Armour Energy proposes demerger of its northern basin oil and gas assets

Armour Energy Ltd., Brisbane, has proposed a demerger and separate Australian Stock Exchange listing for the company’s north Australian basins business.

The proposal involves establishing a new wholly-owned subsidiary, McArthur Oil & Gas Ltd. (MOGL), to hold the northern basin oil and gas assets and operations, demerging from Armour through an in-specie share distribution to existing shareholders.

The plan is for MOGL to enter a conditional agreement to acquire from Armour the northern basin business for $40 million (Aus.) plus a minimum 33.3% retained interest by Armour shareholders in MOGL subject to completion of an IPO and ASX listing of MOGL.

The IPO will seek to raise $60-65 million (Aus.) to fund the purchase and MOGL’s forward work programs.

The focus will be on an accelerated development of the existing conventional gas discoveries, including securing one or more joint venture partners to help explore the proven conventional Coxco-Cooley dolomitic breccias and Reward dolomite as well as the unconventional Barney Creek and Tawallah Group Wollogorang formation and McDermott shale plays.

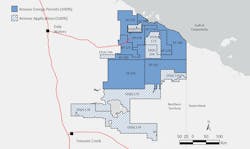

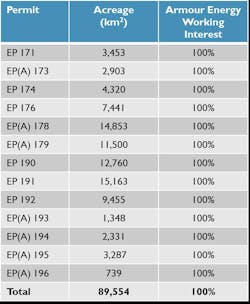

Armour is 100% owner and operator of 13 permits in the McArthur and South Nicholson basins of the Northern Territory covering an area of just under 97,000 sq km.

There are more than 190 conventional leads and prospects with prospective (P50) gas resources of 4.4 tcf and unconventional shale gas prospective (P50) resources of 30 tcf.

Retention licence applications have been made covering the conventional gas discoveries and gas sale discussions are under way with the aim of beginning gas sales from 2022 onwards.

Armour is targeting completion of the proposed demerger and IPO by the end of the September quarter 2021.