OGJ Newsletter

Market Movement

Is OPEC's consideration of output cut warranted?

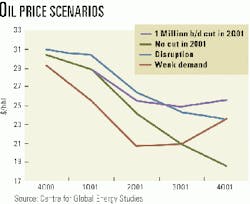

The current outcry for another oil output increase notwithstanding, is OPEC's consideration of a production cut early next year warranted?

The signs point to oil markets currently being tighter than previously suspected.

According to London think tank Centre for Global Energy Studies, a look at raw supply and demand data suggests that the global stockbuild was supposed to have reached 230,000 b/d at the end of the third quarter. But, says CGES, OECD industry stocks in that period rose only 68 million bbl, and floating stocks climbed by only 40 million bbl. That means as much as 126 million bbl of oil stocks are unaccounted for.

"If these barrels do exist, then they must be in the wrong place and cannot reach refiners due to shipping constraints," CGES said.

"Either way, the market is probably tighter than we previously thought, providing fundamental support for the recent oil price jumps due to turmoil in the Palestinian territories and Saddam's threats to suspend oil exports if he does not get his way."

OPEC (excluding Iraq) contends it has boosted production by 3.2 million b/d during March-October this year, more than enough to balance the market.

But CGES contends that the actual increase was no more than 2.1 million b/d, because some members were already producing over quota in March. Demand this year is up about 1 million b/d vs. a year ago, while OPEC and non-OPEC supply increases this year are pegged at a combined 2.7 million b/d. That ostensibly would suggest a supply glut this year, but it does not take into consideration the massive global stockdraw of 1.2 million b/d in 1999 that was required before a 2000 stockbuild could begin.

Possible price slide ahead

Nevertheless, OPEC's concern about a price slide in the year to come is well-founded. If there are no disruptions in Iraqi supplies and if winter temperatures are normal, heating oil and other products stocks will continue to build (there is ample evidence that a buildup of secondary and tertiary stocks of heating oil is being overlooked by a market fixated on primary storage levels).

A healthy level of demand will keep margins sustained, and refineries will continue to operate near capacity. As the winter winds down, and it turns out that there was no crisis in heating oil supply after all, the first quarter will end with a hefty buildup in both distillate and gasoline stocks. Refiners will trim back runs just ahead of the seasonally slack second quarter, demand for crude will drop, and then so will crude prices (see chart).

The key question here for OPEC is when will crude prices slide? The timing of inventory buildup suggests that it will not occur soon enough to trigger output cuts by the time of OPEC's next meeting in mid-January.

"OPEC, however, may need to cut output in March to stabilize prices at $25/bbl for the rest of the year," CGES said. "Prices are unlikely to be low enough by then to prompt them to take the necessary action."

And if it doesn't take action then, the analyst warns, the continued additional output will spawn a glut that will take oil prices back down to $18/bbl.

Western Canada gas prices soaring

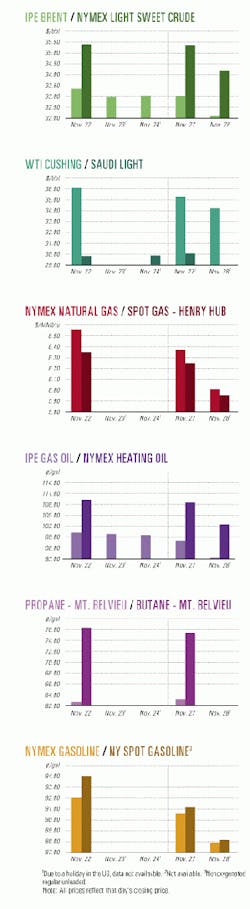

Plummeting temperatures in the US Northeast and other markets are pushing prices for Western Canada natural gas to new highs.

Spot prices for Alberta gas hit a record high of $8.15 (Can)/MMbtu Nov. 21. That compared with a price of $2.80 the same time a year ago.

Natural gas on the spot market at the major AECO-C trading hub in southern Alberta is trading at more than triple the prices at this time a year ago.

Westcoast Energy said a cold snap on the West Coast and continuing gas demand for electric power generation in California created price spikes late last month. Prices at the Sumas, Wash., border point Nov. 20 rose 75% on the day to as much as $21.76/MMbtu. There were also bottlenecks in the Northwest Pipeline system in the US-which interconnects with Westcoast-that added to demand for Canadian gas.

Forward selling prices for Canadian producers until the end of October 2001 are now at $6.92/MMbtu.

null

null

null

Industry Trends

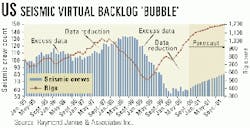

It may be late 2001 before the US seismic crew count sees a dramatic turnaround.

The US seismic business is expected to gradually improve in the next 6-12 months, say analysts with Raymond James & Associates Inc., mainly with increased spec data library consumption and with more reprocessing of that data.

Rather than being a leading indicator of US drilling activity, the seismic business has become the "lagging result" of drilling activity because improved processing and data gathering technology has created a backlog of drillable prospects.

In the past, increased seismic crew activity typically indicated that drilling activity would follow soon after, said Raymond James analysts J. Marshall Adkins and James M. Rollyson.

As late as 1995, the seismic crew count typically moved up in advance of drilling activity. But as seismic crews began to outpace the number of rigs drilling, the backlog of drillable prospects rose high enough to begin driving the drilling rig count. The backlog of prospects then began shrinking when the rig count increased during 1997.

Seismic companies continued shooting seismic data for their own spec data libraries through 1998, when the rig count began to fall early that year. From early 1998 to mid-1999, an "incredible build" in seismic data grew, as did the implied build of drillable prospects, the analysts noted.

"If we assume a constant efficiency relationship between seismic crews and drilling rigs, then the excess amount of drillable prospects should be running out right about now," said Adkins and Rollyson. "Looking long term, we expect an exploding drilling count will eventually work off the high backlog of prospects and lead to meaningfully higher demand for seismic crew activity."

Accordingly, the analysts see only a slight improvement in the US seismic crew count in the coming year (see chart).

Canadian reserves may not fill the gas demand gap in the US.

A study by Canadian Energy Research Institute, Calgary, suggests that reliance on Canadian reserves to fill the gas demand gap in the US may be misplaced. "Western Canada's reserves are not what they used to be. Moreover, new reserves on the Canadian East Coast and elsewhere are not yet developed enough to make up the shortfall in what US gas users expect," the report said.

The author, Len Coad, is vice-president of North American natural gas and electricity for CERI. Coad said: "Most forecasts show Canadian gas consumption rising at a steady 1.5-3%/year and show exports of Canadian gas rising from approximately 3 tcf/year today to something at or above 4 tcf/year by 2010. To meet these requirements, Canadian gas production would need to increase by 3 bcfd over the 10-year period. "Although not beyond the realm of possibility, recent supply trends suggest that this is clearly a stretch target for supply. This is particularly true when we consider recent trends in well productivity and decline rates. Although the WCSB [Western Canadian Sedimentary Basin] resource base is far from depleted, the challenge of increasing production is more significant than in past years."

Government Developments

Alaska Gov. Tony Knowles contends a pipeline to take North Slope gas to the Lower 48 should parallel the existing TAPS oil pipeline to Fairbanks, and then follow the Alaska Highway south.

Knowles last month said that pipeline route would be faster and cheaper to build than one from the North Slope 400 miles across the Beaufort Sea to the Mackenzie River delta.

He admitted the latter routewould be shorter but has "formidable technical, environmental, and logistical challenges that may never be satisfactorily addressed."

Bob King, a Knowles spokesman, said not enough information has been gathered regarding whether a subsea arctic pipeline as long as the one proposed could be built, given the problems of polar ice pack shifts and other difficulties related to arctic conditions.

Earlier this year, Knowles vowed to spend the rest of his term working to bring North Slope gas to market (OGJ, Oct. 9, 2000, p. 62). The pipeline would not only give Alaska communities and Lower 48 markets access to more gas but could encourage the development of more LNG or gas-to-liquids projects and technology, Knowles said. He said the state would begin collecting data for permitting and right-of-way reviews.

To speed the construction process, Knowles plans to ask the Alaska legislature in January for $4 million to finance efforts to expedite the line. He also plans to file a bill to amend the state's 1998 Stranded Gas Development Act to include a gas pipeline or a GTL project.

UK oil majors have been cleared of charges of 'anticompetitive' behavior.

The UK Office of Fair Trading (OFT) has rejected claims first made by a number of independent fuel retailers in September that major oil companies were selling wholesale fuel to them at prices higher than at their own branded service stations.

Following an inquiry into allegations of anticompetitive behavior by UK oil giants, OFT concluded that a combination of high crude prices and "public pressure on UK retail prices" were to blame for a squeeze on retailers' margins.

There was "no evidence of either price-fixing agreements or abuse of a dominant position by the oil companies," it said.

OFT acknowledged that all retailers were suffering a squeeze on margins because of the "unusual combination of circumstances" currently affecting the market.

"I sympathize with the problems the independent retailers have been encountering," stated Director General of Fair Trading John Vickers. "They have had to pay wholesale prices that have reflected the increased world oil [price] pressure, while public pressure has held down prices at the pump.

"The OFT will continue to monitor this market very closely and will not hesitate to take action if we find that firms in the industry are deliberately damaging competition," he added.

Quick Takes

CHIEFTAIN has earmarked $162 million (Can.) for 2001 that is focused on US Gulf of Mexico exploration.

The budget anticipates prices of $3.71/Mcf for gas and $24.55/bbl for oil, which will enable it to fund its drilling program with internally generated cash flow.

Chieftain plans to participate in drilling 36 gross wells (13.7 net) in 2001, operating half of them. About two thirds are wildcats, and the rest are development wells. The exploration program includes three deepwater prospects.

By the end of this year, Chieftain expects to have participated in about 35 wells (13.1 net), all in the gulf, and the directors approved a 14% increase in the original 2000 capital budget to $151 million (Can.). Chieftain is participating in five wildcats that are currently being drilled in the gulf.

In other exploration news, Agip China will invest $8 million for gas exploration the next 2 years on the Sebei Block in northwestern China's Qaidam basin. Agip and China National Petroleum Corp. signed a deal in May of this year. Agip and PetroChina, a subsidiary of CNPC, have set up a joint management committee to manage the program. The Sebei Block covers 6,998 sq km. Agip China estimates it holds 250 billion cu m of gas resources. PetroChina has discovered six gas fields on the block, with combined proven reserves of 130 billion cu m. Gas production will be moved through a 953-km pipeline to Xining, the capital of Qinghai Province, and Lanzhou, the capital of Gansu Province. The line is under construction and due to be completed in October 2001 (OGJ Online, June 5, 2000).

The Angolan E&P units of BP and Royal/Dutch Shell announced a fourth oil discovery on prolific deepwater Block 18 off Angola. The Paladio well was tested at a rate of 3,980 b/d of 31° gravity crude suggesting, according to the oil companies, the "possibility of a significant oil accumulation." BP said, "Further work will be needed to evaluate the full extent of Paladio." The well was drilled in 1,233 m of water by the Pride Angola deepwater drillship. Sonangol awarded operatorship of Block 18 to Amoco Angola in 1996 (BP subsequently acquired Amoco). BP and Shell each hold 50% equity in the block.

Talisman Energy plans to spud three wildcats in Sudan's Heglig region this year. Nigel Hares, vice-president of international operations, said the wells will be started before yearend. Talisman has a 25% interest in 12 million acres that include oil fields with reserves of 850 million bbl. Heglig is producing about 200,000 b/d of crude that is shipped by pipeline to Port Sudan for export. Other partners in the Greater Nile Oil Project are CNPC, Petronas, and the Sudan government.

MMS is planning an environmental impact statement for proposed appraisal drilling off Santa Barbara County, Calif. The EIS will identify and assess potential impacts and mitigation associated with proposals to drill five to eight delineation wells on three undeveloped units in the Santa Maria basin and one undeveloped unit in the western Santa Barbara Channel. MMS will hold two public meetings in Santa Barbara County to provide information and receive comments. MMS said a draft EIS, to be published next summer, will evaluate sequential drilling of the wells by a single mobile offshore drilling unit.

BP has awarded two deepwater development contracts for its Gulf of Mexico projects.

BP awarded $1 billion in offshore service contracts to J. Ray McDermott and a unit of Heerema Marine Contractors Holding for work on several of its deepwater Gulf of Mexico projects, including the Crazy Horse, Mad Dog, Holstein, and Atlantis developments.

Three of the four projects will be spar developments. Crazy Horse, in 6,000 ft of water in the Boarshead basin, 125 miles southeast of New Orleans, has estimated recoverable oil and gas totaling at least 1 billion boe. The other three projects are in 4,500-6,500 ft of water in the southern Green Canyon area of the gulf, 150 miles south of New Orleans. McDermott will construct topside facilities, and Heerema will install facilities, associated pipelines, and gathering lines. The installation agreement calls for the use of two Heerema deepwater construction vessels, Balder and Thialf, both of which will undergo upgrades in preparation for the jobs. The installation contract value could reach $400 million. Fabrication will begin in the second half of 2001, and BP plans to begin installation in 2002-03.

In other development action, CMS Oil & Gas, a unit of CMS Energy, said that its Alba No. 8 well in Equatorial Guinea flowed on test at a rate of 27.5 MMcfd of gas and 2,040 b/d of condensate from a 46/64-in. choke with flowing tubing pressure of 3,000 psi. Alba field is 18 miles off Equatorial Guinea, north of Bioko Island. The well is the fourth and last in an accelerated development project, initiated in 1999 to increase the field's production capacity to 225 MMcfd of gas from 90 MMcfd. Up to 125 MMcfd will be supplied to a methanol production plant under construction on Bioko Island. An additional 10 MMcfd will be used for onshore operations, and the remaining 90 MMcfd will be reinjected. The methanol production plant is scheduled to be completed by second quarter 2001. As part of the project, CMS and its partners installed a tripod well platform and a 4-pile, 12-slot manned platform with compression, various infield flow lines, and a 19-mile pipeline from the Alba field to Bioko Island.

The UK's PSC HEAVY LIFT Ltd. CLAIMS A WORLD RECORD FOR HEAVIEST OBJECT EVER LIFTED.

PSC has again shattered the record for the heaviest object ever lifted, after lifting R&B Falcon's Deepwater Horizon RBS-8D semisubmersible deck -weighing 12,680 tonnes-(see photo).

Les Brown, managing director of PSC said, "The deck was lifted over a vertical distance of 33 m with the aid of 34 No. PSC L600 strand jacks, a system that has a maximum lifting capacity of 19,000 tonnes. This allowed the two lower hull sections to be skidded underneath the deck, using an active loadout system supplied by PSC, to complete the semisubmersible structure."

In July 1999, PSC claimed a world record weight of 11,000 tonnes for lifting a deck for the Deepwater Horizon's sister rig, Deepwater Nautilus.

OILSANDS projects take center stage this week in production news.

OPTI Canada plans to file an application in December with Alberta regulators for a $450 million (Can.) oilsands project in the Fort McMurray region of northern Alberta.

OPTI will seek approval for development of the project in 2001 and production of 30,000 b/d in 2004. A second phase, planned for 2005, would double output at the site near Gregoire Lake, 25 miles southeast of Fort McMurray. OPTI is a subsidiary of the Ormat Group of Cos. of Israel.

Project manager Phil Rettger said the proposed plant would use steam-assisted gravity drainage (SAGD) technology to recover bitumen. The project would include an on-site plant to generate steam and electricity. OPTI would use gasified asphalt as a fuel rather than natural gas, which is used in most SAGD operations.

OPTI is building a 500 b/d pilot plant near Cold Lake, Alta., to test the system.

Meanwhile, Japan Canada Oil Sands (JACOS), Calgary, plans to increase production at its Hangingstone pilot project in northern Alberta to 10,000 b/d from 1,500 b/d by 2005. The project is 31 miles southwest of Fort McMurray.

JACOS, which is owned by the Japanese government and private investors, estimates the expansion will cost $130 million (Can.). A regulatory application has been filed to increase approved capacity at the pilot plant to 11,000 b/d.

Canadian Natural Resources Ltd. (CNRL) will drill 200 coreholes this winter on leases in northern Alberta, where it plans to develop a major oilsands project. CNRL Vice-Pres. Real Doucet said the company plans to produce 300,000 b/d of oil by 2010 at the Mic Mac site, about 43 miles north of Fort McMurray. Doucet said the leases have more than 2.4 billion bbl of mineable oil. The $6.5 billion (Can.) project would consist of a truck and shovel mining operation to produce 200,000 b/d and an in situ project using steam extraction to produce 100,000 b/d. The company plans to file in 2002 for regulatory approval for the Mic Mac project. It acquired the leases from BP in mid-1999.

Elsewhere on the production front, the licensees at Statoil's Yme field have decided to close down production from the small Norwegian North Sea development next summer, on the basis of new production and oil price forecasts that make Yme appear uneconomic. The contract with Mærsk Contractors Norge, which owns and operates the Mærsk Giant production jack up that has been producing oil from the field since February 1996, has been canceled effective June 1, 2001. The charter for the Navion Saga storage ship operated by Rasmussen Maritime has been canceled effective May 21. Yme currently has seven active wells flowing some 16,000 b/d of oil, according to Statoil. Once these wells start being shut in next March, output is expected to drop to 9,000 b/d. The field is forecast to have yielded some 51 million bbl of oil by the time it ceases production. Yme was developed at a cost of some 2.1 billion kroner. Statoil holds a 35% interest in the field; the state's direct financial interest, 30%; Norsk Hydro, 25%; and RWE-DEA Norge, 10%.

ExxonMobil confirmed reports last month that it would raise its natural gas production from the Sable Offshore Energy Project in Canada to 600 MMcfd from its current production of 500 MMcfd when two pipelines linking Sable Island gas to Nova Scotia and New Brunswick are complete. ExxonMobil will ramp up production to 550 MMcfd, once those lines start up in late November, and eventually will raise output to 600 MMcfd. Gas production from Sable Island moves to markets in eastern Canada and the US Northeast via the 650-mile, 530 MMcfd Maritimes & Northeast Pipeline. The project includes three offshore platforms, a 125-mile subsea pipeline, natural gas processing and fractionation plants, and the M&NE Pipeline. ExxonMobil holds a 59.8% interest in the Sable Island project through its Mobil Canada subsidiary and its 70% interest in Imperial Oil, which holds a 9% equity share of the project.

Topping pipeline news this week, Sonatrach awarded two major construction contracts, valued at a combined $185 million, to build an 822-km pipeline between the southeast Haoud El Hamra oil field and the northwest port of Arzew. The project has been divided into spreads of 419 km and 403 km. The $95 million contract to construct the first section was awarded to Algeria's Cosider Iron and Steel Group and Halliburton subsidiary Brown & Root Condor.

The second-phase contract, worth $90 million, was won by Russian companies Stroy and TransGaz. The pipeline project, which will include six pumping stations, is due to be completed within 2 years. It would transport crude from new discoveries.

In other pipeline-related developments, Thai and Japanese state oil firms signed an accord for a 9-month joint study of the natural gas market in Southeast Asia and potential gas pipeline interconnections. Petroleum Authority of Thailand and Japan National Oil Corp. will study markets in countries sharing the greater Gulf of Thailand area, which include Thailand, Cambodia, Viet Nam, and Malaysia. The study will identify potential investment opportunities in development of gas reserves, including interconnecting pipelines under the broader Trans-ASEAN Pipeline System; power generation; industrial fuels; district cooling and heating; and other applications.

India's government has approved the Expansion of two refineries.

The Indian government approved the expansion of Kochi Refineries Ltd.'s plant at Ambalamugal to 13.5 million tonnes/year from 7.5 million at a cost of 43.7 billion rupees. Orginally known as Cochin Refineries, the KRL plant was built in the 1960s as a government JV with Phillips Petroleum. It has been expanded several times. The government is selling its interest in KRL to Bharat Petroleum, but as refinery operator, KRL will oversee the 3-year expansion.

Also due for expansion is the Chennai Refineries at Madras, formerly known as Madras Refineries. Capacity will be raised to 9.5 million tonnes/year from 6.5 million at a cost of 23.6 billion rupees.

Meanwhile, the government is selling its interests in four stand-alone refineries to Indian oil majors. Indian Oil Corp. will buy the Chennai and Bongaigaon refinery and petrochemicals plants, while Bharat Petroleum will acquire the Kochi and Numaligarh refineries.

CORRECTION: In the right panel of Fig. 4, (OGJ, Nov. 13, 2000, p. 22) the left axis should have contained the following values, from top to bottom, in million b/d: 1.5; 1.2; 0.9; 0.6; 0.3; and 0.