OGJ Newsletter

GENERAL INTEREST — Quick Takes

Aramco signs agreements aimed at expansion

Saudi Aramco has entered agreements aimed at expanding into offshore construction in Saudi Arabia.

The expansion follows plans announced by Saudi officials in April to make Aramco an industrial conglomerate in a program of sweeping economic reform called Saudi Vision 2030 (OGJ Online, Apr. 25, 2016).

Aramco signed a joint development agreement with National Shipping Co. of Saudi Arabia (Bahri), Lamprell of Dubai, and Hyundai Heavy Industries for a maritime yard in eastern Saudi Arabia to provide engineering, manufacturing, and repair services for offshore rigs, commercial vessels, and offshore support vessels.

The companies signed a memorandum of understanding (MOU) for the project in January and have been conducting due diligence and feasibility studies. The plant would be at Ras Al Khair.

Under the JDA they'll work on financing, construction, operation, and ownership issues and begin negotiations of definitive agreements before making a final investment decision.

Separately, Aramco signed an MOU with GE and Cividale SPA of Italy to build a forging and casting manufacturing plant for maritime and energy industries in the Middle East and North Africa. Like the maritime plant, the facility would be at Ras Al Khair.

Joint investment would be more than $400 million.

Aramco also is working with partners to develop an onshore rig manufacturing facility, an engine manufacturing project, and an energy industrial city to accelerate manufacturing industries serving the oil and gas business.

Mubadala, Oxy withdraw from Bahrain venture

Mubadala Petroleum and Occidental Petroleum Corp. have withdrawn from Tatweer Petroleum, a joint venture formed in 2009 to redevelop Bahrain oil field, according to press reports (OGJ Online, Nov. 10, 2009).

The remaining Tatweer shareholder, Nogaholding, owned by the Bahraini government, owns about half of Tatweer.

According to Mubadala Petroleum, owned by the government of Abu Dhabi, Tatweer drilled more than 780 wells and refurbished and added production equipment and gas and water-handling facilities to boost output rates to 44,400 b/d of oil and 2.3 bcfd of natural gas by yearend 2014 from 26,100 b/d of oil and 1.6 bcfd of gas when it began work.

Bahrain field, discovered in 1932, earlier was known as Awali field.

Dove to succeed Sheffield at PNR

Timothy L. Dove, president and chief operating officer of Pioneer Natural Resources Co. (PNR), Dallas, has been named president and chief executive officer of the company to succeed Scott D. Sheffield, who will retire at yearend.

Both executives worked for predecessor company Parker & Parsley Petroleum Co., which became PNR after the merger of Mesa Petroleum in 1997.

At the time of the merger, Sheffield was Parker & Parsley's chairman of the board and chief executive officer and became chief executive of the new firm. He was elected chairman in 1999.

Dove was Parker & Parsley senior vice-president at the time of the Mesa merger and held several PNR executive positions before becoming president and chief operating officer in 2004.

Sheffield will continue as executive chairman of the PNR board through 2017, when he'll retire as an executive and employee of the company but remain on the board.

Cutt appointed Cobalt International CEO

Timothy J. Cutt has been named chief executive officer and Class 1 member of the board of directors of Cobalt International Energy Inc., Houston, effective July 2. Until last March, he was president, petroleum, of BHP Billiton.

Cutt, who has worked in the oil and gas industry more than 30 years, succeeds Joseph H. Bryant, who resigned as CEO and chairman and member of the board.

Van P. Whitfield, executive vice-president and chief operating officer, was appointed interim CEO effective June 1 and a Class 2 member of the board.

Also effective June 1, William P. Utt, lead independent director, was appointed interim chairman.

Exploration & Development — Quick Takes

NPD studies cores from northeastern Barents Sea

The Norwegian Petroleum Directorate had seven shallow wells drilled in the northeastern Barents Sea in fall 2015, resulting in 1,000 m of stratigraphic drill cores to help assess the resource base.

The area is not open for petroleum activity. NPD did not disclose the well depths.

Meter by meter, the cores are being examined and registered in the NPD "core store" in Stavanger. NPD said the cores provide "a quick overview of rock types and sedimentary structures."

Containing source and reservoir rocks, the cores measure 5-7 cm in diameter and are split lengthwise. They are being studied with a magnifying glass, tape measure, and hydrochloric acid.

"Once these studies have been completed, we will understand much more about the geology in these sea areas," said Andreas Bjornestad, a geologist who participated in the drilling expedition with the vessel Bucentaur (OGJ Online, Feb. 28, 2013).

The cores were initially brought to the NPD core store in Trondheim, where three consultants readied them for descriptions. In April, they were moved to Stavanger, which holds samples and drill cuttings from nearly all exploration and production wells drilled on the Norwegian shelf. The vast majority of those drill cores are from reservoir rocks, NPD said.

NPD greenlights North Sea wildcat, Brasse prospect

The Norwegian Petroleum Directorate has granted Faroe Petroleum Norge AS a permit for well 31/7-1 on its jointly owned Brasse prospect in PL740. The area in this licence is part of Blocks 31/7 and 30/9. PL740 was awarded in APA 2013. This is the first well to be drilled in the license.

According to Faroe's web site, the prospect holds stacked reservoir potential in Upper and Middle Jurassic. Well 31/07-01 will be drilled from the Transocean Arctic drilling facility and is expected to spud sometime in mid-2016. Faroe holds equal interest in PL740 with Core Energy AS.

Drilling approved for Indonesia's South Block A

Indonesia has approved the Amanah Timur No. 1 (AT1) appraisal well, and ACL International Ltd.'s subsidiary Renco Elang Energy Ltd. said the well will spud before Nov. 30. Renco, the operator of South Block A, is drilling AT1 to test the Paya Bili prospect at TD of 700 m and to evaluate reservoir productivity in a pre-1940 oil field as well as deeper untested sandstones.

South Block A is onshore and offshore Aceh Province, North Sumatra, Indonesia (OGJ Online, May 18, 2009). The prospect lies within the North Sumatra basin and is one of the most productive hydrocarbon provinces in Indonesia with more than 80 known oil and gas fields. ACL acquired 38.25% interest in South Block A in July 2015.

South Block A is split into two portions. The West block covers 1,257 sq km onshore the North Sumatra. The East block covers 637 sq km, extending into the coastal area and offshore. East block also includes four exploration wells and 180 km of 2D seismic.

The operator estimates combined P50 unrisked resources at 442 bcf of gas and 47 million bbl of oil and condensate. The probability of success with identified leads range from 11% to 48%, the company said.

The JV recently completed 183 km of 2D seismic survey, which targeted the Simpang, Djerneh, Amanah, Sungai Lyu, and Paya Bili prospects. Lion Energy Ltd.'s operational update cites the Simpang Deep as the largest of the identified leads, which has more than 25 sq km potential areal closure with similar objectives as the Matang discovery (OGJ Online, Apr. 23, 2016). The JV may select this target for a planned late-2017 drilling campaign.

JV partner Lion Energy holds 35% interest in South Block A through its subsidiary KRX Energy (SBA) Pte. Ltd. According to the company's web site, Renco holds 51% overall as operator of the block, and PT Prosys Oil & Gas International also holds a participating interest.

Black Sea seismic program under way off Romania

Carlyle Group's Black Sea Oil & Gas SRL has awarded GC Rieber Shipping a 45-day contract for seismic work offshore Romania in the Black Sea. Wholly owned subsidiary Dolphin Geophysical Ltd. will deliver fast-track 3D seismic with its 16-streamer Polar Marquis.

Black Sea Oil & Gas has interest in three blocks, XIII Pelican, XV Midia Shallow, and EX-25 Luceafarul, which cover 5,000 sq km within the underexplored Romanian continental shelf. Black Sea Oil & Gas operates the blocks on behalf of its partners Gas Plus International BV (Midia and Pelican) and Petro Ventures Europe BV (Midia, Pelican, and Luceafarul).

On May 11 OMV AG said its subsidiary OMV Petrom SA completed a second exploration drilling campaign in January on its Neptun Deep block offshore Romania. In all, seven wells were finalized with most encountering gas (OGJ Online, May 12, 2016). The company said further interpretation was needed to determine commercial viability, but in 2013 OMV assessed that Neptun might produce 6.5 billion cu m/year. First production is expected before 2020. ExxonMobil Corp. is an equal 50% partner.

Drilling & Production — Quick Takes

EIA: US oil output in March fell 5.4% year-over-year

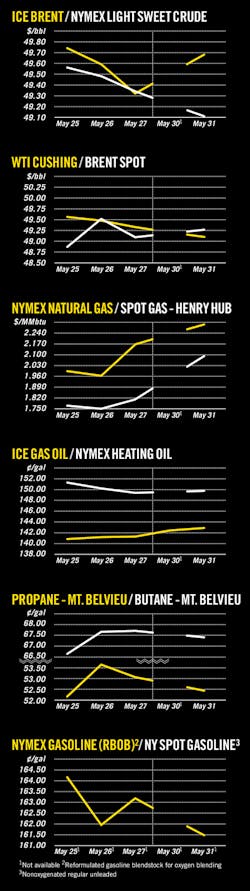

US crude oil production in March averaged 9.127 million b/d, down from 9.133 million b/d in February and 9.648 million b/d in March 2015, according to the most recent data from the US Energy Information Administration.

The overall US crude output decline was led by a more than 10% drop year-over-year in Texas. Production in the state during March totaled 3.276 million b/d, decreasing from 3.316 million b/d in February and 3.644 million b/d in March 2015.

North Dakota output during the month was 1.109 million b/d, down from 1.116 million b/d in February and 1.189 in March 2015.

Onshore production declines were partially offset by a 16% year-over-year jump in production from federal waters of the Gulf of Mexico, where March output averaged 1.641 million b/d, rising from 1.577 million b/d in February and 1.414 million b/d in March 2015.

US natural gas production in March was 91.06 bcf, down from 92.011 bcf in February but still up from 90.768 bcf in March 2015. Texas's gas output was 22.605 bcf, falling from 22.931 bcf in February and 24.087 bcf in March 2015.

Pennsylvania's gas output totaled 14.67 bcf, down from 14.945 bcf in February but still up 11.2% year-over-year from 13.191 bcf. Gas production from the Gulf of Mexico totaled 3.562 bcf, up from 3.496 bcf in February and 3.203 bcf in March 2015.

EIA: Permian oil-output drop to increase in June

Crude oil production in June from the seven major US shale regions is expected to fall 113,000 b/d month-over-month to 4.85 million b/d, according to the US Energy Information Administration's latest Drilling Productivity Report (DPR).

The DPR focuses on the Bakken, Eagle Ford, Haynesville, Marcellus, Niobrara, Permian, and Utica, which altogether accounted for 95% of US crude production increases and all US natural gas production increases during 2011-13.

For the third consecutive month, the Permian is forecast to record an oil-output decline. The projected 10,000-b/d loss in June would bring its total output to 2.02 million b/d. The West Texas basin was the last major oil-producing region for which the EIA projected a monthly loss since overall US shale output began falling in spring 2015.

In South Texas, the Eagle Ford is again expected to represent most of the overall US loss in June, shedding 58,000 b/d to 1.21 million b/d. The Bakken is projected to drop 28,000 b/d to 1.02 million b/d, and the Niobrara is projected to drop 15,000 b/d to 391,000 b/d.

New-well oil production/rig in June across the seven regions is expected to rise by a rig-weighted average of 13 b/d to 575 b/d, reflecting a 23-b/d jump in the Eagle Ford to 994, 23-b/d gain in the Niobrara to 915, 17-b/d increase in the Bakken to 832 b/d, and 13-b/d rise in the Permian to 493 b/d.

Gas production from the regions is forecast to fall 464 MMcfd to 45.97 bcfd. The Eagle Ford is expected to lose 195 MMcfd to 6.3 bcfd, followed by a 74-MMcfd drop in the Niobrara to 4.11 bcfd, 64-MMcfd decrease in the Haynesville to 5.98 bcfd, and 53-MMcfd losses in each of the Marcellus and Permian to 17.29 bcfd and 6.97 bcfd, respectively.

EIA projects gas output from the Utica to increase 4 MMcfd to 3.66 bcfd.

PROCESSING — Quick Takes

Rosneft, Pertamina ink deal for integrated complex

Russia's OJSC Rosneft and PT Pertamina (Persoro) of Indonesia have signed a framework agreement to cooperate on development of a grassroots refining and petrochemical complex to be built at Tuban, in East Java, Indonesia.

As part of the agreement, Rosneft and Pertamina will perform a bankable feasibility study to finance the project as well as establish a joint venture for its implementation, Rosneft said.

The companies also have agreed to execute studies to investigate the following: prospects for joint projects in the area of crude and oil products supplies, logistics, and infrastructure; potential for Pertamina to enter in Rosneft's upstream projects in Russia as an equity holder; and partnership in international joint projects for refining.

Rosneft said the companies will take final investment decision on the proposed complex once they have completed the feasibility study, basic engineering design (BED), and front-end engineering design (FEED) for the project.

The agreement follows Pertamina's previously announced plans to build refineries and upgrade existing plants as part of its strategy to reduce fuel imports into Indonesia by boosting domestic production (OGJ Online, Dec. 15, 2014).

Rosneft, which has led competition for a share in the long-stalled Tuban complex, views the deal as a launching pad for expanding its footprint as a reliable partner in oil and gas production as well as refining throughout the Asia-Pacific region.

A timeframe for when the firms would complete the feasibility study, BED, and FEED on the project was not disclosed.

Lukoil commissions unit at Volgograd refinery

PJSC Lukoil subsidiary OOO Lukoil Volgogradneftepererabotka has commissioned a vacuum gas oil (VGO) deep-conversion hydrocracking complex at its Volgograd refinery in southern Russia as part of a program to boost overall capacities of the company's refining assets (OGJ Online, Feb. 19, 2013).

Entered into commercial operation on May 31, the deep-processing complex includes a 3.5 million-tonne/year VGO hydrocracker, units for hydrogen production and sulfur recovery, as well as auxiliary installations, Lukoil said.

Completed in 3 years at a cost of $2.2 billion, the complex will increase the refinery's annual output of the following products for primary distribution to markets in southern parts of Russia: Euro 5 diesel fuels by 1.8 million tpy, motor gasoline components by 600,000 tpy, and LPGs by 100,000 tpy.

Startup of the Volgograd deep-processing complex establishes Lukoil as the first Russian operator to fulfill its commitments under a July 2011 quadripartite agreement on modernization of Russia's oil processing industry between oil companies; the Federal Antimonopoly Service of the Russian Federation; the Federal Service for Environmental, Technological, and Nuclear Supervision (Rostechnadzor); and the Federal Agency for Technical Regulating and Metrology (Rosstandart) to reequip and upgrade oil processing capacities at the country's refineries.

Addition of the complex at Volgograd follows Lukoil's June 2015 commissioning of the 6 million-tpy AVT-1 crude distillation unit at the refinery (OGJ Online, June 25, 2015; Feb. 20, 2015), which has lifted crude oil processing capacity at the site to a current 15.7 million tpy from its previous 11 million-tpy capacity, Lukoil said in its latest annual report.

CPC lets contract for Cambodian grassroots refinery

Petrochemical Co. Ltd. (CPC) has let a contract to China National Petroleum Corp. (CNPC) unit Northeast Refining & Chemical Engineering Co. to build the first phase of a proposed 5 million-tonne/year refinery in Cambodia's southwestern province of Preah Sihanouk, along the Gulf of Thailand.

As part of the $620-million Phase 1 contract, CNPC Northeast Refining & Chemical Engineering will provide engineering, procurement, and construction on the project, according to a series of releases from Cambodia's government.

Construction on Phase 1 of the refinery, which will have a capacity of 2 million tpy, is scheduled to begin this October and be completed by yearend 2018.

In the years following commissioning of Phase 1, CPC plans to invest in additional expansions of the refinery that will increase its overall crude processing capacity to 5 million tpy, according to the government of Cambodia.

CPC's total capital investment in the grassroots refinery will be about $3 billion, the company said.

The new refinery-which will be Cambodia's first since a 10,000-b/d plant built in 1968 was irreparably damaged in the early 1970's during the country's civil war-will produce finished products for domestic consumption as well as export, Cambodia's Ministry of Mines & Energy said in a post to its official Facebook account.

CPC previously let a licensing and engineering services contract to KBR and Tinajin Petrochemical Engineering Design Co. Ltd. for a 1.2 million-tpy hydrocracker for a proposed 5-million-tpy refinery originally planned for startup in 2015 in Cambodia's Kampong Som Petrochemical Industrial Zone (OGJ Online, Jan. 18, 2013).

It remains unclear whether contracts let for earlier iterations of the long-planned refinery remain in effect under CPC's revised program for the plant.

TRANSPORTATION — Quick Takes

Gladstone LNG's second train starts up

The Santos Ltd.-led $18.5-billion Gladstone LNG (GLNG) project on Curtis Island near Gladstone in central east coast Queensland has brought on line its Train 2, just 8 months after Train 1. The Santos group has produced in excess of 2 million tonnes of LNG since Train 1 came on stream in October 2015 and shipped 32 cargoes in that time.

The JV comprises Santos 30%, Petronas 27.5%, Total SA 27.5%, and Korea Gas Corp. 15%.

The three coal seam gas-LNG projects on Curtis Island now have five out of the six planned trains in operation. These include GLNG (2 trains), BG's Queensland Curtis LNG (2 trains) and Origin Energy's Australia Pacific LNG (1 train).

All gas supplies are being sourced from the Surat-Bowen basins of inland southeast Queensland.

Chevron gets environmental nod for Gorgon Train 4

The Australian government has granted environmental approval to Chevron Australia Pty. Ltd. for Train 4 at the firm's $54-billion Gorgon-Jansz LNG plant on Barrow Island off Western Australia. Valid until yearend 2069, the expansion approval has numerous stringent environmental management, monitoring, and reporting conditions attached.

At this stage, however, Chevron has little inclination to move into a Train 4 mode. The company and its joint venture partners recently began production with Train 1, while Trains 2 and 3 are still under construction. Train 1 was shut down for repairs for 2 months soon after coming on stream, but is now back online.

The JV's priority is to complete the foundation project of three trains and has yet to make a decision to proceed with planning of a fourth. Train 2 is due to come online later this year with Train 3 just 6 months after that.

Slumping oil prices and oversupply in the global LNG market has dampened the zest for further expansion in the short term, although there appears to be plenty of gas in undeveloped fields in the Greater Gorgon region to support a fourth train.

Nevertheless the government approval and its timeframe does provide environmental certainty should a decision to proceed with Train 4 be made in the future.

HMEP to build US-Mexico refined products line

Howard Midstream Energy Partners LLC (HMEP) unit Dos Aguilas Pipeline LLC will build the 287-mile, 12-in. OD Dos Aguilas products pipeline following a successful open season. Dos Aguilas is an open access system of refined products terminals and pipelines from Corpus Christi, Tex., to northern Mexico. HMEP expects the project to service first-half 2018.

Dos Aguilas will ship gasoline, ultra-low sulfur diesel, and jet fuel from the Corpus Christi refinery to Laredo, Tex., and on to northern Mexico through deliveries to Nuevo Laredo, Tamaulipas, and Monterrey, Nuevo Leon. The project is broken down for regulatory purposes into four pipelines, with different names: Border Express Pipeline, Corpus Christi to Laredo (141 miles); Borrego Pipeline, Laredo to the US-Mexico border (10 miles); Poliducto Frontera Pipeline, US-Mexico border to Nuevo Laredo (12 miles); and Poliducto del Norte Pipeline, Nuevo Laredo to Monterrey (124 miles).

Howard will build terminals, with a combined 1.2 million bbl of storage, at the pipeline's start in Robstown, Tex., Laredo, Nuevo Laredo, and at the pipeline's end in Santa Catarina, Mexico, near Monterrey.