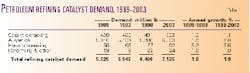

Refining catalyst demand inches ahead between 1998 and 2003

Petroleum refining catalyst demand will grow 1.9%/year between 1998 and 2003-a result of proposed gasoline sulfur limits, declining crude quality, and a move to new, higher-value products.

Growth between 1989 and 1998 was 1.8%/year (Table 1).

The growth between 1998 and 2003 corresponds with a 4.4%/year growth in sales, to $1.3 billion in 2003. Demand for petroleum refining catalysts, which totaled $1.1 billion in the US in 1998, is primarily a function of the amount of crude oil being refined, trends in refined products consumption, and the level of existing environmental regulation.

Broader trends in the crude oil industry also play a role, especially pricing, industry consolidation, and the quality of crude stocks.

These numbers are based on a report by Freedonia Group Inc., Cleveland, Ohio.

Consolidation in the refining industry will restrain value growth by inhibiting price increases, however. It will be offset somewhat by a shift in product mix toward more expensive catalysts.

Growth in volume demand will be limited by use of more-efficient catalysts and increasing recycling and regeneration activity. In 1998, catalysts used in catalytic cracking accounted for more than 46% of demand, the largest percentage for any one catalyst.

Between 1998 and 2003, however, hydroprocessing catalysts will experience the fastest growth, followed by alkylation catalysts.

Regulations, mergers

Environmental regulations are increasing the demand for catalysts used to remove impurities such as sulfur, nitrogen, and metals from crude oil. For example, in 1999, the US Environmental Protection Agency (EPA) introduced a proposal for new sulfur limits for gasoline, lowering the allowable sulfur from 330 ppm (wt) to 30 ppm (wt).

These stricter limits will increase the need for catalysts used in hydrodesulfurization processes. They could also benefit reforming catalysts as refiners search for methods to increase octane, which severe hydrodesulfurization decreases.

The late 1990s witnessed a number of mergers between petroleum companies. British Petroleum plc and Amoco Corp. created BP Amoco, now called BP, and Exxon Corp. and Mobil Corp. created ExxonMobil Corp.

These mergers reduced the market base for catalyst producers. Large players benefit from stronger buying power, which makes it difficult for catalyst manufacturers to raise prices.

Mergers often lead to plant rationalization, which reduces catalyst usage.

Merchant sales

Merchant sales from catalyst companies, independent of refinery operators, will continue to dominate catalyst usage in the near future. These merchants provided more than 80% of the total catalyst volume sold in 1998. Their stronghold is firm because they employ personnel who are familiar with refining processes.

Merchants of fluid-cracking catalysts have the largest presence in the refining catalyst industry.

Nevertheless, some petroleum refiners still maintain a presence in catalyst research and development (R&D). For example, ExxonMobil is a leader in zeolite fluid-catalytic cracking catalysts, and Chevron is involved in hydrocracking and hydrorefining catalysts.

Catalytic cracking and alkylation

Demand for catalysts used in catalytic cracking will rise 1.1%/year between 1998 and 2003, slower than growth in all other refining catalyst categories. Excess inventory and downward price pressures will restrain advances.

The declining quality of crude oil as well as the growing use of catalytic cracking as an incremental producer of propylene will provide some upward momentum.

The continuing decline in crude-oil quality will provide opportunities for growth in demand. The quality of the crude oil recovered tends to decline over time as the lighter crudes are recovered first. Unlike light crudes, heavy crude oils require more catalytic cracking and, therefore, more catalysts.

Demand for alkylation catalysts will rise by about 2.0%/year between 1998 and 2003, while sales will increase by more than 5%/year. Growing environmental concerns over the use of methyl tertiary butyl ether (MTBE) and increasing demand for high octane gasoline will augment demand for alkylation catalysts.

Alkylates are a promising alternative to MTBE in gasoline since they have high octane numbers, have exceptional antiknock properties, and are clean burning.

Liquid inorganic acids accounted for the majority of alkylation catalyst demand in 1998. New products such as solid-acid catalysts, however, are being developed for alkylation processes in response to environmental concerns over the handling and disposal of traditional acid products.

Freedonia expects demand for solid-acid catalysts to experience strong growth, but it will likely account for only a small portion of alkylation-catalyst demand.

The demand for liquid inorganic acids will reach $300 million by 2003.

There are two basic liquid acid alkylation processes: one based on hydrofluoric acid and the other on sulfuric acid. Both processes require significant handling safeguards, are potentially corrosive, and generate by-products that are difficult to dispose of.

In using these acids, refineries balance trade-off costs between the higher catalyst consumption of sulfuric acid and the higher price of hydrofluoric acid. Regeneration facilities are almost always required for sulfuric acid processes to avoid waste-acid disposal problems.

Hydrofluoric acid, a highly reactive chemical, also requires the extensive use of expensive corrosion resistant materials.

As a result of environmental concerns, sulfuric acid catalysts have been increasingly substituted for hydrofluoric acids when possible. However, this has been limited to new alkylation units because of the high cost of converting existing units.

Hydroprocessing

Demand for hydroprocessing catalysts will rise by 3.6%/year through 2003-significantly faster than growth in demand for petroleum refining catalysts in general. Advances will be driven by increasing demand for cleaner fuels and new gasoline sulfur limits proposed by the US EPA.

Hydroprocessing includes both hydrotreating and hydrocracking. Both hydrotreating and hydrocracking catalysts will experience similar growth of 3.6%/year.

- Hydrotreating. The EPA's new proposed sulfur limits for gasoline will boost demand for hydrotreating catalysts as will introduction of new catalysts with improved activity and selectivity. Base-metal catalysts, used almost exclusively in this refining process, will continue their dominance.

Hydrotreating-catalyst manufacturers are looking to improve their margins in a highly competitive market by introducing new products with improved yield and selectivity.

- Hydrocracking. Advances for hydro cracking catalysts will arise from tightening sulfur limits in gasoline proposed by the EPA in 1999 and the introduction of new hydrocracking catalysts.

The manufacture of hydrocracking catalysts requires the use of zeolites and precious metals. These two materials will experience strong demand growth, but base metals will continue to represent the largest percentage of hydrocracking catalyst demand through 2003.

Reforming catalysts, others

Growth for reforming and other petroleum refining catalysts-1.8%/year between 1998 and 2003-will result from the new sulfur limits for gasoline proposed by the EPA. Advances will also come from the steadily increasing demands for premium gasoline as well as the introduction of catalysts with improved activity and selectivity.

Catalysts for other petroleum refining processes include those used in sulfur-recovery units, isomerization units, and other miscellaneous process plants.

- Reforming. The steadily increasing demand for premium gasoline will result in increased reforming capacity, which should benefit catalyst usage. Catalytic reforming converts low-octane naphthas into high-octane gasoline blending components called reformate.

- Sulfur recovery and oxidation. Sulfur-recovery and oxidation catalysts in particular will benefit from the EPA's proposal to limit sulfur content in gasoline. Sulfur recovery is a chemical treatment to remove sulfur or sulfur compounds from hydrocarbons.

Oxidation catalysts work in units that provide additional oxygen to the sulfur-recovery plant.

- Isomerization. Isomerization catalysts will also benefit from demand for premium gasoline. Isomerization catalysts are used to convert straight-chain paraffins to their branched-chain counterparts that have substantially higher octane numbers. In addition, isomerization produces feedstock for alkylation, used to produce high-octane gasoline components.

Demand for isomerization catalysts will benefit from the development of catalysts with improved performance capabilities. For example, Cosmo Oil Co., Tokyo, and Cosmo Research Institute Ltd., Saitama, Japan, have developed, jointly with Mitsubishi Heavy Industries, Tokyo, a light-naphtha isomerization catalyst.

This new catalyst is a platinum-supported, sulfuric acid-treated zirconia catalyst, designed to transform light-naphtha into a high-octane gasoline base.

The technology is targeted as a solution for meeting environmental standards, such as those for vapor pressure. It also allows for production of gasoline at octane values about three points higher than those produced with a platinum-zeolite base catalyst, while eliminating requirements for pretreatment facilities such as a dryer.

- Miscellaneous catalysts. A variety of materials is used in the manufacture of reforming and other refining catalysts including precious metals, base metals, and other materials.

Biocatalysts, which are a focal point of research and development, have found application in desulfurization processes. The US Department of Energy recently awarded Petro Star Inc., Anchorage, Alas., a grant to develop biodesulfurization catalysts and build a demonstration plant (OGJ, Aug. 28, 2000, p. 9).

New product development

New product development is an important aspect of the petroleum refining catalyst industry. Demand for more sophisticated process and catalyst technology is increasing to meet both legislative and market dynamics.

Catalyst manufacturers are under more pressure than ever to reduce costs and speed product development. These companies are continuously investing in research and development to improve their catalysts and catalyst technology.

In general, new products introduced by catalyst manufacturers are designed specifically to meet environmental and safety concerns or to improve performance and cost. Often, new catalysts do both.

With increasingly stringent environmental regulations introduced by government agencies, such as the EPA, and growing concern over safety, catalyst manufacturers have been working on products that are safer for the environment and less hazardous to use.

Several companies have introduced alternative liquid as well as solid-acid catalysts for use in alkylation processes to replace hydrofluoric and sulfuric acids. These alternative catalysts produce less hazardous materials as a by-product of the alkylation process. They are also safer to handle, are less corrosive to equipment, and require no treatment of waste acid.

Solid acids are based on zeolite chemistry or other amorphous acidified silica alumina and are designed to avoid these problems. The high cost of switching to a relatively new technology, however, limits their commercialization.

Catalyst manufacturers are also concerned with providing catalysts with improved performance at a lower cost. For instance, in 1998 Akzo Nobel introduced new hydroprocessing catalysts designed with high-activity to reduce the amount of new equipment needed to meet sulfur limits.

Catalyst manufacturers are developing new technology to improve catalyst production. Engelhard, for example, introduced its Fact technology for controlling porosity of aluminosilicate zeolite catalysts. The technology is designed to produce zeolite catalysts that yield more fuel and reduce emissions as well as remove by-products such as carbon monoxide, carbon dioxide, and nitrogen dioxide.