Baytex adds operated Eagle Ford assets in $2.5-billion deal to acquire Ranger Oil

Baytex Energy Corp., Calgary, has agreed to acquire Ranger Oil Corp., Houston, a pure play Eagle Ford company, in a cash and stock transaction totaling about $2.5 billion (C$3.4 billion) including debt assumption of about of $650 million.

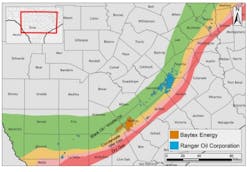

The deal sees Baytex acquire operating capability in the Eagle Ford, on-trend with its non-operated position in the Karnes Trough, building a diversified oil-weighted portfolio when combined with its Western Canadian Sedimentary basin assets, said Eric T. Greager, Baytex president and chief executive officer, in a release Feb. 28.

The Ranger inventory immediately competes for capital, with about 741 net undrilled locations representing 12-15 years of oil-weighted drilling opportunities, according to Baytex. Inventory includes 523 quality Lower Eagle Ford opportunities and 218 additional Upper Eagle Ford and Austin Chalk opportunities, Baytex said. The company believes it can grow production modestly from the acquired assets with two rigs and about 50-55 net wells/year.

In all, Ranger brings 162,000 net acres in the crude oil window of the Eagle Ford shale, highly concentrated in Gonzales, Lavaca, Fayette, and Dewitt counties in Texas, and production of 67,000-70,000 boe/d (working interest) that is 96% operated (72% light oil, 15% NGLs, 13% natural gas).Baytex's production is forecast to average 155,000-160,000 boe/d (52% light oil, 22% heavy oil, 11% NGLs, 14% natural gas) for the 12-month period following closing, which is expected late in this year's second quarter. Prior to the deal, Baytex reported full year 2022 average production of 83,519 boe/d (84% oil and NGL), a 4% increase over 2021, and outlined 2023 plans to produce 86,000-89,000 boe/d, delineate Peavine Clearwater acreage, and progress its Duvernay light oil resource play.

Under the terms of the agreement, Ranger shareholders will receive 7.49 Baytex shares plus $13.31 cash, for each Ranger common share, for total consideration of about $44.36 per share. Baytex shareholders will own about 63% of the combined company, and Ranger shareholders will own about 37%.

The combine will be led by the Baytex executive team and board of directors. Baytex intends to add one senior operational leader to the leadership team and retain the Ranger teams operating in Houston. At closing, Baytex expects to appoint Jeffrey E. Wojahn, a current Ranger Oil board member, and one additional independent director from the Ranger board to the Baytex board.

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.