Enerplus to acquire Bakken acreage, increases 2021 production guidance

Enerplus Corp., Calgary, has agreed to acquire Little Knife and Murphy Creek acreage interests in the Bakken shale in Williston basin in North Dakota from Hess Corp. for $312 million, effective Mar. 1, and has updated its 2021 guidance including an increased production outlook.

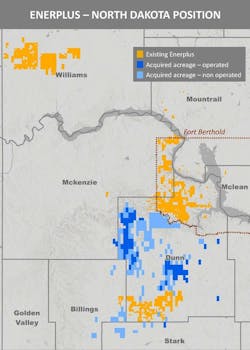

The company is acquiring 78,700 largely contiguous net acres in Dunn County, ND, adjacent to its core Bakken position. The deal includes 110 net tier one undrilled locations (77% operated) which immediately compete for capital with Enerplus' existing locations, the company said.

With the acquired assets, Enerplus estimates it will have about 10 years of drilling inventory under mid-single digit annual liquids production growth rates. The deal includes 120 net operated undrilled locations which are economic based on current crude oil prices, and which offer the potential for more compelling returns with the application of modern stimulation and production technologies, it said.

The acreage is 100% held by production with an average of two producing wells per drilling spacing unit. Recent development by offset operators deploying modern stimulation designs (high proppant and fluid intensity) has delivered strong well results in both the Middle Bakken and Three Forks formations, Enerplus said. The total 230 net undrilled inventory locations are almost exclusively focused in the Middle Bakken formation, and additional development potential exists beyond this in the Three Forks formation, Enerplus said. The acreage has limited exposure to federal land (less than 3% of the total net acreage).

The deal includes about 6,000 boe/d (76% tight oil, 10% NGL, 14% natural gas) of estimated working interest production (before deduction of royalties) with a base decline rate under 20% (10% on the operated production, 37% on the non-operated production).

An independent reserves report on the properties, prepared by McDaniel & Associates, as of Mar. 1, assigned proved plus probable reserves of 62.7 MMboe consisting of 49.7 million bbl of tight oil, 7.1 million bbl of NGL, and 35.1 bcf of shale gas (working interest).

Closing is subject to customary closing conditions and is expected to occur in May.

Enerplus has increased its 2021 production guidance to 111,000-115,000 boe/d from 103,500-108,500 boe/d, including 68,500-71,500 b/d of liquids from 63,000-67,000 b/d based on an 8-month contribution from the acquisition to the company's 2021 production. The increase was also driven by operating performance in North Dakota and higher than expected production in the Marcellus through the first 3 months of the year.

Capital spending in 2021 is revised to $360-400 million from $335-385 million in connection with the acquired assets.