W&T Offshore increases production 12% quarter-over-quarter

W&T Offshore Inc. increased production by 12% quarter-over-quarter to 42,400 boe/d (48% liquids) in second-quarter 2022 (3.9 MMboe), exceeding the high end of guidance, and has raised its full year 2022 production guidance mid-point by 2% to 42,200 boe/d from 38,200 boe/d.

Second-quarter 2022 production was comprised of 16,200 b/d of oil (38%), 4,200 b/d of natural gas liquids (10%), and 131.8 MMcfd of natural gas (52%).

The company generated net income of $123.4 million in the quarter. Adjusted net income totaled $190.5 million. Revenues for second-quarter 2022 were $273.8 million, which were 43% higher than first-quarter 2022 revenue of $191 million, and 106% higher than $132.8 million in second-quarter 2021.

As of June 30, 2022, W&T had available liquidity of $427.7 million comprised of $377.7 million in cash and cash equivalents and $50 million of borrowing availability under W&T's first priority lien secured revolving facility. At quarter-end, the company had total debt of $709.2 million.

Capital expenditures (excluding changes in working capital associated with investing activities) in the quarter were $8.1 million. Additionally, the company spent $17.5 million to acquire the remaining 20% working interests in Ship Shoal 230, South Marsh Island/Vermilion 191, and South Marsh Island 73 fields.

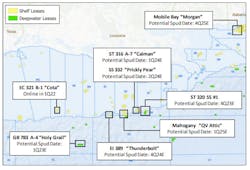

W&T's range for capital expenditures in 2022 remains unchanged at $70-90 million for the full year, which excludes acquisition opportunities. Included in this range are planned expenditures related to one deepwater well and three shelf wells, as well as capital costs for facilities, leasehold, seismic, and recompletions. The company has flexibility to adjust spending as it has no long-term rig commitments or near-term drilling obligations.