Chesapeake eyes Haynesville rig addition in second-half 2024

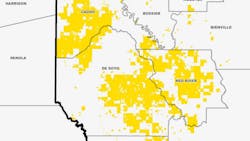

Chesapeake Energy Corp., Oklahoma City, expects to add a rig to its Haynesville shale operations in second-half 2024 if Gulf Coast LNG export plants are brought into service as planned.

President and chief executive officer Nick Dell’Osso said Nov. 1 such a move would help position Chesapeake for a production increase in 2025. Dell’Osso and his team are preliminarily guiding for a 2024 production run rate from the Haynesville and Marcellus basins in line with the 3.2 bcfd forecast for the current quarter. That number was 3.28 bcfd in this year's third quarter.

"We are paying attention to the fact that the export capacity for LNG should come online by the end of the year, setting up for unmet demand in 2025," Dell’Osso said on a conference call with analysts. "If that looks like it’s going to play out and the strip looks like it’s going to hold, then we would add a rig in the second half of the year."

Adding a Haynesville rig next summer or fall would grow Chesapeake’s count in the Haynesville to six and reverse a move made this summer as part of a plan to defer some development work while waiting for natural gas prices to rise (OGJ Online, Aug. 2, 2023). Dell’Osso said while his team has "all the flexibility in the world" when it comes to adding a sixth Haynesville rig; energy market trends will need to justify the investment.

Chesapeake’s total natural gas production (about 3% of which comes from the Eagle Ford) was nearly 3.4 bcfd in third-quarter 2023, when the company spudded 35 wells. Drilling activity for fourth-quarter 2023 is expected to be 35-45 wells. Chief operating officer Josh Viets told analysts that overall well productivity has been improving, which let the company hold off on putting a second frac crew in the field for several months. That addition will happen later this month.

Third-quarter net income at Chesapeake totaled $70 million, down from $883 million in the year-ago quarter when the company netted more than $1.2 billion from derivative settlements. Adjusted net income was $155 million versus $730 million as natural gas, oil, and NGL revenues fell to $682 million from nearly $3 billion. The company’s average realized price for natural gas during the quarter was $2.58/mcf, down from $4.10 in third-quarter 2022.

Dell’Osso and his team also said this week they have signed a heads of agreement with Vitol Inc. for up to 1 million tonnes/year of LNG for up to 15 years. The target start date is 2028 and the companies will jointly pick the liquefaction plant for the LNG.

Shares of Chesapeake (Ticker: CHK) rose slightly to about $86.40 in Nov. 1 trading. They are up about 5% over the past 5 months, which has grown the company’s market capitalization to nearly $11.5 billion.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications Healthcare Innovation, IndustryWeek, FleetOwner, Oil & Gas Journal and T&D World. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.