ExxonMobil to acquire Pioneer Natural Resources in $64.5-billion deal

Exxon Mobil Corp. has agreed to acquire Pioneer Natural Resources in a $64.5-billion stock deal (including net debt) that more than doubles the oil and gas major’s Permian basin footprint.

Under the deal terms, Pioneer shareholders would receive 2.3234 shares of ExxonMobil for each Pioneer share.

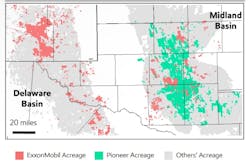

The merger, ExxonMobil’s largest since acquiring Mobil two decades ago, adds Pioneer’s more than 850,000 net acres in Midland basin to ExxonMobil’s 570,000 net acres in Delaware and Midland basins, “creating the industry’s leading high-quality undeveloped US unconventional inventory position,” that, together, hold an estimated 16 billion boe resource in the Permian, the companies said in a joint release Oct. 11.

At close, ExxonMobil’s Permian production volume will more than double to 1.3 MMboe/d, based on 2023 volumes, and is expected to increase to about 2 MMboe/d in 2027. (ExxonMobil had previously set a 1 MMboe/d 2027 target for its Permian operations.)

Asked about those growth plans standing out from other large Permian deals that have been followed by rig reductions and lower production, ExxonMobil chairman and chief executive officer Darren Woods said the basic plan is to build on the respective strengths of both companies rather than trim.

“As a starting point, our assumption is we keep doing that," Woods said. "As the teams get together [...] we may adjust that because we see opportunities that make more sense. But we haven’t done the work yet that would suggest that that’s going to lead to any different outcome.”

Coveted acreage, growth ambitions

For ExxonMobil, the deal would address investor concerns around Permian resource backlog, said TD Cowen analysts in an Oct. 11 investor’s note. “The standalone entities were expected to grow 550 kboe/d from 2023 to 2027 while combined guide is 700 kboe/d. The acceleration speaks to the capital efficiency of the combined entities,” the analysts said.

Woods noted the benefit of the highly contiguous nature of the tier-one acreage, saying it allows ExxonMobil “greater opportunities to deploy our technologies, delivering operating and capital efficiency as well as significantly increasing production.”

Field digitalization and automation are expected to optimize production throughput and cost, and the contiguous acreage will allow ExxonMobil to drill long laterals—up to four miles—resulting in fewer wells and a smaller surface footprint, the company said.

"Volume is not the objective here. Value is the objective,” senior vice-president Neil Chapman said on a media call, emphasizing that adding contiguous acreage to ExxonMobil's Midland positions is a key factor in the deal. "This is the best deal for ExxonMobil. It allows us to do what we've been doing in the Delaware [...] and apply it to [Pioneer's] resources."

Pioneer, the largest independent oil and gas producer in the Permian basin, was an early adopter of US shale technology, said Rob Thummel, senior portfolio manager at Tortoise in an email to Oil & Gas Journal, and the acreage position is “highly coveted given its low drilling cost and its size.”

ExxonMobil expects a cost of supply of less than $35/bbl from Pioneer’s assets. By 2027, the company said, short-cycle barrels will comprise more than 40% of the total upstream volumes, allowing the combine to quickly respond to demand changes and capture price and volume upside.

Integrated logistics will create value, as light Permian crude from both companies enter ExxonMobil’s refinery and chemical footprint on the US Gulf Coast.

ExxonMobil in this year’s first quarter started up a 250,000 b/d refinery expansion in Beaumont, expanding light-oil processing capacity. Elsewhere, the operator has ethane steam crackers working to meet growing demand for high-performance chemicals. The company's 1.8-million tonne/year (tpy) Corpus Christi chemical complex started up in 2021, its 450,000-tpy Baton Rouge polypropylene unit in 2022, and its 750,000 tpy Baytown chemicals expansion in this year’s third quarter (OGJ Online, Dec. 6, 2022; Sept. 19, 2023).

Environmental best-practices will combine as the operator plans to accelerate Pioneer’s net-zero plan to 2035 from 2050, Woods continued. ExxonMobil currently has plans to achieve net zero Scope 1 and Scope 2 greenhouse gas emissions from its current Permian unconventional operations by 2030. In addition, using combined operating capabilities and infrastructure, ExxonMobil expects to increase the amount of recycled water used in its Permian fracturing operations to more than 90% by 2030.

The deal, subject to customary regulatory reviews and approvals—including by Pioneer shareholders—is expected to close in first-half 2024. While Federal Trade Commission approval will be required, TD Cowen analysts note, the “combined entity represents about 10% of total Permian oil production,” levels that “should prove quite acceptable.”

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.