Energy Transfer to acquire Enable Midstream in $7 billion equity deal

Energy Transfer LP has agreed to acquire Enable Midstream Partners LP in an all-equity transaction valued at $7.2 billion.

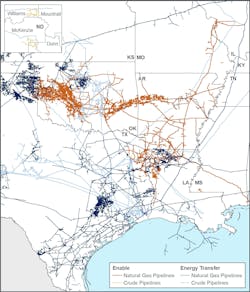

The deal strengthens Energy Transfer’s NGL infrastructure by adding natural gas gathering and processing assets in the Anadarko Basin in Oklahoma and integrates assets with Energy Transfer’s existing NGL transportation and fractionation assets on the US Gulf Coast, the company said. The acquisition also provides gas gathering and processing assets in the Arkoma basin across Oklahoma and Arkansas, as well as the Haynesville Shale in East Texas and North Louisiana.

Energy Transfer expects the combined company to generate more than $100 million of annual run-rate cost and efficiency synergies, excluding potential financial and commercial synergies.

Enable’s assets include 14,000 miles of natural gas, crude oil, condensate and produced water gathering pipelines, 2.6 bcfd of natural gas processing capacity, 7,800 miles of interstate pipelines (including Southeast Supply Header LLC of which Enable owns 50%), 2,200 miles of intrastate pipelines, and seven natural gas storage facilities comprising 84.5 bcf of storage capacity.

Under the terms of the agreement, Enable common unitholders will receive 0.8595 ET common units for each Enable common unit. In addition, each outstanding Enable Series A preferred unit will be exchanged for 0.0265 Series G preferred units of Energy Transfer. The transaction will include a $10 million cash payment for Enable’s general partner.