OGJ Newsletter

GENERAL INTEREST — Quick Takes

ExxonMobil's third-quarter earnings slide 38%

ExxonMobil Corp. recorded third-quarter earnings of $2.7 billion, down from $4.2 billion a year earlier. The multinational firm says the results reflect lower refining margins and commodity prices.

Upstream earnings were $620 million in the quarter, down $738 million from third-quarter 2015. Lower liquids and gas realizations decreased earnings by $880 million, while volume and mix effects increased earnings by $80 million. All other items, including lower expenses partly offset by unfavorable foreign exchange effects, increased earnings by $60 million.

US upstream earnings declined $35 million year-over-year to a loss of $477 million, while outside the US, upstream earnings were $1.1 billion, down $703 million from the prior year.

Companywide liquids production totaled 2.2 million boe/d, down 120,000 boe/d year-over-year. Higher downtime, mainly in Nigeria, and field decline were partly offset by project startups. Natural gas production was 9.6 bcfd, up 77 MMcfd from 2015 as project start ups more than offset field decline and divestment impacts.

Downstream earnings were $1.2 billion, down $804 million from third-quarter 2015. Weaker margins, mainly in refining, decreased earnings by $1.6 billion, while favorable volume and mix effects increased earnings by $170 million. All other items increased earnings by $580 million, including lower maintenance expenses and gains from divestments in Canada.

Earnings from US downstream were $225 million, down $262 million year-over-year. Downstream earnings outside the US of $1 billion were $542 million lower than the prior year.

Chemical earnings of $1.2 billion were $56 million lower than that of third-quarter 2015. Margins decreased earnings by $10 million, while volume and mix effects increased earnings by $20 million. All other items decreased earnings by $70 million due primarily to higher maintenance expenses.

US chemical earnings of $434 million were $92 million lower than in third-quarter 2015. Chemical earnings outside the US of $737 million were $36 million higher than the prior year.

During the quarter, capital and exploration expenses were reduced 45% to $4.2 billion.

Oxy expands Permian basin interests

Occidental Petroleum Corp. has acquired 35,000 net acres in the Permian basin horizontal drilling play and expanded its enhanced oil recovery holdings in the basin through transactions with private sellers totaling $2 billion.

The acquired leasehold in Reeves and Pecos counties, Tex., includes 7,000 boe/d of net production, 72% oil, from 68 horizontal wells. Oxy estimated the acreage has at least 700 gross horizontal-drilling locations targeting Permian Wolfcamp A and B and Bone Spring strata. The acquired acreage is near other Oxy development sites. It expands the company's leasehold in the area to nearly 59,000 acres.

The acquired working interests in producing carbon-dioxide floods and related equipment increase Oxy's ownership in several properties where the company is operator or an existing working interest holder.

The properties produce 4,000 boe/d, 80% oil. They have net proved-developed-producing reserves estimated at 25 million boe and total proved reserves estimated at 41 million boe.

Statoil cuts capex by another $1 billion

Statoil ASA is lowering its capital expenditure guidance for 2016 by another $1 billion after taking a third-quarter adjusted net loss of $261 million, down from adjusted earnings of $445 million a year earlier.

The Norwegian firm's planned capex is now $11 billion including an exploration guidance reduction to $1.5 billion from $1.8 billion. The firm's production guidance remains unchanged, and expected organic production growth is 1%/year during 2014-17.

Statoil recorded third-quarter equity production of 1.805 million boe/d, down from 1.909 million boe/d during same period in 2015. The reduction was mainly due to planned maintenance and deferral of gas sales, the firm says. Excluding those elements and divestments, the underlying production growth was 5% compared with last year's third quarter.

As of Sept. 30, Statoil had completed 21 exploration wells, with adjusted exploration expenses in the quarter of $581 million, up from $412 million in third-quarter 2015.

Statoil at the end of the second quarter also reported plans to shed $1 billion in capex (OGJ Online, July 27, 2016).

Noble, Consol to split Marcellus JV

Consol Energy Inc., Pittsburgh, and Noble Energy Inc., Houston, have agreed to separate their 50-50 joint venture formed in 2011 for the exploration, development, and operation primarily of Marcellus shale properties in Pennsylvania and West Virginia. An exchange agreement determines each firm will own and operate 100% interest in its properties and wells in two separate operating areas, with respective independent control and flexibility of future development over its area.

All acreage operated by the firms in their respective operating areas will remain fully dedicated to CONE Midstream Partners LP. Prior to the split, the JV collectively operated 669,000 Marcellus acres. Consol and Noble each held 50% working interest. As of the effective date of the exchange agreement on Oct. 1, total flowing production to the JV was 1.07 bcfd of natural gas equivalent.

After the split's completion, expected in the fourth quarter, Consol will operate 100% working interest in 306,000 Marcellus acres with associated production of 620 MMcfed. The majority of its acreage resides in Pennsylvania.

Noble will operate 100% working interest in 363,000 Marcellus acres with associated production of 450 MMcfed. The majority of its acreage resides in West Virginia. Noble also will remit to Consol a $205-million cash payment at closing. The exchange of assets and cash result in the elimination of the remaining outstanding carry cost obligation due from Noble.

Exploration & Development — Quick Takes

ExxonMobil makes oil discovery offshore Nigeria

ExxonMobil Corp.'s Owowo-3 well has encountered a 460-ft column of oil-bearing sandstone offshore Nigeria. Combined with the operator's Owowo-2 discovery, which encountered 515 ft of reservoir, the field could contain 500 million bbl to 1 billion bbl of oil, ExxonMobil said.

ExxonMobil affiliate Esso Exploration & Production Nigeria Ltd. spudded the Owowo-3 on Sep. 23 and drilled to 10,410 ft in 1,890 ft of water. Owowo field spans portions of the contract areas of oil prospecting license 223 (OPL 223) and oil mining license 139 (OML 139).

ExxonMobil holds 27% interest and is operator for OPL 223 and OML 139. Joint venture partners include Chevron Nigeria Deepwater Ltd. 27%, Total E&P Nigeria Ltd. 18%, Nexen Petroleum Deepwater Nigeria Ltd. 18%, and Nigeria Petroleum Development Co. Ltd. 10%.

Gazprom Neft discovers oil field in northern Russia

PJSC Gazprom Neft said three exploratory wells found six "independent oil deposits" in the Zapadno-Chatylkinsky license block in the Yamalo-Nenets autonomous okrug in northern Russia. Commercial development is planned for 2018.

The company said total geological reserves confirmed by the State Commission on Mineral Reserves are estimated at more than 40 million tonnes. It cited the Jurassic Sigovsky formation and depths of 2.5-3 km.

Gazprom Neft acquired block development license in 2012.

Inpex exploratory well off southern Japan finds gas

Inpex Corp., Tokyo, said an offshore exploratory well encountered a thin natural gas reservoir in a shallow zone and "unexpected, strong gas indications" in the deepest zone, "suggesting the presence of a high-pressure gas column."

The well was drilled by Transocean's M.G. Hulme Jr. semisubmersible drilling rig in 210 m of water to a depth 2,900 m below the sea floor. Drilling began June 5 and was concluded Oct. 26.

The location is about 130 km offshore, northwest of Shimane Prefecture and north of Yamaguchi Prefecture. The company said the area has not been drilled since the 1980s.

The company will conduct a detailed analysis of data obtained (OGJ Online, June 8, 2016).

Condor to complete Poyraz well in Turkey

Condor Petroleum Inc., Calgary, has cemented production casing in a well that logged at least 135 m of net natural gas pay in stacked reservoirs at the edge of Poyraz Ridge gas field under development in northwestern Turkey.

Pay in the Poyraz 3 well is in Miocene Kirazli and Gazhanedere sandstones and Eocene Sogucak carbonate.

The company said the well encountered no gas-water contact in basal Gazhanedere reservoirs. The gas-water contact in the Sogucak was confirmed to be at the structural spill point of Poyraz Ridge field.

Condor President and Chief Executive Officer Don Streu said borehole imaging of the Sogucak "confirms the presence of an extensive network of fractures with the pay column, which should serve to enhance flow performance."

The well will be tested and completed when the rig moves off location. Condor next will drill Poyraz West 5, an appraisal on a different drilling pad designed to test the northwestern extension of the field.

Poyraz Ridge gas field is in the 171-sq-km Ortakoy license area on Gallipoli Peninsula, comprising four contiguous production licenses. Condor acquired a 100% interest in the area in November 2015.

Poyraz Ridge is one of five discoveries on seven structures drilled. The gas is 94% methane.

The field is 17 km from the 36-in. Interconnect Turkey-Greece-Italy pipeline, which has unused capacity. Condor has received preliminary tie-in approval from Turkish authorities.

Condor plans to start gas production in mid-2017. It has conducted front-end engineering and procurement for facilities designed to handle as much as 15 MMscfd of gas.

Statoil to move ahead on Trestakk discovery

Statoil ASA has submitted a plan for development and operation of the Trestakk discovery on the Halten Bank to the minister for petroleum and energy in Bodo, Norway. Capital expenditures are estimated at 5.5 billion kroner.

Discovered in 1986 by the 6406/3-2 well, Trestakk lies in 300 m of water in the Norwegian Sea just south of Asgard. The discovery was further delineated by well 6406/3-4 and identified oil in Middle Jurassic sandstones in the Garn formation. The top of the reservoir lies at a depth of 3,885 m, and it was deposited in a shallow marine environment with calcite cemented intervals.

Trestakk contains 78 million boe, which is mainly oil. The project will be tied back to the Asgard A oil production vessel, with planned production startup anticipated in 2019.

"Trestakk is a good example of what is possible to achieve through spending time on working toward the best concept selection," said Torger Rod, head of Statoil project development. The operator's first investment estimates were 10 billion kroner, which was reduced to 7 billion kroner when the concept selection was made in January (OGJ Online, Feb. 15, 2016).

The concept selection consists of a template structure and an attached satellite well, which will be tied back to Asgard A. Three production wells and two gas injection wells will be drilled for a total of five wells. Statoil attributed the 50% reduction in cost to "rethinking" the original design, and the increase in recoverable oil will extend the life of Asgard A toward 2030, the company said.

Drilling & Production — Quick Takes

Aramco, Nabors sign joint-venture agreement

Nabors Industries Ltd. reported the signing of an agreement to form a joint venture in Saudi Arabia to own, manage, and operate onshore drilling rigs. The JV, which will be equally owned by Saudi Aramco and Nabors, is expected to be formed and commence operations in second-quarter 2017.

Aramco has sought to localize industry hubs in order to foster economic diversification and job creation, the companies said. "This JV is one of the anchor projects that has grown out of this strategy, which supports the wider development and localization of industries such as rig and rig equipment manufacturing and casting and forging," they said.

Aramco and Nabors each will contribute land rigs to the JV in the first years of operation along with capital commitments toward future onshore drilling rigs, which will be manufactured in Saudi Arabia.

Mubadala lets contract for Jasmine field FPSO

Mubadala Petroleum awarded a modified contract to Petrofac that extended contracts related to the FPF-003 floating production, storage, and offloading vessel (Jasmine FPSO) for Jasmine oil field offshore Thailand.

A new agreement covering the life of the field involves operations and maintenance services potentially until 2023. Mubadala and PetroFirst Infrastructure Ltd. also signed an extension to an associated charter lease for the vessel Bareboat Charter. Ultimate field life for Jasmine field depends on continued infill drilling, operational efficiency, and commodity prices. Jasmine field already produced more than 60 million bbl.

Mubadala operates Jasmine field and holds 100% interest. Current average production is 13,000 b/d.

Offshore cost cuts credited to downsizing, design

Offshore developments have experienced lower breakeven prices over the last 2 years with more than half of the cost reductions achieved through downsizing, simplification, and design, said Rystad Energy.

Engineers have reassessed their design approach to make project development and the budget process more predictable, said Rystad analysts.

Operators and service companies have worked together to lower costs. High-grading of rigs, vessels, equipment, and labor also yielded breakeven improvements as did the renegotiation of rig and maintenance contracts.

Audun Martinsen, Rystad vice-president of oil field research, said, "By focusing on the areas with the highest potential within their portfolios, exploration and production companies naturally gained the most from these newfound efficiencies by high-grading their undeveloped fields."

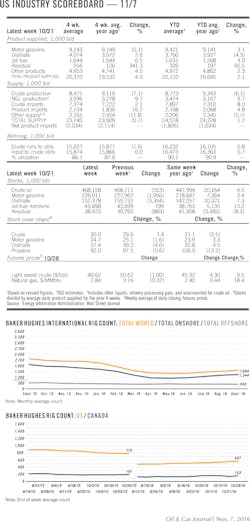

WoodMac: US indies seeking cash-flow neutrality

Independent operators are likely to remain cautious while setting 2017 budgets, said Wood Mackenzie Ltd. analysts, adding that higher oil prices are needed before independents are willing to commit to investments that would meaningfully boost production growth.

"The pace at which tight oil rebounds is one of the biggest wildcards impacting near-term oil prices," WoodMac said. "Unless oil prices rebound to $60/bbl, a return to double-digit production growth is still some way off for most."

Analysts see independents striving for cash-flow neutrality, which means financing daily operations without taking on external debt. Capital discipline remains a priority.

WoodMac believes some companies could finance 10% production growth while staying cash-flow neutral if light, sweet oil prices were to stay above $60/bbl on the New York Mercantile Exchange.

Kris Nicol, WoodMac principal analyst for corporate research, said, "We estimate that our peer group of the 17 largest US independents requires an average of $50/bbl West Texas Intermediate in 2017 to be cash-flow neutral and replace production declines."

He estimates oil would have to trade at $57/bbl for companies to increase production at 5% and $63/bbl for companies to increase production 10%.

Meanwhile, a continued production decline is likely if companies maintain current levels of spending. "We estimate that half of the companies' production would decline if capex remained flat from 2016 to 2017," Nicol said, adding several companies require more than 40% spending increases just to offset production declines.

PROCESSING — Quick Takes

Braskem commissions Texas specialty PE plant

Braskem America, a subsidiary of Braskem SA, Sao Paulo, has initiated commissioning activities at its UTEC ultrahigh-molecular weight polyethylene (UHMWPE) production plant at the company's La Porte, Tex., manufacturing site.

As part of the commissioning phase, which began this month, Braskem is completing a series of functional and process-control tests to verify performance of controls and integrated safety systems at the plant are ready for the production line's full startup, which is scheduled to occur by yearend, the company said.

First announced in June 2014 and built by Saulsbury Industries Inc., Odessa, Tex., the plant comes as part of Braskem's North American growth strategy, which includes expanding production capacity of the company's proprietary UTEC UHMWPE product line in Brazil, Braskem said.

The company has yet to disclose details regarding either the cost or capacity of the grassroots UHMWPE plant.

Braskem's combined annual production of high-density polyethylene, linear low-density polyethylene, and UHMWPE from eight unidentified plants during 2015 totaled 2.23 million tonnes, the company said in a May 5 filing with the US Securities and Exchange Commission.

KNPC lets contract for refineries' Clean Fuels Project

Kuwait National Petroleum Co. (KNPC) has let a contract to SPIE Oil & Gas Services, a subsidiary of SPIE SA, Cergy, France, to provide commissioning management and support services (CMSS) for KNPC's Clean Fuels Project (CFP), which aims to upgrade and expand its Mina Abdullah and Mina Al Ahmadi refineries in southern Kuwait (OGJ Online, Apr. 1, 2013).

SPIE Oil & Gas Services' scope of work under the contract will include delivery of CMSS at both the Mina Abdullah and Mina Al Ahmadi refineries, SPIE said.

Currently in its engineering, procurement, and construction phase, KNPC's CFP will include rehabilitation, expansion, and transformation of the 270,000-b/d Mina Abdullah and 466,000-b/d Mina Al Ahmadi refineries into an integrated merchant refining complex with a combined crude processing capacity of 800,000 b/d (OGJ Online, Mar. 5, 2015).

As part of the project, KNPC also proposes to permanently shut down the 200,000-b/d Shuaiba refinery following construction of the long-planned 615,000-b/d grassroots refinery complex at Al-Zour, which is due to be completed sometime in 2018-19 (OGJ Online, Aug. 5, 2016).

HollyFrontier buying Petro-Canada Lubricants

HollyFrontier Corp., Dallas, has entered a definitive agreement to acquire Petro-Canada Lubricants Inc. (PCLI) from Suncor Energy for $1.125 billion (Can.), including working capital estimated at $342 million.

The buyer said the 15,600-b/d PCLI plant at Mississauga, Ont., is North America's only producer of Group III base oils. HollyFrontier also will acquire PCLI's global distribution and marketing assets, including a perpetual exclusive license to use the Petro-Canada trademark with lubricants.

HollyFrontier said the acquisition will make it the fourth-largest lubricants producer in North America, with capacity of 28,000 b/d, about 10% of North American production.

TRANSPORTATION — Quick Takes

Chevron's Wheatstone LNG project costs skyrocket

Chevron Corp. has encountered a $5-billion cost blowout with its Wheatstone LNG project in Western Australia (OGJ Online, Apr. 21, 2016).

The company said the project would now cost close to $34 billion to complete, a figure that dwarfs the most recent estimate of $29 billion for development.

Chevron cited the overheated construction market at the time work commenced on the project for part of the cost increase. Additionally, there have been difficulties in having key components of equipment built offshore.

There has been late module delivery due to poor performance at one of the fabricating yards where the contractor proved unable to effectively manage the size and the scale of the work scope.

Chevron also admitted that it had failed to estimate the quantity of materials needed for the project, in part brought about by taking the decision to proceed when only 15% of the engineering work had been completed. The rest was based on rule of thumb.

Wheatstone is scheduled to come on stream in mid-2017.

Chevron's Gorgon project also suffered a cost blow-out of $17 billion prior to start of gas projection, but now has a more upbeat story with Train 1 producing LNG at a rate of 5 million tonnes/year along with 6,700 b/d of condensate.

Train 2 at Gorgon is now also on stream and ramping up to supply two to three export shipments a week. Train 3 is expected to come on stream in mid-2017.

DTE closes Appalachia midstream assets deal

DTE Energy Co., Detroit, has completed its $1.3-billion acquisition of midstream natural gas assets in Pennsylvania and West Virginia. The firm purchased 100% of Appalachia Gathering System in Pennsylvania and West Virginia, and 40% of Stonewall Gas Gathering in West Virginia from M3 Midstream LLC. DTE also bought 15% of SGG from Vega Energy Partners Ltd.

The assets gather gas produced in the Appalachia region and provide access to multiple markets, including the Great Lakes region, through interconnections with Columbia Gas Transmission, Texas Eastern Transmission, and the NEXUS Gas Transmission project currently being developed by DTE and Spectra Energy.