Market Movement

Prices rising, stocks growing slightly

Oil prices last week hit a 6-month high-with the October contract closing on NYMEX Aug. 30 at $33.32/bbl-in spite of Saudi Arabia announcing plans at midweek to work with fellow OPEC members to adjust the involuntary price band mechanism initiated by the group in June. The rise also came amid the release of EIA weekly data on US supply stock levels, which, despite inching upward by 2 million bbl, were still 32 million bbl below last year's volumes.

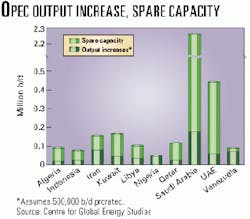

But, despite the near unanimity over the fact that world markets require more crude oil, it would seem unlikely that OPEC will increase its output any time soon-especially given the fact that a significant portion of spare capacity to do so is held by so few of the organization's members (see chart).

Even the price band mechanism-which calls for a 500,000 b/d production increase if the OPEC basket price stays above $28/bbl for a period of 20 working days-will not likely be initiated before OPEC members meet again Sept. 10.

According to London think tank Centre for Global Energy Studies (CGES), Saudi Arabia did produce more oil last month-but not for export to foreign markets. The additional crude was used, rather, for Saudi domestic desalination and power generation demand, which typically increases during the summer months.

CGES stressed the need for industry to build both its crude and product stocks. CGES reckons that US distillate stocks at the end of July afford only 30 days' worth of cover-a figure 6 days lower than the end of July last year. The act of building those stocks will be a difficult one, given insufficient crude stock cover in both the US and Europe.

CGES said, "To put extra barrels into stock in the present backwardated market is not sensible; it is better to sell prompt oil and buy futures. Building inventory requires a rising forward curve and, for that to happen, the market needs more wet barrels over a period of time."

Demand erosion?

While CGES estimates that OPEC will enjoy a combined $80 billion in extra export revenues this year, there are already signs that high oil prices are eroding demand. The analyst notes that consumer inflation has risen by almost a percentage point in the advanced economies, moving up in lockstep with interest rates.

"Unsurprisingly, economic growth in these countries is expected to drop to 2.5% per annum in 2001 from 3.5% this year," it said. "One percent less growth implies 0.5 million b/d less oil demand in the OECD, apart from the direct drop in demand due to higher prices."

While demand may be slacking off somewhat, for now, the market remains as tight as ever, as shown by the continuing strength in oil prices due to OPEC's intransigence thus far in responding to the growing outcry for it to step up production.

OPEC could readily supply the market with the oil it needs-the group is capable of producing another 500,000 b/d without any member exceeding its capacity, save for Nigeria and possibly Indonesia, CGES notes. Saudi Arabia alone could take up the slack, but, despite its earlier pronouncements on hiking output unilaterally and any entreaties from Pres. Clinton-currently jawboning some OPEC countries to jack up output-it isn't likely. In short, OPEC simply would rather risk what its members see as a temporary, gradual easing of demand that can be rectified next year rather than risk a price collapse now.

null

null

null

Industry Trends

Will major oils' share prices continue to languish despite stronger oil prices?

According to investment firm Merrill Lynch, since the start of the third quarter, the major oils index-the index of ma- jor oil company share performance relative to the share performance of the S&P 500-has averaged a 2% decline in share price. Meanwhile, the S&P 500 has increased 3% (see chart).

"We believe that [while] major oil share price performance has suffered from investors reducing positions in response to a perceived peak in oil prices," said Merrill Lynch, "ellipsedeclining oil prices are not incompatible with strong performance in major oil shares." Merrill Lynch points out as a practical analog the period during 1996-97 when major oil share performance was strong despite declining oil prices.

Beginning in January 1996, the analyst said, "major oil shares initially failed to respond to the increase in oil prices from $18/ bblellipseto $24/bbl in April. Despite improving fundamentals and declining inventories, equity markets were concerned that the expected return of oil exports from Iraq under the UN-monitored 'oil-for-food' program would crater oil prices. "As a result, oil stocks languished through the first half of 1996. In mid-1996, Iraq and the UN announced an agreement regarding renewed oil exports, pulling oil prices down from $24/bbl to $20/bblellipsemajor oil shares were actually unaffected by the decline in oil prices. As 1996 wore on, ongoing political haggling between the UN and Iraq delayed the actual start of Iraqi exports."

There are two chief similarities between the current equity market environment and those of 1996-97, says Merrill Lynch-trepidation that an increase in supply will lead to sub-$20/bbl oil prices and worries that major oil shares will decline as oil prices fall from peak levels.

"Like 1996-97, we believe that the major oil shares will react positively to the elimination of uncertainty about OPEC supply management and a stabilization of oil prices above $20/bbl," said the firm.

Spending increases by major oil companies give hope for growth in the offshore rig employment market, according to Global Marine.

The company's Summary of Current Offshore Rig Economics, or SCORE, rose 4.5% to 31.2% in July from 29.8% in June. SCORE reflects current rig day rates as a percentage of the estimated rate required to justify building new rigs on speculation.

The July SCORE represents a 32.1% increase from July 1999 and a 27.2% decrease from the preceding 5-year average for the month. "Our optimism that the current recovery of offshore drilling markets will continue strengthening is bolstered by indications that major oil companies are now getting back into the game as we have not seen for some time," said Global Marine CEO Bob Rose.

Government Developments

IRAN AND JAPAN HAVE FORMED THEIR FIRST JOINT ENERGY COMMITTEE.

Iran's deputy oil minister for international affairs, Mehdi Hosseini, told the Iranian News Agency that energy issues dominated meetings with a visiting Japanese delegation. He said the meetings were a prelude to the commissioning of the first joint Iran-Japan energy committee, adding that, in 2 days of talks, the energy situation in Japan, Southeast Asia, Iran, and the Middle East had been reviewed.

Other topics of discussion included improving production, studying consumption patterns in oil and gas, and utilizing compressed natural gas in vehicles.

Hosseini added that an agreement relating to Japan-Iran cooperation on oil, gas, and electricity has been signed with the 12-member Japanese industry and international trade ministry delegation, headed by Hirofumi Kono, the director-general of the Natural Resources and Energy Agency.

Since 1993, Hosseini said, agreements between the two countries have been limited to trade in crude oil. Japan is currently importing 500,000 b/d of crude from Iran, or 1% of the country's total imports, the official noted.

The Australian government agreed to exclude LNG from the nation's overall greenhouse gas reduction measures, sending a sigh of relief through the Australian petroleum industry.

It also postponed plans to create a domestic greenhouse gas emissions-trading regime until similar trading schemes are introduced elsewhere.

The decision boosted prospects for Australia's industry, which previously had been under a cloud that threatened to restrict its ability to compete against international LNG producers such as Indonesia, Malaysia, Oman, and Qatar, none of which are affected by greenhouse gas abatement programs. The most immediate relief is felt by the Woodside-led North West Shelf consortium that is planning a 50% increase in capacity to its LNG project.

The decision also was welcomed by the Australian petroleum industry, and the Australian Petroleum Production & Exploration Association called it a big win for global greenhouse gas abatement efforts and a major plus for investor certainty, job creation, and regional development.

Alaska Gov. Tony Knowles pledged to spend the rest of his term in office working to break ground on a natural gas pipeline in the next 2 years to bring gas from Alaska's North Slope to markets in the US Lower 48.

Knowles said he intends to introduce legislation to lower tax barriers for potential stranded-gas projects such as a pipeline to the Lower 48 and GTL facilities. For the past 20 years, Alaska has sought ways to transport ANS gas to markets where potential reserves could be three times the proven 35 tcf.

Efforts have been stifled, however, by the cost of such a project and lack of markets. While some industry players have proposed shipping the reserves in the form of LNG to Asia, the LNG markets in Southeast Asia are already well fed. With strong demand and prices for natural gas occurring in the US Lower 48, Alaska's drive to find markets for ANS gas comes at an opportune moment for the state.

Quick Takes

Turnaround work has halted PRODUCTION temporarily from STATOIL'S SLEIPNER PLATFORMS.

Statoil said production from its Sleipner East and West fields in the North Sea was halted for a major turnaround. The Sleipner A, B, and T platforms shut down Aug. 14. The first of the units is due to resume production after 20 days and the remaining two after 24 days.

Part of Sleipner A is to be modified because reservoir pressure is sinking as gas and condensate are produced. This shift to low-pressure production includes modifications to wells, inlet separators, and recompression facilities, said Statoil.

A process train for Sleipner condensate at Statoil's Kårstø treatment complex north of Stavanger was closed down for maintenance during this period. Gas delivery commitments from Sleipner are being met by other fields during the shutdown.

In other production news, Ship repair specialist Cammell Lairds and Aker Maritime UK unit Aker McNulty sealed an agreement to team together on floating production conversion work. The deal builds on a cooperative relationship forged by the two companies when working together on projects, including Enterprise's Pierce Berge FPSO and Kerr-McGee's Janice floater.

TOPPING EXPLORATION NEWS, BP and BHP said the Atlantis-2 appraisal well, drilled on Green Canyon Block 743 in 6,675 ft of water in the Gulf of Mexico, found a further 200 ft of net oil pay in addition to the pay found in oil-bearing Miocene sands reported in July (OGJ Online, July 18, 2000).

This brings the total net pay to over 500 ft. Operator BP drilled the appraisal well to 18,600 ft TD in the Atwater foldbelt ultradeepwater area. Interests in the well are BP, 56%, and BHP, 44%.

A sidetrack will now be drilled from Atlantis-2 to secure further data on the lateral extent and nature of the reservoirs, says BHP.

Indo-Pacific Energy said that a farmout agreement recently signed with Texas Petroleum Investment Co. (TPIC) will provide funding for exploration wells to be drilled in New Zealand's onshore Taranaki basin. Terms call for TPIC to fund the Ratapiko-1 exploration well, which will be drilled on Permit PEP 38723 in November. TPIC also will fund a second exploration well on another prospect on the permit, to be drilled during the next 2 years. In return for these outlays, TPIC will be assigned a 55% working interest in PEP 38723, with Indo-Pacific retaining 36% and Gondwana Energy 9%. The Ratapiko-1 well will be drilled to 5,000 ft to test a seismically defined trap in Mount Messenger sandstones. PEP 38723 is a lightly drilled, 20,000-acre area that includes several commercial oil and gas fields. x AMG Oil acquired funding for the first phase of its upcoming drilling program in New Zealand's Canterbury basin. A single private investor acquired a block of 400,000 units at $2.25/unit, raising $900,000 in working capital. The funds raised by this share issuance will go towards the cost of drilling the Ealing-1 and Arcadia-1 exploration wells. AMG is currently in negotiations with prospective industry partners and with the financial community with a view to raise another $1 million-just about enough to complete the program. The first well is expected to spud by the end of September. F Woodside Petroleum, operator of the WA-33-P joint venture off Western Australia, reports that the Brecknock South-1 exploration well was drilled to TD of 4,008 m and that wireline logs show it found a 167-m gross hydrocarbon column over a single interval in the main reservoir objective. Because of the find, the partners in the block will remap the Brecknock and Brecknock South fields. Brecknock South-1 is in the Browse basin 20 km south of the 1979 Brecknock-1 well. Water depth is 420 m.

A COLLAPSed SEAbed has placed a JACK UP OUT OF COMMISSION in the UK North Sea.

Ensco finished assessing the damage to its Ensco 101 harsh-environment jack up rig after an incident announced Aug. 7.

At that time, the company said the jack up sustained the damage while moving onto a drilling location in the UK North Sea and that the rig was then sent to a shipyard for damage assessment and repair.

The incident investigation has now been completed, Ensco said, and repairs have begun.

While jacking the rig out of the water, a foundation failure and soil flow occurred in the seabed under one of the legs. This foundation failure caused the rig's legs to experience abnormal stresses, resulting in localized damage to the hull and legs. The assessment indicated damage that was more extensive than originally anticipated, said Ensco. Extent of damage and delivery of high-strength material to effect repairs could result in the rig being out of service until late in the fourth quarter, says the firm.

Logic's SATELLITE SCHEME IS READY TO START UP.

The first five undeveloped UK North Sea discoveries earmarked to be brought to market under the government-industry initiative Leading Oil & Gas Industry Competitiveness' (LOGIC) "satellite accelerator" scheme are the Solan, Strathmore, Kestrel, Kessog, and Wood.

Total reserves for the five fields-operated by BP, Amerada Hess, and Shell Expro-are estimated at more than 200 million boe and could lead, according to LOGIC, to "as much as £500 million of new development investment."

BP says the marginal Wood field-an oil and gas discovery left undeveloped by the operator as "subeconomic under current development scenarios"-is scheduled to be the first development out of the blocks under the scheme.

Amerada's Solan and Strathmore oil discoveries west of the Shetlands, Shell's northern North Sea Kestrel oil find, and BP's high-pressure, high-temperature gas-condensate Kessog discovery will be rolled out on "a phased basis over the next 4-6 months."

A GTL proposal tOPs GAS PROCESSING NEWS.

In a recent conference call, Rentech discussed its plans to convert the newly acquired Sand Creek plant in Commerce City, Colo., from a methanol plant to a GTL plant.

Once the conversion is complete, Sand Creek would become the first commercial GTL plant in the US, 3-5 years before any other such plants are likely, the company said.

Rentech subsidiary Rentech Development and Republic Financial, Aurora, Colo., jointly own Sand Creek Energy, the new owner of the facility. Basic engineering work for GTL conversion has been completed.

Once the conversion is complete, the plant is expected to produce 800-1,000 b/d of high-value, clean-burning, sulfur- and aromatic-free diesel fuel and other products.

An Indian Oil Corp.-led LNG consortium that was recently awarded the right to construct an LNG complex in the eastern Indian port city of Kakinada in Andhra Pradesh plans to float four separate JVs to implement different segments of the ambitious 184.5 billion-rupee ($4.22 billion) project (OGJ Online, July 26, 2000). Other consortium members include Petronas and Cocanada Port, a special-purpose vehicle floated by Singapore's International Seaports. The first phase of the Kakinada LNG project, which will cost 51.5 billion rupees, includes the construction of the first LNG terminal at a cost of 1.5 billion rupees. A pipeline network will cost 35 billion rupees, and storage and regasification facilities, 15 billion rupees. A second phase, pegged at 63 billion rupees, entails an LNG terminal (3 billion), storage and regasification facilities (30 billion) and a pipeline network (30 billion). The third phase, costing 30 billion rupees, will involve inland and storage facilities and a distribution network for dimethyl ether, an alternate fuel. A further 40 billion rupees will be spent later to construct a power plant.

Chevron reached a $7 million settlement with the US EPA and the US Department of Justice concerning alleged violations of the Clean Air Act at its El Segundo refinery marine terminal. The terminal is 1.5 miles offshore. Chevron will also stop using its marine terminal until it agrees with EPA on a plan to lower emissions. Until then, the company will conduct its petroleum-loading operations at a third party's marine terminals.

The settlement involves two environmental improvements. The first is a $500,000 project to upgrade refinery valve components, which will further reduce emissions. The other is a $500,000 project to help build and operate a health clinic in Wilmington, Calif., to diagnose and treat respiratory diseases, EPA said. Chevron will also pay $6 million to the US government. Chevron says that none of these commitments assigns or implies any wrongdoing and that it believes it was in compliance with the applicable rules.

IN DEVELOPMENTS ON THE PETROCHEMICAL FRONT, a consortium of BASF, Sinopec, and Sinopec subsidiary Yangzi Petroleum Corp. (YPC) signed a letter of intent with Shaw Group to provide engineering, procurement, and construction services for a 600,000 tonne/year ethylene plant and related facilities to be built at Nanjing, China. The agreement paves the way for negotiation of a turnkey contract.

Shaw unit Stone & Webster will be responsible for engineering and procurement related to the contract, while it will subcontract the construction portion to an unnamed Chinese firm. Plant equipment and materials included in Shaw's July 2000 purchase of Stone & Webster will be utilized, says Shaw (OGJ Online, July 10, 2000).

This plant is the first unit awarded for the planned $2.7 billion integrated petrochemical complex being developed by BASF and YPC in Nanjing. The complex is expected to go on stream in 2004 or 2005.BASF and YPC expect the final contract documents with Shaw to be executed as early as December.

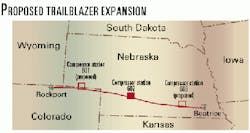

TRAILBLAZER Pipeline is seeking to EXPAND its system through added compression.

Trailblazer reported that its additional capacity of 300 MMcfd was fully subscribed with fixed rates for a minimum term of 10 years.

Pending FERC approval, company officials said the $54 million expansion project will be completed in fourth quarter 2002. Trailblazer will add a total 50,000 hp of new compression and increase the existing 5,200 hp of compression at Compressor Station 602 by 4,800 hp (see map).

Significant growth in Rocky Mountain natural gas supplies has prompted the need for additional pipeline transportation service, the company said.

Kinder Morgan Energy Partners owns a two-thirds interest in Trailblazer, with the other one-third interest owned by Enron unit Enron Trailblazer Pipeline. Trailblazer is operated by Natural Gas Pipeline of America, a unit of Kinder Morgan.

Canada's NEB approved AEC Suffield Gas Pipeline's application to construct and operate a 190 MMcfd natural gas pipeline from southeastern Alberta to southwestern Saskatchewan. The pipeline, which will cost about $22.3 million, will be known as the North Suffield Pipeline. AEC Suffield applied to construct about 97 km of 16-in. pipeline and associated control facilities. The pipeline will originate on the western side of the Suffield Military Training Block, extend along the northern boundary of that block, then eastward to tie into the existing AEC Suffield meter station that connects with TransCanada's system near Burstall, Sask. AEC Suffield plans an in-service date of Nov. 1. F Pembina Pipeline is conducting integrity testing on its Western pipeline system, required as a result of an Aug. 1 pipeline break and crude oil spill into the upper Pine River of Northeast British Columbia (OGJ Online, Aug. 2, 2000). Authorization to resume restricted operations was granted from the Oil and Gas Commission of British Columbia on Aug. 23, says Pembina. Resumption of operation is conditional on the commission's requirements, however, including that the affected line be leak and strength-tested within 12 months. The company plans to test the Taylor-to-Prince George section of the pipeline before putting it back into service at reduced operating pressure.

NL BULLETIN

Preparations for next month's OPEC heads of state summit in Caracas are complete, according to Venezuelan Deputy Foreign Minister Jorge Valero, who also heads the presidential commission responsible for organizing the gathering. A preliminary draft of a declaration that will be reviewed by the OPEC foreign, finance, and oil ministers, and later signed by the heads of state, has been completed, said Valero.

The document, among other things, underlines the need to adapt OPEC to the new demands of the international economy, promote a constructive dialogue among oil producers and consumers, and strengthen ties between OPEC member countries and oil producers that do not belong to the organization, including Russia, Oman, Mexico, Norway, and Angola. Another key aspect of the document, Valero said, deals with the need to strengthen ties among OPEC nations.