Oasis Petroleum Inc. will exit the Permian basin through a series of divestitures to focus on its Williston basin acreage position, the company said May 20. Buyers were not named.

Total gross potential consideration is $481 million consisting of $406 million at closing and up to three $25 million annual contingent payments in 2023, 2024, and 2025 if WTI averages over $60/bbl in each respective calendar year.

The transactions include 24,000 net acres and first-quarter 2021 production of 7,200 boe/d. Oasis Midstream Partners LP retains midstream assets in Panther DevCo.

The primary transaction is expected to close around June 30, 2021, subject to customary closing conditions, and two smaller transactions have already closed.

The Permian assets were difficult to scale, and the sale allows the operator to focus on the Williston position where it sees great upside opportunity, said Danny Brown, chief executive officer. Brown was named to the position in April.

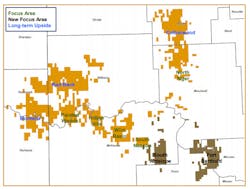

In May, the company shored up its Williston basin position through a $745-million transaction with Diamondback Energy where it gained some 27,000 boe/d of production in first-quarter 2021 on a two-stream basis and 95,000 net acres (OGJ Online, May 4, 2021). Pro forma Williston basin acreage stands at 497,000 net acres with first-quarter production of 77,000 boe/d.

The company emerged from bankruptcy in November 2020 (OGJ Online, Sept. 30, 2020).

Outlook

Oasis has updated its fiscal year 2021 volume and capex guidance to reflect the Permian divestment. FY21 volumes of 63,500-66,500 boe/d are expected with fourth-quarter 2021 volumes of 74,500-77,500 boe/d.

Exploration and production capex for 2021 is guided at $205-220 million, as incremental activity that was planned in the Permian is expected to shift into the Williston in this year’s second half. The company is evaluating various development scenarios for 2022. According to a May investor presentation, Bakken focus areas are expected to be Wild Basin, South Nesson, Indian Hills, Painted Woods, North Alger, South Antelope, and Fort Berthold.

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.