behalf of several leading regional producers, is currently drafting a charter to set up such association.

References

- Al-Sa'doun, A.W., "Al-Ta'awon Al-Sina'e in the Arabian Gulf," No. 75, January 1999, pp. 3-23.

- Industrial Data Bank, GOIC.

- MEED Petrochemical Special report, MEED, Vol. 43, No. 46, November 1999, p. 13.

- Al-Sa'doun A.W., "Saudi Arabia's petrochemical industry diversifies to face challenges," OGJ, Aug. 16, 1999, p. 65.

- A. Bettman, Chemical Management Review, Vol. 2, No. 3, May-June 2000, p. 23.

- Chang, T., "Time to share," OGJ, Aug. 16, 1999, p. 17.

- Farry, M., "Ethane from associated gas still the most economical,"OGJ, June 8, 1998, p. 115.

- Data provided by SABIC.

- ECN, Vol. 68, No. 1,789, Nov. 17, 1997, p. 10.

- Walthie, T., CAN/CMR/ECN (First European Petrochemicals Supplement, September 1999, p. 14.

- MEED, Vol. 44, No. 21, May 28, 2000, p.6.

- MEED, Vol.44, No. 30, July 28, 2000, p.13.

- ECN, Vol. 71, No. 1870, July 1999, p.31.

- Al-Sa'doun, A.W., Oil and Arab Cooperation, Vol. 23, No. 81, 1997, pp. 23-43.

The author

Abdul Wahab Al-Sa'doun is director of the industrial information and coordination department at the Qatar-based Gulf Organization for Industrial Consulting (GOIC). He started his career as a research chemist in the research department of SABIC R&D Center, Riyadh, where he worked from 1990 to 1995. Al-Sa'doun joined GOIC in January 1996 where he worked as a petrochemical expert in the projects department until 1997, when he was appointed his current position. Al-Sa'doun holds a PhD in industrial chemistry from King's College, University of London.